Evaluation – The CRA's Management of Interrelated Businesses

Executive summary

The purpose of this evaluation is to provide the Commissioner, CRA management, and the Board of Management with an independent assessment of the CRA’s administration of compliance with rules regarding interrelated businesses. Interrelated businesses refer to networks of businesses and their direct or indirect owners (e.g., multiple companies owned by an individual). A number of business tax incentive programs, such as the Small Business Deduction, have rules regarding interrelated businesses. Collectively, these programs carry an annual value of nearly $28.75 billion.

The evaluation examined a sample [content protected] business tax incentive programs where there are rules, generally aimed at preventing duplicate claims, regarding interrelationships. Key findings of the evaluation are as follows:

- CRA’s processes rely mainly on the consistency and accuracy of taxpayers’ submissions although taxpayers and their representatives are challenged to understand the complex rules regarding interrelationships.

- Roles and responsibilities, existing tools and related activities [content protected] do not provide a complete integrated whole-of-taxpayer view [content protected]

- [content protected]

While the evaluation identified that the CRA has made a number of important improvements to the T2 tax line, there are opportunities to better leverage and integrate existing taxpayer data through digital tools and to better facilitate compliance through preventative education and timelier engagement with taxpayers.

Summary of recommendations

- The Collections and Verification Branch (CVB) should:

- [content protected]

- [content protected]

- The Assessment, Benefit, and Service Branch (ABSB) should:

- [content protected]

- [content protected]

- with support from other branches through cyclical T2 published information consultation channels, enhance the clarity and understandability of the published information that pertains to reporting interrelationships.

- The Legislative Policy and Regulatory Affairs Branch (LPRAB), with support from the Public Affairs Branch (PAB), should enhance the clarity and understandability of the information pertaining to reporting interrelationships.

Management response

The ABSB (Business Returns Directorate), the CVB (Business Compliance Directorate), and the LPRAB (Income Tax Rulings Directorate) all agree with the recommendations in this report and have developed related action plans. The Audit, Evaluation, and Risk Branch (AERB) has determined that the action plans appear reasonable to address the recommendations.

Introduction

This evaluation was included in the 2022-2023 Risk-Based Assurance and Advisory Plan (Mid-Year Update), which was approved by the Board of Management on September 14, 2022. The related Evaluation Framework was approved by the Audit Committee on March 23, 2023. The study period for this evaluation included calendar years 2015 to 2021.

For fiscal 2020-2021, the CRA managed $411.96 billion in federal government tax incentives, with $82.43 billion directed toward businesses. Of this amount, more than one third (i.e., $28.75 billion, comprising 10 incentive programs) include business interrelationship requirements that must be met to qualify for incentives. The Small Business Deduction (SBD) and the Stock option deduction are examples of these incentive programs.

The CRA is responsible for ensuring that businesses comply with tax legislation related to the various tax incentive programs they may claim through their tax filings. Eligibility for these tax incentives depends on various reported factors, such as residency, relationships with other taxpayers, and the nature of reported revenues or investments.

To determine businesses’ eligibility for the various tax incentives, the Income Tax Act and Excise Tax Act have requirements on corporations’ interrelationships with other corporations, individuals, trusts and partnerships. These relationships are described using terms such as associated, related, affiliated or connected. Collectively these are referred to as “interrelationships” in this report.

[content protected]

The approved Evaluation Framework identified the following two issues as the subject of research for this evaluation:

- To what extent is the CRA effectively and efficiently managing interrelated business compliance?

- What compliance outcomes is the CRA achieving among interrelated businesses?

Background

The purpose of this evaluation is to provide the Commissioner, CRA management, and the Board of Management with an independent assessment of the CRA’s administration of business compliance pertaining to interrelationships.

It is understood the CRA has many programs across its business lines to address and treat tax compliance across a spectrum of tax rules. This evaluation however has studied the CRA’s approach specifically around rules pertaining to interrelationships between businesses and the reporting and compliance related to various tax incentive programs. This provides the CRA with a unique lens into this specific area of tax and recognize opportunities to optimize its programs in this area.

The CRA strives to assign unique roles to each branch for the purposes of supporting an efficient process for the assessment of taxes and benefits, among other roles. During the assessment process, branches share the responsibility of ensuring eligibility for tax incentive programs. Each program also assesses the returns for internal accuracy and for potential risks. However, certain tax incentives have eligibility requirements regarding interrelationships. This requires integration of information across returns, schedules, and even branches.

Among the multiple tax incentives with interrelationships requirements, as described in the Department of Finance’s 2024 Report on Federal Tax Expenditures (PDF, 5.5 MB) (2021 expenditures referenced below), the evaluation examined a sample of tax incentive programs for businesses with requirements related to interrelationships, with a focus on the following [content protected]

[content protected]

Additionally, this evaluation touches on certain broader topics that can impact multiple incentive programs and tax lines. This includes, for example, the validation of Canadian-controlled Private Corporation self-declared status during assessment and verification activities.

Evaluation methodology

The evaluation’s approach consisted of the following two types of analysis:

- Analysis of relationships between business and their owners.

- Review of the CRA’s administration of interrelatedness requirements, as part of its assessing and verification activities, for [content protected] incentive programs noted in the previous section of this report.

The methodology for examination included the following:

- Data analysis: The evaluation analyzed tax and benefit data of corporations, individuals, partnerships, and trusts to determine relationships between them, and the potential impacts of these relationships on compliance. The evaluation also assessed the amounts that the CRA already detects and addresses through its current processes and, where possible, the estimated amounts of potentially ineligible incentive claims that have not been addressed.

- File and document review: CRA files and documents (including legislation, frameworks, policies, procedures, performance reports, governance structures, and roles and responsibilities) as they pertain to individual and corporate compliance.

- Literature review: The evaluation team reviewed literature on business trends, attitudes, and behaviors (such as government reports, books, and academic research).

- Internal interviews: The evaluation team interviewed CRA management and employees working in program areas responsible for assessing tax returns and verifying claims for tax incentives.

- Public Opinion Research: Four focus groups were conducted with tax professionals to gauge their level of understanding of the association rules.

The evaluation team maintained open communication channels with CRA stakeholders through regular meetings and status updates (see Appendix C). For methodological limitations, refer to Appendix D.

Findings, recommendations, and management action plans

The findings of the evaluation are detailed below along with recommendations to address mandatory requirements or issues/opportunities of higher significance. CRA management agrees with the recommendations in this report and has developed related action plans. The AERB has determined that these action plans appear reasonable to address the related requirement, issue or opportunity.

Complex rules require the CRA to deploy more education and outreach efforts to better support voluntary compliance

What did we find?

The range and complexity of business ownership structures and resulting relationships result in rules associated with tax incentives and interrelated businesses that are highly complex. Interviews with the ABSB assessors, the CVB verification agents, and auditors in the Compliance Programs Branch (CPB) indicated a common view that tax rules related to interrelationships are perceived as complex and impact stakeholder understanding of associated requirements.

Focus groups with tax professionals conducted during this evaluation corroborated this view. For example, 74% of the tax professionals participating in the focus groups were unable to correctly respond to questions around associated corporations and GST/HST registration. Further, while tax forms and schedules that address interrelated businesses are designed to balance user-friendliness and the capture of accurate and complete information, the inherent complexity of the rules may increase the likelihood of gaps or errors in the forms and schedules submitted by taxpayers.

The evaluation also identified that the information resources provided to taxpayers to help them understand the interrelationship rules are limited to two main documents: the archived Information Bulletin IT-64R4 "Corporations: Association and Control" and the Income Tax Folio S1-F5-C1 "Related Persons and Dealing at Arm's Length". The evaluating team’s analysis of these documents indicated that they were relatively technical and most suitable for tax professionals as they are generally intended to be. The evaluation team was however unable to find examples of any "simple to use" tools, such as decision trees, to support taxpayer understanding of the rules that could impact their eligibility for business incentive programs and to accurately complete required schedules or provide appropriate information to their tax professionals.

Regarding education or outreach, the only identified initiative was the High Net Worth Compliance Directorate’s (within the CPB) effort to develop a new letter campaign initiative that would remind taxpayers of their obligation in regards of reporting interrelationships accurately.

Why does this matter?

Given this high degree of complexity, there is an increased need for the CRA to have effective preventative controls, such as providing educational programs and information resources to taxpayers/preparers to help them understand and comply with incentive program rules. There is also a need for the CRA to have timely and effective detective controls, including controls that alert taxpayers of mistakes at the time of filing, so that corrections can be made earlier while also preventing similar errors in the future.

Functional roles and responsibilities for managing compliance could benefit from increased integration

What did we find?

Across programs and functions, various teams provide assessment, verification and audit activities intended to prevent and detect potential non-compliance. However, the evaluation found that efficiency of tax administration processes was driving the roles and related activities within individual tax programs and even within individual sections within the program, that tend to be siloed. In fact, T2 assessment programs aim to process 95% of the returns within published service standards, which is achieved through efficient processes such as the use of automation.

Based on interviews with representatives from each of these T2 teams, the evaluation identified different interpretations across the teams regarding each other’s roles and responsibilities:

[content protected]

Why does this matter?

There is an increased risk that inconsistencies, errors or omissions in taxpayer provided data do not trigger appropriate follow-up and review. [content protected]

[content protected]

What did we find?

(i) Opportunities exist for increasing the capacity and capability (i.e., tools and training) to integrate available taxpayer data

[content protected]

The evaluation also identified that there is limited capability, automated or otherwise, to identify and proactively address interrelated business issues across tax incentive programs when examining claims. [content protected]

[content protected]

[content protected]This assessment identified the following:

[content protected]

While this section describes various challenges associated with [content protected], the evaluation also identified opportunities where strategic enhancements [content protected]

(ii) Verification and assessment activities could be better optimized to identify issues related to interrelationships between businesses

For the period of 2015 to 2021 inclusive, the evaluation team estimated that CRA’s various compliance activities detected an average of $487 million per year in ineligible incentive claims related to potential non-compliance [content protected]

Additionally, in 2021 the evaluation estimated that there were [content protected]

(iii) Trend toward more programs with interrelated business implications

Factually, the evaluation noted recent trends towards the introduction of more generous and refundable tax credits in the T2 tax line. This indicates an opportunity for the CRA to revisit how it might optimize its analysis of files with interrelated characteristics. [content protected]

Should this trend continue, it will become increasingly important to ensure that validation related to interrelated business is both effective and efficient.

(iv) CRA is investing in continuous improvement of the T2 tax line

There are currently many continuous improvement initiatives in the CRA that aim at improving the compliance management of various programs, including those related to examining interrelationships, among other compliance issues:

- Enhanced Governance – Improved horizontal governance through the establishment of new committees and working groups:

- Senior Management – Compliance and Collections Executive Steering Committee

- Intermediate – T2 Strategies and Operations Committee

- Working Group – T2 Integrity Controls Review working group

- Workload Management – Implementation of new Economic Entity audit teams that organize workloads around interrelated taxpayers.

- Technology Investments – Completion of the Business Intelligence Redesign initiative as well as other Branch specific investments.

These initiatives each represent important opportunities for the CRA to improve the effectiveness and efficiency of managing compliance with rules related to interrelated business through better integration of information, tools, processes, and oversight mechanisms.

Why is this important?

As noted earlier, there are $28.75B T2 tax incentive programs that involve rules related to interrelated businesses and new tax incentives with interrelationship rules being introduced. Improving the tools, mechanisms and processes to identify interrelationships and address non-compliance will help the CRA correct reporting errors earlier in the compliance continuum, reducing the need for more costly interventions further down the continuum.

[content protected]

Recommendation #1

The Collections and Verification Branch (CVB) should, when feasible:

- [content protected]

- continue to enhance and explore the provision of digital tools and their use by field staff that complement ongoing Agency approaches to identifying potential non-compliance that is relevant to interrelationships [content protected]

Management Response: The Business Compliance Directorate (BCD) within the CVB agrees with this recommendation and commits to conduct further analysis and consult with stakeholders to identify opportunities for program efficiency gains:

- The BCD recognizes that users in local offices, as well as those assigned to the National Verification and Collections Centre (NVCC), could benefit from a modernized approach to analyzing files with interrelated characteristics.

- The BCD will continue to research, analyze data and assess existing processes with the goal of confirming assumptions [content protected]

- [content protected]

- After considering all the information listed in the evaluation report with regard to tax incentives, the BCD agrees to launching a project related [content protected]

- The BCD will provide updates on the progress of the project [content protected]

The target completion date for this action plan is [content protected].

- The BCD recognizes that front-line staff would gain in efficiency through the use of digital tools allowing them, on one hand, to reduce the clerical component in reference to access to data for the benefit of analysis, as well as to perform screening of files for which the tools have already identified potential in terms of risk and therefore would improve the performance of these teams as well as the Agency's return on investment, more particularly with regard to interrelated businesses.

- The BCD provides ongoing support to programs (their clients), front-line staff and other users, in order to address the problems, they encounter and meet their needs. This is done in collaboration with various Agency stakeholders, and includes research, analysis in identifying gaps and improving the effectiveness of business compliance workloads.

- The Business Compliance Directorate will be able to better identify new sources of work due to the use of constantly evolving digital tools and thus ensure fair treatment of taxpayers, including those who establish more complex business structures, while contributing to better visibility and performance of the Agency's compliance programs.

- [content protected]

[content protected]

Recommendation #2

The Assessment, Benefit, and Service Branch (ABSB) should:

- [content protected]

- [content protected]

- with support from other branches through cyclical T2 published information consultation channels, enhance the clarity and understandability of the published information that pertains to reporting interrelationships.

Management response

The Assessment, Benefit and Service Branch agrees with this recommendation.

The ABSB, in consultation with CRA stakeholders will:

- [content protected]

- [content protected]

- [content protected]

- [content protected]

[content protected]

The ABSB in consultation with CRA stakeholders will also:

- establish a multi-branch working group to conduct a detailed review on T2 forms and schedules that have not been recently reviewed and prioritized based on complexity (Quarter 1 of 2025-2026);

- establish a framework to ensure ongoing regular reviews of T2 forms and schedules (Quarter 1 of 2025-2026).

The target completion date for this action plan is June 2025

Finally, the ABSB, in consultation with CRA stakeholders:

- review the content of T2 forms, guides and webpages with respect to reporting interrelationships to determine where information can be added or simplified.

The target completion date for this action plan is June 2025.

Recommendation #3

The LPRAB, with support from the PAB, should enhance the clarity and understandability of the information pertaining to reporting interrelationships.

Management Response: The LPRAB agrees with the recommendation and has developed the action plan described below.

As noted by the AERB in their evaluation, certain relationships need to be considered in determining if certain tax benefits are available to a taxpayer or in determining if these benefits should be shared between different taxpayers.

A discussion of the relevant relationships and related rules are described in archived Information Bulletin IT-64R4 "Corporations: Association and Control" and the Income Tax Folio S1-F5-C1 "Related Persons and Dealing at Arm's Length". LPRAB recognizes that these documents are relatively technical and may not properly assist less sophisticated taxpayers.

The LPRAB will work with PAB and other CRA stakeholders to provide clear and understandable information, within the timeline described below, to assist less sophisticated taxpayers in understanding and reporting relevant relationships.

The LPRAB will provide a status update at the end of each of the quarters identified below.

The target completion date for this action plan is June 2025.

Conclusion

This evaluation was designed to assess the CRA’s management of compliance related to interrelated businesses and the related outcomes. The evaluation identified that the CRA has developed and implemented a number of functions, tools, and processes to identify relationships, and to detect and address non-compliance within interrelated groups and across interrelated businesses. Important opportunities exist to design and integrate processes and tools that effectively leverage taxpayer information and more efficiently achieve and facilitate better compliance outcomes earlier in the compliance continuum, such as at the assessment and verification stages. The CRA is encouraged to consider these opportunities in concert with the many continuous improvement initiatives already in place.

Acknowledgement

In closing, we would like to thank the ABSB, the CPB, the CVB and the LPRAB for the time dedicated and the information provided during this engagement.

Appendix A: Evaluation issues and methodology

Based on the Audit, Evaluation, and Risk Branch’s consultations and research, the following issues have been identified. Each issue was investigated through a series of research questions.

Issue 1: To what extent is the CRA effectively and efficiently managing interrelated business compliance?

- Does the CRA have adequate tools, mechanisms, and processes in place to identify interrelationships between businesses and to detect and address non-compliance within the interrelated business groups?

- Are the CRA’s tools effective in detecting and addressing non-compliance across interrelated businesses?

- What impacts can an integrated view have on the organization of work in the different CRA areas that are responsible for the compliance of businesses?

Issue 2: What compliance outcomes is the CRA achieving among interrelated businesses?

- What are the tax revenue loss risks specific to relationships between taxpayers?

- How effectively is the CRA facilitating compliance among interrelated businesses?

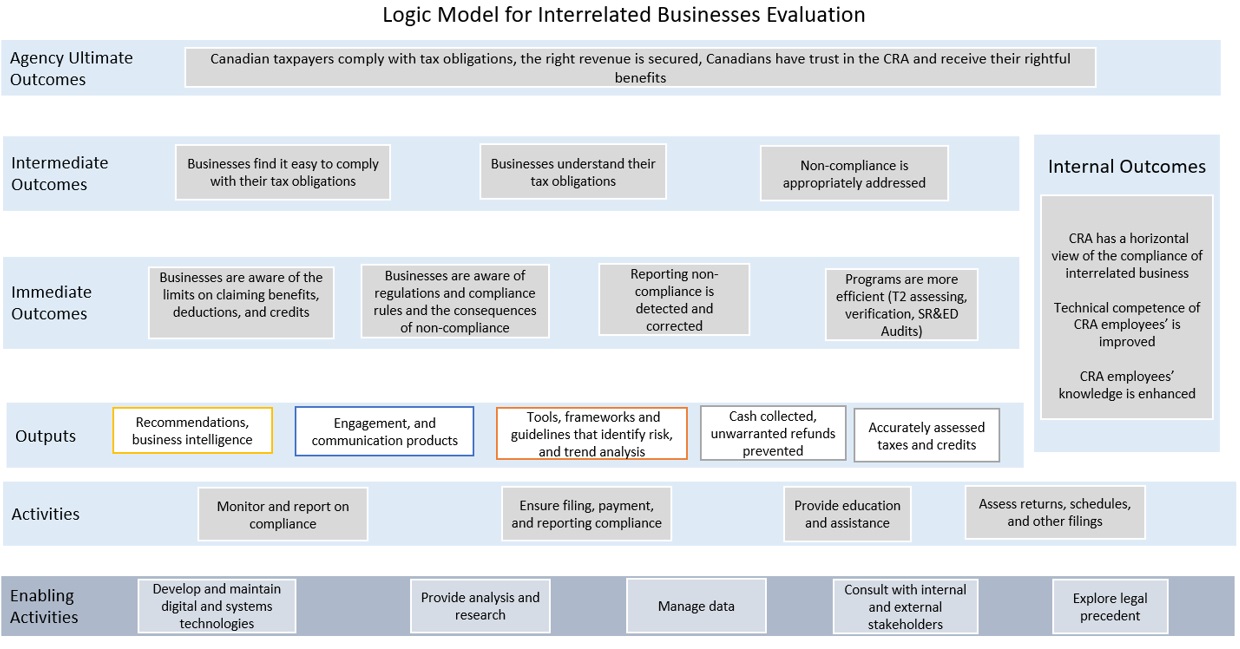

Appendix B: Logic Model

Description

The graphic’s title is “Logic Model for interrelated Businesses Evaluation”. It contains the logic model for the project that demonstrates the relationship between program activities and the cause-effect between activities outputs, and immediate, intermediate, or ultimate outcomes it goes from down to up.

The first row’s title is “Agency Ultimate Outcomes”: which are that Canadian taxpayers comply with tax obligations, the right revenue is secured, Canadians have trust in the CRA and receive their rightful benefits

The second row’s title is "Intermediate outcomes”. It contains the following items: Businesses find it easy to comply with their tax obligations, businesses understand their tax obligations, non-compliance is appropriately addressed.

The third row’s title is “immediate outcomes”: Businesses are aware of the limits on claiming benefits, deductions, and credits, Businesses are aware of regulations and compliance rules and the consequences of non-compliance, reporting non-compliance is detected and corrected, Programs are more efficient (T2 assessing, verification, SR&ED Audits).

The right side contain a shared theme between the second, third and fourth rows. The theme’s title is “Internal Outcomes”. It contains the following information: CRA has a horizontal view of the compliance of interrelated business, technical competence of CRA employees’ is improved, CRA employees’ knowledge is enhanced.

The fourth row’s title is ”outputs”. It contains the following items: Recommendations, business intelligence, engagement, and communication products, tools, frameworks, and guidelines that identify risk, and trend analysis, cash collected, unwarranted refunds prevented, accurately assessed taxes and credits.

The fifth row’s title is ”activities”. It contains the following items: Monitor and report on compliance, ensure filing, payment, and reporting compliance, provide education and assistance, assess returns, schedules, and other filings.

The sixth row’s title is ”Enabling Activities”. It contains the following items: Develop and maintain digital and systems technologies, provide analysis and research, manage data, consult with internal and external stakeholders, explore legal precedent.

Appendix C: List of CRA stakeholders

The CRA’s mandate to ensure that businesses comply with registration, filing, reporting, and payment rules is achieved through a combination of specialized programs (such as T1, T2, and goods and services tax/harmonized sales tax (GST/HST)) and functions (assessing, audit, objections, and collections). The table below describes the key internal stakeholders and their roles and responsibilities.

| Stakeholder | Roles and responsibilities |

|---|---|

| Assessment, Benefit, and Service Branch (ABSB) |

|

| Collections and Verification Branch (CVB) |

|

| Compliance Programs Branch (CPB) |

|

| Legislative Policy and Regulatory Affairs Branch (LPRAB) |

|

| Other stakeholders |

|

Appendix D: Methodological limitations

- Historic data of parent-child relationships is limited to populations where there is a claim for child benefits such as the Canada Child Benefit or the Universal Childcare Benefit. The data does not include parent, child, and sibling relationships for taxpayers where the children were born before 1975. The data also did not include individuals who had never claimed child benefits. Nonetheless, the evaluation was able to regroup 19.3 million individuals into family units.

- Data is restricted to filed information as recorded on CRA systems, and thus, the evaluation team could not account for persons that provided inaccurate data such as tax year ends, Social Insurance Numbers (SIN) and Business Numbers (BN) or those who failed to file required forms and schedules.

- [content protected]

- [content protected]

- [content protected]

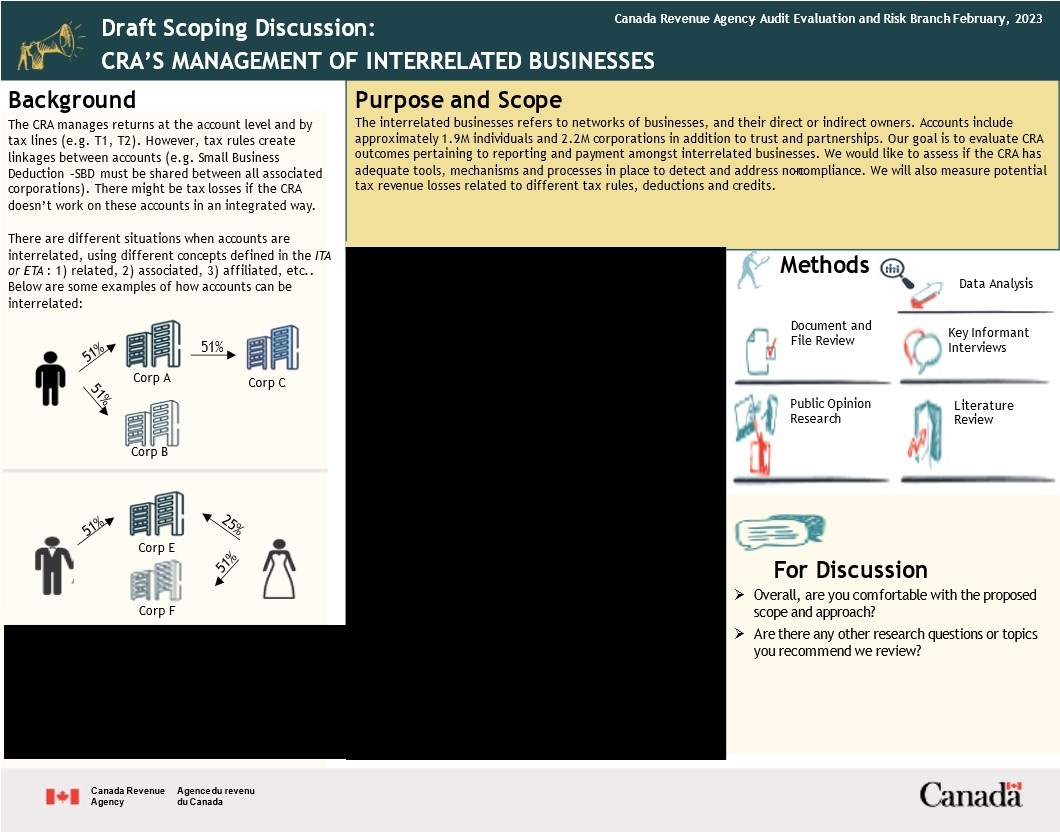

Appendix E: Infographic presentation of the evaluation topic, for discussion and illustration

Description

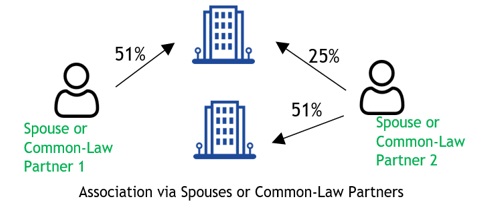

The objective of this figure is to demonstrate the infographic that was used during presentations, interviews, and discussions with stakeholders. The infographic is titled CRA’s Management of Interrelated Business. The infographic is divided into 4 sections. The first section is the background. The objective of the background section is to explain that CRA manages returns at the account level and is not integrating data to detect linkages between accounts that are important for various tax rules. The figure illustrates two images that show how accounts can be interrelated. The first case depicts association between three corporations, wherein one person owns majority shares of two corporations, Corp A and B, and Corp B owns majority of share in Corp C. The second case depicts association between two corporations, wherein one person owns majority shares of one corporation, Corp E, and their spouse owns majority shares of another corporation, Corp F, and owns at least 25% shares of Corp E. The second section is the Purpose and Scope, wherein the goal of the evaluation is to assess CRA’s outcomes of managing interrelated businesses, and whether sufficient tools and mechanisms exist to detect the non-compliance. The third section is the Methods, demonstrating 5 methods used in the evaluation: Document and file review, public opinion research, data analysis, key informant interviews, and literature review. The fourth section is the Discussion, where there is a prompt asking the interviewee if they are comfortable with the scope or if they had any questions or recommendations.

Appendix F: Glossary

| Term | Definition |

|---|---|

| Affiliated persons | A person is affiliated with themself, their spouse or common-law partner; a corporation is affiliated with a person that controls the corporation (or a person affiliated with that person). |

| Associated corporations | One corporation exerts control over another, or two corporations are controlled by the same person or group of persons. |

| [content protected] | [content protected] |

| Component | A group of related, associated, affiliated, and/or connected corporations along with their controlling shareholders. Shareholders may be individuals, corporations, partnerships, or trusts. |

| Connected persons | The payer and recipient of dividends are connected when the recipient owns more than 10% of the fair market value of the voting shares of the payer. |

| [content protected] | [content protected] |

| General Tax Reduction | The General Rate Reduction (GRR) is applied to Active Business Income not eligible for either the Small Business Deduction or the Additional Refundable Tax. At its core, it is designed to incentivize businesses to focus on generating Active Business Income rather than Investment Income, since the General Rate Reduction does not apply to Aggregate Investment Income. The Personal Services Businesses do not qualify for the General Rate Reduction, in addition to not qualifying for the Small Business Deduction. |

| [content protected] | [content protected] |

| Integrated view | An examination of tax compliance that considers the taxpayer, not in isolation, but as a member of a group of interrelated businesses. |

| Interrelated businesses |

Individuals, partnerships, and corporations that may be related, associated, affiliated, or connected under the Income Tax Act or Excise Tax Act. |

| Non-arm's length transaction | A relationship or transaction between persons who are related to each other. |

| Personal Services Businesses (PSB) | Personal Services Businesses (PSBs) exist where the individual performing the work would be considered to be an employee of the payer if it were not for the existence of the corporation. This structure is sometimes referred to as an incorporated employee. They do not qualify for many of the corporate tax incentives that corporations are entitled to, such as the Small Business Deduction or the General Tax Reduction. Determining if a corporation is a Personal Services Businesses requires a review of the corporation's ownership structure and the relationship between the employer, employee, and corporation. |

| Related persons | Persons linked by blood, marriage, common law, adoption, or control. |

| [content protected] | [content protected] |

| [content protected] | [content protected] |

Footnotes

Page details

- Date modified: