Analysis of trends in spending and human resources

From Employment and Social Development Canada

Official title: Employment and Social Development Canada 2016–2017 Departmental Results Report

Overview

This section presents an overview of the Department’s financial and human resource expenditures for the 2016 to 2017 fiscal year compared with previous years.

This section contains the following subsections:

- Actual Expenditures

- Actual Human Resources

- Expenditures by Vote

- Alignment of Spending With the Whole-of-Government Framework

- Financial Statements and Financial Statements Highlights

Actual expenditures

Departmental spending trend

ESDC expenditures on programs and services total $122.8 billion, of which $116.5 billion, or approximately 95 percent, directly benefits Canadians through Employment Insurance (EI), the Canada Pension Plan (CPP), Old Age Security (OAS) and other statutory transfer payment programs. Departmental expenditures were $1.9 billion in voted grants and contributions and $2.2 billion for Employment Insurance Part II.

Description of Figure 1

| Category | Fiscal year 2016 to 2017 actual spending |

|

|---|---|---|

| Amount in millions of dollars | Percentage | |

| Old Age Security / Guaranteed Income Supplement / Allowance | 48,201.8 | 39.3% |

| Canada Pension Plan (CPP) | 42,502.1 | 34.6% |

| Employment Insurance (EI) | 20,711.1 | 16.9% |

| Universal Child Care / Canada Student Loans / Other Statutory Payments | 5,039.2 | 4.1% |

| Gross Operating Expenditures | 3,171.8 | 2.6% |

| Voted Grants and Contributions | 1,878.8 | 1.5% |

| Other - Passport Services, Workers' Compensation and EI/CPP charges | 1,250.0 | 1.0% |

| Consolidated total | 122,754.8 | 100.0% |

Employment and Social Development Canada - Gross expenditures (in millions of dollars)

| Budgetary | Sub-total | Total | |

|---|---|---|---|

| Net Operating Costs | n/a | 1,241.4 | |

| Add Recoveries in relation to: | Canada Pension Plan | 297.9 | n/a |

| Employment Insurance Operating Account | 1,357.6 | n/a | |

| Workers' Compensation | 124.6 | n/a | |

| Passport Services | 141.5 | n/a | |

| Other | 8.8 | n/a | |

| Total recoveries | n/a | 1,930.4 | |

| Gross Operating Costs | n/a | 3,171.8 | |

| Voted Grants and Contributions | n/a | 1,878.8 | |

| Total Gross Expenditures | n/a | 5,050.6 | |

| Other – Workers' Compensation and EI/CPP Charges and Recoveries | n/a | 1,250.0 | |

Employment and Social Development Canada - Statutory transfer payments (in millions of dollars)

| Grants and Contributions | Sub-total | Total | |

|---|---|---|---|

| Old Age Security | n/a | 36,749.2 | |

| Guaranteed Income Supplement | n/a | 10,922.4 | |

| Allowance | n/a | 530.2 | |

| Other Statutory Payments | Universal Child Care Benefit | 1,976.1 | n/a |

| Canada Student Loans | 1,529.8 | n/a | |

| Canada Education Savings Grant | 858.6 | n/a | |

| Canada Disability Savings Program | 500.1 | n/a | |

| Canada Learning Bond | 133.4 | n/a | |

| Wage Earner Protection Program | 19.0 | n/a | |

| Total other statutory payments | n/a | 5,017.0 | |

| Sub-total grants and contributions | n/a | 53,218.8 | |

| Canada Pension Plan Benefits | n/a | 42,502.1 | |

| Employment Insurance Benefits | Part I | 18,531.2 | n/a |

| Part II | 2,179.9 | n/a | |

| Total Employment Insurance Benefits | n/a | 20,711.1 | |

| Other Specified Purpose Accounts | n/a | 22.2Footnote 1 | |

| Total Statutory Transfer Payments | n/a | 116,454.2 | |

The following figure illustrates ESDC’s spending trend from fiscal year 2014 to 2015 to fiscal year 2019 to 2020. In fiscal year 2016 to 2017, the Department spent $122.8 billion in achieving its expected results. Planned spending presented from fiscal year 2017 to 2018 to fiscal year 2019 to 2020 corresponds to the forecasted planned spending presented in the 2017–18 Departmental Plan.

Description of Figure 2

| Fiscal year | VotedFootnote 2 | Statutory | Sunset Programs – Anticipated | Total |

|---|---|---|---|---|

| 2014-2015 | 4 193 458 020 | 107 738 209 017 | no data | 111 931 667 037 |

| 2015-2016 | 4 058 896 841 | 118 784 815 253 | no data | 122 843 712 094 |

| 2016-2017 | 4 544 346 847 | 118 210 473 233 | no data | 128 754 820 080 |

| 2017-2018 | 4 180 286 832 | 124 165 103 414 | no data | 128 345 390 246 |

| 2018-2019 | 3 876 102 045 | 129 511 026 233 | no data | 133 387 128 278 |

| 2019-2020 | 3 559 895 983 | 135 662 532 058 | no data | 139 222 428 041 |

ESDC usually shows a constant increase in its Departmental Spending Trend. As noted in the graph above, the growth is attributable to statutory spending. ESDC is responsible for the direct delivery of programs such as OAS, the CPP, EI and other statutory transfer payments. Those programs can be affected by variances in the average number of beneficiaries and variances in the average benefit rates. This is the case for the OAS/Guaranteed Income Supplement (GIS) and CPP programs. For EI, spending can be influenced by many factors such as the number of eligible individuals establishing claims for EI benefits, which varies with the economy, the benefit rates or new measures implemented. The combined effect of those programs explain the main increase in Statutory spending overall.

In fiscal year 2016 to 2017, the total actual expenditures were $88.9 million less than in fiscal year 2015 to 2016. This is the result of a decrease of $574.3 million in statutory payments and an increase of $485.4 million in voted expenditures.

Statutory payments have followed their usual trend in fiscal year 2016 to 2017. There have been increases to OAS/GIS payments ($2.7 billion) and to CPP benefits ($1.8 billion) caused by the aging population and the changes in average monthly benefits. The fiscal year 2016 to 2017 average monthly rate for the OAS basic pension was $549.00, $8.37 more than the average rate from fiscal year 2015 to 2016. There was also an increase to the average number of beneficiaries from 5.6 million to 5.8 million for fiscal year 2016 to 2017.

EI benefits have also increased by $1.3 billion. The majority of the increase is mainly due to temporary legislative changes made through Budget 2016 announcements to extend the duration of EI regular benefits by 5 weeks for eligible claimants in the 15 EI economic regions, with up to an additional 20 weeks for long-tenured workers.

Other statutory programs show variances throughout the years (increase of $412 million for fiscal year 2016 to 2017 compared to fiscal year 2015 to 2016), namely the Canada Student Loans Program, the Canada Education Savings Grant Program and the Canada Disability Savings Program.

In fiscal year 2016 to 2017, these increases were offset by a large decrease of $6.8 billion to the Universal Child Care Benefit (UCCB) program. Budget 2016 introduced the Canada Child Benefit (CCB). The UCCB was replaced by the CCB and this change came into effect on July 1, 2016.

Overall increases and decreases to voted expenditures result mainly from variances in grants and contributions spending as well as from write-offs of irrecoverable debts owed to the Crown for directly financed Canada Student Loans in fiscal year 2014 to 2015 to fiscal year 2016 to 2017. The increase in grants and contributions from fiscal year 2015 to 2016 to fiscal year 2016 to 2017 is mainly due to the Youth Employment Strategy, the Canada Job Fund and the Homelessness programs having spent more than in fiscal year 2015 to 2016 due to additional funding received in fiscal year 2016 to 2017.

Budgetary performance summary

Budgetary performance summary for program(s) and internal services (dollars)Footnote 3

| Strategic Outcomes, Programs and Internal Services | Fiscal Year 2016 to 2017 Main Estimates |

Fiscal Year 2016 to 2017 Planned Spending |

Fiscal Year 2017 to 2018 Planned Spending |

Fiscal Year 2018 to 2019 Planned Spending |

Fiscal Year 2016 to 2017 Total Authorities Available for Use |

Fiscal Year 2016 to 2017 Actual Spending (authorities used) |

Fiscal Year 2015 to 2016 Actual Spending (authorities used)Footnote 4 |

Fiscal Year 2014 to 2015 Actual Spending (authorities used)Footnote 4 |

|---|---|---|---|---|---|---|---|---|

| Strategic Outcome 1: Government-wide Service excellence | ||||||||

| Program 1.1: Service Network Supporting Government Departments |

59,958,885 | 59,958,885 | 61,037,812 | 58,554,056 | 65,086,542 | 57,983,719 | 55,566,034 | 55,744,363 |

| Program 1.2: Delivery of Services for Other Government of Canada Programs |

164,172,167 | 164,172,167 | 178,192,378 | 1,681,622 | 161,490,000 | 127,104,037 | 133,440,054 | 157,236,664 |

| Strategic Outcome 1 Sub-total |

224,131,052 | 224,131,052 | 239,230,190 | 60,235,678 | 226,576,542 | 185,087,756 | 189,006,088 | 212,981,027 |

| Strategic Outcome 2: A skilled, adaptable and inclusive labour force and an efficient labour market | ||||||||

| Program 2.1: Skills and Employment | 2,436,178,048 | 22,187,663,325 | 24,578,109,363 | 24,232,054,261 | 23,623,267,335 | 23,467,649,089 | 21,794,776,029 | 20,440,879,133 |

| Program 2.2: Learning | 2,479,065,886 | 2,479,065,886 | 2,969,076,593 | 3,074,026,937 | 2,860,670,636 | 2,850,167,430 | 2,489,519,001 | 2,555,842,600 |

| Strategic Outcome 2 Sub-total |

4,915,243,934 | 24,666,729,211 | 27,547,185,956 | 27,306,081,198 | 26,483,937,971 | 26,317,816,519 | 24,284,295,030 | 22,996,721,733 |

| Strategic Outcome 3: Safe, fair and productive workplaces and cooperative workplace relations | ||||||||

| Program 3.1: Labour | 276,475,615 | 276,475,615 | 285,484,779 | 285,484,779 | 254,489,624 | 253,469,223 | 251,871,310 | 248,564,407 |

| Strategic Outcome 3 Sub-total |

276,475,615 | 276,475,615 | 285,484,779 | 285,484,779 | 254,489,624 | 253,469,223 | 251,871,310 | 248,564,407 |

| Strategic Outcome 4: Income security, access to opportunities and well-being for individuals, families and communities | ||||||||

| Program 4.1: Income Security | 49,194,616,913 | 92,909,168,672 | 97,929,274,126 | 103,322,693,183 | 91,636,331,831 | 91,631,984,510 | 87,042,524,292 | 83,569,177,338 |

| Program 4.2: Social Development | 7,933,212,853 | 7,933,212,853 | 311,001,403 | 243,649,279 | 2,266,438,200 | 2,239,757,375 | 8,961,100,867 | 2,940,137,196 |

| Strategic Outcome 4 Sub-total |

57,127,829,766 | 100,842,381,525 | 98,240,275,529 | 103,566,342,462 | 93,902,770,031 | 93,871,741,885 | 96,003,625,159 | 86,509,314,534 |

| Support to achieve all Strategic Outcomes | ||||||||

| Internal Services | 860,183,573 | 860,183,573 | 754,615,282 | 722,700,214 | 904,263,116 | 876,667,336 | 892,479,726 | 899,807,522 |

| Internal Services Sub-total |

860,183,573 | 860,183,573 | 754,615,282 | 722,700,214 | 904,263,116 | 876,667,336 | 892,479,726 | 899,807,522 |

| Other costsFootnote 5 | n/a | 1,208,650,163 | 1,278,598,510 | 1,446,283,947 | 1,207,237,353 | 1,250,037,361 | 1,222,434,781 | 1,064,277,814 |

| Sub-total | n/a | 1,208,650,163 | 1,278,598,510 | 1,446,283,947 | 1,207,237,353 | 1,250,037,361 | 1,222,434,781 | 1,064,277,814 |

| Total | 63,403,863,940 | 128,078,551,139 | 128,345,390,246 | 133,387,128,278 | 122,979,274,637 | 122,754,820,080 | 122,843,712,094 | 111,931,667,037 |

| Vote netted revenues | (1,765,982,132) | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| Total at Net | 61,637,881,808 | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

Budgetary performance summary for programs and internal services

The overall increase in spending of $21.5 billion from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending can mainly be explained by increases to Canada Pension Plan and Old Age Security benefits caused by the aging population and changes in the average monthly benefits.

The significant reduction from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending for Delivery of Services for Other Government of Canada Programs is mainly explained by the need to renew agreements on Passport services funding in fiscal year 2017 to 2018. The Department will have to request funding for fiscal year 2018 to 2019 and future years. As for the variance between planned spending for fiscal year 2016 to 2017 and actual spending for fiscal year 2016 to 2017, the difference is mainly due to the Passport contingency reserve that was created for unexpected circumstances and increases in volumes and not used. The unused funds remain in the non-lapsing Passport Revolving Fund.

Under Skills and Employment, the difference in financial resources from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending is mainly due to higher Employment Insurance benefits.

Under the Learning program, the overall increase in spending from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending is a result of increases to the Canada Loans and Grants for Students and Apprentices Program, including the Canada Education Savings Grant and the Canada Learning Bond.

The variances related to Labour from year to year are mostly attributable to changes in Wage Earner Protection Program and federal workers’ compensation payments.

The overall increase under Income Security from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending can be explained by increases in the number of beneficiaries and the average monthly benefits payments for Old Age Security ($9.9 billion) and the Canada Pension Plan ($9.5 billion).

In Social Development, the significant decrease from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending is a result of the Budget 2016 introduction of the Canada Child Benefit that came into effect on July 1, 2016, and replaced the Universal Child Care Benefit. The same reason applies to the variances that exist when comparing fiscal year 2015 to 2016 actual spending and fiscal year 2016 to 2017 actual spending.

The overall decrease between fiscal year 2014 to 2015 actual spending and fiscal year 2018 to 2019 planned spending for Internal Services can be explained by a revised guide issued by TBS on recording and reporting Internal Services expenditures that was effective April 1, 2016. As per this new guide, all special purpose real property as well as office accommodation retrofits done at the request of a program are to be charged to the programs and not to Internal Services. Internal Services’ future plans have been adjusted accordingly. A decrease in Internal Services occurred in fiscal year 2016 to 2017 as well, but this reduction is not as high as it should be due to the recording of temporary costs for overpayments in relation to the Phoenix pay issue, which increased expenditures.

The variance of $27.6 million in actual spending under Other Costs from fiscal year 2015 to 2016 to fiscal year 2016 to 2017 is mainly related to increased charges from other government departments to both the CPP and EI. Those increases are, in part, compensated by a decrease in EI doubtful accounts.

Actual human resources

| Strategic Outcomes, Programs and Internal Services | Fiscal year 2014 to 2015 ActualFootnote 4 |

Fiscal year 2015 to 2016 ActualFootnote 4 |

Fiscal year 2016 to 2017 Planned |

Fiscal year 2016 to 2017 Actual |

Fiscal year 2017 to 2018 Planned |

Fiscal year 2018 to 2019 Planned |

|---|---|---|---|---|---|---|

| Strategic Outcome 1: Government-wide Service excellence | ||||||

| Program 1.1: Service Network Supporting Government Departments |

509 | 399 | 410 | 330 | 410 | 410 |

| Program 1.2: Delivery of Services for Other Government of Canada Programs |

1,396 | 1,977 | 2,356 | 1,849 | 12 | 12 |

| Strategic Outcome 1 Sub-total |

1,905 | 2,376 | 2,766 | 2,179 | 422 | 422 |

| Strategic Outcome 2: A skilled, adaptable and inclusive labour force and an efficient labour market | ||||||

| Program 2.1: Skills and Employment | 9,083 | 9,053 | 8,872 | 9,722 | 8,344 | 8,344 |

| Program 2.2: Learning | 342 | 323 | 348 | 324 | 348 | 348 |

| Strategic Outcome 2 Sub-total |

9,425 | 9,376 | 9,220 | 10,046 | 8,692 | 8,692 |

| Strategic Outcome 3: Safe, fair and productive workplaces and cooperative workplace relations | ||||||

| Program 3.1: Labour | 604 | 645 | 641 | 647 | 638 | 638 |

| Strategic Outcome 3 Sub-total |

604 | 645 | 641 | 647 | 638 | 638 |

| Strategic Outcome 4: Income security, access to opportunities and well-being for individuals, families and communities | ||||||

| Program 4.1: Income Security | 4,166 | 4,381 | 3,753 | 4,801 | 3,484 | 3,484 |

| Program 4.2: Social Development | 362 | 289 | 337 | 309 | 337 | 337 |

| Strategic Outcome 4 Sub-total |

4,528 | 4,670 | 4,090 | 5,110 | 3,821 | 3,821 |

| Support to achieve all Strategic Outcomes | ||||||

| Program Internal Services |

3,997 | 3,943 | 4,164 | 3,843 | 3,989 | 3,989 |

| Internal Services Sub-total |

3,997 | 3,943 | 4,164 | 3,843 | 3,989 | 3,989 |

| Total | 20,459 | 21,010 | 20,881 | 21,825 | 17,562 | 17,562 |

Human resources summary for programs and internal services

There is an overall decrease of 2,897 FTEs from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs. This can be explained by the following three areas within Employment and Social Development Canada.

Under the Delivery of Services for Other Government of Canada Programs, there is an overall reduction of 1,384 FTEs from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs. This reduction in FTEs is mainly explained by the need to renew agreements on Passport services in fiscal year 2017 to 2018. The Department will have to request funding and FTEs for fiscal year 2018 to 2019 and future years. As for the variance between planned FTEs for fiscal year 2016 to 2017 and actual FTEs for fiscal year 2016 to 2017, the difference is mainly due to the Passport contingency reserve that was created for unexpected circumstances and increases in volumes and not used. The funding unused related to Passport FTEs remains in the non-lapsing Passport Revolving Fund.

Under Skills and Employment, FTE utilization has remained stable over the past three years. The overall decrease of 739 FTEs from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs is mainly due to requests for additional funds and FTEs for Employment Insurance (EI) measures in past years to address increased EI workload and other EI related needs. Planned FTEs for fiscal year 2017 to 2018 and fiscal year 2018 to 2019 do not include such requests. As for the variance between planned FTEs for fiscal year 2016 to 2017 and actual FTEs for fiscal year 2016 to 2017, the difference is due to the fact that such requests for additional funding and FTEs were done after planned FTE amounts were determined.

Under Income Security, FTE utilization has also remained stable over the last three years. The overall decrease of 682 FTEs under Income Security from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs can mainly be explained by requests for funds and FTEs in past years to address CPP and OAS workload. Planned FTEs for fiscal year 2017 to 2018 and fiscal year 2018 to 2019 do not include such requests. As for the variance between planned FTEs for fiscal year 2016 to 2017 and actual FTEs for fiscal year 2016 to 2017, the difference is due to the fact that such requests for additional funding and FTEs were done after planned FTE amounts were determined.

Expenditures by vote

For information on Employment and Social Development Canada’s organizational votes and statutory expenditures, consult the Public Accounts of Canada 2017.Footnote 6

Alignment of Spending With the Whole-of-Government Framework

| Programs | Spending Areas | Government of Canada Outcomes |

2016–17 Actual Spending |

|---|---|---|---|

| Program 1.1: Service Network Supporting Government Departments |

Government Affairs | A transparent, accountable and responsive federal government | 57,983,719 |

| Program 1.2: Delivery of Services for Other Government of Canada Programs |

Government Affairs | A transparent, accountable and responsive federal government | 127,104,037 |

| Program 2.1: Skills and Employment |

Economic Affairs | Income security and employment for Canadians | 23,467,649,089 |

| Program 2.2: Learning | Economic Affairs | An innovative and knowledge-based economy | 2,850,167,430 |

| Program 3.1: Labour | Economic Affairs | A fair and secure marketplace | 253,469,223 |

| Program 4.1: Income Security | Economic Affairs | Income security and employment for Canadians | 91,631,984,510 |

| Program 4.2: Social Development |

Social Affairs | A diverse society that promotes linguistic duality and social inclusion | 2,239,757,375 |

| Spending Areas | Total Planned Spending | Total Actual Spending |

|---|---|---|

| Economic Affairs | 111,695,144,753 | 118,203,270,252 |

| Social Affairs | 3,081,658,183 | 2,239,757,375 |

| Government Affairs | 223,224,592 | 185,087,756 |

Financial Statements and financial statements highlights

The financial highlights are intended to serve as a general overview of ESDC’s financial position and operations.

The following condensed consolidated financial statements are prepared in accordance with the Government’s accounting policies, which are based on Canadian public-sector accounting standards and are therefore different from reporting on the use of authorities, reflected in Sections II and III of this report. Reconciliation between authorities used and the net cost of operations is set out in Note 3 of the Department’s consolidated financial statements.

These consolidated financial statements include the transactions of the Employment Insurance Operating Account, a sub-entity under the control of ESDC. The accounts of this sub-entity have been consolidated with those of ESDC, and all inter-organizational balances and transactions have been eliminated. The Canada Pension Plan (CPP) is excluded from ESDC’s reporting entity because changes to the CPP require the agreement of two-thirds of participating provinces and it is therefore not controlled by the Government.

The unaudited departmental financial statements can be found on ESDC’s websiteFootnote 8.

Financial statements

Refer to the complete Employment and Social Development Canada Financial Statements (Unaudited) for the Year Ended March 31, 2017Footnote 9, which also includes an Annex to the statement of management responsibility including internal control over financial reporting.

| Details | Fiscal Year 2016 to 2017 Planned ResultsFootnote 10 |

Fiscal Year 2016 to 2017 Actual |

Fiscal year 2015 to 2016 Actual |

Difference (Fiscal year 2016 to 2017 Actual Minus fiscal year 2016 to 2017 Planned) |

Difference (Fiscal Year 2016 to 2017 Actual Minus Fiscal year 2015 to 2016 Actual) |

|---|---|---|---|---|---|

| Total expenses | 83,840,502,172 | 79,381,986,648 | 80,006,506,641 | (4,458,515,524) | (624,519,993) |

| Total revenues | 23,208,459,707 | 23,057,177,694 | 24,028,381,916 | (151,282,013) | (971,204,222) |

| Net cost of operations before government funding and transfers | 60,632,042,465 | 56,324,808,954 | 55,978,124,725 | (4,307,233,511) | 346,684,229 |

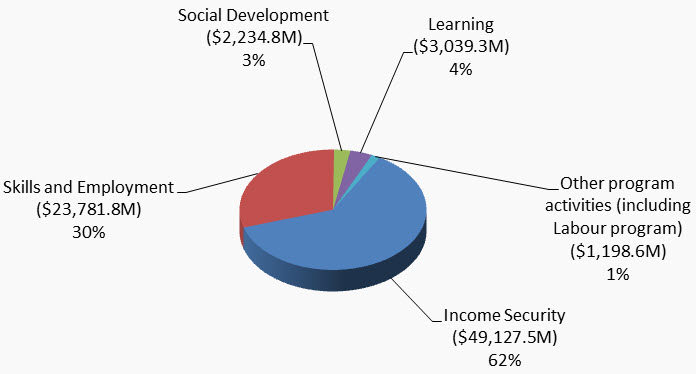

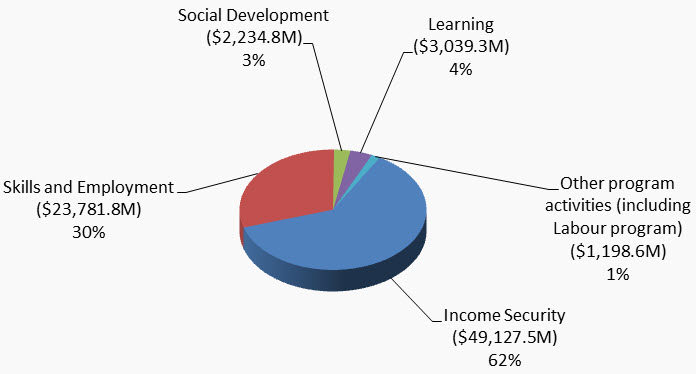

Expenses by major program activity

Description of Figure 3

| Program activities | in dollars | percentage |

|---|---|---|

| Income Security | 49,127,488 | 61.89% |

| Skills and Employment | 23,781,831 | 29.96% |

| Social Development | 2,234,791 | 2.82% |

| Learning | 3,039,277 | 3.83% |

| Other program activities (including Labour program) | 1,198,600 | 1.51% |

| Total | 79,381,987 | 100% |

Actual over planned

The 2016 to 2017 fiscal year’s expenses were $4,458.5 million lower than planned. The variance is mainly attributable to the elimination of the Universal Child Care Benefit program in July 2016, which was offset by unplanned increases in unemployment rates and benefits.

Actual year over year

Total expenses for fiscal year 2016 to 2017 amounted to $79,382.0 million, a decrease of $624.5 million over the previous year’s total expenses of $80,006.5 million. The decrease in expenses is mostly attributable to:

- an increase of $2,825.2 million in Income Security expenses mainly due to the increase in the eligible population for OAS caused by the growing aging population and the increase in the maximum monthly benefit amount, and the increase to the annual Guaranteed Income Supplement benefit for the lowest-income single seniors introduced in Budget 2016;

- an increase of $1,619.3 million in Skills and Employment expenses mainly due to increases in the average weekly benefits and in the number of EI beneficiaries as well as new temporary measures introduced in Budget 2016;

- an increase of $498.6 million in Learning expenses mainly due to increases in the amounts available through the Canada Student Grants Program beginning August 2016; and

- a decrease of $5,494.1 million in Social Development expenses mainly due to the elimination of the Universal Child Care Benefit program in July 2016.

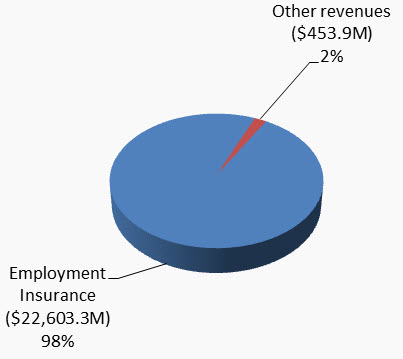

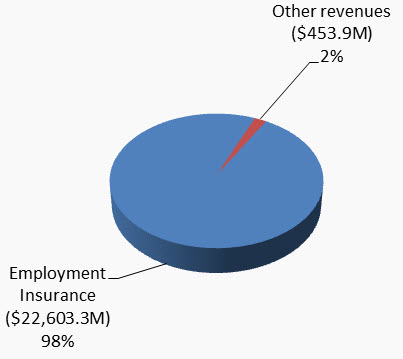

Revenues by type

Description of Figure 4

| Revenues | in dollars | percentage |

|---|---|---|

| Employment Insurance | 22,603,337 | 98.03% |

| Other revenues | 453,841 | 1.97% |

| Total | 23,057,178 | 100% |

Actual over planned

The 2016 to 2017 fiscal year’s revenues were $151.3 million lower than planned. The variance is mainly attributable to the total EI insurable earnings being lower than planned due to lower than expected growth in wages and employment.

Actual year over year

Total revenues for fiscal year 2016 to 2017 amounted to $23,057.2 million, a decrease of $971.2 million from the previous year's total revenues of $24,028.4 million. The majority of this decrease can be explained by a decrease in the premium rate for EI in 2017, which was offset by increases in the maximum insurable earnings and a growth in employment.

| Details | Fiscal Year 2016 to 2017 | Fiscal Year 2015 to 2016 | Difference (fiscal year 2016 to 2017 minus fiscal year 2015 to 2016) |

|---|---|---|---|

| Total net financial assets | 19,423,599,715 | 19,224,961,665 | 198,638,050 |

| Total net liabilities | 2,759,089,800 | 2,664,848,744 | 94,241,056 |

| Departmental net financial asset | 16,664,509,915 | 16,560,112,921 | 104,396,994 |

| Total non-financial assets | 246,384,354 | 277,921,707 | (31,537,353) |

| Departmental net financial position | 16,910,894,269 | 16,838,034,628 | 72,859,641 |

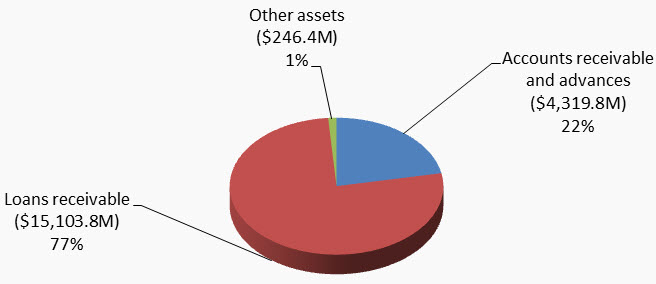

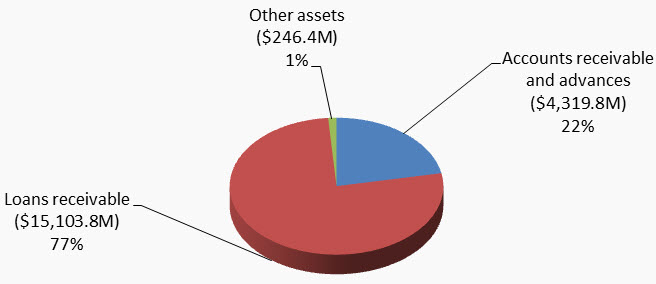

Assets by type

Description of Figure 5

| Assets | in dollars | percentage |

|---|---|---|

| Accounts receivable and advances | 4,319,773 | 21.96% |

| Loans receivable | 15,103,827 | 76.79% |

| Other assets | 246,384 | 1.25% |

| Total | 19,669,984 | 100% |

Total assets (including financial and non-financials assets) amounted to $19,670.0 million as at March 31, 2017, an increase of $167.1 million over the previous year's total assets of $19,502.9 million. The increase in assets is mainly attributable to:

- a decrease of $315.7 million in accounts receivable and advances mostly due to an decrease in EI premiums receivable from the Canada Revenue Agency that is in line with the overall premiums revenue decrease; and

- an increase of $514.3 million in loans receivable mostly caused by an excess of new Canada Student Loans disbursed over the total amount of repayments received.

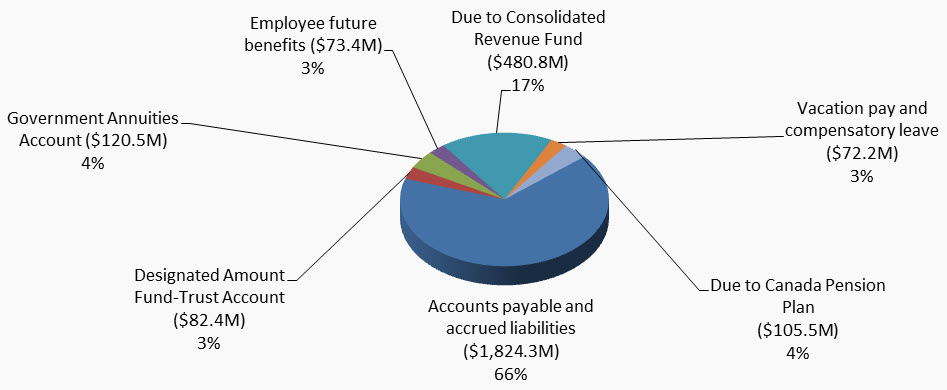

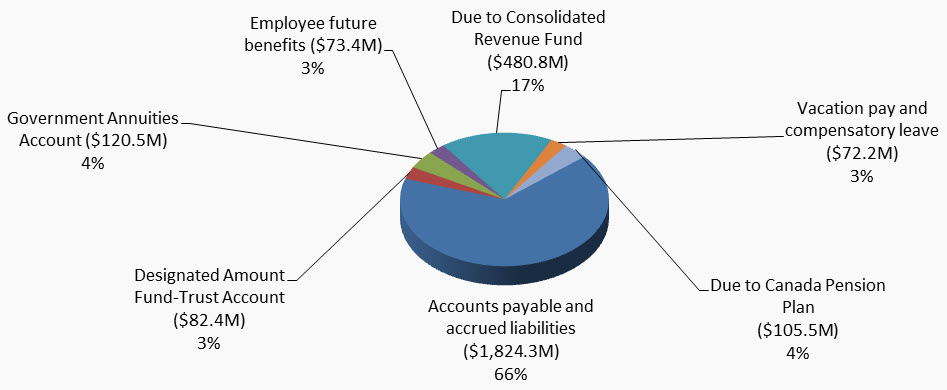

Liabilities by type

Description of Figure 6

| Liabilities | in dollars | percentage |

|---|---|---|

| Accounts payable and accrued liabilities | 1,824,340 | 66.12% |

| Designated Amount Fund-Trust Account | 82,397 | 2.99% |

| Government Annuities Account | 120,487 | 4.37% |

| Employee future benefits | 73,353 | 2.66% |

| Due to Consolidated Revenue Fund | 480,796 | 17.43% |

| Vacation pay and compensatory leave | 72,209 | 2.62% |

| Due to Canada Pension Plan | 105,508 | 3.82% |

| Total | 2,759,090 | 100% |

Total liabilities amounted to $2,759.1 million as at March 31, 2017, an increase of $94.3 million over the previous year's total liabilities of $2,664.8 million. The increase in liabilities is mostly due to timing of year-end payments.

From Employment and Social Development Canada

Official title: Employment and Social Development Canada 2016–2017 Departmental Results Report

Overview

This section presents an overview of the Department’s financial and human resource expenditures for the 2016 to 2017 fiscal year compared with previous years.

This section contains the following subsections:

- Actual Expenditures

- Actual Human Resources

- Expenditures by Vote

- Alignment of Spending With the Whole-of-Government Framework

- Financial Statements and Financial Statements Highlights

Actual expenditures

Departmental spending trend

ESDC expenditures on programs and services total $122.8 billion, of which $116.5 billion, or approximately 95 percent, directly benefits Canadians through Employment Insurance (EI), the Canada Pension Plan (CPP), Old Age Security (OAS) and other statutory transfer payment programs. Departmental expenditures were $1.9 billion in voted grants and contributions and $2.2 billion for Employment Insurance Part II.

Description of Figure 1

| Category | Fiscal year 2016 to 2017 actual spending |

|

|---|---|---|

| Amount in millions of dollars | Percentage | |

| Old Age Security / Guaranteed Income Supplement / Allowance | 48,201.8 | 39.3% |

| Canada Pension Plan (CPP) | 42,502.1 | 34.6% |

| Employment Insurance (EI) | 20,711.1 | 16.9% |

| Universal Child Care / Canada Student Loans / Other Statutory Payments | 5,039.2 | 4.1% |

| Gross Operating Expenditures | 3,171.8 | 2.6% |

| Voted Grants and Contributions | 1,878.8 | 1.5% |

| Other - Passport Services, Workers' Compensation and EI/CPP charges | 1,250.0 | 1.0% |

| Consolidated total | 122,754.8 | 100.0% |

Employment and Social Development Canada - Gross expenditures (in millions of dollars)

| Budgetary | Sub-total | Total | |

|---|---|---|---|

| Net Operating Costs | n/a | 1,241.4 | |

| Add Recoveries in relation to: | Canada Pension Plan | 297.9 | n/a |

| Employment Insurance Operating Account | 1,357.6 | n/a | |

| Workers' Compensation | 124.6 | n/a | |

| Passport Services | 141.5 | n/a | |

| Other | 8.8 | n/a | |

| Total recoveries | n/a | 1,930.4 | |

| Gross Operating Costs | n/a | 3,171.8 | |

| Voted Grants and Contributions | n/a | 1,878.8 | |

| Total Gross Expenditures | n/a | 5,050.6 | |

| Other – Workers' Compensation and EI/CPP Charges and Recoveries | n/a | 1,250.0 | |

Employment and Social Development Canada - Statutory transfer payments (in millions of dollars)

| Grants and Contributions | Sub-total | Total | |

|---|---|---|---|

| Old Age Security | n/a | 36,749.2 | |

| Guaranteed Income Supplement | n/a | 10,922.4 | |

| Allowance | n/a | 530.2 | |

| Other Statutory Payments | Universal Child Care Benefit | 1,976.1 | n/a |

| Canada Student Loans | 1,529.8 | n/a | |

| Canada Education Savings Grant | 858.6 | n/a | |

| Canada Disability Savings Program | 500.1 | n/a | |

| Canada Learning Bond | 133.4 | n/a | |

| Wage Earner Protection Program | 19.0 | n/a | |

| Total other statutory payments | n/a | 5,017.0 | |

| Sub-total grants and contributions | n/a | 53,218.8 | |

| Canada Pension Plan Benefits | n/a | 42,502.1 | |

| Employment Insurance Benefits | Part I | 18,531.2 | n/a |

| Part II | 2,179.9 | n/a | |

| Total Employment Insurance Benefits | n/a | 20,711.1 | |

| Other Specified Purpose Accounts | n/a | 22.2Footnote 1 | |

| Total Statutory Transfer Payments | n/a | 116,454.2 | |

The following figure illustrates ESDC’s spending trend from fiscal year 2014 to 2015 to fiscal year 2019 to 2020. In fiscal year 2016 to 2017, the Department spent $122.8 billion in achieving its expected results. Planned spending presented from fiscal year 2017 to 2018 to fiscal year 2019 to 2020 corresponds to the forecasted planned spending presented in the 2017–18 Departmental Plan.

Description of Figure 2

| Fiscal year | VotedFootnote 2 | Statutory | Sunset Programs – Anticipated | Total |

|---|---|---|---|---|

| 2014-2015 | 4 193 458 020 | 107 738 209 017 | no data | 111 931 667 037 |

| 2015-2016 | 4 058 896 841 | 118 784 815 253 | no data | 122 843 712 094 |

| 2016-2017 | 4 544 346 847 | 118 210 473 233 | no data | 128 754 820 080 |

| 2017-2018 | 4 180 286 832 | 124 165 103 414 | no data | 128 345 390 246 |

| 2018-2019 | 3 876 102 045 | 129 511 026 233 | no data | 133 387 128 278 |

| 2019-2020 | 3 559 895 983 | 135 662 532 058 | no data | 139 222 428 041 |

ESDC usually shows a constant increase in its Departmental Spending Trend. As noted in the graph above, the growth is attributable to statutory spending. ESDC is responsible for the direct delivery of programs such as OAS, the CPP, EI and other statutory transfer payments. Those programs can be affected by variances in the average number of beneficiaries and variances in the average benefit rates. This is the case for the OAS/Guaranteed Income Supplement (GIS) and CPP programs. For EI, spending can be influenced by many factors such as the number of eligible individuals establishing claims for EI benefits, which varies with the economy, the benefit rates or new measures implemented. The combined effect of those programs explain the main increase in Statutory spending overall.

In fiscal year 2016 to 2017, the total actual expenditures were $88.9 million less than in fiscal year 2015 to 2016. This is the result of a decrease of $574.3 million in statutory payments and an increase of $485.4 million in voted expenditures.

Statutory payments have followed their usual trend in fiscal year 2016 to 2017. There have been increases to OAS/GIS payments ($2.7 billion) and to CPP benefits ($1.8 billion) caused by the aging population and the changes in average monthly benefits. The fiscal year 2016 to 2017 average monthly rate for the OAS basic pension was $549.00, $8.37 more than the average rate from fiscal year 2015 to 2016. There was also an increase to the average number of beneficiaries from 5.6 million to 5.8 million for fiscal year 2016 to 2017.

EI benefits have also increased by $1.3 billion. The majority of the increase is mainly due to temporary legislative changes made through Budget 2016 announcements to extend the duration of EI regular benefits by 5 weeks for eligible claimants in the 15 EI economic regions, with up to an additional 20 weeks for long-tenured workers.

Other statutory programs show variances throughout the years (increase of $412 million for fiscal year 2016 to 2017 compared to fiscal year 2015 to 2016), namely the Canada Student Loans Program, the Canada Education Savings Grant Program and the Canada Disability Savings Program.

In fiscal year 2016 to 2017, these increases were offset by a large decrease of $6.8 billion to the Universal Child Care Benefit (UCCB) program. Budget 2016 introduced the Canada Child Benefit (CCB). The UCCB was replaced by the CCB and this change came into effect on July 1, 2016.

Overall increases and decreases to voted expenditures result mainly from variances in grants and contributions spending as well as from write-offs of irrecoverable debts owed to the Crown for directly financed Canada Student Loans in fiscal year 2014 to 2015 to fiscal year 2016 to 2017. The increase in grants and contributions from fiscal year 2015 to 2016 to fiscal year 2016 to 2017 is mainly due to the Youth Employment Strategy, the Canada Job Fund and the Homelessness programs having spent more than in fiscal year 2015 to 2016 due to additional funding received in fiscal year 2016 to 2017.

Budgetary performance summary

Budgetary performance summary for program(s) and internal services (dollars)Footnote 3

| Strategic Outcomes, Programs and Internal Services | Fiscal Year 2016 to 2017 Main Estimates |

Fiscal Year 2016 to 2017 Planned Spending |

Fiscal Year 2017 to 2018 Planned Spending |

Fiscal Year 2018 to 2019 Planned Spending |

Fiscal Year 2016 to 2017 Total Authorities Available for Use |

Fiscal Year 2016 to 2017 Actual Spending (authorities used) |

Fiscal Year 2015 to 2016 Actual Spending (authorities used)Footnote 4 |

Fiscal Year 2014 to 2015 Actual Spending (authorities used)Footnote 4 |

|---|---|---|---|---|---|---|---|---|

| Strategic Outcome 1: Government-wide Service excellence | ||||||||

| Program 1.1: Service Network Supporting Government Departments |

59,958,885 | 59,958,885 | 61,037,812 | 58,554,056 | 65,086,542 | 57,983,719 | 55,566,034 | 55,744,363 |

| Program 1.2: Delivery of Services for Other Government of Canada Programs |

164,172,167 | 164,172,167 | 178,192,378 | 1,681,622 | 161,490,000 | 127,104,037 | 133,440,054 | 157,236,664 |

| Strategic Outcome 1 Sub-total |

224,131,052 | 224,131,052 | 239,230,190 | 60,235,678 | 226,576,542 | 185,087,756 | 189,006,088 | 212,981,027 |

| Strategic Outcome 2: A skilled, adaptable and inclusive labour force and an efficient labour market | ||||||||

| Program 2.1: Skills and Employment | 2,436,178,048 | 22,187,663,325 | 24,578,109,363 | 24,232,054,261 | 23,623,267,335 | 23,467,649,089 | 21,794,776,029 | 20,440,879,133 |

| Program 2.2: Learning | 2,479,065,886 | 2,479,065,886 | 2,969,076,593 | 3,074,026,937 | 2,860,670,636 | 2,850,167,430 | 2,489,519,001 | 2,555,842,600 |

| Strategic Outcome 2 Sub-total |

4,915,243,934 | 24,666,729,211 | 27,547,185,956 | 27,306,081,198 | 26,483,937,971 | 26,317,816,519 | 24,284,295,030 | 22,996,721,733 |

| Strategic Outcome 3: Safe, fair and productive workplaces and cooperative workplace relations | ||||||||

| Program 3.1: Labour | 276,475,615 | 276,475,615 | 285,484,779 | 285,484,779 | 254,489,624 | 253,469,223 | 251,871,310 | 248,564,407 |

| Strategic Outcome 3 Sub-total |

276,475,615 | 276,475,615 | 285,484,779 | 285,484,779 | 254,489,624 | 253,469,223 | 251,871,310 | 248,564,407 |

| Strategic Outcome 4: Income security, access to opportunities and well-being for individuals, families and communities | ||||||||

| Program 4.1: Income Security | 49,194,616,913 | 92,909,168,672 | 97,929,274,126 | 103,322,693,183 | 91,636,331,831 | 91,631,984,510 | 87,042,524,292 | 83,569,177,338 |

| Program 4.2: Social Development | 7,933,212,853 | 7,933,212,853 | 311,001,403 | 243,649,279 | 2,266,438,200 | 2,239,757,375 | 8,961,100,867 | 2,940,137,196 |

| Strategic Outcome 4 Sub-total |

57,127,829,766 | 100,842,381,525 | 98,240,275,529 | 103,566,342,462 | 93,902,770,031 | 93,871,741,885 | 96,003,625,159 | 86,509,314,534 |

| Support to achieve all Strategic Outcomes | ||||||||

| Internal Services | 860,183,573 | 860,183,573 | 754,615,282 | 722,700,214 | 904,263,116 | 876,667,336 | 892,479,726 | 899,807,522 |

| Internal Services Sub-total |

860,183,573 | 860,183,573 | 754,615,282 | 722,700,214 | 904,263,116 | 876,667,336 | 892,479,726 | 899,807,522 |

| Other costsFootnote 5 | n/a | 1,208,650,163 | 1,278,598,510 | 1,446,283,947 | 1,207,237,353 | 1,250,037,361 | 1,222,434,781 | 1,064,277,814 |

| Sub-total | n/a | 1,208,650,163 | 1,278,598,510 | 1,446,283,947 | 1,207,237,353 | 1,250,037,361 | 1,222,434,781 | 1,064,277,814 |

| Total | 63,403,863,940 | 128,078,551,139 | 128,345,390,246 | 133,387,128,278 | 122,979,274,637 | 122,754,820,080 | 122,843,712,094 | 111,931,667,037 |

| Vote netted revenues | (1,765,982,132) | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| Total at Net | 61,637,881,808 | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

Budgetary performance summary for programs and internal services

The overall increase in spending of $21.5 billion from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending can mainly be explained by increases to Canada Pension Plan and Old Age Security benefits caused by the aging population and changes in the average monthly benefits.

The significant reduction from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending for Delivery of Services for Other Government of Canada Programs is mainly explained by the need to renew agreements on Passport services funding in fiscal year 2017 to 2018. The Department will have to request funding for fiscal year 2018 to 2019 and future years. As for the variance between planned spending for fiscal year 2016 to 2017 and actual spending for fiscal year 2016 to 2017, the difference is mainly due to the Passport contingency reserve that was created for unexpected circumstances and increases in volumes and not used. The unused funds remain in the non-lapsing Passport Revolving Fund.

Under Skills and Employment, the difference in financial resources from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending is mainly due to higher Employment Insurance benefits.

Under the Learning program, the overall increase in spending from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending is a result of increases to the Canada Loans and Grants for Students and Apprentices Program, including the Canada Education Savings Grant and the Canada Learning Bond.

The variances related to Labour from year to year are mostly attributable to changes in Wage Earner Protection Program and federal workers’ compensation payments.

The overall increase under Income Security from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending can be explained by increases in the number of beneficiaries and the average monthly benefits payments for Old Age Security ($9.9 billion) and the Canada Pension Plan ($9.5 billion).

In Social Development, the significant decrease from fiscal year 2014 to 2015 actual spending to fiscal year 2018 to 2019 planned spending is a result of the Budget 2016 introduction of the Canada Child Benefit that came into effect on July 1, 2016, and replaced the Universal Child Care Benefit. The same reason applies to the variances that exist when comparing fiscal year 2015 to 2016 actual spending and fiscal year 2016 to 2017 actual spending.

The overall decrease between fiscal year 2014 to 2015 actual spending and fiscal year 2018 to 2019 planned spending for Internal Services can be explained by a revised guide issued by TBS on recording and reporting Internal Services expenditures that was effective April 1, 2016. As per this new guide, all special purpose real property as well as office accommodation retrofits done at the request of a program are to be charged to the programs and not to Internal Services. Internal Services’ future plans have been adjusted accordingly. A decrease in Internal Services occurred in fiscal year 2016 to 2017 as well, but this reduction is not as high as it should be due to the recording of temporary costs for overpayments in relation to the Phoenix pay issue, which increased expenditures.

The variance of $27.6 million in actual spending under Other Costs from fiscal year 2015 to 2016 to fiscal year 2016 to 2017 is mainly related to increased charges from other government departments to both the CPP and EI. Those increases are, in part, compensated by a decrease in EI doubtful accounts.

Actual human resources

| Strategic Outcomes, Programs and Internal Services | Fiscal year 2014 to 2015 ActualFootnote 4 |

Fiscal year 2015 to 2016 ActualFootnote 4 |

Fiscal year 2016 to 2017 Planned |

Fiscal year 2016 to 2017 Actual |

Fiscal year 2017 to 2018 Planned |

Fiscal year 2018 to 2019 Planned |

|---|---|---|---|---|---|---|

| Strategic Outcome 1: Government-wide Service excellence | ||||||

| Program 1.1: Service Network Supporting Government Departments |

509 | 399 | 410 | 330 | 410 | 410 |

| Program 1.2: Delivery of Services for Other Government of Canada Programs |

1,396 | 1,977 | 2,356 | 1,849 | 12 | 12 |

| Strategic Outcome 1 Sub-total |

1,905 | 2,376 | 2,766 | 2,179 | 422 | 422 |

| Strategic Outcome 2: A skilled, adaptable and inclusive labour force and an efficient labour market | ||||||

| Program 2.1: Skills and Employment | 9,083 | 9,053 | 8,872 | 9,722 | 8,344 | 8,344 |

| Program 2.2: Learning | 342 | 323 | 348 | 324 | 348 | 348 |

| Strategic Outcome 2 Sub-total |

9,425 | 9,376 | 9,220 | 10,046 | 8,692 | 8,692 |

| Strategic Outcome 3: Safe, fair and productive workplaces and cooperative workplace relations | ||||||

| Program 3.1: Labour | 604 | 645 | 641 | 647 | 638 | 638 |

| Strategic Outcome 3 Sub-total |

604 | 645 | 641 | 647 | 638 | 638 |

| Strategic Outcome 4: Income security, access to opportunities and well-being for individuals, families and communities | ||||||

| Program 4.1: Income Security | 4,166 | 4,381 | 3,753 | 4,801 | 3,484 | 3,484 |

| Program 4.2: Social Development | 362 | 289 | 337 | 309 | 337 | 337 |

| Strategic Outcome 4 Sub-total |

4,528 | 4,670 | 4,090 | 5,110 | 3,821 | 3,821 |

| Support to achieve all Strategic Outcomes | ||||||

| Program Internal Services |

3,997 | 3,943 | 4,164 | 3,843 | 3,989 | 3,989 |

| Internal Services Sub-total |

3,997 | 3,943 | 4,164 | 3,843 | 3,989 | 3,989 |

| Total | 20,459 | 21,010 | 20,881 | 21,825 | 17,562 | 17,562 |

Human resources summary for programs and internal services

There is an overall decrease of 2,897 FTEs from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs. This can be explained by the following three areas within Employment and Social Development Canada.

Under the Delivery of Services for Other Government of Canada Programs, there is an overall reduction of 1,384 FTEs from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs. This reduction in FTEs is mainly explained by the need to renew agreements on Passport services in fiscal year 2017 to 2018. The Department will have to request funding and FTEs for fiscal year 2018 to 2019 and future years. As for the variance between planned FTEs for fiscal year 2016 to 2017 and actual FTEs for fiscal year 2016 to 2017, the difference is mainly due to the Passport contingency reserve that was created for unexpected circumstances and increases in volumes and not used. The funding unused related to Passport FTEs remains in the non-lapsing Passport Revolving Fund.

Under Skills and Employment, FTE utilization has remained stable over the past three years. The overall decrease of 739 FTEs from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs is mainly due to requests for additional funds and FTEs for Employment Insurance (EI) measures in past years to address increased EI workload and other EI related needs. Planned FTEs for fiscal year 2017 to 2018 and fiscal year 2018 to 2019 do not include such requests. As for the variance between planned FTEs for fiscal year 2016 to 2017 and actual FTEs for fiscal year 2016 to 2017, the difference is due to the fact that such requests for additional funding and FTEs were done after planned FTE amounts were determined.

Under Income Security, FTE utilization has also remained stable over the last three years. The overall decrease of 682 FTEs under Income Security from fiscal year 2014 to 2015 actual FTEs to fiscal year 2018 to 2019 planned FTEs can mainly be explained by requests for funds and FTEs in past years to address CPP and OAS workload. Planned FTEs for fiscal year 2017 to 2018 and fiscal year 2018 to 2019 do not include such requests. As for the variance between planned FTEs for fiscal year 2016 to 2017 and actual FTEs for fiscal year 2016 to 2017, the difference is due to the fact that such requests for additional funding and FTEs were done after planned FTE amounts were determined.

Expenditures by vote

For information on Employment and Social Development Canada’s organizational votes and statutory expenditures, consult the Public Accounts of Canada 2017.Footnote 6

Alignment of Spending With the Whole-of-Government Framework

| Programs | Spending Areas | Government of Canada Outcomes |

2016–17 Actual Spending |

|---|---|---|---|

| Program 1.1: Service Network Supporting Government Departments |

Government Affairs | A transparent, accountable and responsive federal government | 57,983,719 |

| Program 1.2: Delivery of Services for Other Government of Canada Programs |

Government Affairs | A transparent, accountable and responsive federal government | 127,104,037 |

| Program 2.1: Skills and Employment |

Economic Affairs | Income security and employment for Canadians | 23,467,649,089 |

| Program 2.2: Learning | Economic Affairs | An innovative and knowledge-based economy | 2,850,167,430 |

| Program 3.1: Labour | Economic Affairs | A fair and secure marketplace | 253,469,223 |

| Program 4.1: Income Security | Economic Affairs | Income security and employment for Canadians | 91,631,984,510 |

| Program 4.2: Social Development |

Social Affairs | A diverse society that promotes linguistic duality and social inclusion | 2,239,757,375 |

| Spending Areas | Total Planned Spending | Total Actual Spending |

|---|---|---|

| Economic Affairs | 111,695,144,753 | 118,203,270,252 |

| Social Affairs | 3,081,658,183 | 2,239,757,375 |

| Government Affairs | 223,224,592 | 185,087,756 |

Financial Statements and financial statements highlights

The financial highlights are intended to serve as a general overview of ESDC’s financial position and operations.

The following condensed consolidated financial statements are prepared in accordance with the Government’s accounting policies, which are based on Canadian public-sector accounting standards and are therefore different from reporting on the use of authorities, reflected in Sections II and III of this report. Reconciliation between authorities used and the net cost of operations is set out in Note 3 of the Department’s consolidated financial statements.

These consolidated financial statements include the transactions of the Employment Insurance Operating Account, a sub-entity under the control of ESDC. The accounts of this sub-entity have been consolidated with those of ESDC, and all inter-organizational balances and transactions have been eliminated. The Canada Pension Plan (CPP) is excluded from ESDC’s reporting entity because changes to the CPP require the agreement of two-thirds of participating provinces and it is therefore not controlled by the Government.

The unaudited departmental financial statements can be found on ESDC’s websiteFootnote 8.

Financial statements

Refer to the complete Employment and Social Development Canada Financial Statements (Unaudited) for the Year Ended March 31, 2017Footnote 9, which also includes an Annex to the statement of management responsibility including internal control over financial reporting.

| Details | Fiscal Year 2016 to 2017 Planned ResultsFootnote 10 |

Fiscal Year 2016 to 2017 Actual |

Fiscal year 2015 to 2016 Actual |

Difference (Fiscal year 2016 to 2017 Actual Minus fiscal year 2016 to 2017 Planned) |

Difference (Fiscal Year 2016 to 2017 Actual Minus Fiscal year 2015 to 2016 Actual) |

|---|---|---|---|---|---|

| Total expenses | 83,840,502,172 | 79,381,986,648 | 80,006,506,641 | (4,458,515,524) | (624,519,993) |

| Total revenues | 23,208,459,707 | 23,057,177,694 | 24,028,381,916 | (151,282,013) | (971,204,222) |

| Net cost of operations before government funding and transfers | 60,632,042,465 | 56,324,808,954 | 55,978,124,725 | (4,307,233,511) | 346,684,229 |

Expenses by major program activity

Description of Figure 3

| Program activities | in dollars | percentage |

|---|---|---|

| Income Security | 49,127,488 | 61.89% |

| Skills and Employment | 23,781,831 | 29.96% |

| Social Development | 2,234,791 | 2.82% |

| Learning | 3,039,277 | 3.83% |

| Other program activities (including Labour program) | 1,198,600 | 1.51% |

| Total | 79,381,987 | 100% |

Actual over planned

The 2016 to 2017 fiscal year’s expenses were $4,458.5 million lower than planned. The variance is mainly attributable to the elimination of the Universal Child Care Benefit program in July 2016, which was offset by unplanned increases in unemployment rates and benefits.

Actual year over year

Total expenses for fiscal year 2016 to 2017 amounted to $79,382.0 million, a decrease of $624.5 million over the previous year’s total expenses of $80,006.5 million. The decrease in expenses is mostly attributable to:

- an increase of $2,825.2 million in Income Security expenses mainly due to the increase in the eligible population for OAS caused by the growing aging population and the increase in the maximum monthly benefit amount, and the increase to the annual Guaranteed Income Supplement benefit for the lowest-income single seniors introduced in Budget 2016;

- an increase of $1,619.3 million in Skills and Employment expenses mainly due to increases in the average weekly benefits and in the number of EI beneficiaries as well as new temporary measures introduced in Budget 2016;

- an increase of $498.6 million in Learning expenses mainly due to increases in the amounts available through the Canada Student Grants Program beginning August 2016; and

- a decrease of $5,494.1 million in Social Development expenses mainly due to the elimination of the Universal Child Care Benefit program in July 2016.

Revenues by type

Description of Figure 4

| Revenues | in dollars | percentage |

|---|---|---|

| Employment Insurance | 22,603,337 | 98.03% |

| Other revenues | 453,841 | 1.97% |

| Total | 23,057,178 | 100% |

Actual over planned

The 2016 to 2017 fiscal year’s revenues were $151.3 million lower than planned. The variance is mainly attributable to the total EI insurable earnings being lower than planned due to lower than expected growth in wages and employment.

Actual year over year

Total revenues for fiscal year 2016 to 2017 amounted to $23,057.2 million, a decrease of $971.2 million from the previous year's total revenues of $24,028.4 million. The majority of this decrease can be explained by a decrease in the premium rate for EI in 2017, which was offset by increases in the maximum insurable earnings and a growth in employment.

| Details | Fiscal Year 2016 to 2017 | Fiscal Year 2015 to 2016 | Difference (fiscal year 2016 to 2017 minus fiscal year 2015 to 2016) |

|---|---|---|---|

| Total net financial assets | 19,423,599,715 | 19,224,961,665 | 198,638,050 |

| Total net liabilities | 2,759,089,800 | 2,664,848,744 | 94,241,056 |

| Departmental net financial asset | 16,664,509,915 | 16,560,112,921 | 104,396,994 |

| Total non-financial assets | 246,384,354 | 277,921,707 | (31,537,353) |

| Departmental net financial position | 16,910,894,269 | 16,838,034,628 | 72,859,641 |

Assets by type

Description of Figure 5

| Assets | in dollars | percentage |

|---|---|---|

| Accounts receivable and advances | 4,319,773 | 21.96% |

| Loans receivable | 15,103,827 | 76.79% |

| Other assets | 246,384 | 1.25% |

| Total | 19,669,984 | 100% |

Total assets (including financial and non-financials assets) amounted to $19,670.0 million as at March 31, 2017, an increase of $167.1 million over the previous year's total assets of $19,502.9 million. The increase in assets is mainly attributable to:

- a decrease of $315.7 million in accounts receivable and advances mostly due to an decrease in EI premiums receivable from the Canada Revenue Agency that is in line with the overall premiums revenue decrease; and

- an increase of $514.3 million in loans receivable mostly caused by an excess of new Canada Student Loans disbursed over the total amount of repayments received.

Liabilities by type

Description of Figure 6

| Liabilities | in dollars | percentage |

|---|---|---|

| Accounts payable and accrued liabilities | 1,824,340 | 66.12% |

| Designated Amount Fund-Trust Account | 82,397 | 2.99% |

| Government Annuities Account | 120,487 | 4.37% |

| Employee future benefits | 73,353 | 2.66% |

| Due to Consolidated Revenue Fund | 480,796 | 17.43% |

| Vacation pay and compensatory leave | 72,209 | 2.62% |

| Due to Canada Pension Plan | 105,508 | 3.82% |

| Total | 2,759,090 | 100% |

Total liabilities amounted to $2,759.1 million as at March 31, 2017, an increase of $94.3 million over the previous year's total liabilities of $2,664.8 million. The increase in liabilities is mostly due to timing of year-end payments.

Page details

- Date modified: