Quarterly Financial Report for the quarter ended December 31, 2015

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the 2015-16 Main Estimates. The Administrative Tribunals Support Service of Canada (ATSSC) had no items in the 2015-16 Supplementary Estimates (A and B) process. The report has not been subject to an external audit or review.

The ATSSC is responsible for providing support services and facilities to 11 federal administrative tribunals by way of a single, integrated organization.

The ATSSC provides efficient and effective services which support tribunal chairs and members in exercising their statutory responsibilities and ensures that their independence is protected in a manner which promotes Canadians' confidence in the federal tribunal system.

These services include the specialized services required by each tribunal (e.g., registry, research and analysis, legal and other case-specific work), as well as corporate services (e.g., human resources, financial services, information technology, accommodations, security and communications).

Established on November 1, 2014, the ATSSC is consistent with the government’s ongoing commitment to improve the effectiveness and efficiency of its administration and operations. By consolidating the provision of support services for 11 administrative tribunals, the government is strengthening overall capacity and modernizing operations to better meet the administrative needs of federal tribunals and to improve access to justice for Canadians.

Further information on the mandate, roles, responsibilities and programs of the ATSSC can be found by accessing the department’s 2015-16 Main Estimates.

Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department's spending authorities granted by Parliament and those used by the department consistent with the Main Estimates for the 2015-16 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of Fiscal Quarter and Fiscal Year to Date (YTD) Results

The ATSSC’s financial structure is composed of voted program authorities, vote-netted revenue authority, and statutory authorities for contributions to employee benefit plans.

Comparative financial information for the third quarter of 2014-15 is not included in this report because the ATSSC was established on November 1, 2014. For this reason, the authorities and expenditures for the third quarter of 2014-15 represent only a portion of a full quarter, rendering the year-to-year variance analysis incomplete.

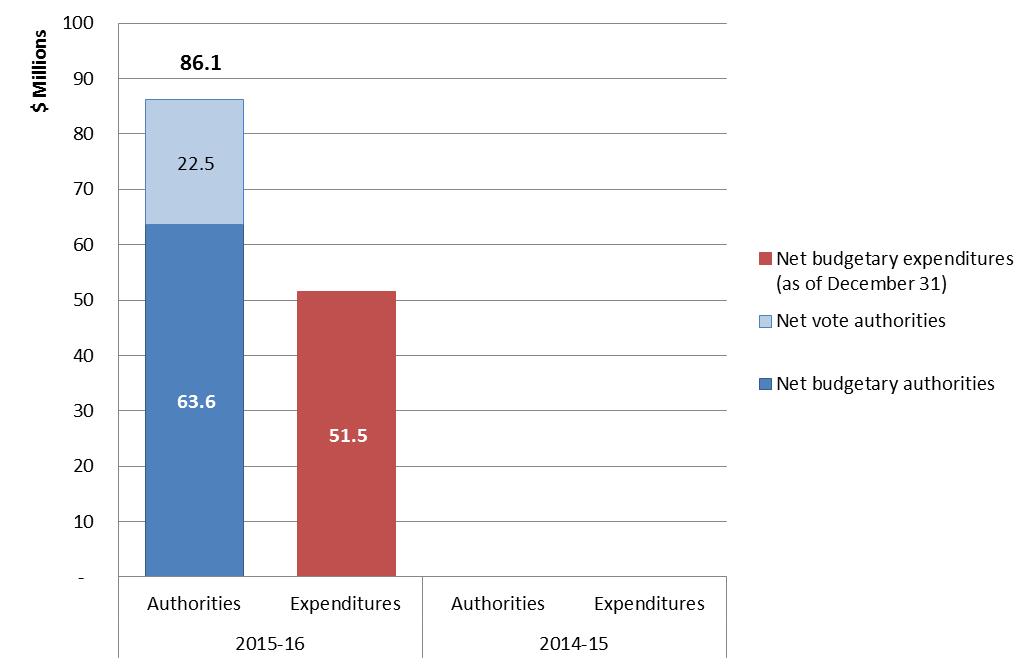

For the period ending December 31, 2015, the ATSSC had total authorities of $86.1 million, including budgetary authorities of $63.6 million and vote-netted revenue (VNR) of $22.5 million. Budgetary authorities of $60.9 million from the Main Estimates, an increase in statutory authorities of $0.6 million and $2.5 million from Treasury Board Central Votes (Operating Budget Carry Forward) are partially offset by a reduction of $0.4 million for the department’s contribution to support Government of Canada back-office transformation initiatives. The VNR authority has increased by $4.9 million to augment resources that are required to help reduce the Social Security Tribunal’s (SST) caseload backlog. The VNR gives the ATSSC the authority to make recoverable expenditures on behalf of the Canada Pension Plan and the Employment Insurance Operating Account. Presented in Chart 1 below are the gross and net budgetary authorities and expenditures for the third quarter of 2015-16. For more details, refer to the Statement of Authorities.

Chart 1: Comparison of Budgetary Authorities and Expenditures as of December 31, 2014 and December 31, 2015

Chart Description: For the period ending December 31, 2015, the ATSSC had total authorities of $86.1 million, including $63.6 million of budgetary authorities and $22.5 million of vote-netted revenue. The ATSSC incurred a total of $51.5 million in expenditures in the first three quarters of fiscal year 2015-16.

The ATSSC collected $8.8 million in revenues and incurred a total of $60.3 million in expenditures in the first three quarters of 2015-16 for a total of $51.5 million in net budgetary expenditures. This represents approximately 81% of the total budgetary authorities. The majority of the $51.5 million relates to personnel expenditures totalling $38.6 million, or 75% of the total expenditures. The remaining 25% primarily comprises other subsidies and payments (mainly the balance of an advance payment to Employment and Social Development Canada (ESDC) for the administration of the SST), professional and special services (mainly translation costs), and transportation and communications (mainly travel costs). Refer to the Departmental Budgetary Expenditures by Standard Object for more details.

Risks and Uncertainties

The ATSSC has identified four key risks and responses for 2015-16.

The tribunals face a risk of unexpected caseload surges that may challenge the ATSSC’s ability to provide the required level of support to the tribunals in the discharge of their mandates. While the caseload is beyond the control of the tribunals, strategies will be developed to address circumstances where tribunals face higher than expected demands. Emerging trends are being monitored to determine the potential impact on caseloads, legislative changes are being monitored to assess the impact on ATSSC resources, and budgets and allocations are monitored closely to appropriately re-allocate resources if and where required.

There is also a risk to the ATSSC’s ability to meet increased corporate accountability expectations, such as reporting, security, procurement, etc. To manage this risk, a workforce management strategy will be initiated to support the organization’s strategic priorities and to ensure the ATSSC has the proper skills, knowledge and resources to meet its mandate.

The impacts of change will continue to require that senior management embrace change and foster a culture of leadership at all levels. As such, the transformation agenda will be promoted by engaging leadership at the executive level across the organization. As well, the ATSSC will plan and define its priorities and establish governance models that will seek employee input and that will support timely decision making.

Lastly, the ATSSC does not have an integrated security and emergency management framework. The ATSSC is in the process of developing a Departmental Security Plan as required by the Policy on Government Security and the Directive on Departmental Security Management. To do so, it will assess its capacity to respond to a security and emergency management risk and build the necessary capacity where required. The ATSSC is also developing an integrated security plan that addresses both physical and information security compliance requirements.

Significant Changes in Relation to Operations, Personnel and Programs

There have been no significant changes to the programs or structure since the ATSSC was established on November 1, 2014. The SST continues to be supported by ESDC as its full transition to the ATSSC is still in the planning stages.

Approval by Senior Officials

Approved by:

Original signed by

--------------------------------------------

Marie-France Pelletier, Chief Administrator

Ottawa, Canada

February 26, 2015

Original signed by

------------------------------------------

Luc Robitaille, Director General, Corporate Services and Chief Financial Officer

Statement of Authorities (unaudited)

(in dollars)

| Fiscal year 2015-16 | |||

|---|---|---|---|

| Total available for use for the year ending March 31, 2016 * |

Used during the quarter ended December 31, 2015 |

Year to date used at quarter-end |

|

| Vote 1 - Program expenditures | 76,894,679 | 16,765,582 | 53,885,812 |

| Less: Revenues netted against expenditures | (22,540,600) | (8,845,300) | (8,845,300) |

| Net Program expenditures | 54,354,079 | 7,920,282 | 45,040,512 |

| Budgetary statutory authorities | 9,226,993 | 2,149,748 | 6,449,245 |

| Total Budgetary authorities | 63,581,072 | 10,070,030 | 51,489,757 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental Budgetary Expenditures by Standard Object (unaudited)

(in dollars)

| Fiscal year 2015-16 | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2016 |

Expended during the quarter ended December 31, 2015 |

Year to date used at quarter-end |

|

| Expenditures: | |||

| Personnel | 63,796,494 | 16,044,342 | 46,520,614 |

| Transportation and communications | 5,220,842 | 812,379 | 1,880,381 |

| Information | 557,271 | 106,639 | 331,512 |

| Professional and special services | 10,989,840 | 1,410,687 | 3,415,529 |

| Rentals | 2,349,812 | 187,101 | 614,753 |

| Purchased repair and maintenance | 421,232 | 10,195 | 42,125 |

| Utilities, materials and supplies | 827,708 | 160,313 | 378,162 |

| Acquisition of machinery and equipment | 1,550,746 | 301,513 | 485,257 |

| Other subsidies and payments | 407,727 | (117,839) | 6,666,724 |

| Total gross budgetary expenditures | 86,121,672 | 18,915,330 | 60,335,057 |

| Less Revenues netted against expenditures: | |||

| Revenues | (22,540,600) | (8,845,300) | (8,845,300) |

| Total Revenues netted against expenditures: | (22,540,600) | (8,845,300) | (8,845,300) |

| Total net budgetary expenditures | 63,581,072 | 10,070,030 | 51,489,757 |

Page details

- Date modified: