Consultation Paper: Creating a Patent Box Regime

Introduction

Patent-owning businesses grow faster and pay higher wages. However, on the number of patents held, Canada lags behind other countries we are competing with to attract investment and grow our economy.

To build a world-class intellectual property regime, since 2015, the federal government has taken important steps to improve Canada's intellectual property (IP) performance, including through the launch of the National Intellectual Property Strategy in 2018, and Elevate IP and IP Assist announced in Budget 2021. In Budget 2021, the government announced the Strategic Intellectual Property Program Review, which received further support in Budget 2022 and which Innovation, Science and Economic Development Canada (ISED) held consultations on from March 23, 2023, to May 14, 2023.

In Budget 2022, the federal government made nearly $100 million in investments to develop Canada's intellectual property regime, and committed to seeking views on the suitability of adopting a patent box regime to encourage the development and retention of intellectual property stemming from R&D conducted in Canada.

Creating a Patent Box Regime

The government is seeking views on the suitability of creating a patent box regime to encourage the development and retention of IP stemming from R&D conducted in Canada. A patent box provides a preferential tax rate to income derived from certain types of intellectual property to incentivize research and development in that country, and is currently used in 13 European Union member states.

If a patent box regime were put in place, the government would need to take into account the outer limits of the "nexus approach" agreed to by OECD countries in 2015, established by the Forum on Harmful Tax Practices and published in the 2015 Final Report on Action 5 of the Action Plan on Base Erosion and Profit Shifting. The report outlines the nexus approach as allowing "a taxpayer to benefit from an IP regime only to the extent that the taxpayer itself incurred qualifying R&D expenditures that gave rise to the IP income." The nexus approach was created with a view of ensuring IP regimes around the world encourage R&D activities, and foster economic growth and new employment opportunities.

Key Questions for Consideration

The Department of Finance is seeking feedback from stakeholders on the following questions:

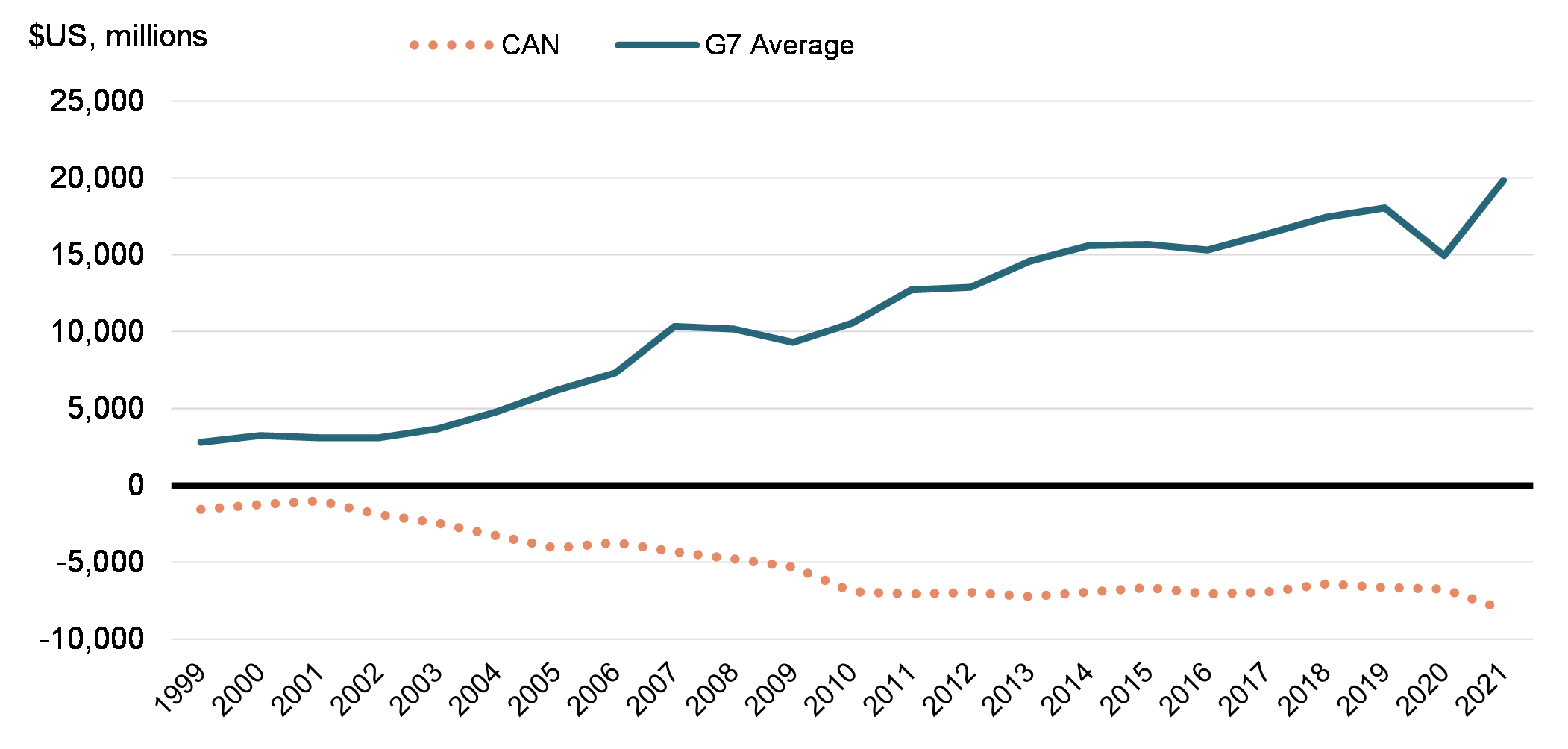

- In contrast to its international peers, Canada has a net balance of payments deficit (receipts minus payments) on charges for the use of IP that has grown over the last two decades (see the chart below). In other words, businesses in Canada outlay more to entities in other countries for the use of IP than they receive from international sources for the same purpose. What sort of dynamics might be underlying this trend? What factors have contributed to Canada's negative balance?

- Would implementation of a patent box regime improve Canada's competitiveness as a location for developing, commercializing, and retaining ownership of IP? With respect to competitiveness as a location for developing IP, how would support through a patent box regime compare to support provided through the SR&ED program?

- How important are tax considerations in decisions regarding where to commercialize IP and where to locate IP? Which factors besides tax rates impact businesses' decisions around where to locate and commercialize IP derived from R&D conducted in Canada? How should the Department of Finance account for these factors in determining how businesses might alter their behaviour in response to implementation of a patent box regime?

- What would be a competitive combined federal-provincial/territorial tax rate under a Canadian patent box regime?

- The Action 5 Final Report identifies the IP assets that are in-scope of a nexus compliant approach.Footnote 1 Should all these assets be eligible for a potential patent box regime in Canada? Are there differences in business practices with respect to different types of IP assets that should lead the Department of Finance to expect that commercialization and IP location decisions for each asset would respond differently to a patent box regime?

- If Canada were to implement a patent box regime, compliance with the nexus approach would require businesses to report detailed information around expenditures incurred in the development of eligible IP, similar to requirements in place under regimes in other jurisdictions that are compliant with the nexus approach. Drawing on experience with nexus-compliant regimes in other jurisdictions, please share any comments on challenges and best practices in this regard.

- Are there design features of a patent box regime that the Department of Finance should consider specifically to limit new fiscal costs to the government?

Page details

- Date modified: