ReFILE

Overview

ReFILE is an online service that allows individuals, CVITP volunteers and other EFILE service providers to send online adjustment requests for tax returns. CVITP volunteers must use the UFile CVITP software.

Beginning with the 2023 tax year, if a tax return was submitted electronically and a change needs to be made, CVITP volunteers can use ReFILE to send the adjustment request.

To allow organizations to use ReFILE, an individual’s information may be kept for up to 28 days from the date the tax return was submitted. This rule only applies to organizations and volunteers who offer the ReFILE service. For more information on how to ensure you are keeping individuals’ information safe, refer to Saving a tax return; and Safeguarding an individual's information.

Important note

To use ReFILE, the individual’s tax return must have been filed electronically, they must have received their notice of assessment (NOA) and you must have an electronic copy of their tax return available.

If the tax return was not initially submitted electronically and a change needs to be made, the individual can use the Change my return service online or form T1-ADJ T1 Adjustment Request can be sent to the CRA by mail.

Eligibility criteria

ReFILE can be used through the tax software provided by the CVITP if the following conditions apply:

- the individual’s tax return was filed electronically

- you have a saved copy of the tax return

- the individual received their NOA

- the individual returns to the same CVITP clinic

- the individual’s amended tax return is being sent by the same volunteer who filed the original tax return

- only corrections, such as adding missing slips or changing amounts, will be made

ReFILE cannot be used to make changes to personal information such as:

- marital status

- address

- direct deposit

- email address

Refer the individual to My Account for Individuals or to Update your CRA information if changes related to their personal information are required.

The individual must send the following adjustment requests by mail:

- change a return that has not been assessed

- change a return where nine reassessments have been processed for a particular tax year

- apply for Tax credits and benefits for individuals

- apply for the disability tax credit

- change a return for a tax year that has a reassessment in progress

- change a return for an international taxpayer, newcomers to Canada and individuals who left Canada during the year

How to use ReFILE

There are a number of steps to follow in the UFile CVITP tax software to successfully send an adjustment request using ReFILE.

Important note

You must have the individual’s authorization to change their tax return before using ReFILE.

- Follow the instructions applicable to your situation:

A T1S60 completed for a ReFILE situation will have the letter “R” populated after the tax year.

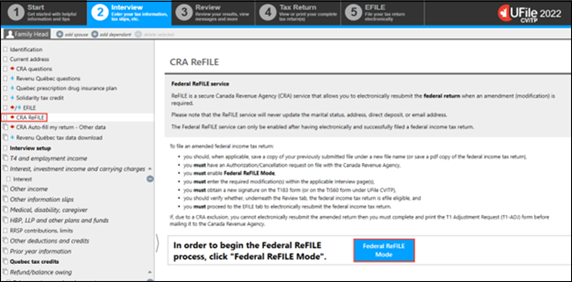

Step 1: CRA ReFILE

To start the ReFILE process, open the individual’s saved tax return.

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

CRA ReFILE topic is highlighted

CRA ReFILE page

Federal ReFILE Mode is highlighted

- from the Interview tab, select CRA ReFILE from the left-side menu

- click Federal ReFILE Mode to start amending the tax return

Step 2: Amendments

Text version of the above image

Interview setup topic

Interest topic

Bond interest page

Interest income from bonds is highlighted

- enter the required changes in the applicable interview pages(s) and click Next for each modified page.

CVITP tip

If you are using Auto-fill my return to automatically fill in missing information follow the instructions in How to use Auto-fill my return.

Step 3: EFILE eligibility

Text version of the above image

UFile screen

Under Review tab

First Last sub-tab

Messages topic

Message page

MaxBack notes and analysis is highlighted

- once all the modifications are entered, verify that the tax return is EFILE eligible under the Review tab.

- refer to Troubleshooting if you are not eligible to use ReFILE to submit the adjustment request.

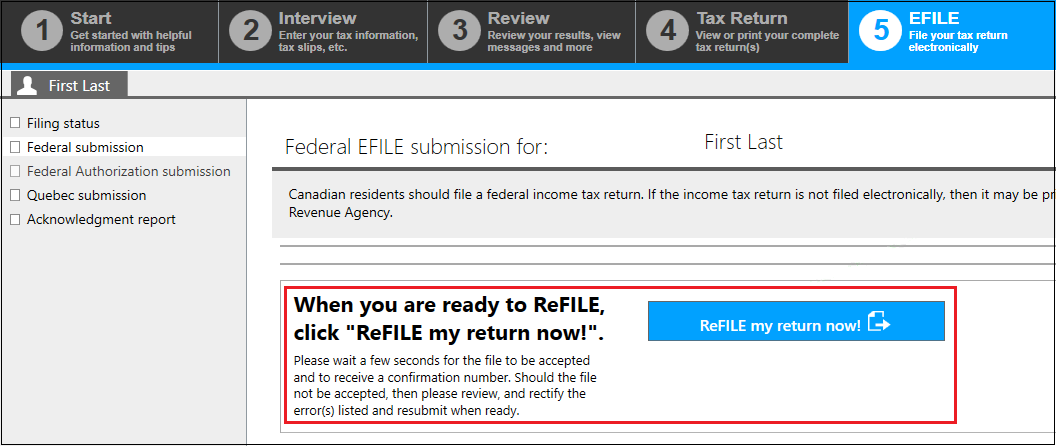

Step 4: ReFILE the tax return

Text version of the above image

UFile screen

Under EFILE tab

First Last sub-tab

Federal submission topic

Federal EFILE submission for: First last page

When you are ready to ReFILE, click “ReFILE my return now!” section is highlighted

- proceed to the EFILE tab and click “ReFILE my return now!”.

Tax tip

After changes to the tax return have been requested using ReFILE, remind the individual to keep all of their receipts and supporting documentation in case the CRA asks to see them.

Processing time

The time required to complete an adjustment varies depending on the type of adjustment requested and the circumstances involved.

When the review is done, the CRA will send the individual one of the following:

- a notice of reassessment showing any changes to their tax return

- a letter explaining why the CRA did not make the changes that were requested or why no changes were needed

For more information about processing times refer to the Check CRA processing times tool on Canada.ca.

Troubleshooting

The most common situations that prevent a tax return from being amended electronically are:

- the individual's first or last name is incorrect

- the individual's date of birth is incorrect

- a mandatory field has not been filled out

- the tax return has already been submitted

When you attempt to re-submit a tax return after you correct an error, ensure that you have received either a green Accepted status, or a red Rejected status in the Federal EFILE Report generated by the tax software.

Important reminder

If you cannot use ReFILE due to a CRA exclusion, refer the individual to My Account for Individuals or to Update your CRA information on Canada.ca. Form T1-ADJ, T1 Adjustment Request , can also be completed and sent to the CRA by mail.

Page details

- Date modified: