2021 Study of the economic impacts of music streaming on the Canadian music industry

Prepared for Canadian Heritage

June 2nd 2021

Wall Communications Inc.

NOTE: The views expressed in this document are solely those of Wall Communications Inc. and do not necessarily represent the views of the Canadian Heritage or any other person or agency.

On this page

- List of figures

- List of tables

- List of acronyms and abbreviations

- Executive summary

- Four categories of rights-holders

- Earnings by rights-holder category in overall industry

- Earnings by rights-holder category in the streaming market

- Major labels vs. indie labels

- Canadian artists

- The Quebec francophone market

- The impact of COVID-19

- Streaming services and payouts

- Technological disruption and industry changes

- Changing industry ownership structure

- Data

- 2021 Study of the economic impacts of music streaming on the Canadian music industry

- Introduction

- Identifying the supply chain elements and the parties involved

- Earnings in the Canadian music (sound recording) industry by rights-holder segment

- 3.1 Introduction

- 3.2 Industry overview

- 3.3 Who earns what in Canadian recorded music: the big picture

- 3.4 Songwriter sound recording earnings

- 3.5 Publisher sound recording earnings

- 3.6 Performer sound recording earnings

- 3.7 Record label sound recording earnings

- 3.8 Industry earnings by all rights-holder categories

- Streaming earnings in the Canadian music industry by rights-holder category

- 4.1 Overview of streaming in the Canadian sound recording industry

- 4.2 Songwriter streaming earnings

- 4.3 Publisher earnings from streaming services

- 4.4 Performer earnings from streaming services

- 4.5 Record label earnings from streaming services

- 4.6 Industry streaming earnings by all rights-holder categories

- Streaming industry deeper dive: majors vs. indies; domestic vs. foreign; Quebec francophone market; COVID-19

- Industry changes and competition

- Final observations

- Appendices

List of figures

- Figure 1: Canadian Sound Recording Earnings by Rights-Holders, 2019

- Figure 2: Recorded Music Revenues by Format (IFPI Global Music Report: Canada) 2016 to 2020 ($US)

- Figure 3: Canadian Streaming Earnings by Rights-Holders, 2019

- Figure 4: Guide for Music Makers to Collect Music Royalties in Canada

- Figure 5: Canadian Sound Recording Earnings by Rights-Holders, 2019

- Figure 6: Recorded Music Revenues by Format (IFPI Global Music Report: Canada) 2016 to 2020 ($US)

- Figure 7: Canadian Streaming Earnings by Rights-Holders, 2019

- Figure 8: Share of Streams in Top 50 Songs by Canadian Artists in Canada, 2020

- Figure 9: Global music subscriber market share, Q1 2020

- Figure 10: Key Digital Distributors and their Ownership Ties

List of tables

- Table 1: Estimated earnings (DIY) from various streaming services (1 million streams)

- Table 2: Earnings by rights-holder category 2019 – overall industry

- Table 3: Recorded music revenues by format (IFPI global music report: Canada) 2016 to 2020 ($US)

- Table 4: Earnings by rights-holder category 2019 – streaming services

- Table 5: Number of label participants by category: major, independent labels and DIY

- Table 6: Market shares of label categories: global, Canada and Canada streaming

- Table 7: Top 10 Canadian indie labels (IFPA 2019)

- Table 8: Top 10 Canadian indie labels: total streams by all artists (2018 to 2020 Releases)

- Table 9: Canadian performer song streams in top 50 (Canada 2020)

- Table 10: Top streamed songs in Canada featuring Drake, The Weeknd, Bieber or Mendes, 2020

- Table 11: Estimated earnings (DIY) from various streaming services (1 million streams)

List of acronyms and abbreviations

- ACTRA

- Alliance of canadian cinema, television and radio artists

- APEM

- Association des professionnels de l’édition musicale

- AV

- Audio-visual

- BMG

- Bertelsmann Music Group

- CISAC

- International confederation of authors and composers

- CMO

- Collective management organization

- CMRRA

- Canadian musical reproduction rights agency

- DAW

- Digital audio workstation

- DIY

- Do it yourself

- IFPI

- International federation of the phonographic industry

- IP

- Intellectual property

- IPO

- Initial public offering

- MPC

- Music publishers of Canada

- MROC

- Musicians rights organization of Canada

- PR

- Performance rights

- PRO

- Performance rights organizations

- RACS

- Recording artists’ collecting society

- RR

- Reproduction rights

- SOCAN

- Society of composers, authors and music publishers of Canada

- StatCan

- Statistics Canada

- UMG

- Universal Music Group

Executive summary

This Study examines the impact of music streaming services on Canadian music creators. This issue was examined previously in a Study conducted by Wall Communications Inc. two years ago.Footnote 1 In essence, the mandate of the 2021 Study hasn’t changed substantially – just the time period. The last two years have seen a number of industry developments pertinent to understanding the impact of streaming.

While we investigate several issues,Footnote 2 the fundamental questions of this Study begin with straightforward enquiries: How much is being earned in the recorded music business in Canada? How much in streaming? And who is earning it?

Four categories of rights-holders

We examine the status of four categories of rights-holders: songwriters, publishers, performers and record labels (producers). The “music creation” role of each of these rights-holder categories is first explained. In brief, songwriters are those parties who write lyrics, compose music or both. Publishers can be seen as the business partners of songwriters, seeking out ways to monetize the songs they represent. Performers (also referred to as artists) are the parties that perform songs in a sound recording. Record labels (also known as producers) typically fund sound recordings and own the rights to the master recording, among other functions.

Songwriters own the copyright for a composition and are entitled to payment for the public performance of a song as well as for the reproduction of a song that has been recorded. Publishers typically have a similar status, sharing in the songwriters’ rights payments, or receiving a percentage of rights payment for administering the use of the musical works. Performers (featured and non-featured) are entitled to certain “neighbouring” rights for the recording of their performance. The neighbouring rights obtain when a sound recording is performed publicly. These royalty payments are referred to in the Canadian Copyright Act as “equitable remuneration”.Footnote 3 There is also a right for reproduction for purposes of enabling certain types of public performance of a sound recording. Record labels have their own “neighbouring” rights for the public performance of a sound recording as well as a reproduction right for purposes of enabling a public performance.

We estimate the amount and share of earnings of each rights-holder category in the Canadian recorded music industry. We then estimate the share of earnings of each category with respect to music streaming (primarily subscription) services.Footnote 4

Earnings by rights-holder category in overall industry

Regarding the share of earnings in the overall Canadian recorded music industry, we find that record labels earn over half of industry earnings with writers, publishers and performers earning between 13% and 20% of the total.

Wall Communications Inc. 2021

Figure 1: Canadian sound recording earnings by rights-holders, 2019 – text version

| Rights-holder | Earnings | Share |

|---|---|---|

| Songwriters | $187.4M | 20% |

| Publishers | $143.0M | 15% |

| Performers | $125.0M | 13% |

| Record labels | $482.5M | 52% |

Earnings by rights-holder category in the streaming market

Streaming has become the most prevalent means of music consumption in Canada and elsewhere. The International Federation of the Phonographic Industry (IFPI) reported Canadian streaming revenues (for record labels) of $129.0M US in 2016 (or 35% of total revenues) but that had risen to $359.0M US (or 74% of total revenues) in 2020.

IFPI Global Music Report 2021 (Canada) and Wall Communications Inc. 2021

Figure 2: Recorded music revenues by format (IFPI Global Music Report: Canada) 2016 to 2020 ($US) – text version

| Year | Streaming | Other | Total |

|---|---|---|---|

| 2016 | 129,200,000 | 241,900,000 | $371M |

| 2017 | 194,000,000 | 230,500,000 | $425M |

| 2018 | 255,900,000 | 170,600,000 | $427M |

| 2019 | 304,800,000 | 142,000,000 | $447M |

| 2020 | 359,000,000 | 124,000,000 | $483M |

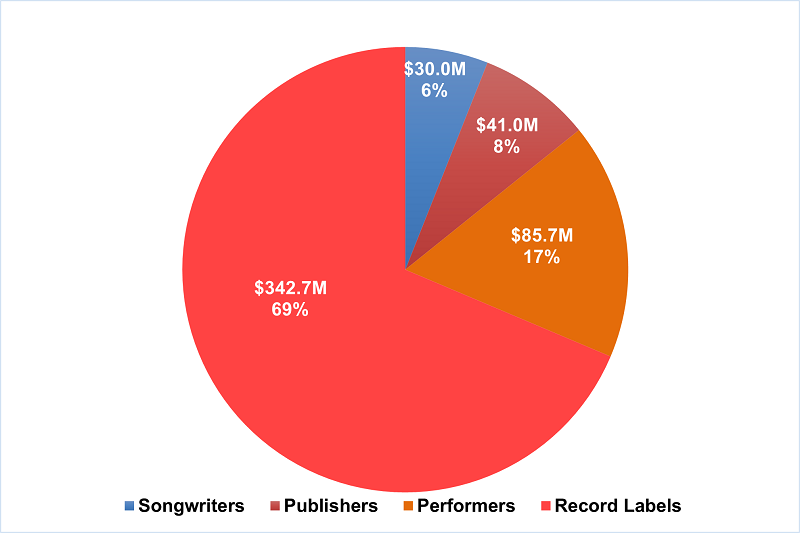

With respect to earnings from music streaming services, the percentage earned by record labels is significantly larger, increasing from 52% (of overall recorded music earnings) to 69% specifically from streaming services 2019. Songwriters earned only 6% of the total with publishers earning 8%. Performers earned 17%.

Wall Communications Inc. 2021

Figure 3: Canadian streaming earnings by rights-holders, 2019 – text version

| Rights Holder | Earnings | Share |

|---|---|---|

| Songwriters | $30.0M | 6% |

| Publishers | $41.0M | 8% |

| Performers | $85.7M | 17% |

| Record Labels | $342.7M | 69% |

Major labels vs. indie labels

The major record labels (Sony, Universal Music Group and Warner) dominate the recorded music industry globally and domestically. This also extends to the streaming segment where they occupy an estimated 72% of the Canadian market. The major labels represent virtually all of the most successful Canadian performers (such as The Weeknd, Justin Bieber, Shawn Mendes and Drake). Other large record labels (for example, Bertelsmann Music Group, Kobalt/AWAL and other non-Canadian Indies) make up much of the remainder of Canadian streaming revenues.

Of the top 50 streamed songs in Canada (by both domestic and foreign artists) in 2020, there were no featured performers represented by an independent or Indie label (Canadian or international) – all songs featured performers who are represented by a major label. We take this as an indication of the significant role that the majors play in the Canadian market.

Canadian artists

Examining the share of streams by Canadian artists, out of a total 2.42 billion streams by the top 50 songs in Canada in 2020 (Canadian and non-Canadian performers), songs featuring Canadians garnered 372.9 million streams – or 15.4% of streams. Almost 90% of the 372.9 million streams were by The Weeknd, Justin Bieber, Shawn Mendes and Drake. There were no performers represented by a Canadian Indie record label in the Top 50 steamed songs.

Of the total 1.15 billion streams in the top 50 songs featuring Canadian performers, 700 million streams (more than 60%) were by just 4 artists: Drake, The Weeknd, Justin Bieber and Shawn Mendes. Given the extreme success in the streaming market by a handful of Canadian artists, the implication for other Canadian artists (for example, Indie artists but also less popular artists on major labels) is that there is less – much less – earned by them: the streaming market is largely captured by non-Canadian performers and a handful of uber-successful Canadian performers.

The Quebec francophone market

The Canadian francophone music market (which is primarily based in Quebec) has several differences from the rest of the Canadian market.Footnote 5 Because language created a partial barrier in cultural products with the rest of Canada (and most of the US and other countries), Quebec Francophone music creators have had a separate music ecosystem that has allowed them to develop and achieve relative success: careers in all industry segments were both possible and sustainable.

The close-knit Quebec Francophone music community has seen significant change recently, including the exit of established distributors, the entry of new multi-national distributors (including a major label), and the growing presence of Quebecor in several areas of the Quebec music industry.

Moreover, the move to music consumption on streaming services at the expense of terrestrial radio (in particular) has led to diminished royalty incomes from traditional broadcast media, relatively lower earnings from streaming, lower marketplace exposure and diminished physical sales.Footnote 6 Streaming has also made discoverability of provincial artists more difficult.

The ecosystem that served Quebec Francophone music creators so well in the era of traditional media is not able to perform the same role in the streaming era.

The impact of COVID-19

The impact of COVID-19 on the Canadian music industry, and the industry outside of Canada, has been well documented by several recent studies.Footnote 7 Rather than attempting to redo the research in these studies, we provide some of the key conclusions and our own observations respecting the intersection of streaming growth and the COVID-19 pandemic.

The impact appears to be most pronounced for artists that haven’t yet built up a large audience for their music (that is, non-major label artists).

Key among the impacts of COVID-19 has been the loss of live performance income from local venue, touring and festival work for most musicians.Footnote 8 Performers generate an estimated 75% of their income from live events and touring (compared to less than a third in the 1990’s).Footnote 9 Touring is a key element in having music discovered – a benefit no longer available to assist with physical product sales and digital services revenues. Royalty income derived from the playing of recorded music in restaurants, gyms, bars, and other venues where people gathered has also suffered.Footnote 10 Musicians that score for TV, film and advertisements are seeing their incomes fall as companies curtail their activities. Non-streaming platforms (like radio) have suffered and accordingly will result in lower royalty payments.Footnote 11

Streaming services and payouts

The proliferation of digital streaming services that use music is extremely large and growing. The options for consumers to access streamed music are therefore equally expansive and growing. So too are licensing opportunities from new types of social media services that utilize recorded music.

We note that estimated rights-holder earnings from 1 million streams vary by streaming service provider but appear to average in the $4,000 to $5,000 range. These payments for 1 million streams are typically divided amongst several rights-holders. We further note that the majority of Canadian artists on streaming services do not achieve 1 million streams in a year.

| Streaming Service | Streams | Earnings ($US) |

|---|---|---|

| Spotify | 1 Million | $4,000 |

| Apple | 1 Million | $5,000 |

| Tidal | 1 Million | $12,000 |

| Deezer | 1 Million | $4,700 |

| Amazon | 1 Million | $5,000 |

| Pandora | 1 Million | $1,400 |

| YouTube | 1 Million | $1,750 |

| SoundCloud | 1 Million | $1,300 |

Source: Music Gateway and Wall Communications Inc. 2021

Spotify reported in 2020 that there are about 551,000 songs with cumulative streaming totals of 1 million (over the life of the service) which would have each generated roughly $4,000 US in earnings.Footnote 12 13,400 artists generated $50,000 US or more in royalty payments in 2020.Footnote 13 Only 7,800 artists generated $100,000 US or more in that year; 1,820 artists generated $500,000 US or more and 870 artists generated $1M US or more.

While there is some substantial success for top artists, there is a fast drop-off below them. With roughly 7 million artists on SpotifyFootnote 14, only 0.11% generated earnings of $100,000 US or more in 2020 and that does not account for how those earnings were divided amongst rights-holders (for example, band members, co-writers).

Technological disruption and industry changes

Technology has been a major force behind the advent of streaming. Technological advances enabling streaming include digitization of content, digital transmission, Internet ubiquity and algorithmic decision-making. Technology has also caused several fundamental changes in industry structure.

While the proliferation of streaming services (services dedicated to music or services that incorporate music) has provided many more outlets for creators, technology has also enabled new entry into every part of the music supply chain. Songwriters/performers can now create (that is, write, record and produce) music without leaving their homes. The necessity of using a sophisticated studio, of using an arranger and/or producer, even of using professional session musicians, is gone.

All aspects of the recording process – such as engineering, mixing and mastering – can now be accomplished within personal digital audio workstation (DAW) software or by using an online third party. Creators can now carry out every part of producing a master recording by themselves or use third parties for certain functions – all without the involvement of a record label.

At every juncture in the music supply chain, technology has enabled a growing number of third party players to take on virtually all of the functions that once were the purview of record labels. In addition, the distinction between the roles that any party performs is also blurring with companies expanding vertically into adjacent industry segments.

A “third party” industry structure built upon new technology has fomented an enormous rise in the number of Do It Yourself (DIY) artists. In lockstep, the number of songs (and their recordings) created every year has also risen astronomically. Estimates of the number of songs uploaded onto streaming platforms every day varies from 40,000 to 60,000.Footnote 15

The breaking down of technological and infrastructure barriers (that once heavily challenged music creators) has allowed them to now make higher quality music less expensively and to get that music to consumers more easily. On its surface, these developments should have improved the lot of all music creators. However the monetary benefits up to now have flowed primarily to large record labels more so than other rights-holders.

Record labels (particularly the majors and other large labels) have been able to gain in a relative sense while other rights-holders have not. The simple reality of master recording ownership by record labels provides them with a key negotiating advantage. A song in its most rudimentary form is a set of lyrics and/or music. However, until the song is “fixed” or embodied in a sound recording, it can’t be readily monetized. That monetization capability gives the owner of the recording significant negotiating power over the terms of use (including payments) for the song.

Songwriters and publishers (and performers to some extent) rely on sound recording owners to advance their cause – the sound recording is the primary vehicle by which rights-holders monetize their rights. While other non-recorded uses of music (for example, live performance) pay royalties, the vast majority of royalty earnings are generated from the use of sound recordings.

There has been a “hollowing out’ of the middle class of music creators. The Parliamentary Committee Reviewing the Copyright Act recently noted the “difficult realities” facing the declining artistic middle class; namely, significant decreases in earnings since the 1990s and a growing number of artists living below the poverty line. While significant success has been found by relatively few at the very top, the bulk of artists have been hard hit. In particular, independent and DIY rights-holders have suffered as streaming has come to dominate the music consumption landscape.

However, there are signs that the landscape – and potentially the welfare of middle-class creators – is changing.

From 2017 to 2020 the percentage of streams on Spotify represented by the major labels has declined from 87% to 78%.Footnote 16 Merlin, the association of independent artists, labels and distributors, reported that their members now account for more than 15% of the global digital music market.Footnote 17 Of the 40,000 to 60,000 tracks uploaded to Spotify per day, eight times more music by volume was uploaded by DIY artists than was released by the three major labels. DIY artists earned an estimated $960M globally in 2019 with an estimated 27% growth to $1.22B in 2020.Footnote 18

While the future remains unpredictable and to this point only the most successful music creators have enjoyed significant prosperity from streaming, there are positive signs that Indie artists – and those in the bottom and middle classes of writers and performers – may see better days ahead.

Changing industry ownership structure

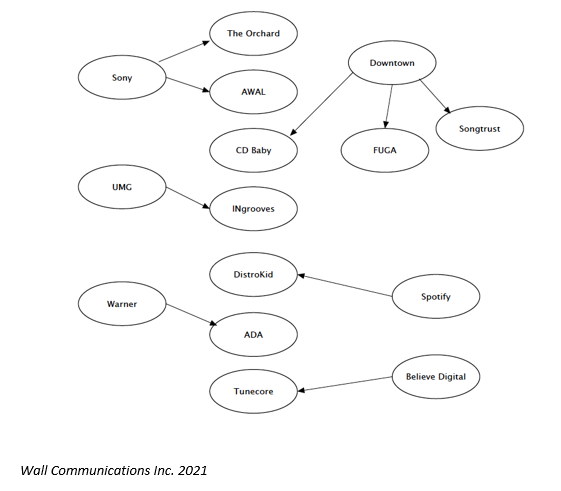

While the dominance of the majors still prevails in 2021, several factors (for example, technology, third party service companies) are changing the industry. In addition, the corporate landscape is also changing. The inter-corporate relationships amongst key parties are complex and ever-changing. First off, we note the cross ownership of major labels (Sony and Universal) in Spotify; the ownership of Tencent in Spotify and Universal and Warner; and the involvement of common institutional investors in Apple, Amazon and Spotify.

Major labels have not only become significant players in the “independent” distribution business (for example, Sony ownership of The Orchard which offers distribution services to Indie artists and labels), but continue to buy other independent operators (for example, 2021 Sony purchase of AWAL/Kobalt).

The entry of the majors into the Indie sector has been accompanied by their entry into a very important part of the streaming sector (and particularly in the discoverability of music): playlisting. The majors each have a playlist brand Filtr by Sony, Topsify by Warner, and Digster by Universal. While Spotify creates the majority of the playlists appearing on its streaming service, the playlists of the majors are second to Spotify, with Indie label playlists rarely appearing on the service.

While the foray of Sony and the other majors into the Indie space has created a major structural change, the publishing world has been equally jarred by several high profile, high priced acquisitions. While the past decade has been dotted with purchases of publishing catalogues (or other publishing companies), the activity in the past year has been of an entirely different magnitude.

The industry has seen prominent songwriters sell their publishing rights in the last year: Bob Dylan, Paul Simon, Neil Young and many others – purchases in the hundreds of millions of dollars. The landscape now includes several music rights related Initial Public Offerings (IPOs) – including by Warner Music Group (2020) and Universal Music Group (UMG) (announced) – as well as Hipgnosis. Private equity firms are also becoming significantly involved in the industry.

Data

One of the key issues hampering competition in the music industry has been the lack of availability, transparency and comprehensiveness of data. Technology is changing that.

To a large extent, the advent of Collective Management Organizations (CMOs), third party distributors and streaming services that publish (and otherwise make artist specific data available) have greatly improved structural transparency issues. Clearly defined and understood terms of service have replaced vague contractual language that offered artists little opportunity to dig deeper into matters of personal business concern. CMOs (we note those in Canada) were some of the first music business agencies to provide for greater transparency and have often made the commitment to transparency a prime sales point for their services.

Many of the new entrants that provide third party services to DIY and Indie artists have built their businesses on the collection, formatting and analysis of data. Understanding the technology that powers the data collection, storage and analysis has often been the doorway into the industry for many modern music entrepreneurs.

In an industry where success has traditionally been built on factors such as live touring, marketing, promotion and pure luck, data is taking its place as a king/queen maker.Footnote 19 Being able to track who and where a song is being streamed, in what frequency, over what period, etc. provides a toolset that just did not exist prior to streaming.

Streaming services themselves rely heavily on data and its application to customize playlists for individual users (for example, Spotify), record labels feed data into machine learning algorithms to help predict the success probabilities of artists, and similar tools are now available for all aspects of music creation and marketing.

The role of data and its analysis within the industry goes deeper. Some artists are concerned that instead of data being used to assist an artist build a career, it will instead begin to drive how the content is created – an outcome that is anathema to many artists’ sensibility. But given the opportunity for financial reward based on song popularity, there is no doubt it is already happening.

Algorithms, using “big data”, provide tools to help shape more popular music, but also to offer greater discoverability of musical works and artists for listeners. The metadata (that is so readily created and utilized in digital music) is the electricity that enables the streaming industry to develop new applications and better serve both listeners and rights-holders.

Data has an intrinsic valuable in music creation and consumption and its value and applications are increasing. Who owns it, how it is exploited and who exploits its value is very much a work in progress.

2021 Study of the economic impacts of music streaming on the Canadian music industry

Wall Communications Inc. 2021

Introduction

This Study examines the impact of music streaming services on Canadian music creators. This issue was examined previously in a Study conducted by Wall Communications Inc. two years ago.Footnote 20 In essence, the mandate of the 2021 Study hasn’t changed substantially – just the time period. The last two years have seen a number of industry developments pertinent to understanding the impact of streaming.

The previous Study began with an apparent conundrum:

“The streaming of music has been a somewhat controversial development for music creators at the same time it is generally perceived as highly beneficial to music listeners. For many creators music streaming via commercial providers has reportedly led to severely diminished incomes and by some accounts streaming has had a devastating impact on music creators’ ability to simply make a living pursuing a career built around making music.”

“In seemingly contrarian observations, the business of recorded music (and streaming specifically) seems to be booming (globally, in the US and in Canada) according to numerous reports.”Footnote 21

This apparent conundrum remains in 2021. To the extent it is necessary to state the obvious, the consumption of music today is largely driven by audio and audio-visual (AV) streaming services. Moreover, streaming has propelled the sound recording business on an upward trajectory where, as recently as six years ago, it was still in a period of negative growth.Footnote 22 The industry is flush with renewed consumer spending on and (business licensing of) recorded music.Footnote 23

At the same time, reports of music creators earning de minimis sums on the use of their works on streaming services – or certainly not enough for a living wage – fill trade journals, blogs, policy reports and mainstream media.

This Study seeks to understand how these seemingly contradictory events can occur simultaneously – if in fact they do reflect reality. While we investigate several issues,Footnote 24 the fundamental questions of this Study begin with straightforward enquiries: How much is being earned in the recorded music business in Canada? How much in streaming? And who is earning it?

In order to examine this issue, we need to categorize those persons who create music in Canada. Given that we are concerned with the monetization characteristics of streamed musical works, we categorize industry segments into various rights-holder groups.

“Music creators” are often casually identified as the people and agencies that create songs in the most basic form – that is, lyric writers (words) and composers (music).Footnote 25 The perception relates to the fact that these people impart the first – and arguably the most significant “creative effort” in constructing a musical work.Footnote 26 Of course, when a song is recorded, the featured performer of the song will also add considerable creative content.Footnote 27

Other parties that are involved with the creation of a music sound recording include publishers (who seek out performance and other monetization opportunities for the songs they represent), record labels (typically responsible for arranging for and financing the actual recording session and producing a master recording of the performance of a musical work), the non-featured performers on a recording session (the session musicians) and other people involved in a recording session and the subsequent processing of the recording (such as sound engineers, mix engineers, and mastering engineers).Footnote 28

As a side note, record labels typically wear several hats including artist development, distribution of product (including negotiating with music delivery services (such as streaming services) for payment for the use of a song and the collection of those monies) and marketing and promotion of the sound recording.Footnote 29

With no slight intended towards writers, composers or featured performers, we will use the term Canadian “music creators” in its broadest form to refer to the entire supply chain of Canadian recorded music creation and delivery to consumers.Footnote 30

We should also make special note of CMOs – the organizations who collect and distribute royalty payments to their rights-holding members (variously songwriters, publishers, performers and record labels). CMOs perform a key role in the industry with their involvement in each sector. While they are involved as a major intermediary for each of the four sectors, other commercial arrangements occur without the participation of the CMOs. Record labels in particular conduct a significant amount of business outside of the CMOs (for example, negotiating and collecting payments from streaming services on behalf of their own master recording rights but also on behalf of the performing artist and sometimes other rights-owning parties).Footnote 31

The main body of this Study begins with a relatively detailed description (Section 2) of various rights-holders and the activities of each. While guaranteed to induce somnolence in all but the most dedicated readers, it is nonetheless essential to for later discussions. To anyone outside the industry (and many who work within the industry) the complexity of rights-holder activities, rights, contractual arrangements and terminology is conspicuously confusing. Section 2 hopefully reduces some of that.

Section 3 compiles relevant data on earnings within the music industry and estimates those earnings for various rights-holder groups in Canada for the year 2019. Due to confidentiality constraints and other limitations on data, we estimate earnings using a variety of tools, including extrapolation, comparative analysis and proxy analysis among others.Footnote 32 Ultimately, we arrive at earnings estimates for four rights-holder categories: songwriters, publishers, performers (artists) and producers (record labels).

Section 4 carries the analysis one step further, focusing on earnings specific to the music streaming part of the industry. Again a variety of tools are used to estimate earnings by rights-holder category.

Section 5 provides a deeper dive into several characteristics of streaming sector, including the relative roles of major vs. Indie labels, domestic vs. foreign royalty earnings, the unique challenges of the Quebec Francophone market and the impact of COVID-19.

Section 6 examines the current state and trajectory of the streaming sector, significant industry developments and implications for competition in the industry.

Section 7 provides some brief observations.

The Appendices include a description of Methodology, a list of parties providing input into the study and a list of References.

Identifying the supply chain elements and the parties involved

We intend to generally follow the categorization provided by different rights-holders as this essentially accords with the different activities undertaken by various parties in the music creation industry. More importantly, we are focused in this Study on how various rights holders have been economically impacted by music streaming services.

There are four broad supply input categories:

- lyric writers and music composers (“songwriters”);

- publishers (agents acting on behalf of songwriters to have songs placed in different media);

- performers (featured and non-featured); and

- producers (usually record labels but including all those other than performers involved in the actual sound recording process).

There is a further input supply function that is performed by streaming services such as Spotify, Apple Music and others in delivering songs to consumers.Footnote 33 Streaming servicesFootnote 34 are not examined per se in this Study (except to the extent that they pay rights holders for the use of musical works and are the prime “agent of change” impacting music creators).

The parties associated with each of these four supply stages of music creation will have certain rights engaged when a sound recording is used by third parties (such as a streaming service, or radio or television or film or in a physical or digital format sold to consumers). The rights of each category are discussed below along with a description of their functions.

We would also note that in the past (that is, prior to the widespread development and adoption of the Internet and related technological advances), each supply chain category had its own relatively distinct industry infrastructure – with discrete parties performing the functions. Today, a single person (or small group of individuals) may perform all or many of the functions in the supply chain. This technology led ability to perform many music creation functions is disrupting and redefining the industry – although the vast majority of industry commerce still relies on the traditional supply chain parties (with the exception of music delivery to consumers, which is now primarily provided by streaming services).

2.1 Songwriters

We use the term songwriters to describe those who create the musical composition and/or lyrics to a musical work. This would include those who create popular songs and all other genres of music as well as composers of music for film and television.

The more traditional model for songwriting in popular music (prior to the 1960’s) was to have a stable of persons dedicated to the writing of songs (for example, the Tin Pan Alley and the Brill Building songwriting models).Footnote 35 These songs were often created by a duo – a lyricist and a music composer. The songs would then be marketed by publishers (discussed in the next section) to performers (think of performers like Frank Sinatra who were dedicated singers or performers, not writers). The model changed in the 1960’s as popular artists began to both write and perform their own songs.

That model has endured up to today although it has further evolved to a point where multiple persons may be involved in the writing of a song (where several co-writers may contribute just few lyrical or musical lines to a song) as well as blurring the line between the actual writing of the song and the production and recording of the song.Footnote 36

As a side note, we re-emphasize the difficulty in defining the relative value creation in a song regarding contributions provided by various parties. For example, the song “Take It Easy” was primarily written – both the lyrics and the music - by Jackson Browne.Footnote 37 However, Glen Frey provided two lyric lines in a verse (as well as creating the ultimate song arrangement) and received co-writer status. As it turns out, the two lines provided by Frey are often the most quoted and referenced lines from the song.Footnote 38

In addition to the relative value creation issue, the number of writers on a song has increased over time, creating further complications related to the division of intellectual property (IP) rights. The 2018 song “Sicko Mode” has more than 30 credited writers.Footnote 39

In the older model of a few dedicated writers for a song, writers were provided with certain copyrights to both protect and allow for monetization of their work. Those protections and IP rights endure today. There are two rights at issue for songwriters: mechanical rights (also called reproduction rights or RR) and public performance rights (PR).

A songwriter’s mechanical right provides for compensation to a writer when a song is reproduced on any medium.Footnote 40

“Mechanical royalties are royalties paid to a songwriter. .. whenever a physical or digital copy of one of their songs or compositions is made. They’re the royalties earned from the right to mechanically re-produce your recorded song in almost any format. For example, when a record label presses a CD or vinyl album of your song, or songs on an album, you’re owed mechanical royalties. The same holds true if your music is reproduced for a digital download, or an interactive stream.”Footnote 41

“Mechanical royalties are paid by whoever obtains a license to reproduce and distribute your song or composition. Mechanical rights are broadly based on the act of mechanically reproducing your music, and as such, are one type of what are called “reproduction rights.”Footnote 42

A songwriter’s performance right provides for compensation to a writer whenever a song is used in a performance to the public. “The performing right is the right to perform a song or composition in public – such as in a live concert, background music, a radio or TV broadcast, a streaming playlist at a bar, or any other type of public performance. The performing right gives copyright owners of songs the sole right to perform, or authorize the performance in public, of their songs.”Footnote 43

In Canada, the royalty rates for mechanical and PR (and the type of medium a royalty rate applies to) are generally set by the Copyright Board of Canada.Footnote 44 The royalties are paid by whoever licenses the song for delivery on their media platform (for example, radio, satellite radio, streaming service). CMOs that collect and distribute royalty payments on behalf of songwriters are discussed in the next section.Footnote 45 However, we note at this point that the Society of Composers, Authors and Music Publishers of Canada (SOCAN) is the Canadian CMO for collecting and distributing songwriter public PR royalties. The Canadian Musical Reproduction Rights Agency (CMRRA) collects and distributes mechanical royalties for publishers and self-publishing songwriters while a division of SOCAN (formerly called SODRAC but renamed as SOCAN RR) collects and distributes songwriter mechanical royalties (mostly in Quebec and for foreign writers).

2.2 Publishers

Once a song has been created by a lyricist and/or music composer, it can progress to its use in either a live performance or in a sound recording. The role of the publisher is to act as an agent on behalf of the song to advance its usage. In a more traditional role, the publisher would actually print the lyrics and music in a song-sheet and publish and sell the sheet to the public. That function is not prominent today. However, the role of getting a song placed with a performing artist (particularly for sound recordings) is still extremely important. It is useful to think of the publisher as the party most oriented to monetizing the value of a song – a business partner to the songwriter if you will.

A music publisher is in the business of acquiring, licensing, administering, marketing and promoting songs. “A music publisher is the business partner in a musical composition. A good music publisher has the knowledge and contacts to promote a composition. Typically a publisher enters into a songwriter/publisher agreement with the songwriter, whereby the songwriter assigns ownership and control of the copyright protected musical works to the publisher in exchange for a percentage of the income derived from the exploitation of the musical works. A music publisher cannot collect more than 50% of the performing right.”Footnote 46

Every songwriter may assign a portion of their PR to a publisher (as noted above, not more than 50% to the publisher). The rights that a songwriter assigns to a publisher are distinct and separate from the author’s portion of the PR.Footnote 47

There are many types of publishing business arrangements between a songwriter and a publisher. A “single song” agreement refers to an arrangement for a single song with a royalty percentage split between the writer and publisher for the life of the copyright for an individual work. An “exclusive agreement” refers to a split between the writer and the publisher for the life of the copyright for all works within a specified period of time.

A “co-publishing agreement” occurs when two or more publishing companies co-own the copyright. In today’s market, this is often an arrangement between the publishing company and the artist’s “self-publishing” entity (de facto or de jure), such that the actual split between the songwriter and the publishing company approaches more like a 75/25 split in favor of the songwriter versus the traditional split of 50/50.

Another popular arrangement in today’s market is an administration agreement whereby a copyright owner contracts a publisher to administer the copyrights for a percentage of the revenue for a specified period of time. The administrator does not own the copyright but takes a fee (typically 10 to 15%) for the administration of the copyright.

A sub-publishing agreement is an agreement between a domestic publisher and a publisher in a foreign territory to represent a songwriter’s catalogue in that territory.Footnote 48 A sub-publisher will collect and distribute royalties to the original publisher for a percentage of the revenue. An important aspect of this arrangement is that sub-publishing arrangements often result in faster payments to copyright owners than would occur when a domestic CMO is involved in collecting and distributing royalties remitted from a foreign territory CMO. For this reason, Canadian publishers usually make direct arrangements with foreign publishers and/or foreign collective rights organizations.

In the same way that publishers own a portion of the PR, they usually also own the right to collect mechanical (or reproduction) royalties for a song and retain their share of the songwriting mechanical copyright. Publishers are often the collector of the entire songwriter rights payments from licensees, and in turn will remit the songwriter’s portion to the songwriter.

For various broadcast and streaming services, Canadian publishers receive mechanical rights (or reproduction royalty) payments from the CMOs CMRRA and SOCAN RR, who collect royalties on their behalf. For physical products (such as CDs and vinyl), mechanical rights payments will be directly received from record labels (who are the makers and distributors of the product). And as noted, publisher will often negotiated and directly receive payments from foreign publishers and collectives.

It is worth noting that the many functions that a publisher can perform will, in practice, be frequently shared amongst several publishers and/or other parties. For example, an independent publisher may own or control a song catalogue but still use a major publishing company to administer (that is, collect) the royalties.Footnote 49

On a final note regarding publishing, the terminology of publishing (and song rights more generally) is rife with inconsistency, fuzziness and outright error. “Publishing” is sometimes used to describe the entirety of authors’ and publishers’ rights; sometimes “songwriter rights” is used to describe the entirety of both the authors’ and the publishers’ rights. Sometimes the two terms are used to separately describe the distinct control or ownership rights associated with each of the parties. This lack of consistent terminology can be a considerable impediment to understanding the industry.

2.3 Performers (artists)

Also referred to as “artists”, performers are the people that give a performance of a musical work, either in a live setting or in a sound recording. While not (necessarily) involved in the writing of a song, a performer’s interpretation of a song can elevate the musical work to a higher emotional, intellectual or spiritual plane.

Most often we associate a song with its featured performer.Footnote 50 In popular music this is usually the lead singer, the lead instrumentalist or the person(s) commonly seen as the “face” of a band. The lead performer is generally the person who has signed a recording contract with a record label. The recording contract, negotiated between the featured performer and the record label, gives rise to a sharing of rights between the parties.

The public PR of a performer in a sound recording are known as “neighbouring rights” (as opposed to the “copyrights” of the songwriter and publisher, who own the underlying musical work). Although these rights are not precisely the same, they are both forms of IP rights and generally provide for remuneration when the rights are licensed for use.

We refer to a recorded performance of a musical work as its own IP creation where the rights associated with the performance relate to the actual sound recording of a musical work performance, not the underlying musical work itself. Also note that the actual live performance of a song (outside of a recording studio) does not garner any “neighbouring rights” except to the extent that the live performance is recorded and then made available on other media (such as radio, a non-interactive streaming service, a CD, etc.). The sound recording of a performance forms the basis of a performer’s neighbouring rights and RR.

The Canadian Copyright Act mandates that neighbouring rights be split 50/50 between performers and owners of the master. However, performers and record labels often negotiate “all in” deals where revenues from all sources are shared on a negotiated basis. In general, a performer is due compensation every time the sound recording is presented to the public in a radio broadcast, satellite radio broadcast or non-interactive streaming service.Footnote 51

Non-featured performers, such as session musicians and background singers, typically do not negotiate recording contracts with the record label but are hired by the producer on a fee-for-performance basis (that is, they are paid a set fee for their performance contributions in a recording session). Nonetheless, non-featured performers are still entitled to compensation when a sound recording that includes their performance is transmitted to the public.

As is the case with writers and publishers, the job of collecting and distributing royalties to performers is most often assigned to a CMO. In Canada, the role of collecting and distributing performer royalties falls to the Musicians Rights Organization of Canada (MROC), Alliance of Canadian Cinema, Television and Radio Artists (ACTRA), Recording Artists’ Collecting Society (RACS) and Artisti.Footnote 52 Each of these CMOs provides the same essential service. ACTRA RACS and Artisti are associated with unions (ACTRA and Union des Artistes respectively) while MROC is an independent organization.Footnote 53

All three of these CMOs are members of a third party organization (Re:Sound) for the actual collection of public performance royalties from licensed users. Re:Sound is in many ways the counterpart to SOCAN but represents performers (and makers) instead of songwriters and publishers.Footnote 54 Re:Sound began life as the Neighbouring Rights Collective of Canada and is also responsible for filing tariff applications and appearing before the Copyright Board. While Re:Sound collects royalties on behalf of the above noted CMOs, it also acts itself as a CMO – performers can register directly with Re:Sound if they so choose.Footnote 55 As this Study will focus on streaming, we note at this point that Re:Sound does not collect royalties for interactive streaming – those royalties flow from the streaming service to the record label, and from the label to the performer.

As noted earlier, a featured performer will typically negotiate a contract with a record label, which usually includes all rights available to the performer (although all terms can be negotiable). The performer’s share of earnings from all business activities (including those activities triggering rights payments) will depend on the negotiating power of each side. A well established performer will have greater negotiating power and may command a share that is greater (sometimes much greater) than 50% while a new act may have limited negotiating power and will consequently only get less (sometimes much less) than a 50% share from the label.Footnote 56 Neighbouring rights, collected by CMO’s such as Re:Sound and its member organizations, are mandated to pay performers and “makers” on a 50/50 basis (although interactive streaming services royalties are not covered by the statute).

Featured performers of a certain stature will also retain managers, touring or booking agents, lawyers and other personnel to assist them in their careers (including the sound recording aspects of their careers). These secondary or tertiary personnel may be vital to a performer’s career and may or may not share in the performer’s rights.Footnote 57 The earnings of secondary personnel are made by way of a separate contract between the performer and the secondary service provider.

2.4 Producers (record labels)

It is useful to think of the relationship between featured performers and record labels as similar to the relationship between songwriters and publishers: one tends to provide more of the creative content while the other has more of a business focus.

The term “producer” also has a specific technical meaning in the music world – a person who oversees all aspects of making a sound recording. This person will typically operate as an independent contractor hired by the record label to work with a team of others (for example, sound engineer, arranger, session musicians) to ensure the recording results in a product that the artist is satisfied with and that the recording meets the needs of the record label. When we use the term “producer” in the rights world, we are usually speaking of the record label who has hired the record producer for a session, funds the recording process and most importantly for our purposes, will retain the rights to the master recording.

In the sense that the label has funded the recording and will own the master recording (and its associated rights), the record label is the “producer” of the recording. We will use the term “record label” and “producer” synonymously (while referring when necessary to the technical session producer as the “recording session producer”).

In the past, a record label may have kept one or more “in-house” recording session producers on staff and may also have operated its own recording studio or studios. Today most recording session producers are independent contractors who are hired by record labels and most recording studios operate independent of a record label (but are frequently booked by the label or the recording session producer).

What does a record label do? Record labels are involved in the financing, manufacture, production, marketing, promotion and distribution of music. These functions have evolved over time but still describe the primary functions of a record label, even though the methods of carrying out the functions has changed.Footnote 58

It is useful to divide record labels into three broad categories: major labels, independent labels, and DIY artists (artists who essentially act as their own labels). We also note below that Merlin, an umbrella organization of independent labels, offers independent labels (including Canadian Indie labels) a means of gaining negotiating power. In addition, major labels may offer a variety of services (for example, distribution, marketing, promotion) to independent labels – and even to DIY artists.

In the global music industry (including Canada), there are a handful of “major” record labels that dominate the landscape: Universal, Warner and Sony.Footnote 59 Two other record labels are sometimes considered “majors” (although they are significantly smaller than the Big 3): Bertelsmann Music Group (BMG) and Kobalt. All other labels are called “independent labels” (or Indies). For reasons to be discussed later, we will use “majors” to mean the big three labels.

“Merlin” is a global digital music rights licensing member-based organization composed of independent record labels (as well as independent distributors and other rights-holders).Footnote 60 Merlin negotiates rights licensing for its members with streaming services such as Spotify, TikTok, Facebook, Deezer, etc. It essentially provides more negotiating power for independent labels. Merlin’s membership consists of about 20,000 independent record labels, distributors and other parties in 63 countries and includes most of the larger independent record labels. There are some Canadian members (for example, Secret City Records) but most Canadian independent labels are not members.

Indie labels are in many ways analogous to farm teams or minor league teams. Indie labels may stay within a narrower musical niche or operate for many years at a smallish scale but success is usually defined in relatively modest terms. It is generally acknowledged in the industry that taking an artist to the highest levels of popular success requires the resources and negotiating heft of a major label. In fact, virtually every top act in Canada is signed to a major label or is with a smaller label that itself has some type of distribution or other agreement with a major label.

Finally, DIY artists while not record labels strictly speaking perform the functions of a record label themselves or contract with third parties to perform some of those functions. By most accounts the growth in DIY is the fastest growing segment of the recorded music industry.Footnote 61 In Canada, DIY artists appear to comprise the bulk of music creators by body count.

As noted earlier, a record label can wear many hats and perform many functions. One of the key functions performed by record labels in the pre-streaming world was “distribution”. The pre-streaming distribution function primarily involved arranging for and transporting physical products (such as vinyl records and CDs) from a manufacturing facility to a local distribution warehouse or directly to retail outlets. This physical distribution function still exists, although the diminishing role of retail physical sales has concomitantly lessened the role of physical distribution.

In its place, the distribution of digital content has largely supplanted physical product distribution. “Digital distribution” has come to largely refer to delivering digital copies of songs to streaming services but also entails the negotiating and collecting of monies from those streaming services. Record labels (particularly major labels) dominate the physical distribution space and now largely dominate the digital distribution space. However, just as many of the other business activities of major record labels now face competition, so too does digital distribution. In particular, dedicated digital distribution companies such as CD Baby, DistroKid and others have developed to provide DIY artists and even smaller independent record labels with an alternative means of getting their music on streaming services.

Record labels utilize CMOs, but perhaps to a lesser extent than the other three industry segments. Record labels generally own the rights to the master recording. The licensing of the master recording right occurs directly between the label and streaming services and also for synchronization (sync rights) when a musical work is used in an AV production (such as a TV show or a film). The CMO Re:Sound collects and distributes royalty payments to record labels (including the majors in Canada) for their neighbouring rights for certain sound recording uses (for example, terrestrial radio, satellite radio, background music – but not interactive streaming services such as Spotify, Apple Music and Amazon).

Earnings in the Canadian music (sound recording) industry by rights-holder segment

3.1 Introduction

Building on the previous section describing the four key categories of creators/rights-holders, this section addresses the economic (specifically earnings) parameters of those creators. We focus on earnings before expenses (other than royalty payments to other rights-holders) since revenue information is widely available but expense and profitability data is very limited.

While we have used the best available data to estimate the earnings of rights-holders, we note several “data” caveats. We use annual sums in our calculations, but there is sometimes a difference in the reporting period (for example, calendar year versus fiscal year). CMOs may distribute funds on different schedules such that a CMO may be reporting distributions from an earlier period relative to other CMOs. Some data has been provided in confidence such that a detailed reference for some calculations is not possible. As certain data are not publicly available and could not be obtained from the relevant parties, we use percentages derived from industry averages and industry advice and for some calculations. Such instances are noted where appropriate.

One of the major drawbacks of existing industry research has been the lack of referenced and consistent data on earnings by rights-holder categories. In the interest of providing a more fulsome representation of the industry and its rights-holder categories, we have used all available means to derive estimates of industry earnings.Footnote 62

3.2 Industry overview

The earnings of each category of stakeholder are directly tied to the rights of each category and how those rights get monetized. The rights of each party in the music supply chain are relatively well defined in law, allowing them the opportunity to monetize those rights by licensing or otherwise selling the use of their music rights.

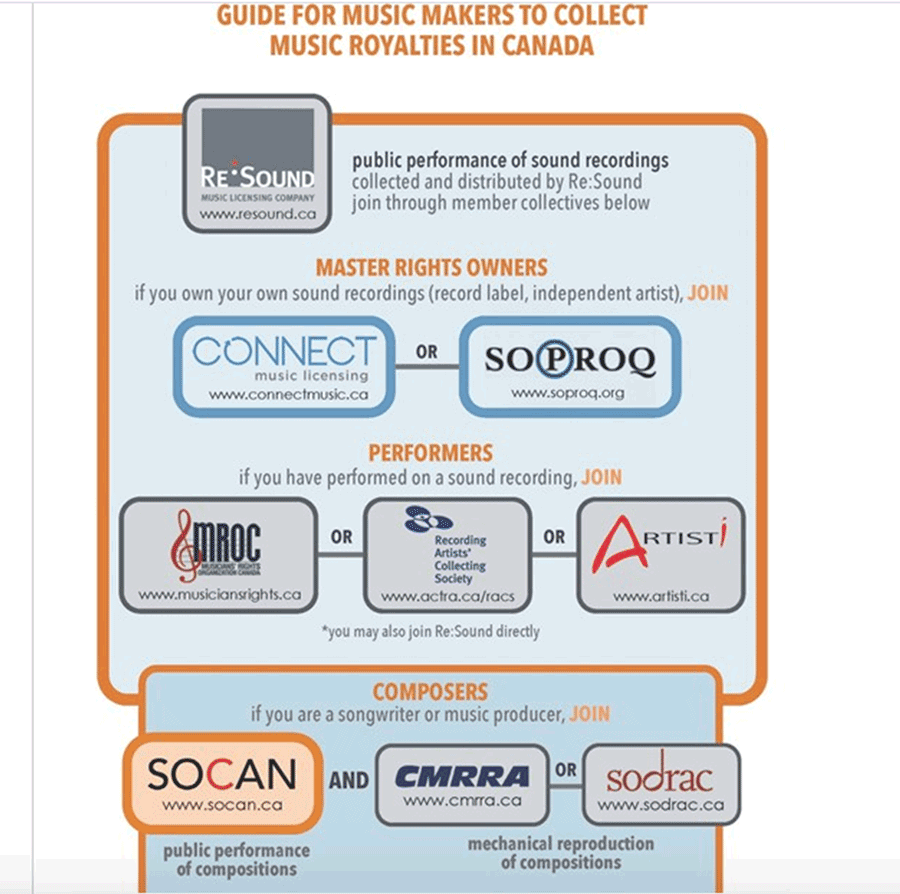

A large portion of music creator earnings is administered through a CMO.Footnote 63 It should be noted that CMOs can (and do) perform overlapping functions such that a rights-holder may have a choice between which CMO to use for the administration of a given right.Footnote 64 Figure 4 displays the key CMOs in Canada. The bottom part of Figure 4 (titled “Composers”) actually represents the CMOs for “songwriters” (or “authors” including both lyric writers and music composers) as well as for publishers. Two types of copyrights are noted: public performances (or public PR) and mechanical reproduction (or RR).

For PR of authors and publishers, the primary CMO in Canada is SOCAN. RR are largely handled by CMRRA (representing publishers and self published songwriters) but RR are also administered by SOCAN RR primarily representing Quebec and foreign authors and publishers.

A different type of IP right (a “neighbouring right”, also commonly termed the “equitable remuneration” right) is depicted in the upper portion of the diagram. These public PR apply to performers and to owners of the master recording rights (who are typically record labels). The rights of master recording owners are administered by either CONNECT or SOPROQ while performers use MROC, ACTRA RACS or Artisti. All five of these CMOs actually use an umbrella CMO (Re:Sound) to collect royalties on their behalf for many services (although not all – interactive streaming services are subject to direct negotiated rates).

Similar to the two distinct rights of authors and publishers (that is, a public performance right and a mechanical right), master recording owners and performers are each entitled to a payment when their music is publicly performed (neighbouring right) as well as whenever a recording or reproduction of the work is made for purposes of enabling delivery of the music to users.

Source: Connect Music

Figure 4: Guide for music makers to collect music royalties in Canada – text version

Public performance of sound recordings collected and distributed by Re:Sound, may join through member collectives below (or may also join Re:Sound directly):

- Master Rights Owners: If you own your own sound recordings (record label, independent artist), JOIN:

- Connect OR

- SOPROQ

- Performers: If you have performed on a sound recording, JOIN:

- MROC OR

- Recording Artists Collecting Society OR

- Artisti

- Composers: If you are a songwriter or music producer, JOIN:

- SOCAN (Public performance of compositions)

- CMRRA (Mechanical reproduction of compositions) OR

- SODRAC (Mechanical reproduction of compositions)

It is important to note that the CMOs collect and distribute royalties to their members for a specific set of rights, each of which is also associated with a particular kind of use or uses. For example, the royalty rate for a songwriter will be different when the music is used in a commercial terrestrial radio broadcast versus a satellite radio broadcast.Footnote 65

3.3 Who earns what in Canadian recorded music: the big picture

This Section boldly jumps to one of the Study’s “Big Picture” findings – specifically the finding on how Canadian sound recording dollars are shared amongst rights-holders categories. We recognize that stating our results at this juncture somewhat puts the horse before the cart (or closer to home metaphorically, it presents the recording before the recording performance has occurred). However, proceeding in this way creates less narrative confusion and puts an immediate focus on a key topic of this Study: who is getting what? The derivation and detail on how estimates were generated follows in Sections 3.4, 3.5, 3.6 and 3.7.

Data for the year 2019 was used. While some data for 2020 is now available it is not a complete set. From what is available for 2020, we do not expect the picture to differ materially from the 2019 Figure 5 provided below (in terms of percentage shares).

Wall Communications Inc. 2021

Figure 5: Canadian sound recording earnings by rights-holders, 2019 – text version

| Earnings | Share | |

|---|---|---|

| Songwriters | $187.4M | 20% |

| Publishers | $143.0M | 15% |

| Performers | $125.0M | 13% |

| Record Labels | $482.5M | 52% |

Having provided a graphic overview of our findings, the next sections provide the details underlying Figure 5.

3.4 Songwriter sound recording earnings

As noted the key songwriter CMOs in Canada are SOCAN (PR), SOCAN RR (RR) and CMRRA (via co-publisher agreements or directly from CMRRA for self-publishers).Footnote 66 SOCAN reports that payments (or “distributions”) to songwriters for PR in 2019 were $96.2M to $33.8M from Canadian sources and $62.4M from foreign sources). In addition, “co-publishing” arrangements between songwriters and publishers have resulted in a portion of publisher PR payments being shared with songwriters.Footnote 67 We estimate that $34.9M of domestic publisher PR earnings flow back to songwriters.

Payments collected by SOCAN RR for songwriter/publishers for RR were $12.0M. Of this, we estimate songwriters earned about half, or $6.6M.Footnote 68

While SOCAN and SOCAN RR pay songwriters directly, writers also receive a portion of the royalties paid to publishers for RR. The publisher and the songwriter share the RR payments on a negotiated basis.Footnote 69 We estimate the RR royalties going to songwriters from earnings flowing through publishers is estimated at $26.0M in 2019.Footnote 70

In total, songwriters earned an estimated $163.7M in total royalties administered by Canadian CMOs.

This is not the complete tally of earnings by songwriters from their sound recorded music creations. An additional source of revenue comes from the synchronization of a musical work to an AV work (such as a TV show or film). Songwriters are entitled to a payment for the use of their music in an AV production.Footnote 71 However, the payments for this use are negotiated directly between the user of the work (for example, the company producing the show or film) and the representative of the songwriter (usually the publisher).Footnote 72

In 2019, record labels earned $6.8M US (or $9.0M CDN) in sync payments.Footnote 73 Writers/publishers typically receive the same payment as record labels.Footnote 74 Of the $9.0M, songwriters would have earned an estimated $4.5M in 2019 from sync licensing using a 50/50 split between writers and publishers.

In addition, songwriters also receive a payment for the use of their work when the music is contained in a physical product – such as a vinyl record or a CD. The rate for this type of use is 8.1 cents per song (for songs that are 5 minutes or less in length). A useful rule of thumb is that songwriters/publishers earn about 10% of the trade value of physical products.Footnote 75 Record labels, which generally manufacture and distribute physical music products, will generally pay SOCAN and SOCAN RR their royalties (although sometimes the publisher is paid directly by the label).

The reported trade value of physical products in 2019 was $55.8M US – or $74.2M CDN.Footnote 76 Using the 10% of retail value rule of thumb for songwriter earnings, songwriters/publishers would have earned roughly $7.4M in rights payments. However, this would include payments to songwriters/publishers outside of Canada. Assuming that the Canadians purchased Canadian versus non-Canadian records in the same proportion as the SOCAN distributions to Canadian versus non-Canadian rights-holdersFootnote 77 (that is, 64% to Canadians), then Canadian songwriters/publishers would have earned roughly $4.7M. The songwriters’ share (using a 50/50 songwriter/publisher split) would be about $2.4M in 2019.

Finally we note that publishers receive royalty payments from international performance rights organizations (PROs) and individual foreign sub-publishers. This amount is estimated in the “Publisher” section below. Songwriters share in these royalty payments. We estimate that songwriters earned an additional $16.8M in 2019 from direct international royalty payments received by publishers.Footnote 78

If songwriters have signed with a foreign publisher, they would receive payments directly from the foreign publisher. Such payments would not be show up in any of the records that are available for this Study and so are not estimated.

To summarize, songwriters in Canada earned an estimated $163.7M in 2019 from CMO royalty payments, an additional $6.9M in sync and other payments, and a further $16.8M from direct international publisher payments for a total of $187.4M in 2019 for the use of their works.

3.5 Publisher sound recording earnings

According to SOCAN, publishers earned $99.8M in public PR payments in 2019.Footnote 79 As noted, we estimate that a significant part of those publisher PR payments are returned to songwriters as part of “co-publishing” agreements that have become standard in the English language industry.Footnote 80 We estimate that publishers retained PR royalties of $64.9M in 2019.

In addition, we estimate that RR royalties were somewhere between 50% and 75% of total PR earnings.Footnote 81 Given our information on current industry songwriter/publisher splits for RR, the earnings by publishers would be in the order of $40.0M.

Using a similar estimation methodology as was used for songwriters (above), we estimate that publishers earned an additional $4.5M from sync licensing as well as an additional $2.4M from sales of physical products.

Canadian publishers may directly deal with agencies outside of Canada for rights collections or Canadian publishers may use a foreign sub-publisher or administrator. These earnings are paid directly to the publisher and do not flow through a Canadian CMO. Industry sources estimate that these payments could be significant. These are estimated below in the discussion on CIRCUM data.

Publishers are estimated to have earned $111.8M in 2019 from CMO payments and other licensing fees using a “ground up” calculation.

By way of cross check, the survey report by CIRCUM reported gross publisher revenues (before payments to songwriters and other expenses) of $255.0M for 2019.Footnote 82 According to CIRCUM findings, the $255.0M total earnings are made up of PR payments (58% or $147.9M), RR payments (21% or $53.6M) and sync and other (21% or $53.6M). We note that the CIRCUM PR revenue of $147.9M is considerably higher than the PR payments made to publishers in 2019 from SOCAN – roughly $48.0M higher.

There are a few factors that help explain the earnings gap for PR as reported by CIRCUM versus SOCAN. Reporting protocols may differ, definitions may differ depending on the responder and other aspects of the data gathering may vary between SOCAN and CIRCUM. However, the primary reason for the difference in the reported PR payments for publishers is most likely the sizeable payments that are made directly to Canadian publishers from foreign PROs foreign sub-publishers. As one key example of how important these direct international payments can be, it is our understanding that the three majors (and in fact many if not most Indie publishers) are direct members of foreign collecting societies or use a sub-publisher who is a member of a foreign PRO. These royalty payments would not flow through SOCAN.Footnote 83

The direct international payments to Canadian publishers will be shared between songwriters and publishers. We estimate publishers retain $31.2M of these direct international payments.

Using our estimated splits between songwriters and publishers for various rights, we estimate that publishers in total received net (that is, after paying out other rights-holders) royalty payments of about $143.0M in 2019.Footnote 84

3.6 Performer sound recording earnings

As noted earlier, a featured performer will negotiate with a record label for a percentage of the revenue the label earns from the performer’s recordings. The type of sharing agreement can take many forms, but it appears that the “all in” model is most common. In this arrangement, the label and the performer agree on a percentage split of all revenues earned from a recording.Footnote 85

This revenue-sharing arrangement is not usually available to non-featured performers (such as session musicians). Non-featured performers are paid for their session work on a per job (or per hour) basis. They are, however, entitled to royalty payments when they appear on recorded works that are transmitted to the public. Such payments are relatively low (for example, there is no payment for interactive streaming revenues) and are collected by Re:Sound (see below).

There are three dedicated CMOs that collect royalties for performers: MROC, Artisti and ACTRA RACS. All three are members of Re:Sound, an umbrella organization used to collect equitable remuneration royalties on their behalf (although they also each collect certain royalties directly from third parties). Re:Sound then remits these payments to the member CMOs, who then distribute them to their members. As noted earlier, Re:Sound does not collect royalties from interactive streaming services (like Spotify and Apple Music). Those royalties flow from the streaming service to the record label, who then pays the performer as per their contractual arrangements.

MROC handles equitable remuneration (performance) rights royalties, while the two Quebec based CMOs handle both ER royalties and RR royalties (with the largest percentage of collections from ER). In total, the three CMOs received $28.2M for performers in 2019.

The standard arrangement for the performer/label split for physical products was typically 10% – 15% although newer types of sharing arrangements have developed.Footnote 86 (Note that the performer must pay back the advance money provided by the record label before earning net income).Footnote 87 Alternative sharing arrangements between performers and labels can lead to higher shares for a performer. Because these shares are directly negotiated between a performer and a record label, the negotiating power of each side – based on several factors – will largely determine the split outcome.Footnote 88 Even where a “net-profit” contract is negotiated (where the performer and the label may share net profit, for example, on a 50/50 basis), the recoupable costs (such as recording expenses and promotion/marketing costs) are first paid to the label before any revenue is shared. Given that most recordings do not end up covering their recoupable costs, an average share for performers of 10% to 20% on average can be used for estimation purposes.

As noted, data on performer industry earnings (other than CMO provided data) is not directly available. However, revenue data for recording labels is available (which can be used to derive an estimate of performer earnings in 2019). The IFPI has reported industry (that is, record label) revenue of $465.8M US (or $607.5M CDN) for 2019.Footnote 89 The actual amount of shareable revenue would be considerably less as certain costs are removed (for example, distribution expenses, typically in the neighbourhood of 10% of gross revenues, would reduce the monies available to share). Based on industry input, we will use 80% of gross revenue for the base earnings available to share between the label and performers.

Available revenue for sharing is therefore $486.0M in 2019. Using a 15/85 split, performers earned an estimated $73.0M. At the upper range, if a 25/75 split is used, performers earned an estimated $121.5M.Footnote 90 CMO performer earnings must also be added to reach a total for the industry (that is, $28.2M is added).

We therefore estimate total performer earnings from sound recordings in 2019 to be in the range of $100.0M to $150.0M.

3.7 Record label sound recording earnings

Labels earned a gross $607.5M in 2019.Footnote 91 To avoid double counting, we remove the payments to performers (estimated at between $100.0M and $150.0M, or $125M using the average of the estimated range). Record label earnings (net of payments to performers) for 2019 are therefore between $457.5M and $507.5M.Footnote 92

3.8 Industry earnings by all rights-holder categories

Summary: Industry earnings by rights-holder category

- Songwriters = $187.4M

- Publishers = $143.0M

- Performers = $100.0M to $150.0M (mid point $125.0M)

- Record Labels = $457.5M to $507.5M (mid point $482.5M)

| Songwriters | Publishers | Performers | Record Labels | |

|---|---|---|---|---|

| Earnings | $187.4M | $143.0M | $125M | $482.5M |

| Percentage | 20% | 15% | 13% | 52% |

Wall Communications Inc. 2021

Streaming earnings in the Canadian music industry by rights-holder category

4.1 Overview of streaming in the Canadian sound recording industry

By all public accounts, streaming has become the most important source of music consumption in Canada and other parts of the world. Statistics Canada (StatCan) reported no streaming income for the industry in either 2013 or 2015, but it had become the largest contributor at 43% of sales (over any physical or digital sale category) in 2017 and was 69% of sales revenues by 2019.Footnote 93 The IFPI reported streaming revenues (for record labels) of $129.0M US in 2016 (or 35% of total revenues) but that had risen to $359.0M US (or 74% of total revenues) in 2020. MRC/Nielsen data indicates on-demand audio streaming grew from 22.9 billion streams in 2016 to 75.6 billion streams in 2019 while other digital download and physical sales categories fell, confirming the growth (and now prominence) of streaming as the largest means of music consumption.Footnote 94

The following Figure 6 and Table 3 illustrate the growth of streaming in the Canadian market.

IFPI Global Music Report 2021 (Canada) and Wall Communications Inc. 2021

Figure 6: Recorded music revenues by format (IFPI Global Music Report: Canada) 2016 to 2020 ($US) – text version

| Year | Streaming | Other | Total |

|---|---|---|---|

| 2016 | 129,200,000 | 241,900,000 | $371M |

| 2017 | 194,000,000 | 230,500,000 | $425M |

| 2018 | 255,900,000 | 170,600,000 | $427M |

| 2019 | 304,800,000 | 142,000,000 | $447M |

| 2020 | 359,000,000 | 124,000,000 | $483M |

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Streaming | $129.2M | $194.0M | $255.9M | $304.8M | $359.0M |

| Total RM Revenues | $371.1M | $424.5M | $426.5M | $446.8M | $483.0M |

| Streaming Share | 34.8% | 45.7% | 60.0% | 68.2% | 74.4% |

IFPI Global Music Report 2021 (Canada) and Wall Communications Inc. 2021

While the growth of streaming has propelled the industry, earnings from streaming, however, have not accrued to the various industry segments in the same proportions.