Canada Revenue Agency's 2024–25 Departmental plan

Message from the Minister

The Honourable Marie-Claude Bibeau

Minister of National Revenue

The Canada Revenue Agency’s (Agency) strategic priorities for 2024–25 support its vision to be a world-class tax and benefits administration that is trusted, fair, and helpful by putting people first. Building upon past achievements and insights, the 2024–25 Departmental Plan outlines the Agency’s objectives and commitments.

People know the Agency for its role in collecting taxes, but it also plays an important role in redistributing wealth. The Agency brought in $379 billion in tax revenue in 2022–23, which accounts for about 85% of the Government of Canada’s total annual revenue. As well, the CRA distributed over $46 billion in benefits to support individuals, families, children and caregivers in the same period.

The Agency is applying its “People first” philosophy in all aspects of its activities, such as delivering modern services to Canadians and ensuring that they are delivered in a more efficient, timely, and accessible manner for Canadians. This will reduce how many transactions and contacts Canadians have to make to access Government programs. Identifying ways to collaboratively offer services at events organized with other government departments, such as Service Canada, allows a whole-of-government approach to processing transactions. Increasing the number of in-person and virtual clinics, as well as the number of outreach activities in partnership with other government departments, will continue to positively impact Canadians.

Canadians aspire to live in a fair society. A fair tax and benefits system must help underserved populations, young people and newcomers access the benefits and credits to which they are entitled. At the same time, fairness means ensuring that everyone pays their share. Tax cheating and evasion continue to be obstacles for Canadians and tax administrations globally. Addressing these issues requires concerted efforts and collaboration on an international scale to enhance regulatory frameworks and enforcement measures.

On a national level, the Agency is improving compliance in the real estate sector and the underground economy. The Agency is doing its part to make housing more affordable for Canadians. It will use existing tools to access additional data, identify risk and expand compliance activities like the Underused Housing Tax. Also, the Agency is increasing audit activities in high-risk sectors related to real estate and brokerage firms.

Charities also play a very important role in our society. The Agency will continue to regulate charities fairly so that people have confidence that the processes that govern them are independent and fair.

The goals in this plan are clear and ambitious. Being a world-class tax and benefits administration and executing these plans requires a world-class workforce. I am confident in the abilities and dedication of the Agency’s employees. We will continue making impactful contributions to foster economic growth and a prosperous and sustainable future.

I welcome you to read the Departmental Plan in full so you can learn about the Agency’s plans and commitments to taxpayers for 2024–25.

Original signed

Hon. Marie-Claude Bibeau, P.C., M.P

Minister of National Revenue

Message from the Commissioner

Bob Hamilton

Commissioner of the Canada Revenue Agency

I am pleased to present the Canada Revenue Agency’s (CRA) 2024–25 Departmental Plan. The Plan outlines the priorities, objectives and commitments that we will focus on as we continue to contribute to the economic and social well-being of Canadians. We will also strive for our vision to be a world-class tax and benefits administration that is trusted, fair, and helpful by putting people first.

We, at the CRA, show our respect for, and honour the ancestral territory of First Nations, Inuit, and Métis, on which the activities described in this plan will be delivered. We are grateful for their past and present contributions in building an inclusive and diverse country. We recognize Canada’s history and the harmful intergenerational effects of colonization. The CRA is dedicated to working towards Reconciliation with Indigenous Peoples, and we are thankful for the opportunity to work, collaborate, and offer services on these lands.

Our People First philosophy puts people at the centre of everything we do and details our commitment to providing a service experience to Canadians that meets their needs. I take great pride in the ongoing dedication to service demonstrated by the CRA’s employees, and in all that they have enabled our organization to accomplish.

The height of the pandemic is behind us, but in the current economic situation Canadians continue to rely on the benefits available through the tax system. The CRA remains dedicated to ensuring Canadians receive the benefits and credits they qualify for. To help achieve this goal we will continue to increase engagement and support initiatives for hard-to-reach populations and vulnerable Canadians such as the Community Volunteer Income Tax Program (CVITP). Through Budget 2023, the federal government enhanced the eligibility criteria for the File my Return service, to enable more Canadians to quickly and easily auto-file their tax returns. In addition to this, we will pilot a new automatic filing service that will help vulnerable Canadians who currently do not file their taxes, to receive the benefits they qualify for.

Participation in Canada’s self-assessment tax and benefits system is based on Canadians’ confidence in its fairness. Ensuring a fair tax and benefit system that addresses non-compliance remains a top priority for the CRA. We remain committed to improving compliance domestically and with our peers internationally, by combatting aggressive tax planning and tax evasion through educational outreach activities, improved investigation operations, and enhanced audit activities. Additionally, we will continue to ensure compliance with payment obligations by collecting and resolving tax and government programs debt on a timely basis.

Canada’s self-reporting tax system thrives on the trust clients have in the CRA. To strengthen this trust, we are consistently focused on bolstering security, transparency, and accountability. Our dedication to safeguarding taxpayer information remains unwavering. We will continue to invest in cutting-edge technologies and tools, and ensure that they are deployed in a way that upholds the trust of Canadians. These efforts will enable us to proactively detect and mitigate potential threats, whether they stem from within the system or externally, ensuring the privacy and security of taxpayer data. We are also continually seeking out ways to improve transparency and accountability within public institutions. This includes improving how Access to Information and Privacy (ATIP) requests are processed and making it easier for clients to access their information.

Diversity is a valuable strength that we must wholeheartedly embrace and integrate into our organization. I am dedicated to fostering a culture of accessibility and inclusiveness in the CRA, guided by the 2022–23 Deputy Minister’s Commitments on Diversity and Inclusion. This year, the CRA will publish its directive on Employment Equity, Diversity, and Inclusion in addition to its second progress report on the 2023–2025 Accessibility Plan. We will also be taking deliberate actions to ensure a representative workforce at all groups and levels throughout the CRA and responding to the Clerk’s Call to Action on Anti-Racism, Equity, and Inclusion in the Federal Public Service. The dedicated workforce at the CRA will continue to make a meaningful difference in the lives of millions of Canadians.

As we pursue the priorities and commitments outlined in this plan, we will be closely measuring progress, exchanging best practices with our colleagues and international partners, and drawing valuable lessons from challenges and successes. I have confidence that we will sustain the momentum in bringing our vision to fruition and delivering meaningful results for Canadians.

Bob Hamilton

Commissioner of the Canada Revenue Agency

Key achievements in 2022–23

The CRA makes a significant contribution to the Government of Canada. The highlights below illustrate the scope and scale of its operations and the value it delivers. This is indicative of the foundation upon which this plan is built.

A presence coast-to-coast-to-coast

- Approximately 60,000Footnote 1 employees representing 55,168Footnote 2 full-time equivalents (FTEs) in four regions and at headquarters

- 20 Tax Services Offices

- 4 Tax Centres

- 3 National Verification and Collections Centres

- 3 Northern Service Centres

Collecting taxes

- $639.9 billion in revenue and pension contributions administered

- $379 billion in tax revenue, approximately 85% of government annual revenue

Tax filing

- 32.4 million individual tax and benefits returns filed

- 2.9 million corporation income tax returns filed

- 649,420 people helped through the Community Volunteer Income Tax Program (CVITP)

Delivering benefits and tax credits

- $46.4 billion in benefits issued

Digital by design

- 92% of individual income tax and benefit returns filed digitally

- 94% of corporation income tax returns filed digitally

- 78% of T1 refunds issued by direct deposit

Ensuring fairness

- $10.4 billion of tax earned by audit

- 12 cases referred to the Public Prosecution Service of Canada

- $89.1 billion in tax debt resolved

Providing redress

- 64,711 objections received

- 1,498 CPP/EI Appeals referred to the Minister

- 89,689 Taxpayer relief requests received

Making it easy

- 103,172 online chats answered by agents

- 300,578 visits to the “Learn about your taxes” page

- 44,088 businesses contacted via the Liaison Officer service

Core responsibilities and internal services

A. Tax administration

Description

The CRA’s core responsibility for tax administration is to make sure it sustains Canada’s self-assessment tax system. The CRA does this by:

- providing taxpayers with the support and information they need to understand and fulfill their tax obligations;

- taking compliance and enforcement actions when necessary to uphold the integrity of the system; and

- offering avenues for redress whenever taxpayers may disagree with an assessment or a decision.

Program inventory

The following CRA programs support the core responsibility for tax administration:

- Tax services and processing – The CRA helps businesses and individuals to comply with Canada’s tax laws by processing their information and payments, and providing related services.

- Returns compliance – The CRA ensures that individuals, businesses, and trusts are compliant with their withholding, remitting, reporting, and filing obligations.

- Collections – The CRA collects tax and non-tax debts on behalf of the federal, provincial, and territorial governments, as well as for other government departments and agencies.

- Reporting compliance – The CRA protects the integrity of Canada’s self-assessment tax system through education and proactive efforts that are aimed at promoting compliance.

- Objections and appeals – The CRA offers an impartial review process for taxpayers who wish to file a formal dispute.

- Taxpayer relief – The CRA administers the process under which relief of penalties and interest may be granted to taxpayers under certain circumstances.

- Service feedback – The CRA offers clients a process to provide feedback, including complaints, suggestions and compliments, and resolve problems about the service, quality, or timeliness of the CRA work.

- Charities – The CRA administers a national program for the regulation of charities, registered Canadian amateur athletic associations, and registered national arts service organizations.

- Registered plans – The CRA is responsible for registering and monitoring deferred income and savings plans.

- Policy, rulings and interpretation – The CRA offers taxpayers, registrants, and tax intermediaries binding rulings and non-binding interpretations of the acts the CRA administers.

Supporting information on the full description of programs, planned expenditures, human resources, and results related to the CRA’s program inventory is available on GC InfoBase.

Snapshot of planned resources in 2024–25

- Planned spending: $4,237,156,391

- Planned full-time resources: 38,754

Results and targets

For each result related to tax administration, the following table shows the approved performance indicators, results from the three most recently reported fiscal years, and the targets to be achieved by March 31, 2025.

Table 1: Performance indicators, results, and targets for tax administration

Performance Indicator

|

2020–21 results

|

2021–22 results

|

2022–23 results

|

Target

|

|---|---|---|---|---|

Percentage of individual tax returns filed on time

|

85.8%

|

90.5%

|

89%

|

At least 90%

|

Percentage of businesses registered for GST/HST

|

88.7%

|

94.1%

|

89%

|

At least 90%

|

Percentage of tax liabilities paid on time

|

91.3%

|

89.9%

|

90.7%

|

At least 91%

|

Percentage of Canadians who participate in the income tax system

|

93.5%

|

92.4%

|

93.3%

|

At least 93%

|

Ratio of collectible tax debt to total net receipts (cash accounting)

|

21.4%

|

18.9%

|

20.8%

|

At most 20%

|

Percentage of external service standards targets that are met

|

57.6%

|

74%

|

71%

|

At least 75%

|

Service Satisfaction IndexFootnote 3

|

8.1

|

7.3

|

7.3

|

At least 7.5

|

Public Perception Index: TrustFootnote 3

|

7.9

|

6.8

|

6.6

|

At least 7.0

|

Financial, human resources and performance information for the CRA’s program inventory is available on GC InfoBase.

More detailed results and explanations are found in the CRA's Departmental Results Reports.

B. Benefits administration

Description

The CRA’s core responsibility for benefits administration is to ensure that Canadians:

- get the support and information they need to know what benefits and credits they may be eligible to receive;

- receive their benefit and refund payments in a timely manner;

- have avenues of redress when they disagree with a decision on their benefit eligibility.

The CRA uses its federal tax delivery infrastructure to administer almost 200 services and ongoing benefits and one-time payment programs for the provinces and territories, including:

- Canada child benefit

- goods and services tax/harmonized sales tax credit

- children’s special allowances

- disability tax credit

- Canada workers benefit

- provincial and territorial programs

These services and benefits contribute directly to the economic and social well-being of Canadians by supporting individuals, families, children, and caregivers.

Program inventory

The following CRA program supports the core responsibility for benefits administration:

- Benefits – The CRA ensures that Canadians obtain the support and information they need to know what benefits they may be eligible to receive, that they receive their benefit payments in a timely manner, and have avenues of redress when they disagree with a decision on their benefit eligibility.

Supporting information on planned expenditures, human resources, and results related to CRA’s program inventory is available on GC InfoBase

Snapshot of planned resources in 2024–25

- Planned spendingFootnote 4 : $12,294,047,102

- Planned full-time resources: 2,360

Results and targets

For each result related to benefits administration, the following table shows the approved performance indicators, results from the three most recently reported fiscal years, and the targets to be achieved by March 31, 2025.

Table 2: Performance indicators, results, and targets for benefits administration

Performance Indicator

|

2020–21 results

|

2021–22 results

|

2022–23 results

|

Target

|

|---|---|---|---|---|

Percentage of Canada child benefit payments issued to recipients on time

|

100%

|

100%

|

100%

|

100%

|

Percentage of respondents satisfied with overall benefits experience

|

87%

|

85%

|

75%Footnote 5

|

At least 75%

|

Percentage of taxpayers (benefit recipients) who filed as a result of targeted CRA intervention

|

9.0%

|

17.4%

|

11.4%

|

At least 10%

|

Financial, human resources and performance information for the CRA’s program inventory is available on GC InfoBase.

More detailed results and explanations are found in the CRA's Departmental Results Reports.

Internal services

In this section

Description

Internal services are the services provided within a department so it can meet its corporate obligations and deliver its programs. There are 11 categories of internal services:

- management and oversight

- communication

- legal

- human resource management

- financial management

- security

- information management

- information technology

- real property management

- material management

- acquisition management

Snapshot of planned resources in 2024–25

- Planned spending: 1,043,543,907

- Planned full-time resources: 7,565

Strategic priorities and plans to deliver

1. Deliver seamless client experiences and tailored interactions that are digital first

The CRA will ensure that its services are delivered in an efficient, timely, and easily accessible manner for all Canadians in the official language of their choice. This is a continuation of its People First Philosophy and key to improving Canadians’ satisfaction with the CRA’s service and key to improving Canadians’ satisfaction with the CRA’s service and their perception of the CRA. Understanding people’s needs, expectations, and experiences remains crucial in helping the CRA create and improve programs and services, which is making a difference in its culture. An internal service culture survey confirmed that clients’ needs are at the forefront of employees’ minds as they conduct their work.

Continuing to improve services for Canadians requires a digital transformation, to keep pace with technological change and evolve into a modern, digital tax and benefits administration. The CRA is using the Government of Canada’s Digital Standards as an essential part of its digital transformation with the goal of making it easier for Canadians to access information, apply for benefits, and meet tax obligations digitally. The CRA is striving to become an organization where people are equipped and empowered to adapt to new ways of working and thinking, where processes are updated, reimagined, and shared within the CRA. It is also working to make sure the technology is designed and adapted through modern, agile, secure and user-centric approaches.

The CRA is making significant investments in modern information technology (IT) platforms and tools. The evidence coming from web analytics, user feedback, and call centre data has helped the CRA improve online interactions and tasks. In May 2023, web content improvements on Canada.ca made it easier to find, navigate, and use information to settle the taxes of a deceased person. Accelerating the adoption of modern application development practices and experimenting with emerging technologies will continue to advance the CRA’s digital transformation journey.

Additionally, the CRA is continuing the transformation of the Scientific Research & Experimental Development (SR&ED) program to further improve the service experience it provides to businesses. This program is the largest single source of federal government support designed to advance research and development in Canada and provides on average $3.4 billion annually in tax credits to over 17,000 businesses. The SR&ED Program is accelerating the use of digital tools that will make it easier for businesses to access tax incentives. Recent results include:

- launching an interactive version of the SR&ED Self-Assessment and Learning Tool (SALT), and

- adding a new feature for claimants to submit their SALT summary results in My Business Account to request pre-claim services.

This work helped to optimize the CRA’s Web presence and client experience by enabling individuals and businesses to easily access clear, timely, and accurate information about incentives, expenditures and investment taxes and credits on Canada.ca.

1A. Simplify client interactions and advance more ways to interact digitally

The CRA is dedicated to providing a simple client experience that meets Canadians’ service expectations. The CRA’s digital transformation will simplify and streamline tax processes for taxpayers and practitioners, making the application process for benefits simpler and online portals easier to access. For example, intuitive and interactive portals, new chatbots, and online chat services with live agents will make it easier for clients to access a wide range of services and information.

The CRA will also create an internal Accessibility Hub, which will house resources for employees to use to design and deliver programs and services that are easy to access by all Canadians, including persons with disabilities. The CRA will implement a performance measurement framework for accessibility, which will assess the CRA’s overall level of accessibility across all aspects of its operations.

The CRA will work to further integrate service delivery for Canadians. The CRA is supporting the Government’s examination of the ways the full suite of government services are delivered for Canadians. It is working closely with Service Canada to identify opportunities to expand the current range of services offered on behalf of the CRA to make life easier for Canadians.

The ePayroll project is a significant project that will simplify client interactions by making them digital. With the support of Employment and Social Development Canada and the Treasury Board of Canada Secretariat, the CRA has been preparing to build and implement an ePayroll service. The ultimate outcome is envisioned to be a near real-time information service that will modernize and streamline the way Canadian employers provide payroll, employment, and demographic information to multiple departments and agencies of the Government of Canada. This service will improve the speed and accuracy in delivering government services and benefits to Canadians while reducing the administrative burden on Canadian employers and businesses of all sizes. Phase I of the ePayroll project is focused on developing a fully costed implementation plan by March 2024.

Our commitments to Canadians in 2024–25:

- Provide accessible and flexible digital options for Canadians to contact the CRA with expanded chat services.

- Leverage the current direct deposit service through financial institutions’ technology to enable first time filers to sign up for direct deposit.

- Enable clients (individuals, businesses, representatives) to easily track the progress of their requests online through the secure portal and receive electronic notifications of any status changes.

- Provide additional digital notification functionality, on an opt-in basis, within My Business Account.

- Allow claimants of the SR&ED tax incentives to access simplified information and tools, start to build their claim, and track the status of their submitted claims through a Client Portal.

- Improve end-to-end client journeys by enhancing the ways in which CRA collects, responds to and uses client feedback.

1B. Improve access to benefits, particularly for underserved populations

One of the CRA’s primary goals is to ensure Canadians are aware of, and receive the benefits and credits they qualify for. The CRA has taken important steps to improve access to benefits for underserved populations and Indigenous communities. This work must continue to recognize the unique challenges some Canadians face. The CRA will intensify its engagement and support initiatives to ensure that Canadians have access to the benefits to which they are entitled.

Through the CVITP, community organizations hold free tax clinics to help modest-income individuals file their income tax and benefit returns. The number of returns filed through the CVITP increased by 15% from 640,000 in 2021 to 738,280 in 2022. The refund, credit and benefits entitlements amounts through the CVITP have increased from approximately $1.5 billion in 2021 to $1.8 billion in 2022. The CRA is focused on reaching underserved populations and is continuing to work with community organizations to raise awareness about available benefits, and how to access them. For the 2024–25 fiscal year, the CRA plans to increase the number of returns filed through the CVITP by a further 10%.

The CRA has continually worked to help Canadians access the benefits designed to assist them. In 2016–17, the CRA launched the Non-Filer Benefit Letter Initiative to encourage taxpayers (benefit recipients in particular) to file their income tax returns so they can receive the benefits and credits they qualify for. In 2022–23, the CRA sent 197,471 letters, which resulted in 35,673 returns filed, refunds of $21.6 million, and $23.7 million in credits and benefits paid to eligible Canadians.

Our commitments to Canadians in 2024–25:

- Improve how the CRA measures the take-up of benefits for hard-to-reach populations by leveraging data to better understand the characteristics of the population that is not receiving the benefits to which they may be entitled.

- Offer free tax help and education for small businesses about their tax obligations by increasing awareness of the Liaison Officer service, with a focus on Indigenous people and newcomers to Canada who are self-employed or operating a small business.

- Improve access to benefits for vulnerable Canadians by increasing the number of clients served through the CRA’s CVITP.

- Support reconciliation by implementing the CRA’s Indigenous Strategy (2024–2027), which outlines initiatives that build long-lasting and meaningful relationships with Indigenous communities and tailor services for Indigenous clients.

1C. Increase automation for better service delivery

Many low-income Canadians miss out on valuable benefits and support they are entitled to, such as the Canada child benefit and the guaranteed income supplement. To ensure more low-income Canadians are able to quickly and easily auto-file their tax returns, Budget 2023 announced that the federal government will increase the number of Canadians eligible to use the File my Return service. The CRA will also pilot a new automatic filing service that will help vulnerable Canadians who currently do not file their taxes, to receive the benefits they qualify for.

Since 2018, the CRA has delivered a free and simple File my Return service. This service allows eligible Canadians to auto-file their tax return over the phone after answering a series of short questions. The CRA sends Canadians with simple tax situations and lower or fixed income an invitation letter to use the services. For the 2022 tax filing season, approximately 53,000 returns were filed using this service.

Our commitment to Canadians in 2024–25:

- Ensure more low-income Canadians are able to quickly and easily auto-file by increasing the number of persons eligible for File my Return (SimpleFile by phone).

Perspectives to 2026–27 and beyond:

- Enable individuals and businesses to easily access clear, timely, and accurate information about taxes, benefits, and credits on Canada.ca by optimizing the CRA’s Web presence and client experience.

- Enable secure, two-way, fully electronic communication and service delivery to Canada’s registered plans sector by implementing the Registered Plans Application Suite Portal.

- Identify opportunities to reduce the burden of some government services for Canadians by better leveraging in-person Service Canada centres.

Quality of life impacts

In its role as the administrator of benefits and credits, the CRA contributes to the Household income and Financial well-being of individuals and families’ quality of life indicators. These contributions can lead to poverty reduction, impacting the Poverty indicator, by providing vulnerable populations and Indigenous communities with better access to the benefits and credits to which they are entitled.

Key risk

The CRA continually monitors its internal and external environments for events that could affect whether it achieves its strategic priorities and objectives.

The CRA has identified that there is a risk that its services and client interactions may not meet the expectations of those it serves, both internally and externally. The rapid growth of digital options throughout the Canadian economy over the past few years has raised clients’ expectations for similarly modern, digital options when they deal with the CRA.

To mitigate this risk, the CRA is leveraging user research, further enhancing its secure online portals, and optimizing content on Canada.ca to enable clients to find information more easily and quickly. The CRA is also continuing to improve telephone services at its call centres by decreasing wait times and offering other service channels to reduce call volumes.

Gender-based Analysis Plus

A full GBA Plus analysis was conducted for the CRA’s Chat Services Project. As a result of this analysis, there were groups identified who would not be able to fully benefit from the use of general digital services. To mitigate potential impacts, the CRA will maintain the availability of non-digital service delivery channels including phones, paper correspondence and filing, and the Community Volunteer Income Tax Program (CVITP), to ensure the needs of all Canadians are met.

The CRA will also continue to develop and implement comprehensive communications products and strategies related to digital services, and will continue to raise awareness of the support and tools that are available among vulnerable groups of Canadians. Additionally, detailed research into accessibility requirements for persons with disabilities has been conducted and accessibility features will be implemented in the digital services offered through the Chat Services Project.

The CRA performs GBA Plus analysis and applies GBA Plus principles through the development and enhancement of its online portals to ensure inclusive outcomes for Canadians.

The CRA is working toward the following goals when designing its programs and services:

- Inclusive Design Process: using GBA Plus to include persons with disabilities in the design or redesign of programs and services, reducing or removing barriers for inclusive access.

- Accessibility Plan for Client Service: developing an Accessibility Plan for client service to ensure that GBA Plus is applied in creating programs and services, aligning with the priority of delivering seamless digital experiences.

The CRA undertook a GBA Plus analysis and research through an economic study to assess the level of participation in the tax system of Canadians and various segments of the population including Indigenous Peoples. Further GBA Plus factors were explored. The results of these analyses will be used to prioritize outreach activities and communications products.

Sustainable development

The CRA will continue to work with all of its partners to advance Sustainable Development Goals (SDG) 1 and 10 in support of the strategic priority to deliver seamless client experiences and tailored interactions that are digital first.

- SDG 1: reduce poverty in Canada in all its forms.

- The CRA supports the reduction of poverty through the delivery of the Canada Child Benefit, the CVITP, and the Benefits Outreach Program.

- SDG 10: advance reconciliation with Indigenous Peoples and take action on inequality.

- The development of CRA’s first Indigenous Strategy will support reconciliation with Indigenous Peoples and assist in the implementation of the United Nations Declaration on the Rights of Indigenous Peoples Act.

More information on the CRA’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in its Departmental Sustainable Development Strategy.

2. Combat aggressive tax planning and tax evasion

The CRA recognizes that tax evasion and aggressive tax planning are complex issues as they often revolve around secrecy and hiding assets, transactions, income, and wealth. The reasons of these actions can range from deliberate misrepresentation to elaborately coordinated avoidance and evasion schemes. The CRA is aware of the cost of these actions to the treasury and works diligently to ensure that those who choose to break the law face consequences for their actions. Catching tax cheats and ensuring a level playing field is an important driver of Canadians’ perception of the CRA, and their willingness to voluntarily comply with their tax obligations.

The CRA continues to identify and shut down tax schemes and illegitimate tax shelters through increased audits of tax promoters and advisors, improved intelligence gathering, and better communication with taxpayers. Those who choose to participate in or promote these schemes may face serious consequences, including penalties, court-imposed fines, and possibly even jail time. The CRA issues regular warnings about tax schemes to taxpayers through tax alerts, news releases, fact sheets, media advisories, forms, and publications. The CRA received funding in the 2020 Fall Economic Statement to increase audit resources and improve the business intelligence used to identify the highest-risk files within the high net worth (HNW) population. The HNW population is capable of hiding their residency status and their assets offshore, creating significant challenges for the CRA when gathering information. This funding has allowed the CRA to increase its technical expertise, risk assessment data, and to identify the highest risks of non-compliance. With these improvements, the CRA will continue to make efforts to ensure that everyone pays the taxes they owe, and increase the visibility of its compliance activities.

The CRA is continuing its efforts to combat schemes designed to obtain unwarranted GST/HST refunds. Carousel schemes involve complex networks of entities working together to create a fictitious supply chain which are difficult to detect. Through investments, the CRA is implementing measures to better target its resources and expand its business intelligence and data analytics tools to combat these schemes. As part of its multifaceted strategy, the CRA reviews accounts early in the filing history to close suspicious accounts, effectively disrupting schemes early in their lifecycle. Additionally, the CRA collaborates with domestic and international partners to inform its strategy and prevent organized schemes from persisting.

Continued international collaboration through the Forum on Tax Administration (FTA) of the Organisation for Economic Co-operation and Development (OECD) enables the CRA to effectively address non-compliance. Through the FTA, over 50 tax administrations work together on issues of mutual interest to share best practices and improve compliance by putting in place global standards that help to ensure greater tax certainty, transparency, and fairness, as well as prevent tax evasion and avoidance.

With increased transparency and the exchange of financial data under initiatives such as the Common Reporting Standard, Foreign Account Tax Compliance Act, electronic funds transfer data, Country-by-Country Reporting and the Automatic Exchange of Information, it has become more challenging for individuals and corporations to hide assets offshore and evade taxes. New agreements are being negotiated and new tools are being developed to exchange information and support more venues to share best practices. This will give the CRA additional mechanisms to combat these issues.

From Budget 2021, the CRA received an investment of $230 million to improve its ability to collect outstanding taxes; in particular, to collect an additional $5 billion over five years. The targets established, from this investment, for 2021–22 and 2022–23 were exceeded by $274 million, and a total of $1.495 billion in additional outstanding taxes was collected. With the help of this multi-year investment, the CRA will continue to make progress on reducing the tax debt.

2A. Combat the most sophisticated and complex cases of aggressive tax planning, evasion, and fraud

The CRA uses a multifaceted and robust approach to combat sophisticated and complex cases of tax planning, evasion, and fraud. The CRA remains dedicated to maintaining the integrity of Canada’s tax system and ensuring that all taxpayers fulfill their obligations. When appropriate, the CRA will refer the cases to the Public Prosecution Service of Canada (PPSC) for possible criminal prosecution. For the five-year period from April 1, 2018, to March 31, 2023, the courts convicted 144 taxpayers for evading the payment of more than $35.1 million in federal tax combined. In 2022–23, all 12 cases referred to PPSC resulted in a conviction. The CRA publicizes criminal convictions and other high-profile enforcement actions through enforcement notifications.

The Government of Canada has made significant investments in recent years to strengthen the CRA’s audit programs. As a result, the CRA has increased its ability to identify and target aggressive tax planning, and increased the volume of its gross audit reassessments. A total of 62,660 audits, excluding all other compliance interventions were completed in 2022–23 which had a fiscal impactFootnote 6 of $14.3 billion. These investments have also given the CRA the opportunity to fund new initiatives and extend existing programs. Some notable initiatives include the GST/HST agile risk assessments and aggressive GST/HST audits, increased audit coverage of the GST/HST Large Business Audit Program, mitigating the risk from the rapid growth in trusts, and strengthening controls in the real estate sector.

Underground Economy (UE) activity negatively affects economic growth in Canada because compliant businesses struggle to compete with those that do not fully comply. These activities can also reduce funding for public programs from healthcare to parks. The 2022+ Underground Economy Strategy puts the CRA in a position to continually identify, prevent, and address UE activities. The CRA does this by monitoring the environment, addressing new and emerging UE-related risks as they occur, and evaluating and improving how it addresses UE activities in Canada.

Following the Minister’s mandate letter, the CRA created its Real Estate Action Plan to expand its capacity to audit real estate transactions. The actions of this plan will help contribute to the Government of Canada’s goal of creating a healthy, competitive, and stable Canadian housing market. This multi-year plan focuses on key activities such as data analytics, increasing the number of data sources used to examine the real estate sector, equipping auditors with tools and training, establishing a program to focus on the platform economy, increasing how many audit activities the CRA conducts, and working with all partners.

Our commitments to Canadians in 2024–25:

- Expand capacity to investigate tax evasion, tax fraud and benefit fraud, both domestically and internationally by continuing to develop new tools, increase resources, improve training and guidance, and build on partnerships.

- Improve risk assessment and screening processes by integrating additional approaches to identify and address potential willful non-compliance in SR&ED tax incentive claims.

- Identify and combat aggressive tax planning arrangements involving charities.

- Recover $250 million in unwarranted GST/HST refund and rebate claims through investments in new analytical tools using new technology, machine learning, and artificial intelligence (AI).

- Combat aggressive tax planning by designing and developing additional teams, tools and methodologies that enhance audit activities of economic entities and non-residents.

- Reduce tax non-compliance in sectors known for UE activity by focusing on various activities that identify, prevent and address transactions in goods or services which are unreported.

- Expand compliance activities regarding real estate transactions by acquiring additional real estate data and more widely disseminating and applying real estate data across the CRA.

- Improve voluntary compliance and tax awareness by expanding outreach and education activities with particular focus on the real estate sector and UE.

2B. Promote a fair tax system

The CRA recognizes that voluntary compliance is more cost-effective than enforcement, and that Canadians’ participation in Canada’s self-assessment system is based on their confidence in its fairness. The CRA plays a central role in maintaining tax fairness by administering tax law and regulations impartially, conducting audits, and taking appropriate actions against tax evasion and fraud.

In support of the Minister’s mandate and the CRA’s People First philosophy, the CRA designed the Assisted Compliance Program. This program provides a tailored, client-centric experience by using an education-first approach and addressing non-compliance as early as possible with the appropriate level of intervention. The CRA launched the program in 2022 as a pilot project to bridge the gap between traditional outreach and audits. Since the launch, the program has contacted 2,374 taxpayers.

The CRA is also improving the transparency of the assessment process and tax audits on charities. This work is intended to build trust in the CRA’s work on charities, and to fully demonstrate impartiality in decision-making.

The Canada Emergency Wage Subsidy (CEWS) was introduced at the onset of the COVID-19 pandemic to help businesses keep their workforce by partially offsetting their payroll-related costs. At its height, the CEWS was supporting over 5 million employees across Canada, and it provided $100.3 billion in support to 460,000 employers. One hundred percent of CEWS applications went through an automated prepayment validation and reviews to ensure eligibility. CRA audits conducted of the CEWS amounts claimed show that almost 95% of claims were compliant with the legislation. The CRA continues to conduct post-payment audits of the subsidies paid, and expects that it will audit $16.3 billion in claim amounts. Aggressive non-compliance, such as suspected fraud, will be pursued fully by the CRA. The CRA denied or decreased over $37 million in preparer-linked claims and charged more than $14 million in penalties to these files.

The CRA collects tax and non-tax debts on behalf of the federal, provincial, and territorial governments, as well as for other government departments and agencies. It continues to evaluate new approaches to strengthen and streamline tax collection activities, facilitated by improved IT and data analysis, which allow a more targeted and risk-based approach. During the fiscal year 2022–23, the CRA resolvedFootnote 7 a total of $89.1 billion in tax debt. The CRA will continue its robust verification and compliance activities to ensure the integrity of the tax and benefits system for all Canadians.

Our commitments to Canadians in 2024–25:

- Improve the CRA’s ability to use tax gap research and support data-driven decision-making.

- Develop tailored educational products to assist taxpayers in their reporting obligations and prioritize automation in order to minimize administrative burdens by designing the Reporting Fees for Services (RFS) program.

- Ensure compliance with payment obligations by collecting and resolving tax and government programs debt on a timely basis.

- Resolve an additional $1.20 billion in outstanding tax debt as a result of Budget 2021 incremental investments supporting a tax system that promotes fairness.

- Ensure compliance with registration, filing, remitting, and accurate reporting requirements through effective risk assessment.

- Ensuring the integrity of pandemic subsidies by conducting post-payment audits on the CEWS using a risk-based approach, and pursuing suspected cases of willful non-compliance and/or aggressive non-compliance.

- Continue to work towards reforming the international tax system as it applies to large multinational enterprises by engaging with the CRA’s international and domestic partners (including Government of Canada departments, and OECD members) on working towards implementing Pillar One and Pillar Two, and being ready to administer a Digital Services Tax (DST) pursuant to the Government’s longstanding plan for legislation to enact a DST in Canada to ensure that businesses pay their fair share of taxes and that Canada is not at a disadvantage relative to other countries.

- Implement the OECD international framework for the Model Rules for Reporting by Platform Operators with respect to Sellers in the Sharing and Gig Economy.

- Increase awareness of the compliance continuum for charities through publications and promotion of updated web content, as well as targeted messages to the sector.

Perspectives to 2026–27 and beyond:

- Establish and provide training on the management of information for investigations to enhance referrals to the PPSC, and develop new tools and training to ensure investigators and forensic specialists keep pace with sophisticated tax crime.

- Continue to deliver compliance activities focusing on addressing emerging aggressive tax planning and on promoters and advisors in the high net wealth population.

- Modernize risk assessment systems to better manage data and facilitate data-driven decision-making in identifying high-risk files for compliance interventions.

- Develop information technology solutions to provide audit operations with tools that will allow for the ingestion of large volumes of data to help link accounts to complete economic entity audits.

Key risk

The CRA continually monitors its internal and external environments for events that could affect whether it achieves its strategic priorities and objectives.

The CRA faces risks as a result of tax practitioners, promoters, and advisors aiding aggressive tax planning schemes, the taxation of crypto-asset transactions, and high net-worth individuals avoiding or evading taxes using aggressive tax planning schemes.

To continue to make sure Canadians trust the CRA to ensure that everyone pays their fair share of taxes, the CRA is taking steps to mitigate these risks. The CRA is engaging with internal and external partners within the tax community to help taxpayers understand how different crypto-asset events affect their tax obligations. As well, the CRA is exploring how to work with third parties to identify crypto-asset holders. The CRA is also performing more audits to better understand the platform economy and ensure that taxpayers are complying with their obligations.

Gender-based Analysis Plus

The CRA will continue to use GBA Plus to analyze compliance activities by gender and other diversity factors, where possible, to ensure fair and inclusive outcomes for Canadians. The CRA will analyze algorithms designed through business rules and machine learning to monitor for undue bias. If undue bias is found, the CRA will take steps to mitigate the bias through changes to risk assessment and workload development processes.

The CRA will include descriptive analysis when conducting strategic research. For example, research on the tax gap will include demographic analysis which could expand capacity to report on gender and diversity. The results of this research will be used to make adjustments to CRA programs to improve gender equality, diversity and inclusiveness in order to achieve more inclusive outcomes.

3. Strengthen security and safeguard privacy

The CRA has one of the largest holdings of personal information in Canada and it takes its role in safeguarding this information very seriously. The CRA makes every effort to provide taxpayers with the confidence that it will keep their information safe and secure in a constantly changing threat landscape. Giving Canadians confidence that their personal information is protected improves their perception of the CRA and their participation in the self-assessment tax and benefits system.

Funding from Budget 2021 enabled the CRA to invest in new technologies, tools and resources to proactively monitor internal and external security threats, and it continues to dedicate funding to enhance the protection of taxpayers’ information.

Supported by significant financial investments, the CRA’s IT infrastructure and applications have made sure that its services remain secure, reliable and accessible by design. This includes updating or replacing aging applications as part of the Application Sustainability Program. Since 2009, this program has invested nearly $100 million into safeguarding and securing CRA's applications and has contributed to the CRA's strong application health performance.

More recently, the CRA launched the Application Security Program to proactively and consistently enhance its security posture by investing in secure coding and threat modelling, security tooling, and IT-wide training. This program has already shown improvements to the security of CRA’s software applications, and it is expected that it will continue to bring real benefits as the program matures.

By strategically using financial investments, advanced technology, well-informed and trained personnel, and proactive monitoring, the CRA can significantly strengthen its security and safeguards, fostering public trust in the integrity of its operations.

3A. Protect CRA and taxpayer information

Safeguarding taxpayer information is not only a legal and ethical duty, but also an essential part of maintaining a stable and reliable tax and benefit system. When taxpayers trust that the CRA protects their personal information, they are more likely to comply with their tax obligations. This is why the CRA has strict measures in place to analyze, identify, and mitigate potential threats, prevent unauthorized changes to taxpayers’ accounts, and protect sensitive data.

In 2022, the CRA created a dedicated Security Branch which centralized its security programs to better integrate security and more effectively respond to security threats and incidents. The CRA is dedicated to maturing this newly established branch through new strategic initiatives. To improve the protection of CRA systems and data against evolving cyber threats, and to foster a strong security culture, the CRA is adopting industry leading technology, enhanced personnel training, and robust policies.

Our commitments to Canadians in 2024–25:

- Further improve the protection of CRA systems, processes and data from evolving threats and vulnerabilities by adopting IT and people focused solutions.

- Strengthen the CRA’s security stance and safeguard the privacy of taxpayer information by improving its guidance on information and data management.

- Strengthen identity protection services by continuing to enhance processes for detection, reporting and resolution of potential identity theft cases for individual and business accounts threatened by increasingly sophisticated methods of fraudulent access.

- Ensure that AI solutions that are developed and used by the CRA to strengthen operations are designed and deployed in a manner that maintains the trust of Canadians.

3B. Provide timely responses to Access to Information and Privacy (ATIP) requests

The CRA supports transparency and accountability in public institutions. Understanding that Canadians expect to receive requested information quickly and securely, the CRA recognizes that it can improve how it processes incoming ATIP requests to ensure they are dealt with in a timely manner, to meet expectations. The CRA is currently on track to eliminate 189 of its oldest backlog files, all of which the CRA received between April 1, 2020, and March 31, 2021.

Our commitments to Canadians in 2024–25:

- Identify opportunities for taxpayers to receive their information proactively through cost-effective channels other than the ATIP program.

- Close all backlog ATIP requests received before March 31, 2022, by March 31, 2025.

Perspectives to 2026–27 and beyond:

- Improve the standardization of the CRA’s identity management practices to both strengthen and simplify identity verification for Canadians.

Key risk

The CRA continually monitors its internal and external environments for events that could affect whether it achieves its strategic priorities and objectives.

The CRA and its clients are at risk of having their information exposed to cyber threats. Trust that the CRA is safeguarding private information is vital to Canadians’ participation in the tax and benefits system. With more and more information being communicated online, the importance of safeguarding the information, assets, and systems it holds remain a priority.

The CRA closely monitors all risks related to cybersecurity, privacy, and fraud, and takes steps to mitigate these risks. For example, the CRA significantly enhanced its strategic planning to integrate new technologies and solutions, and design security into new systems from the start. The CRA is fortifying its capacity to monitor, detect, and analyze emerging suspicious account activity and external fraud risks. As well, the CRA is providing employees with the necessary fraud risk management tools and training.

Gender-based Analysis Plus

The CRA is aligning itself with the Treasury Board of Canada Secretariat’s strategic direction and policies on ATIP which have integrated GBA Plus philosophies.

GBA plus considerations have been integrated into the CRA’s Directive on AI, and is a component of the AI Stewardship Process.

4. Nurture a high-performing, diverse, and inclusive workforce in a modern, flexible, and accessible workplace

The CRA strives to provide a workplace that is respectful, free of discrimination and harassment, one that values diversity, inclusion, and equitable opportunity. These are at the core of the CRA’s People First philosophy and its four enduring values: collaboration, professionalism, respect, and integrity.

In 2024–25, the CRA will publish its directive on employment equity, diversity, and inclusion. The directive will ensure the CRA establishes equity, diversity, and inclusion in all areas of its business. The CRA will also publish its second progress report on the 2023–2025 Accessibility Plan, in line with the Accessible Canada Act. This progress report will identify barriers to accessibility for employees and clients and help eliminate and prevent those barriers.

The CRA has begun the development of a people strategy, as it looks to the future of tax administration. Aligned with the CRA’s People First philosophy that details how it will provide Canadians with a seamless, empathetic and client-centric service experience, the people strategy will be centred on a thriving employee experience and will help equip employees in a time of accelerated transformation. The employee experience plays a vital role in supporting our aspirations as a world-class organization and achieving the ultimate agency outcome of enhancing the economic and social well-being of Canadians.

As the CRA develops its people strategy, a key focus will be to ensure that all employees are equipped with the essential tools, digital practices, and opportunities for networking, to maximize the effectiveness of the hybrid model of work. With this in mind, the CRA is modernizing by providing a flexible workplace that enables employees to work remotely, on-site, or a combination of both while meeting the requirements of on-site presence. It is a workspace that is supportive, well equipped, and adaptable that strives to meet the needs of its employees. The CRA is using various methods, like surveys, to gain employee insights into employees’ perspectives on the hybrid experience, ultimately informing, and helping to ensure a resilient organization that is ready to meet the challenges of the future. In addition, the CRA plans to review its implementation of this hybrid work model for any effects on diverse groups of employees. The review will show the CRA how to minimize impacts and identify barriers. By nurturing an inclusive workplace, the CRA continues to make progress towards building a fair and representative organization that reflects the rich diversity of Canada.

Applying a structured change management approach to prepare, equip, and support employees through their change journey is instrumental in ensuring project and transformation success. It increases the CRA’s overall capacity for managing change effectively while anticipating and reducing risks and resistance.

4A. Advance diversity and inclusion

The CRA remains devoted to attracting, developing, and keeping a diverse and representative workforce. Over the past number of years, the CRA has increased the diversity of its workforce, and employment equity group members (women, persons with disabilities, visible minorities and Indigenous peoples) are generally well represented within the organization. Within the executive group, the CRA has full representation for women, persons with disabilities and visible minorities. However, areas of underrepresentation exist, particularly for the Indigenous peoples group. Although the CRA has made progress in increasing Indigenous peoples representation within the executive group, its work in this area must and will continue.

To further advance diversity and inclusion, the CRA will keep its focus on removing barriers throughout each phase of the employment cycle. This includes supporting equal access to career opportunities for members of equity-deserving groups. By regularly consulting persons with disabilities, the CRA can confidently take action to address accessibility barriers in a way that is informed by the lived experiences, insights, and challenges faced by those who are most directly affected by these barriers. The CRA also focuses on creating a culture that values and celebrates differences by providing training on unconscious bias and cultural awareness. These initiatives help employees to understand their biases and encourages open dialogue about diversity-related topics. The CRA aims to eliminate national employment equity gaps by 2024.

Our commitments to Canadians in 2024–25:

- Strengthen the accessibility of the CRA’s external and internal programs, services, and operations by delivering upon actions committed to through the CRA’s first Accessibility Plan.

- Implement the anti-racism framework, which is composed of six key elements: engagement, data, anti-discrimination policies, talent management, learning and development, and monitoring at the agency level.

- Publish a directive on equity, diversity, and inclusion to further address systemic and attitudinal barriers surrounding employment opportunities at the CRA.

- Increase the representation of Indigenous peoples within non-executive groups.

- Increase the representation of Indigenous peoples in the executive group.

4B. Enhance leadership development and learning

The CRA is looking at new initiatives that will empower its leaders to inspire, motivate, and drive positive change to elevate a high-performing workforce that has the commitment, competencies and character to lead it into the future.

Continual learning and development help the CRA’s workforce adapt to evolving challenges, embrace innovative approaches, and foster a culture of continuous improvement. Character leadership, which the CRA implemented in 2017, embraces the values, virtues, and traits that lead to excellence of character, and elevates character alongside the technical competencies required to lead. The CRA has since been actively integrating character leadership into its activities. This has included assessing character leadership when staffing executive positions, delivering a character leadership development program for not only current leaders but also employees of all levels, and providing employees with relevant tools and resources.

The CRA has embedded elements of character leadership within all its national leadership development programs, including the Agency Leadership Development Program, the new National Leadership Learning Program set to launch in 2024, and the SponsorMe Plus program. It also includes other programs aimed at developing current and future leaders. By investing in leadership development, the CRA is ensuring that its workforce has essential skills, such as communication, empathy, and strategic thinking, leading to stronger decision-making and better outcomes.

Our commitments to Canadians in 2024–25:

- Create a national leadership development strategy.

- Make it easier for employees to increase their understanding and use of the digital standards by expanding digital training resources, to build a robust and nimble workforce with modern skills and mindset.

Perspectives to 2026–27 and beyond:

- Develop and implement a process to both identify and manage workplace risks concerning well-being for individual employees, teams, and the organization as a whole.

Key risk

The CRA continually monitors its internal and external environments for events that could affect whether it achieves its strategic priorities and objectives.

The CRA faces the risk of employees becoming less engaged and productive if it does not continue to address employee health, well-being, and safety. Maintaining positive qualities in a hybrid work model is also important. In particular, technical skill sets are in high demand as the world becomes increasingly digitized, and the CRA must be able to continue to recruit from this candidate pool.

The CRA is working to ensure that its current employees receive the opportunities needed to maintain and upgrade their skills. In addition, the CRA remains committed to providing 24/7 mental health services to its employees and their families. Overall, the CRA continues to work hard to ensure its workforce feels supported by providing guidance to employees and managers about its implementation of the hybrid work model.

Gender-based Analysis Plus

To correct any gender-based discrimination for employees in jobs that women hold, the CRA will publish a pay equity plan in line with the Pay Equity Act. This tailored plan will address any gender-based discrimination that may be in the CRA’s pay practices and systems.

The CRA will review its implementation of this hybrid work model for any effects on diverse groups of employees. The review will show the CRA how to minimize impacts when possible and identify barriers that may be affecting the CRA’s goal of advancing diversity and inclusion.

Sustainable development

The CRA will continue to work with its partners to advance Sustainable Development Goals (SDG) 10 and 13 in support of the strategic priority for nurturing a high performing, diverse, and inclusive workforce in a modern, flexible, and accessible workplace.

- SDG 10: advance reconciliation with Indigenous Peoples and take action on inequality.

- The development of CRA’s first Indigenous Strategy will support reconciliation with Indigenous Peoples and assist in the implementation of the United Nations Declaration on the Rights of Indigenous Peoples Act. The CRA is also taking action on inequality by applying a diversity and inclusion lens on programs and working to remove barriers for all equity-deserving groups.

- SDG 13: take action on climate change and its impacts.

- The CRA is working to transition to net-zero and climate-resilient operations by 2050. To do this the CRA will develop a climate change adaptation plan, reducing its greenhouse gas emissions from air travel, and renewing the Sustainable Development Policy with updated practices and policies.

More information on the CRA’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy.

CRA staffing principles related to a successful staffing program

Adaptability

Staffing is flexible and responsive to the changing circumstances and to the unique or special needs of the organization.

Efficiency

Staffing is planned and carried out taking into consideration time and cost, and it is linked to business requirements.

Fairness

Staffing is equitable, just, and objective.

Productiveness

Staffing results in the required number of competent people being appointed to conduct the CRA’s business.

Transparency

Communications about staffing are open, honest, respectful, timely, and easy to understand.

CRA staffing principles related to an effective workforce

Competence

The workforce possesses the attributes required for effective job performance.

Non-partisanship

The workforce and staffing decisions must be free from political and bureaucratic influence.

Representativeness

The composition of our workforce reflects the labour market availability of employment equity designated groups.

Planning for contracts awarded to Indigenous businesses

In line with the Government of Canada’s priorities, the CRA is dedicated to strengthening its economic relationship with Indigenous businesses and communities by providing more opportunities to First Nations, Inuit and Métis businesses through its procurement activities. This supports reconciliation efforts and ensures fair, open and transparent procurement practices that result in a supplier base that is more diverse, inclusive and representative of the Canadian population. To increase opportunities for Indigenous businesses, the CRA is using a proactive approach:

- Internal alignment of policy direction and processes: In 2024–25, the CRA will continue to review and refine its policy direction and strengthen accountability to better fulfill its obligations under the Procurement Strategy for Indigenous Business.

- Modified procurement strategy: The CRA will continue to adapt its overall procurement strategy to increase opportunities for Indigenous businesses in the short, medium, and long-term by:

- continuing to direct specific commodities such as IT end-user devices to Indigenous technology resellers;

- continuing to review incoming procurement requirements to determine strategies for increasing opportunities for Indigenous businesses, as applicable (such as those who may not be able to offer national coverage);

- continuing to incorporate a conditional Indigenous clause into competitive solicitations that indicates that if two or more bids are received from Indigenous businesses, only they will be considered;

- reviewing the terms of reference and guidance material for the CRA’s senior management Procurement Review and Oversight Committee to strengthen the committee’s focus on social procurement considerations, including Indigenous procurement.

- Outreach and activities: The CRA will build upon the success of the previous client outreach activities, including the annual Contracting Awareness Month first held in 2022, and will develop and deliver awareness sessions focused on social procurement commitments, including Indigenous procurement.

- Training: All procurement officers, existing or new (including procurement policy and oversight officers) will complete the mandatory course Indigenous Considerations in Procurement from the Canada School of Public Service.

Table 3: Contracts awarded to Indigenous businesses

The following table shows how the department plans to achieve awarding at least 5% of the total value of contracts to Indigenous businesses annually.

5% reporting field

|

2022–23 actual result

|

2023–24 forecasted result

|

2024–25 planned result

|

|---|---|---|---|

Total percentage of contracts with Indigenous businesses

|

10.8%

|

5.9%

|

5.9%

|

Note: The 2022–23 fiscal year was an exceptional year with a higher-than-normal need for certain goods procured from Indigenous businesses.

Taxpayer Bill of Rights

The Taxpayer Bill of Rights describes and defines 16 rights and builds on the CRA’s corporate values of integrity, professionalism, respect, and collaboration. It describes the treatment taxpayers are entitled to when dealing with the CRA. The Bill also sets out five commitments to small businesses to ensure the CRA interacts with them as efficiently and effectively as possible.

The CRA integrates the Bill in its core responsibilities and across all its daily activities. Rights 5 and 6, 9 to 11, and 13 to 15 (identified with an asterisk below) are service rights that govern the CRA’s relationship with taxpayers. General concepts such as fairness, transparency, and courtesy influence those service rights. The CRA promotes widespread understanding of those rights to make sure it integrates them into how it delivers programs and services, and interacts with its clients.

- You have the right to receive entitlements and to pay no more and no less than what is required by law

- You have the right to service in both official languages

- You have the right to privacy and confidentiality

- You have the right to a formal review and a subsequent appeal

- You have the right to be treated professionally, courteously, and fairly*

- You have the right to complete, accurate, clear, and timely information*

- You have the right, unless otherwise provided by law, not to pay income tax amounts in dispute before you have had an impartial review

- You have the right to have the law applied consistently

- You have the right to lodge a service complaint and to be provided with an explanation of the CRA findings*

- You have the right to have the costs of compliance taken into account when administering tax legislation*

- You have the right to expect the CRA to be accountable*

- You have the right to relief from penalties and interest under tax legislation because of extraordinary circumstances

- You have the right to expect the CRA to publish its service standards and report annually*

- You have the right to expect the CRA to warn you about questionable tax schemes in a timely manner*

- You have the right to be represented by a person of your choice*

- You have the right to lodge a service complaint and request a formal review without fear of reprisal

Commitment to small business

- The CRA is committed to administering the tax system in a way that minimizes the costs of compliance for small businesses

- The CRA is committed to working with all governments to streamline service, minimize cost, and reduce the compliance burden

- The CRA is committed to providing service offerings that meet the needs of small businesses

- The CRA is committed to conducting outreach activities that help small businesses comply with the legislation we administer

- The CRA is committed to explaining how we conduct our business with small businesses.

Planned spending and human resources

This section gives an overview of the CRA’s planned spending and human resources for the next three fiscal years. It also compares the CRA’s planned spending for 2024–25 with its actual spending for the current year and the previous year.

Spending

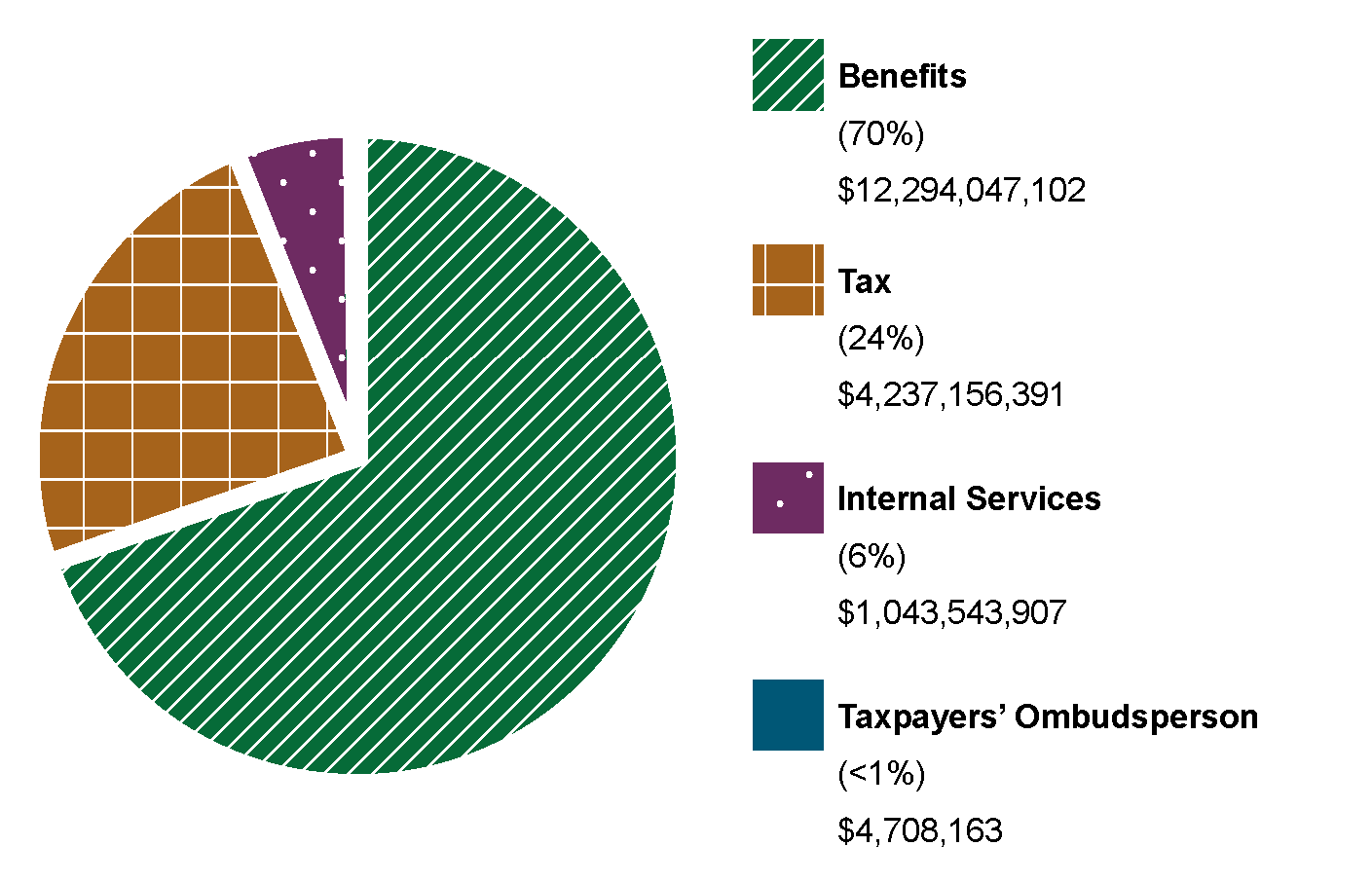

The following chart summarizes the CRA's planned spending by core responsibility.

Table 4: Planned spending by core responsibility in 2024–25

Core responsibilities and internal services

|

Planned spending

|

Percentage of spending

|

|---|---|---|

Tax

|

$4,237,156,391

|

24%

|

Benefits

|

$12,294,047,102

|

70%

|

Taxpayers’ OmbudspersonFootnote 8

|

$4,708,163

|

<1%

|

Internal Services

|

$1,043,543,907

|

6%

|

The benefits core responsibility includes spending associated with benefits compliance, client service, and program administration as well as $12 billion in forecasted statutory transfer payments related to the distribution of fuel charge proceeds to the province or territory of origin, primarily through the Canada Carbon Rebate, as well as for the Children's Special Allowances which provides payments to federal, provincial and territorial agencies and institutions that care for children.

Actual spending summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of the CRA’s core responsibilities and for its internal services for the three previous fiscal years. Amounts for the current fiscal year are forecasted based on spending to date.

Table 5: Actual spending for core responsibilities and internal services (dollars)

Core responsibilities and internal services

|

2021–22 actual expenditures

|

2022–23 actual expenditures

|

2023–24 forecast spending

|

|---|---|---|---|

Tax

|

3,950,635,501

|

4,344,289,750

|

5,002,726,167

|

BenefitsFootnote 9

|

4,403,123,715

|

7,661,832,665

|

10,517,430,125

|

Taxpayers’ OmbudspersonFootnote 8

|

4,049,529

|

4,551,186

|

5,101,823

|

Subtotal

|

8,357,808,745

|

12,010,673,601

|

15,525,258,115

|

Internal services

|

1,131,485,869

|

1,100,800,441

|

1,724,470,736

|

Total

|

9,489,294,614

|

13,111,474,042

|

17,249,728,851

|

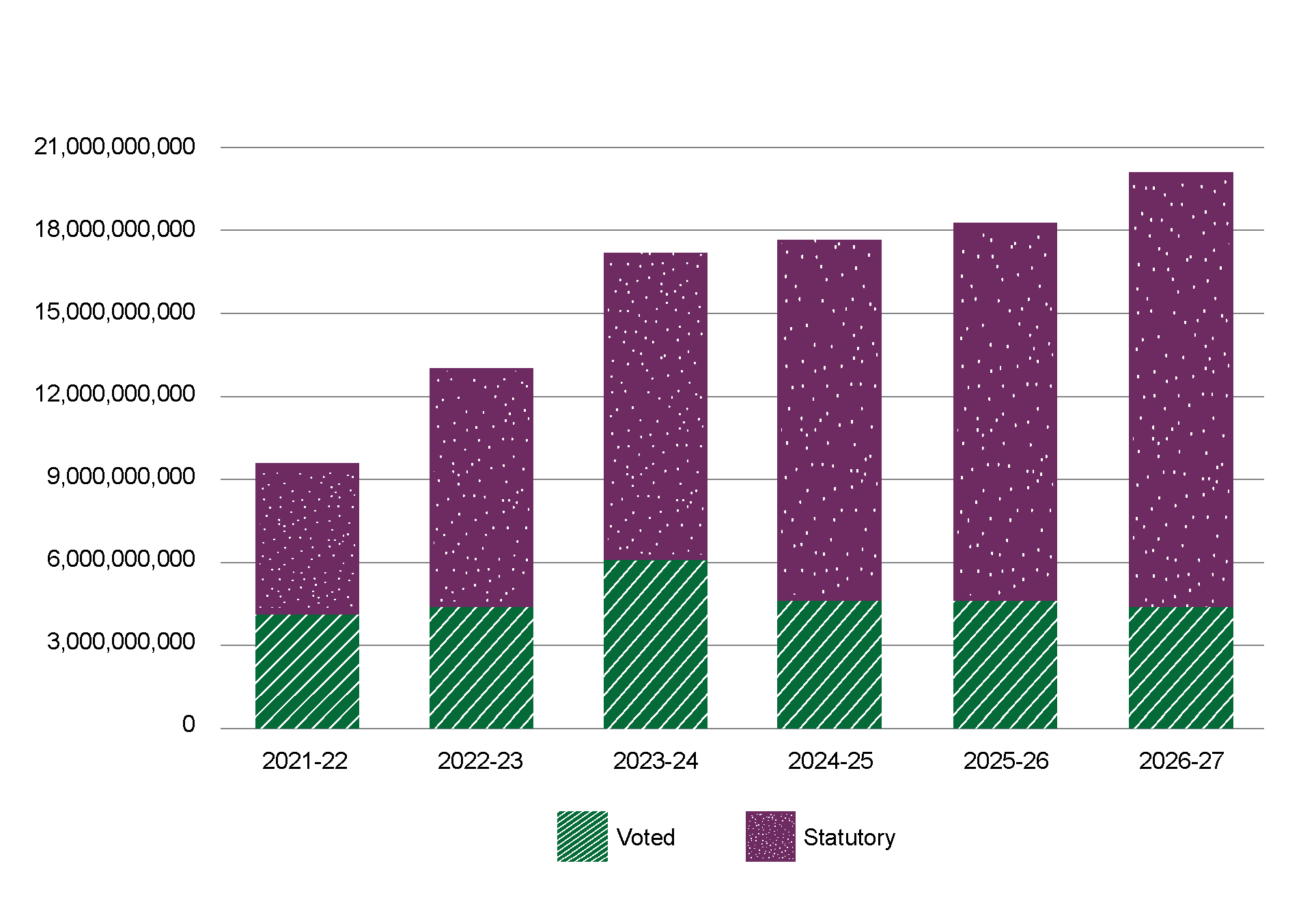

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of the CRA’s core responsibilities and for its internal services for the upcoming three fiscal years.

Table 6: Budgetary planning summary for core responsibilities and internal services (dollars)

Core responsibilities and internal services

|

2024–25 budgetary spending (as indicated in Main Estimates)

|

2024–25 planned spending

|

2025–26 planned spending

|

2026–27 planned spending

|

|---|---|---|---|---|

Tax

|

4,237,156,391

|

4,237,156,391

|

4,196,566,767

|

4,112,541,412

|

BenefitsFootnote 10

|

12,294,047,102

|

12,294,047,102

|

13,026,627,344

|

14,863,904,258

|

Taxpayers’ OmbudspersonFootnote 8

|

4,708,163

|

4,708,163

|

4,515,645

|

4,548,335

|

Subtotal

|

16,535,911,656

|

16,535,911,656

|

17,227,709,756

|

18,980,994,005

|

Internal services

|

1,043,543,907

|

1,043,543,907

|

1,019,092,968

|

993,521,940

|

Total

|

17,579,455,563

|

17,579,455,563

|

18,246,802,724

|

19,974,515,945

|

A significant portion of the increase in the CRA’s overall budget is attributable to its statutory appropriations, in particular to spending associated with the Canada Carbon Rebate. The CRA is responsible for the administration of the fuel charge in jurisdictions that do not meet the federal carbon pricing benchmark. This includes the delivery of the Canada Carbon Rebate which returns the majority of the direct proceeds from the fuel charge to individuals and families of the province in which the proceeds are raised.

Actual and forecast spending under the CRA’s voted appropriations for fiscal years 2021–22 to 2023–24 also includes technical adjustments such as the carry-forward from the previous year and funding for severance payments, parental benefits, and vacation credits. In 2023–24, a significant portion of the increase in forecast spending is a result of retroactive payments associated with collective bargaining adjustments for employees represented by the Public Service Alliance of Canada – Union of Taxation Employees and the Professional Institute of the Public Service of Canada. The 2023–24 fiscal year also reflects higher spending related to the administration of measures announced in the 2021 and 2022 federal budget and economic statements as well as funding to address the post-pandemic sustainability of CRA contact centres. This is partially offset by a reduction in spending on measures associated with the COVID-19 pandemic.

Over the planning period, the reduction in the CRA’s voted appropriations, from $4.655 billion in 2024–25 to $4.572 billion in 2026–27 is a result of a decrease or sunsetting of funding to implement and administer various measures announced in the federal budgets and economic statements as well as those associated with the COVID-19 pandemic. It also reflects the impact of the CRA’s contribution to the Refocusing government spending measures as announced in Budget 2023.