Public Accounts Committee (PAC) 2021 Briefing Book

Notice to readers

This report contains either personal or confidential information, or information related to security, which has been redacted in accordance with the Access to Information Act.

On this page

Meeting Agenda and PAC Membership

A. Summary on Public Accounts 2021

Issue / Question:

The Public Accounts of Canada for fiscal year 2020-2021 were tabled in Parliament by the President of the Treasury Board in December 2021.

Suggested Response:

- The Government of Canada is committed to responsible financial management and oversight.

- The Public Accounts include the audited consolidated financial statements of the Government.

- For the 23rd year in a row, the Government of Canada has received a clean audit opinion on its consolidated financial statements.

- This demonstrates the high quality of Canada's financial reporting.

Background:

- Production and finalization of the Public Accounts of Canada is a joint responsibility between the Receiver General, the Office of the Comptroller General and the Department of Finance.

- The Public Accounts reflect the Government’s audited consolidated financial statements and other detailed financial information for the fiscal year 2020-2021 that ended March 31, 2021.

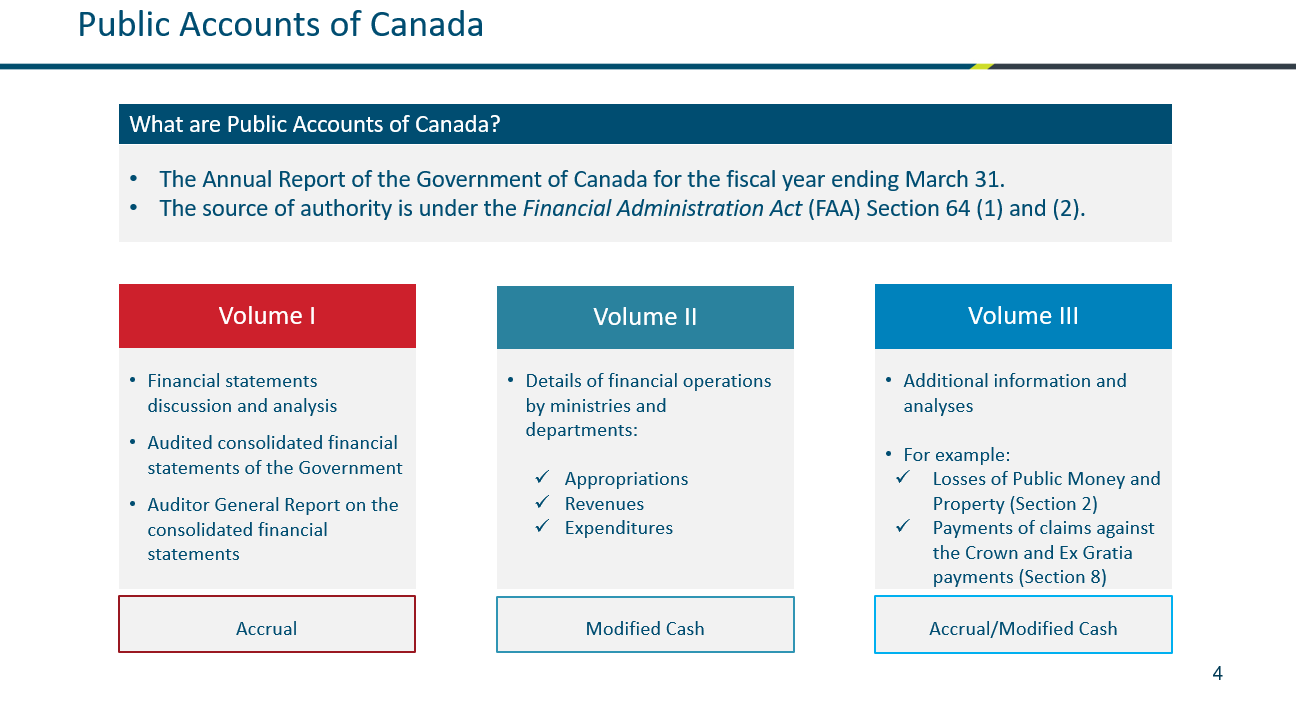

- Volume I – includes the audited consolidated financial statements of the Government; the unmodified audit report from the Auditor General; a financial statements discussion and analysis, which presents 10-year comparative financial information; as well as details on certain financial statement components.

- Volume II – includes financial operations of the departments, including the reconciliations of authorities granted and spent.

- Volume III – includes other supplementary information such as losses, claims against the Crown, ex gratia payments and Ministers’ Office expenditures.

- The Auditor General also simultaneously tables in Parliament, through the Speaker of the House, her observations on key financial audits. This year's observations focuses on the pandemic measures enacted by the government, pay administration and National Defence's inventory and asset pooled items.

- The Public Accounts are tabled in the House of Commons and undergo a review by the Public Accounts Committee.

- The Public Accounts show a deficit of $327.7 billion for the fiscal year 2020-2021, from a budgetary deficit of $343.2 billion projected in the 2020 Economic and Fiscal Snapshot and $354.2 billion revised figure in Budget 2021.

B. Opening remarks

Notes for remarks by Roch Huppé, Comptroller General of Canada, at the Standing Committee on Public Accounts

May 2022

Ottawa

Check against delivery

Introduction

Thank you Mr. Chair and members of the Committee for this opportunity to discuss the Public Accounts of Canada 2021.

I’m pleased to be speaking to you from the traditional unceded territory of the Algonquin Anishnaabeg People.

I am joined today by two of my colleagues from the Treasury Board of Canada Secretariat:

- Monia Lahaie, Assistant Comptroller General of the Financial Management Sector, and

- Diane Peressini, Executive Director of Government Accounting Policy and Reporting.

Mr. Chair, the Public Accounts include the audited consolidated financial statements for the 2020-21 fiscal year, which ended on March 31, 2021, in addition to other unaudited financial information.

I’m pleased to note that, for the 23rd consecutive year, the Auditor General has issued an unmodified or “clean” audit opinion of these financial statements.

This demonstrates, once again, the accuracy of Canada’s financial reporting and the Government of Canada’s commitment as an institution to the responsible financial management and oversight of taxpayer dollars.

I would like to thank the financial management community of the Government of Canada for their excellent work in helping to prepare the Public Accounts.

Its members are responsible for maintaining detailed records of the transactions in their departmental accounts and maintaining strong internal controls.

I would also like to recognize my colleagues at the Department of Finance and the Receiver General for their ongoing support and cooperation in producing the Public Accounts.

And last but not least, I would like to thank the Office of the Auditor General for its continued cooperation and assistance.

Highlights

Allow me to present a few financial highlights from the documents. The government posted an annual deficit of $327.7 billion, compared to a deficit of $39.4 billion in the previous year, and $26.4 billion less than that projected in Budget 2021.

One of the main drivers compared to the prior year relates to program expenses excluding net actuarial losses. It increased by $270.1 billion, or 79.8%, from 2020, largely reflecting transfers to individuals, businesses, and other levels of government under the Economic Response Plan.

Re-opening of books

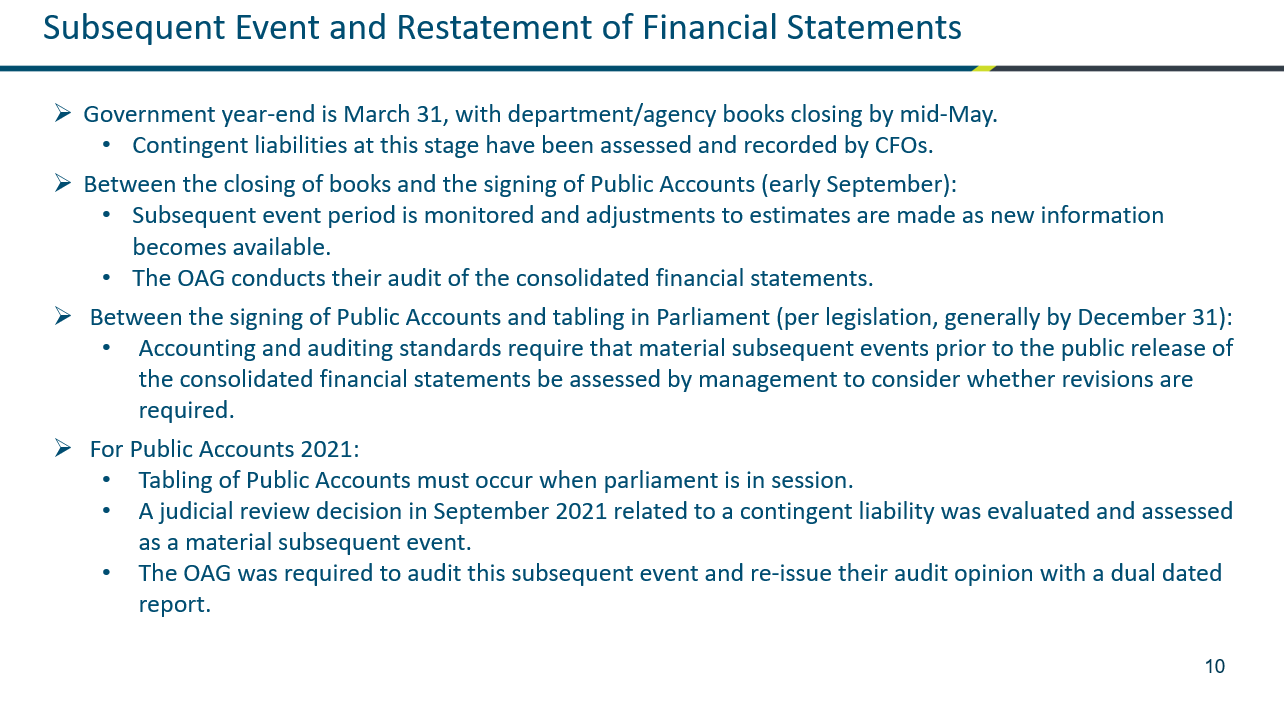

The Public Accounts of Canada 2021 were tabled on December 14, 2021.

The timing of the tabling was a result of the need to ensure that all the necessary adjustments were made to the government's consolidated financial statements in response to a September 29, 2021 court decision, as well as factoring in the time necessary to print the books.

This court decision altered the estimated contingent liability that was reported in the original financial statements completed on September 9.

The government considered the impact of the court ruling and concluded that it required an adjustment to its financial statements. Accordingly, the financial statements were reopened and adjusted after the closing entry was received from Indigenous Services Canada. This is explained in Volume I, Section 2, Note 22 Subsequent events.

This revision is aligned with best practice, as well as Public Sector Accounting Standards and Canadian Auditing Standards. In fact, standards require the Auditor to consider facts up to the time that the financial statements are issued.

The Auditor General then audited the revised estimated contingent liability and dual dated her audit report date on November 19, 2021 to reflect the extension of her audit.

The Public Accounts of Canada 2021 were then finalized, sent for printing, and tabled on December 14, 2021.

While this court decision necessarily delayed the publication of the Public Accounts, I would note that under the Financial Administration Act, the President of the Treasury Board is required to table the Public Accounts by December 31st or, if the House of Commons is not sitting during that period, within the first 15 days once the House reconvenes.

I would also like to note that, it is not unusual for Public Accounts to be tabled in December in years where there is an election.

In 2019, for example, they were tabled on December 12th. In 2015, they were tabled on December 7th.

Modernization

Finally, Mr. Chair, as you know, the government committed to undertake a study of potential changes to the Public Accounts of Canada.

We received preliminary feedback from the Library of Parliament on the presentation and format of the Public Accounts of Canada and have started engaging key stakeholders on potential changes to enhance their clarity and usability.

Any proposed changes will be carefully examined to ensure the Government’s financial information continues to support transparency and accountability to Parliamentarians and Canadians.

As this project advances, the government will continue to work closely with Parliamentarians and stakeholders.

Mr. Chair, thank you for your attention. This concludes my remarks.

C. Presentation deck

Figure 1 - Text version

Public Accounts of Canada 2021

April 2022

Figure 2 - Text version

- Background Information

- Current Reporting Cycle for Government Expenditures

- Public Accounts of Canada

- Roles and Responsibilities

- Accounting Standards

- Financial Results

- Subsequent Event and Restatement of Financial Statements

- Appropriation Information

- Observations

- Annex - Definitions

Figure 3 - Text version

This is a snapshot of some of the key financial reports that are produced annually.

This slide provides an overview of the current Supply Cycle in the Expenditure Management System and where the Public Accounts fit into the process.

Figure 4 - Text version

This slide provides an overview of the Public Accounts of Canada and its contents.

Volume I – In addition to the audited consolidated financial statements of the Government of Canada and the unmodified audit report from the Auditor General in Section 2, Volume I also includes a financial statements discussion and analysis in Section 1 which presents 10-year comparative financial information. Sections 3 to 11 present details on certain financial statement components.

Volume II – includes financial operations of the departments.

Volume III – includes other supplementary information such as Losses, Ex Gratia payments and Ministers’ Office Expenditures.

Figure 5 - Text version

Production and finalization of the Public Accounts is a joint responsibility between the Receiver General, Office of the Comptroller General and the Department of Finance.

The Office of the Auditor General audits the consolidated financial statements of the Government of Canada and provides an audit opinion.

The Public Accounts are tabled in the House of Commons and undergo a review by the Public Accounts Committee.

Figure 6 - Text version

Government accounting standards reside under the Financial Management Policy and complies with Public Sector Accounting Standards.

Figure 7 - Text version

PA 2020-21

The 2021 budgetary deficit of $327.7 billion was $15.5 billion lower than the $343.2 billion deficit projected for 2021 in the 2020 Economic and Fiscal Snapshot. A budget was not tabled in Parliament in 2020.

- Revenues decreased by $17.7 billion, or 5.3%, from 2020, primarily reflecting lower excise taxes and duties, particularly due to COVID–19 shutdowns and the one-time enhanced Goods and Services Tax (GST) credit payment, as well as lower Crown corporation revenues due to the impacts of the COVID 19 pandemic and the Bank of Canada’s secondary market purchases of Government of Canada securities.

- Program expenses excluding net actuarial losses increased by $270 billion, or 80%, primarily reflecting increased transfers to individuals, businesses, and other levels of government under the Economic Response Plan, including the CERB, the CEWS, and transfers under the Safe Restart Agreement.

- Public debt charges decreased by $4 billion, or 16%, from the prior year, largely reflecting lower interest on the government’s public sector pensions and other employee and veteran future benefits, lower interest on treasury bills, and lower Consumer Price Index adjustments on Real Return Bonds.

- Net actuarial losses increased by $4.7 billion, or 44%, from the prior year, due in large part to declines in year-end interest rates used to value the government’s unfunded public sector pension and other employee and veteran future benefit obligations and increased costs associated with the utilization of disability and other future benefits provided to veterans in the previous fiscal year.

Figure 8 - Text version

PA 2020-21

The accumulated deficit (the difference between total liabilities and total assets) stood at $1,048.7 billion at March 31, 2021 compared to $721.4 billion at March 31, 2020.

Figure 9 - Text version

This slide shows the total impact of the major COVID-19 measures on fiscal year 2021.

The impact of the measures for which accounting recognition criteria were met prior to March 31, 2021, are recognized in the government’s 2021 consolidated financial statements, including:

- CEWS $80.2B;

- CERB & EI ERB $63.7B;

- Other transfer payments expenses which include COVID-19 support measures:

- $13.1 billion for the CEBA loan incentive (refer to Note 16 for further details of the Canada Emergency Business Account);

- $4.0 billion for Canada Emergency Rent Subsidy;

- $2.9 billion for Canada Emergency Student Benefit;

- $2.5 billion for the one-time tax-free payment for seniors; and

- $2.2 billion to Canada Mortgage and Housing Corporation for the Canada Emergency Commercial Rent Assistance Program;

- CRB $16.8B

- Safe restart agreement $13.0B

The total impact of the COVID-19 measures on fiscal year 2021 - expenses was $198.4B.

Figure 10 - Text version

- Government year-end is March 31, with department/agency books closing by mid-May.

- Contingent liabilities at this stage have been assessed and recorded by CFOs.

- Between the closing of books and the signing of Public Accounts (early September):

- Subsequent event period is monitored and adjustments to estimates are made as new information becomes available.

- The OAG conducts their audit of the consolidated financial statements.

- Between the signing of Public Accounts and tabling in Parliament (per legislation, generally by December 31):

- Accounting and auditing standards require that material subsequent events prior to the public release of the consolidated financial statements be assessed by management to consider whether revisions are required.

- For Public Accounts 2021:

- Tabling of Public Accounts must occur when parliament is in session.

- A judicial review decision in September 2021 related to a contingent liability was evaluated and assessed as a material subsequent event.

- The OAG was required to audit this subsequent event and re-issue their audit opinion with a dual dated report.

Figure 11 - Text version

This slide shows the composition of the government’s reporting entity which includes not just the departments and agencies but also over 60 Crown corporations, government business enterprises, and other entities. The Enterprise Crown Corporations and Other Government Business Enterprises do not depend on government appropriations to sustain their operations, so they are accounted for using the modified equity method where they appear as an Investment in the Government’s financial statements, and their net income forms part of Government revenues, rather than fully consolidated.

References in PA 2020-21

Departments and Agencies

Expenses = $637.2B

Volume I, Section 2, Note 5. (h), Total expenses by segment ($644.2B)

MINUS

Volume I, Section 4, Table 4.2, Total expenses for consolidated CC and other entities ($7.0B)

Assets = $586.1B

Volume I, Section 2, Consolidated Statement Financial Position, Total Financial Assets ($502.4B)

PLUS

Volume I, Section 2, Consolidated Statement Financial Position, Total Non-Financial Assets ($101.1B)

MINUS

Volume I, Section 4, Table 4.1, Total assets for consolidated CC and other entities ($17.4B)

Consolidated CC and Other Entities (consolidated on a line-by-line basis)

Expenses = $7.0B Volume I, Section 4, Table 4.2, Total expenses for consolidated CC and other entities

Assets = $17.4B Volume I, Section 4, Table 4.1, Total assets for consolidated CC and other entities

ECC and Other GBEs (under modified equity basis)

Expenses = $32.2B Volume I, Section 9, Table 9.4, Total expenses for enterprise CC and other gov business enterprises. FSLI Other revenues

Assets = $1,025.2B Volume I, Section 9, Table 9.3, Total assets for enterprise CC and other gov business enterprises. FSLI Other loans, investments and advances

Figure 12 - Text version

The Voted Budgetary expenditures totalled $132,834M in the 2020-2021 fiscal year, as presented in Table 7 of Volume II of the Public Accounts of Canada.

- 6 ministries account for 55.3% of the total expenditures, however their programs differ significantly from one Ministry to another.

- National Defence has the largest votes amongst all Ministries, including a high proportion of capital spending;

- Indigenous Services, ISED, GAC, FCSD do most of their program delivery through transfer payments (Indigenous Services has the highest voted G&C in government); and,

- PSEP incurs a significant amount of Operating expenditures, resulting from the RCMP’s work with other levels of government to deliver policing services.

- The spending pattern across Government was not as consistent due to COVID-19.

| Ministry | Percentage | Amount |

|---|---|---|

| National Defence | 17.5% | 23,218,588 |

| Indigenous Services | 11.0% | 14,580,895 |

| Public Safety and Emergency Preparedness | 7.1% | 9,419,527 |

| Innovation, Science and Economic Development | 6.9% | 9,158,017 |

| Global Affairs | 6.7% | 8,923,370 |

| Health | 6.1% | 8,086,375 |

| Other Ministries | 44.8% | 59,447,460 |

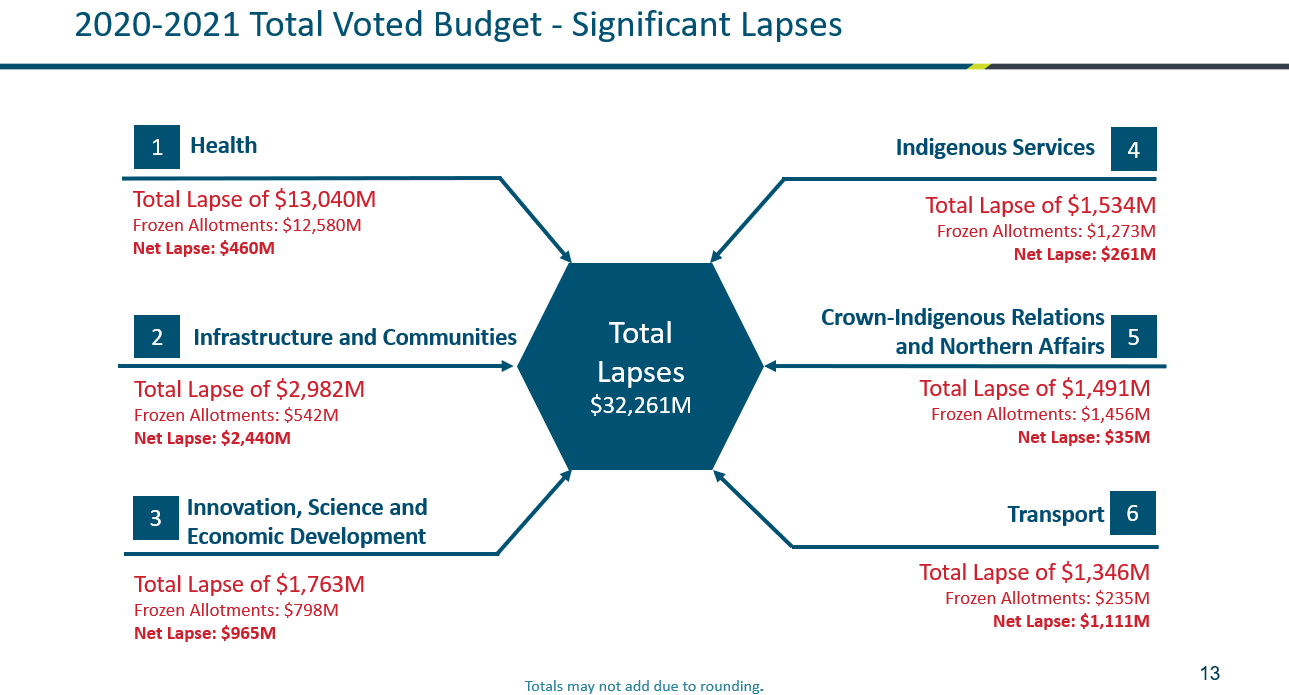

Figure 13 - Text version

Of the Voted Budgetary Lapse of $32.3B, 6 ministries represent $22.2B (69%).

- The largest driver for lapsed authorities was from Covid-19 measures. The government’s response to the Covid-19 pandemic resulted in an unprecedented increase in voted authorities, any of which were ultimately re-profiled to future years. Due to its significant role in response to the pandemic, the Public Health Agency of Canada (under Health) received a significant increase in funding and it was expected that a relatively large proportion would remain unspent in 2020-21.

- There was a $2.4B net lapse for Infrastructure and Communities due to capital and infrastructure project delays. Authorities were not spent due to delays in program implementation or lower than expected demand.

Figure 14 - Text version

Pay Administration

- OAG findings:

- 47% of employees sampled had an error in their basic or acting pay (51% in 2019-20).

- At March 31, 2021, 41% of employees sampled still required corrections to their pay (31% as at March 2020).

- Several factors contributed to the high number of pay errors: pay elements (eg. overtime, acting), backlog of pay action requests, manual processes, internal controls, and training.

- At March 31, 2020, there were 132,700 employees with pay action requests remaining to be processed (156,400 as at March 2020).

- OAG was able to conclude that pay expenses presented fairly in financial statements despite significant errors in the pay of individual employees.

- Overpayments and underpayments made to employees partially offset each other.

National Defence Inventory

- Errors persist in both quantities and value of inventory and asset pooled items.

- National Defence is progressing in the implementation of its long-term inventory management action plan that extends until 2027 as requested by the House of Commons Standing Committee on Public Accounts.

- For the third year, the department reported to PAC that it had substantially met the commitments in its action plan for the 2020-2021 fiscal year.

- One of the inventory management plan’s key commitments is to add a modern scanning and barcoding capability that is scheduled to be implemented by the end of the 2026-2027 fiscal year. The department is also the future upgrade of its enterprise resource planning software.

- Progress has been made over the past year to review how they classify items as either inventory or asset pooled items.

Figure 15 - Text version

Accrual Accounting

Transactions are recognized when revenue is earned, rather than when cash is received, and expenses are recognized when they are incurred, rather than when they are paid.

Appropriation

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

Expenditure Basis of Accounting/Modified Cash Accounting (Appropriation Accounting)

Transactions are recognized when money is paid out of the Consolidated Revenue Fund (CRF), as well as a limited number of transactions which do not affect the CRF until a later date for goods and services received just prior to year-end. Non-cash transactions (e.g. amortization) are not recognized. This is also sometimes called modified cash accounting.

Modified Equity Accounting

The cost of the Government’s equity is reduced by dividends received and adjusted to include the annual profits and losses of corporations, after elimination of unrealized inter-organizational gains and losses. Applies to Crown Corporations and other entities who can sustain their operations without government appropriations.

Unmodified Audit Opinion

Independent auditor's opinion that the financial statements are fairly presented, and in accordance with the accounting policies of the Government which conform with Canadian public sector accounting standards.

Figure 16 - Text version

Special Revenue Spending Authorities

Special revenue spending authorities from Parliament allows departments to use a certain amount of their revenues to finance their directly related expenditures. Those authorities include Revolving Funds and Net Voting and both of these reduce dependence on appropriations from general revenues.

Net Voting

Net voted operations may or may not be self-sustaining and usually the scale of operations is less significant than is the case for revolving funds. The aim of net voting provides that certain revenues offset related expenditures within a fiscal year. (e.g. Shared Services Canada)

Revolving Funds

Generally appropriate for large, distinct, self-sustaining activities that provide client-oriented services. The aim of a revolving fund is to achieve self-sufficiency over its business cycle, therefore appropriations are non-lapsing. (e.g. Passport Canada)

Specified Purpose Accounts (SPAs)

A broad classification of accounts established in the accounts of Canada and reported in the Public Accounts. SPAs, record transactions and expenditures for money payable out of the Consolidated Revenue Fund (CRF) under statutory authorities established for specified purposes. For accounting purposes, SPAs are classified as either a consolidated SPA (Employment Insurance Operating Account), a non-consolidated SPA (Insurance and Death Benefit Accounts) or deferred revenue SPA (Spectrum Licence Fees).

Figure 17 - Text version

Frozen Allotments

Used to prohibit the spending of funds previously appropriated by Parliament. There are two types of frozen allotments: permanent and temporary.

Permanent Frozen Allotments

Used where the Treasury Board has directed that funds lapse at the end of the fiscal year.

Temporary Frozen Allotments

Used where an appropriation is frozen until such time as a condition (conditions) has (have) been met.

Special Purpose Allotments (SPAs)

Used to set apart a portion of an organization’s voted appropriation for a specific initiative or item. Such an allotment is established when the Board wishes to impose special expenditure controls.

D. PAC overview note

Master Overview of the Committee

Standing Committee on Public Accounts (PACP)

Mandate of the Committee

When the Speaker tables a report by the Auditor General in the House of Commons, it is automatically referred to the Public Accounts Committee. The Committee selects the chapters of the report it wants to study and calls the Auditor General and senior public servants from the audited organizations to appear before it to respond to the Office of the Auditor General’s findings. The Committee also reviews the federal government’s consolidated financial statements – the Public Accounts of Canada – and examines financial and/or accounting shortcomings raised by the Auditor General. At the conclusion of a study, the Committee may present a report to the House of Commons that includes recommendations to the government for improvements in administrative and financial practices and controls of federal departments and agencies.

Government policy, and the extent to which policy objectives are achieved, are generally not examined by the Public Accounts Committee. Instead, the Committee focuses on government administration – the economy and efficiency of program delivery as well as the adherence to government policies, directives and standards. The Committee seeks to hold the government to account for effective public administration and due regard for public funds.

Pursuant to Standing Order 108(3) of the House of Commons, the mandate of the Standing Committee on Public Accounts is to review and report on:

- The Public Accounts of Canada;

- All reports of the Auditor General of Canada;

- The Office of the Auditor General’s Departmental Plan and Departmental Results Report; and,

- Any other matter that the House of Commons shall, from time to time, refer to the Committee.

The Committee also reviews:

- The federal government’s consolidated financial statements;

- The Public Accounts of Canada;

- Makes recommendations to the government for improvements in spending practices;

- Considers the Estimates of the Office of the Auditor General.

Other Responsibilities:

- The economy, efficiency and effectiveness of government administration;

- The quality of administrative practices in the delivery of federal programs; and,

- Government’s accountability to Parliament with regard to federal spending.

Committee Members

| Name & Role | Party | Riding | PACP Member since |

|---|---|---|---|

| Chair | |||

| John Williamson | Conservative | New Brunswick Southwest | February 2022 |

| Vice-Chair | |||

| Jean Yip | Liberal | Scarborough—Agincourt | January 2018 |

| Nathalie Sinclair-Desgagné Critic for Public Accounts; Pandemic Programs; Economic Development Agencies |

Bloc Québécois | Terrebonne | December 2021 |

| Members | |||

| Eric Duncan | Conservative | Stormont—Dundas—South Glengarry | February 2022 |

| Jeremy Patzer | Conservative | Cypress Hill—Grasslands | February 2022 |

| Phillip Lawrence Critic for Federal Economic Development Agency for Eastern, Central and Southern Ontario |

Conservative | Northumberland—Peterborough South | October 2020 |

| Blake Desjarlais Critic for TBS; Diversity and Inclusion; Youth; Sport and PSE |

New Democratic Party | Edmonton Greisbach | December 2021 |

| Valerie Bradford | Liberal | Kitchener South – Hespeler | December 2021 |

| Han Dong | Liberal | Don Valley North | December 2021 |

| Peter Fragiskatos Parliamentary Secretary National Revenue |

Liberal | London North Centre | December 2021 |

| Brenda Shanahan | Liberal | Châteauguay—Lacolle | December 2021; and Jan 2016 – Jan 2018 |

Anticipated TBS-Related Activity – 44th Parliament

- Introductory briefings from the Auditor General; Comptroller General of Canada; others.

- Public Accounts of Canada

- Reports of the Auditor General of Canada

TBS Related Committee Activity – 43rd Parliament

- Public Accounts of Canada (Link to study)

- Reports of the Auditor General of Canada:

- Public Service Culture (Link to study)

- No report

Parliament Interventions regarding the 2021 Public Accounts

House Of Commons

Conservative Party of Canada (CPC)

December 8, 2021: During CoW on 2021-22 Supps (B), MP McCauley asked the President of the Treasury Board several times if the Auditor General signed off on the public accounts and if they were tampered with for political gain by the government.

December 10, 2021: During Question Period, MP Kelly McCauley criticized the fact that it’s mid-December and the public accounts aren’t published. He said he heard disturbing stories about the government opening the audited public accounts and changing them for political gain. He asked the President of the Treasury Board if this is the case.

February 2, 2022: During the second reading of Bill C-8, MP Brad Vis said that the public accounts were tabled “six to seven months later than normal”. He said the PBO report demonstrates that Canada is an outlier compared to other developed nations in respect to financial transparency and accountability.

February 3, 2022: During the second reading of Bill C-8, MP Kelly McCauley said that unlike what the government claims, the public accounts show the government “pocketed $138 million above what it actually returned to Canadians”. McCauley also said the public accounts demonstrate Canada has accumulated a debt of “an eye-watering $1.4 trillion”. He accused the government of conflict of interest, saying the public accounts show that Liberal friends were helped with $91 million of taxpayers money were used to subsidize wealthy owners to buy Tesla vehicles.

February 9, 2022: While debating on Bill C-8, MP Pat Kelly showed concerns that the public accounts have never been published so late since 1994. He said that Canada is the last of the G7 countries to publish their financial accounts for the 2020-21 fiscal year and then quoted the PBO about Canada falls short on international fiscal guidelines.

February 15, 2022: During proceedings on Bill C-12, MP Tom Kmiec criticized the government, saying the public accounts show “things have not gone according to plan” with COVID-19 spending and that people got different types of benefit programs they were not eligible for.

March 1, 2022: During an OGGO meeting, MP Kelly McCauley asked the Assistant Secretary of TBS’ Expenditure Management Sector if she believes it’s possible to have legislative to assure that the public accounts and DRRs are released before September 30.

March 23, 2022: In a speech on Bill C-8, MP Kelly McCauley claimed that the public accounts demonstrated out-of-control spending and criticized the government over the fact that the public accounts didn’t include hundreds of billions for unfunded public service pension liabilities and Crown corporation debt.

April 5, 2022: During an opposition motion on defense spending, MP Pierre Paul-Hus showed concerns that according to the most recent public accounts, $1.2 billion of 2021 defense spending was not invested, even though the government promised to not lapse military spending.

New Democratic Party (NDP)

February 2, 2022: During a debate on Bill C-8, MP Daniel Blaikie mentioned that the PBO recently said that when it came to tabling of its public accounts, the government was “considerably late and was an outlier among other G7 countries”. He said that there is not a reason to not report well and in a timely fashion when “so much money is going out the door and so quickly”. He was confused as to why Bill C-8 proposes $1.72 billion on COVID-19 rapid tests while Bill-10 proposes $2.5 billion on this.

February 14, 2022: During debates on Bill C-10, MP Daniel Blaikie criticized the late tabling of the public accounts and said accountability and transparency is important.

February 28, 2022: During a FINA meeting, MP Daniel Blaikie said that it’s reasonable for Canadians “to expect some kind of regular reporting on how the money is being spent as it goes out the door rather than having to wait up to 18 months to see that recorded in the public accounts”.

March 23, 2022: During the report stage of Bill C-8, MP Daniel Blaikie said he heard from the PBO that the government has been late in filing its public accounts and therefore, the NDP thinks additional financial reporting is warranted.

Senate

Conservative Party of Canada (CPC)

November 30, 2021: During Question Period, Senator Elizabeth Marshall asked 2 questions to Senator Gold about when the Public Accounts will be tabled. She was concerned that it has been over 8 months since the end of the financial year and that now the government was requesting additional money despite the content of the Public Accounts, and the dept management project, not being known yet.

December 1, 2021: During Question Period, Senator Leo Housakos criticized the government for “constantly failing to provide transparency” and withholding information. He used the intervention on public accounts made the day before by Senator Marshall as an example of that.

December 14, 2021: During Question Period, Senator Housakos said that “we have a Prime Minister who says he isn’t concerned about monetary policy, a government that took more than two years to table a budget, a government that didn’t mention inflation in the Throne Speech and a Department of Finance that has not yet presented the public accounts or the debt management report for the current year.”

December 14, 2021: In a speech, Senator Marshall mentioned the public accounts several times, reaffirming that the government was late to table the public accounts since they “have traditionally been tabled in parliament during the fall sitting” and only started getting tabled in December under the current government. She affirmed that the PBO said the public accounts should have been at the front end of the pre-Holiday sitting. She thinks the government wanted to push the deadline for the Debt Management Report to late March. She also thinks elected officials did not have all the information they need to properly review Bill C-6 and 2021-22 Supps (B).

December 15, 2021: Senator Marshall said that “the government didn’t release the public accounts for last year until yesterday, so we waited almost nine months for the public accounts. We didn’t have the benefit of that document when we reviewed Supplementary Estimates (B) and Bill C-6”. She thinks this is the latest they’ve been tabled since 1994.

December 16, 2021: In a CoW, Senator Marshall said that the public accounts being released late “creates a big problem for parliamentarians”. She expressed to Hon. Chrystia Freeland that she doesn’t think it’s right that Financial Administration Act allows the deadline of the public accounts to be as late as December 31. She thinks it should be changed to October 31. She asked if Ms. Freeland would support such an amendment, to which the Freeland replied that she takes this issue seriously. Senator Marshall replied by saying it seems there is a decline in the release of accountability documents by the government.

March 1, 2022: During Question Period, Senator Marshall asked when will the debt management report for 2020-21 be tabled and reinstated that by releasing the public accounts so late, they pushed the deadline of the tabling of the dept management report. She regrets not having that report to study Supps C and Bill C-8. She asked if the government is deliberately withholding information.

March 31, 2022: In a speech during the third reading of Bill C-15, Senator Marshall again said the Public Accounts should’ve been released “months earlier” to allow a better review of government spending.

March 31, 2022: In a speech during the third reading of Bill C-16, Senator Housakos mentioned that the PBO recommends to move the publication date of the Public Accounts to no later than September 30th. He again criticized the government for publishing them so late.

April 4, 2022: During Question Period, Senator Martin reinstated that the Public Accounts were tabled too late. She said that the Public Accounts that Veterans Affairs lapsed over $634 million in spending last year, left unspent. She questioned why this “tremendous amount” was left unspent despite Veterans Affairs facing many backlog problems.

Non-affiliated (N-A)

December 14, 2021: Senator Raymonde Gagné moved the second reading of Bill C-6, which contains supply requirements for Supps B 2021-22. She mentioned the public accounts, saying “actual expenditures will be found in the public accounts after the fiscal year is completed” and that “the estimates, which include the Main Estimates, supplementary estimates, departmental plans and departmental results reports, in conjunction with the public accounts, help parliamentarians scrutinize government spending.”

March 30, 2022: Senator Gagné moved the third treading of Bill C-15 and reinstated the importance of the Public Accounts, saying it helps parliamentarians scrutinize government spending despite scrutiny “not always (being) a straightforward matter”.

Independent Senate Group (ISG)

December 15, 2021: Senator Pat said she joins Senator Marshall (CPC) in expressing her deep concern that, unlike some provinces and territories where public accounts must be tabled before October 31st, Senators have yet to see the content of the public accounts until December 14.

Meeting Summaries

Meeting 1 – December 16, 2021

Election of Chair

Full transcript: Evidence – PACP (44) – No. 1

The Standing Committee on Public Accounts (PACP) held its first meeting of the 44th Parliament to elect a chair.

Tom Kmiec (CPC) was nominated and elected as Chair of the Committee. Jean Yip (LPC) and Nathalie Sinclair-Desgagné (Bloc) were nominated and elected as Vice Chairs of the Committee.

The Committee adopted several routine motions for the committee (e.g. steering committee membership, publication of committee proceedings, research staff, travel etc.)

A motion from Blake Desjarlais (NDP) proposed to establish limits to when and how the Committee can move to meet in camera. The motion failed in a recorded division 9-1.

A motion from Jean Yip (LPC) proposed that the Committee receive a briefing from the Canadian Audit and Accountability Foundation for one meeting, which was adopted unanimously.

At 11:51, the meeting adjourned.

Meeting 2 – February 1, 2022

Briefing with Canadian Audit and Accountability Foundation

Full transcript: Evidence – PACP (44-1) – No. 2

Meeting 3 – February 3, 2022

Committee Business (Reports 1-9)

Full transcript: Minutes – PACP (44-1) – No. 3 (in camera)

Meeting 4 – February 8, 2022

Report 5, Lessons Learned from Canada’s Record on Climate Change

Full transcript: Evidence – PACP (44-1) – No. 4

Meeting 5 – February 10, 2022

Report 10, Securing Personal Protective Equipment and Medical Devices

Full transcript: Evidence – PACP (44-1) – No. 5

Meeting 6 – February 15, 2022

Public Sector Pension Investment Board

Full transcript: Evidence – PACP (44-1) – No. 6

Meeting 7 – March 1, 2022

Election of Chair, Report 12, Protecting Canada’s Food System

Full transcript: Evidence – PACP (44-1) – No. 7

In the first few moments of the committee, the committee elected John Williamson as new Chair of the committee.

Meeting 8 – March 3, 2022

Report 11, Health Resources for Indigenous Communities

Full transcript: Evidence – PACP (44-1) – No. 8

Meeting 9 – March 22, 2022

Public Sector Pension Investment Board

Report 10, Securing Personal Protective Equipment and Medical Devices

Full transcript: Minutes – PACP (44-1) – No. 9 (in camera)

Meeting 10 – March 24, 2022

Report 2, Natural Health Products — Health Canada

Full transcript: Evidence – PACP (44-1) – No. 10

Meeting 11 – March 29, 2022

Committee Business

Full transcript: Minutes – PACP (44-1) – No. 11 (in camera)

Meeting 12 – March 31, 2022

Report 13, Health and Safety of Agricultural Temporary Foreign Workers

Full transcript: Evidence – PACP (44-1) – No. 12

Meeting 13 – April 5, 2022

Report 15, Enforcement of Quarantine and COVID-19 Testing Orders

Full transcript: Not available yet

Meeting 14 – April 7, 2022

Report 15, Enforcement of Quarantine and COVID-19 Testing Orders

Full transcript: Not available yet

Bios of the Committee Members

John Williamson (New Brunswick Southwest), Conservative, Chair

- Elected as MP for New Brunswick Southwest in 2011, he was then defeated in 2015 and re-elected in 2019 & 2021.

- Currently also serves as a Member of the Liaison Committee

- Previously served on many committees, including PACP for a brief time in 2013

- Prior to his election, M. Williamson occupied different positions. He was an editorial writer for the National Post from 1998 to 2001, then joined the Canadian Taxpayers Federation until 2008. In 2009, he was hired by Stephen Harper as director of communications in the PMO.

Jean Yip (Scarborough - Agincourt), Liberal, First Vice-Chair

- Elected as MP for Scarborough—Agincourt in a by-election on December 11, 2017, and re-elected in 2019 & 2021.

- Has served on Public Accounts (since 2018), as well as Government Operations and Canada-China committees in the past.

- Before her election, Ms. Yip was an insurance underwriter and constituency assistant.

Nathalie Sinclair-Desgagné (Terrebonne), Bloc Québécois, Second vice-chair

- Elected as MP for Terrebonne in the 2021 federal election.

- BQ Critic for Public Accounts; Pandemic Programs; and Federal Economic Development Agencies.

- Worked at the European Investment Bank and at PWC London.

- Return to Quebec in 2017 to pursue a career in the Quebec business world.

Eric Duncan (Stormont-Dundas-South Glengarry), Conservative, Member

- Elected as MP for Stormont-Dundas-South Glengarry in 2019, and re-elected in 2021.

- Vice-Chair of Procedure and House Affairs Committee

- Has served on COVID-19 Pandemic, Procedure and House Affairs and Library of Parliament committees in the past.

- Prior to his election, Mr. Duncan was one of the youngest elected officials in Canadian History as a municipal Counsellor in North Dundas at the age of 18, and was elected mayor at the age of 22 (from 2010 to 2018).

Jeremy Patzer (Cypress Hills-Grasslands), Conservative, Member

- Elected as MP for Cypress Hills-Grasslands in 2019, and re-elected in 2021.

- Member of the Standing Committee on International Trade.

- Has served on Natural Resources, Industry, Science and Technology and COVID-19 Pandemic committees in the past.

- Prior to his election, Mr. Patzer worked in the telecommunications industry for ten years.

Phillip Lawrence (Northumberland—Peterborough South), Conservative, Member

- Elected as MP for Northumberland—Peterborough South in 2019, and re-elected in 2021

- CPC Critic for the Federal Economic Development Agency for Eastern, Central and Southern Ontario

- Has served on Public Accounts (since 2020), as well as the Justice committees in the past

- Prior to his election, Mr. Lawrence received his BA from Brock University in Political Science, he attended Osgoode Hall Law School and the Schulich School of business to obtain his law degree and MBA, and volunteered at the Financial Planning Standards Council

Blake Desjarlais (Edmonton Greisbach), NDP, Member

- Elected as MP for Edmonton Greisbach in 2021

- NDP Critic for Treasury Board; Diversity and Inclusion; Youth; Sport; and Post-secondary Education

- First openly Two-Spirit person to be an MP, and Alberta’s only Indigenous Member of Parliament

Valerie Bradford (Kitchener South – Hespeler), Liberal, Member

- Elected as MP for Kitchener South – Hespeler in 2021

- Also sits on the Standing Committee on Science and Research (SSRS) and the Subcommittee on Agenda and Procedure of SSRS

- Prior to her election, Ms. Bradford worked as an economic development professional for the City of Kitchener

Han Dong (Don Valley North), Liberal, Member

- Elected as MP for Don Valley North in 2019, and re-elected in 2021

- Also sits on the Standing Committee on Industry and Technology

- Has served on the Ethics, and Human Resources committees in the past

- Prior to his election, Mr. Dong worked with Toronto-based high-tech company dedicated to building safer communities and served as the leader of the Chinatown Gateway Committee established by Mayor John Tory

Peter Fragiskatos (London North Centre), Liberal, Member, Parliamentary Secretary to the Minister of National Revenue

- Elected as MP for London North Centre in 2015, and re-elected in 2019 & 2021

- Serves as Parliamentary Secretary to the Minister of National Revenue

- Has served on the Finance, Canada-China, Human Resources, Public Safety, and Foreign Affairs committees in the past

- Served as a member of the National Security and Intelligence Committee of Parliamentarians (NSICOP)

- Prior to his election, Mr. Fragiskatos was a political science professor at Huron University College and King’s University College, as well as a frequent media commentator on international issues

Brenda Shanahan (Châteauguay—Lacolle), Liberal, Member

- Elected as MP for Châteauguay—Lacolle in 2015, and re-elected in 2019 & 2021

- Caucus Chair

- Has served on Public Accounts (2016-2018), as well as Ethics, Government Operations, and MAID committees in the past

- Has served as a member of the National Security and Intelligence Committee of Parliamentarians (NSICOP)

- Prior to her election, Ms. Shanahan was a banker and social worker, who has also been involved in a number of organizations such as Amnesty International and the Canadian Federation of University Women

Volume I

E.1 – E.3 Variances

Provision for contingent liabilities

Issue / Question:

Why has the Government of Canada's provision for contingent liabilities increased in the year?

Suggested Response:

- The Government of Canada is committed to honouring its obligations and settling claims which impacts the contingent liability balance.

- The contingent liabilities amount changes annually as estimates are revised for existing liabilities, new claims are filed against the Crown, and settlements are reached.

- This year's increase is mainly due to efforts to advance reconciliation with Indigenous People.

- The Government of Canada's contingent liabilities are reviewed on a quarterly basis as required by Treasury Board's Directive on Accounting Standards to ensure that they fairly represent the financial position of Canada.

Background:

- Recent large class action settlements:

- ISC - Safe drinking water Agreement in Principle was reached this year, resulting in an accrual of $1,988M.

- Further increases to contingent liabilities amounting to approximately $19B were incurred as a result of ongoing negotiations relating to claims to advance reconciliation with Indigenous People and other class settlement and legal claims against the Crown.

In any given year, factors that could increase the provision include:

- Recent Court and Tribunal rulings and precedent setting outcomes from settlements of past grievances and claims with the Government can influence others to bring claims forward against the Government of Canada.

- Social activism such as the “Me too” movement against discrimination, sexual harassment and assault can influence individuals to bring forward claims against the Government of Canada for past injustices.

- A provision is also made when it is likely that a payment will be made to honour a guarantee and when the amount of the anticipated loss can be reasonable estimated. The way the Government structures future funding arrangements with third parties which include a Government guarantee also has the potential to increase the liability.

Other Employee and Veteran Future Benefit Liabilities Variance Analysis

Issue / Question:

Why are there significant increases in the liabilities for 'other employee and veteran future benefits' on a year over year basis?

Suggested Response:

- Each year, adjustments are made to the liabilities for other employee and veteran future benefits to:

- add the costs of benefits earned by employees during the year and the accrued interest; and

- deduct benefit payments made to employees, retirees and veterans.

- In the 2020-21 FY, these 3 components resulted in a net increase in the liabilities of $7.9B.

- In addition, a portion of previously unrecognized net actuarial losses were expensed this fiscal year, increasing the liabilities by $9.9B.

Background:

- Other employee and veteran future benefit liabilities include:

- Veterans and Royal Canadian Mounted Police disability and other future benefits

- Pensioners’ health care and dental benefits

- Severance and other benefits

- Accumulated sick leave entitlements

- Workers' compensation

- Significant other future benefits sponsored by consolidated Crown corporations and other entities. (Redacted).

- The liabilities are adjusted to record:

- Any plan amendments, curtailments or settlements – There were no changes to benefit plans in fiscal year 2021 and 2020.

- Recognition of actuarial gains and losses – Consistent with the accounting standards, gains and losses related to experience and changes in actuarial assumptions used to estimate the liabilities are not recorded immediately, rather they are recognized over the average remaining service life of the employee group or the average remaining life expectancy of the benefit recipients under wartime veteran plans.

- Recognition of interest expense – Consistent with the accounting for other long-term liabilities, the Government uses a present value technique to estimate the current value of all future payments to be made under the benefit plans. The interest expense reflects the time value of money and the fact that we are one year closer to making these payments.

- The liabilities for other employee and veteran future benefits are subject to significant volatility. The payments for these benefit plans are made many years into the future and are dependent upon the evolution of factors such as wage increases, workforce composition, retirement rates and mortality rates. The Government estimates these liabilities based upon its historical experience, current facts and circumstances, and expected future developments. Annual changes to the estimates, and changes to the discount rates used to present value the liabilities result in unrealized gains and losses that are recorded as an expense over the average remaining service life of the employee group or the average remaining life expectancy of the benefit recipients under wartime veteran plans.

Enterprise Crown corporations

Issue / Question:

What is the cause of the decrease in our investment in enterprise Crown corporations (ECC) and other government business enterprises' (GBE)?

Suggested Response:

- This amount represents both the Government's investment in share capital for these entities, as well as loans receivable. The accounting for the change involves four main components:

- The government acquired shares in Business Development Bank of Canada (BDC) and Export Development Canada (EDC) totalling $18.5B to support Canadian businesses though the pandemic for programs primarily involving loan guarantees and direct financing.

- The total net income of ECC and GBE increased the investment by $6.8B.

- These increases were offset by a return of equity in the form of dividends of $13.6B, mainly from the Bank of Canada, Canada Mortgage and Housing Corporation (CMHC), and EDC.

- There was also a downward adjustment of $19B mainly related to an accounting elimination entry for the quantitative easing that was entered into by the Bank of Canada which purchased Government of Canada bonds on the secondary market.

Background:

- The shares issued by EDC and BDC are in direct response to programs related to the COVID-19 pandemic. EDC issued shares totalling $10.97B to fund the Business Credit Availability Program (BCAP) and reserve-based lending programs; whereas BDC issued shares totalling $7.5B in order to deliver BCAP and the Highly Affected Sectors Credit Availability Program (HASCAP). These programs primarily involve loan guarantees and direct financing to support Canadian businesses though the pandemic.

- Net income from ECCs has increased when compared to last year primarily due to reversals of provisions for expected credit losses and unrealized gains on financial instruments carried at fair value. Most ECCs experienced greater returns when compared to prior year as a result of more optimistic financial market conditions.

Issue / Question:

What is the Inter-organizational adjustment of $19B in Section 2 Note 15?

Suggested Response:

- This adjustment is done every year to eliminate unrealized inter-organizational gains and losses. The increase this year primarily relates to an $18.4B equity adjustment from quantitative easing undertaken by the Bank of Canada.

- In response to the quantitative easing, an adjustment was required to record the up-front expensing of premiums paid by the Bank of Canada on its secondary market purchases of Government of Canada Bonds.

- Effectively we are purchasing our own bonds which means we eliminate any gains/losses incurred as a result of the market transactions.

Background:

- In order to support liquidity in financial markets, the Government Bond Purchase Program and the Canada Mortgage Bond Purchase Program were established. As a result of these programs, a substantial equity adjustment was required resulting in a decrease in the value of our investment.

- The Department of Finance can respond to the mechanics of quantitative easing and how it was used in the pandemic response.

F.1 – F.3 Phoenix

Phoenix Overpayments

Issue / Question:

How much in Phoenix overpayments have been written-off?

Suggested Response:

- The Government of Canada is committed to resolving public service pay issues as quickly as possible and supporting employees.

- Write-offs are reported at an aggregate level in the Public Accounts and totaled $2.3B ($3.9B in 2020).

- This amount is not broken down specifically for Phoenix overpayments in the Public Accounts.

Background:

- In accordance with the Financial Administration Act and the Debt Write-Off Regulations, departments are responsible for ensuring that debts, obligations and claims written-off or forgiven are accurately reported and that the appropriate approval process has been followed.

- When a debt is written-off, it is removed from the Accounts of Canada. However, the Government maintains its legal right to recover the debt if it becomes possible to do so in the future.

- Debts, obligations and claims written off or forgiven during the fiscal year are listed in the Public Accounts of Canada, Volume III, Section 2.

Issue / Question:

How much in Phoenix overpayments have been written-off due to being statute-barred?

Suggested Response:

- As part of the 2020-21 Public Accounts, there were no Phoenix overpayments written-off due to being statute-barred.

Background:

- The Crown Liability and Proceedings Act (1985) places a statutory restriction of six-years on the recovery of salary overpayments. This means that salary overpayments from 2016 could become statute barred in 2022.

- To address this and preserve the Government of Canada's right to recover these overpayments, the Treasury Board Secretariat (TBS) and Public Services and Procurement Canada (PSPC) jointly issued a bulletin on overpayment recovery flexibilities seeking employee acknowledgement of overpayments or entry into repayment agreements.

- Note: Although the above is under OCHRO and PSPC responsibilities, the following questions may come up in relation to the Public Accounts, given the imminent posting of the new bulletin.

Phoenix: TBS Role

Issue / Question:

What is TBS' role in addressing the pay issues?

Suggested Response:

- Canada’s public servants deserve to be paid properly and on time, and the Government of Canada continues to take action on all fronts to resolve pay issues.

- The ongoing stabilization of the Phoenix Pay System is being pursued by Public Services and Procurement Canada and Treasury Board Secretariat, even as the government is exploring options for a next generation system to eventually replace Phoenix.

- We have also reached damages agreements with all bargaining agents to compensate current and former employees for damages caused by the Phoenix pay system in the core public administration and other agencies.

- The Government of Canada is testing a Human Resources (HR) and pay solution that will be built on the foundation of users' needs and modern people management processes.

- Next Generation HR and Pay will be a user-centric, accessible, and flexible cloud-based solution. It will work on an enterprise scale and meet the complex needs of the government and the diverse needs of federal employees throughout Canada, now and into the future.

Background:

- Treasury Board Secretariat is responsible for HR to Pay Stabilisation mandatory training and leading on the implementation of the Phoenix pay system damages agreements to compensate federal employees impacted by the Phoenix pay system. The Office of the Chief Human Resources Officer within TBS also performs the business owner role for people management and design authority for the NextGen HR and Pay initiative, working closely with Shared Services Canada (SSC) who is the technical and initiative authority.

- Public Services and Procurement Canada is responsible for the operations of the Phoenix pay system and addressing the backlog of pay requests.

- SSC is testing HR and pay systems to replace 34 HR systems across government and the current pay system. This high-profile initiative will produce options and recommendations for a future enterprise-wide NextGen HR and Pay system for the Government of Canada.

- The NextGen HR and Pay team is using an agile approach throughout the initiative and is taking the time necessary to let each step in the process inform the next.

Agreement for damages caused by Phoenix (including PSAC)

Issue / Question:

How has the agreement for damages caused by the Phoenix pay system been incorporated into the Public Accounts of Canada? What is the "Settlement of Phoenix-related damages"?

Suggested Response:

- The Government of Canada recognizes that the implementation of the Phoenix pay system has had an impact, directly or indirectly, on employees.

- Agreements have been reached with all bargaining agents to compensate current and former employees for damages caused by the Phoenix pay system.

- Costs related to the agreements are captured in the Public Accounts in two ways:

- Within the financial statements, when it appears likely that a settlement will be reached, the estimated amount is accrued as a contingent liability and recorded as an expense. As the agreements are reached the liability is reclassified to amounts payable and the expense adjusted, if required, to reflect the actual settlement.

- As payments are made, the amounts are reflected in the Claims against the Crown in Volume 3 of Public Accounts. The disclosures in 2021 primarily relate to payments for the PSAC agreement for the 2017 to 2020 period, which include amounts for general damages and for late implementation of 2014 collective agreements. Any cash amounts paid to current or former employees by departments are also presented in this section.

Background:

- In May 2019, the Government of Canada reached a tentative agreement with members of the Senior Level Phoenix Union-Management sub-committee on damages for compensation for employees impacted by the implementation of the Phoenix Pay system. This agreement was ratified in June 2019 by all federal government bargaining agents except for PSAC. Separate agencies have signed similar agreements covering their employees (except those represented by PSAC).

- In October 2020, PSAC signed a damages agreement similar to the June 2019 agreement with the exception of the general damages provided to employees which consist of cash payments of up to $2,500 instead of leave credits. This includes $1,000 for the late implementation of the 2014 collective agreements.

- The negotiation of a catch-up agreement ratified on March 3, 2021, was triggers following the signing of the PSAC damages agreement in the fall of 2020. The purpose was to align compensation since some elements of the 2020 PSAC agreement differed from the agreement negotiated with other bargaining agents in 2019.

- Claims against the Crown in Volume 3 of Public Accounts 2021 shows Settlement of Phoenix-related damages for $401 million (Redacted).

- The TBS Claims Office has provided guidance to departments on end-to-end business processes for resolving claims associated with a payment equivalent to leave for damages caused by the Phoenix pay system.

- The OCG provided financial coding instructions to departments for payments to former employees

G. OAG observation - Department of National Defence Inventory

Issue / Question:

Can you comment on the status of the implementation for the Department of National Defence's (DND) 2016 Action Plan to address the Office of the Auditor General's (OAG) commentary observations on its inventory?

Suggested Response:

- As of 2021, all commitments have been identified as complete except for two.

- One outstanding commitment from last year is expected to be completed in the 2021-22 fiscal year; the other commitment is experiencing a five-month delay.

- This year, the Office of the Auditor General (OAG) continued to find errors in quantity, pricing, and classification.

- The Office of the Comptroller General (OCG) continues to support DND to resolve these issues.

Background:

- In its 28th report on the 2016 Public Accounts, the Public Accounts Committee (PAC) directed that, beginning in 2017-18, DND is to provide an annual one-page report on progress in implementing its long term 2016 six-point Action Plan to properly record and value its inventory. The annual progress report on the 2020-21 fiscal year was presented on May 30, 2021.

- The 2016 Action Plan comprised of six initiatives: Governance; Automatic Identification Technology; Enhanced Materiel Accountability; Inventory Management Rationalization and Modernization; Pricing; and the Pricing Legacy Data Clean Up.

Outstanding Commitments:

- As of March 31, 2021, the Pricing Legacy Data Clean Up commitment remains outstanding. This is expected to be completed by March 31, 2022 when the software update will be implemented to allow DND to capture weekly analysis of transactions on all inventory records.

- As of March 31, 2021, the Automatic Identification Technology (AIT) Initiative is experiencing a delay. The project is experiencing delays in the implementation of some of the Definition Phase Plan activities, DND has amended its Action Plan for five months.

H. CDEV – Trans Mountain Pipeline

Issue / Question:

Where do I see the Trans Mountain Expansion Project (TMEP) in the Public Accounts? How much did the TMEP cost the Government this year? What is the impact of COVID-19 and decreases in crude oil prices on TMEP?

Suggested Response:

- The Trans Mountain Corporation is a subsidiary of Canada Development Investment Corporation (CDEV), which is a Crown corporation that is consolidated using the modified equity method. Therefore, the net of assets and liabilities of CDEV is reported on an equity basis as an investment in enterprise Crown corporations (ECC) and other government business enterprises (GBE).

- Results of the Trans Mountain Corporation from April 2020 to March 2021 showed revenues of $417M, and operating expenses of $244M. Financing costs were $40M, depreciation totalled $107M, net of tax expense was $8M, for a total net income of approximately $18M.

- As at March 31, 2021, CDEV held $10.0B in outstanding loans from the government to finance the acquisition and construction of the pipeline assets. This is reported as a financial asset under loans to ECCs and GBEs on the Consolidated Statement of Financial Position.

- A quantitative goodwill impairment test was performed by CDEV for amounts presented as at June 30, 2021. It showed that there was no requirement to reduce the carrying value of the goodwill. That means the government is expected to recover its value in TMC.

- Given the nature of Trans Mountain Corporation’s operations, it is not anticipated that the COVID-19 outbreak will have a material impact on TMC’s financial results. Despite the pandemic's impact on crude oil demands and prices, the Trans Mountain pipeline operated at full capacity throughout 2020 and the first half of 2021. There continues to be a refinancing risk as TMP Finance requires further financing as the TMEP enters a very busy construction period.

Background:

- Loans used to finance the acquisition and ongoing construction of the TMX pipeline are through the Government's Canada Account, administered by Export Development Canada, at a 4.7 per cent interest rate. On October 1, 2020, a Second Credit Amending Agreement was executed between the Government of Canada and TMP Finance which resulted in an increase to the available credit on the Construction Facility to $5.1 billion on October 1, 2020 and to $6.1 billion on January 1, 2021. On March 31, 2021, a further amendment was executed increasing the available credit on the Construction Facility to $9.14 billion effective April 1, 2021. The maturity date for all loan facilities was amended to August 29, 2025 effective April 1, 2021.

- CDEV continues to retain cash and short-term investments that provide it with financial flexibility to meet its obligations as they come due. CDEV may be exposed to long-term downturns in the energy industry and economic volatility which is mitigated by the current regulatory frameworks governing TMC’s pipeline operations and the competitive position of its pipeline and oil producing assets. Expected future cash flow from the present operations currently exceeds estimated operating expenses and future capital expenditures, aside from TMEP. Given significant ongoing expenditures in connection with TMEP, CDEV will require the continued availability of future financing in order to complete the project.

- At June 30, 2021, an assessment of indicators of impairment was conducted for CDEV's cash generating units. Despite changes in the macroeconomic environment, neither existing pipeline operations nor TMEP construction had been materially impacted. No indicators were noted for the oil transportation assets, including goodwill, and accordingly an impairment test was not required.

- By conducting an impairment test and concluding that no write downs were required, by definition, this means that CDEV has determined that either the “FV- Cost to sell” or the “present value of the future cash flows from the TMC assets” is HIGHER than the carrying amount of the TMC assets. As a result, CDEV (and therefore the Government of Canada) expects to recover its value in TMC. When this stops being true, indicators of impairment will be evident and an impairment loss will be booked in CDEVs financial statements.

- As at June 30, 2021 work related to TMEP is underway in various phases along the majority of the route and the project construction is approximately 29% complete. TMC is targeting a mechanical completion date for a majority of the project by the end of 2022 with commercial operations commencing in 2023.

I. LEEFF Subsidiary

Issue / Question:

Who is responsible for administering the Large Employer Emergency Funding Facility (LEEFF)? Where do I see the LEEFF in the Public Accounts? How much did the LEEFF cost the Government this year?

Suggested Response:

- Canada Enterprise Emergency Funding Corporation (CEEFC) is wholly-owned by Canada Development Investment Corporation (CDEV).

- CDEV is not considered to control CEEFC, and therefore is not required to consolidate them into their financial statements. As a result, CEEFC is consolidated into the Public Accounts on a line-by-line basis.

- In Public Accounts 2021, LEEFF loans totaled $319M and are recorded in "Other loans, investments and advances" on the statement financial position.

Background:

- CEEFC, a federal non-agent Crown corporation, was incorporated on May 11, 2020 and is responsible for administering LEEFF.

- The objective of LEEFF is to help protect Canadian jobs, help Canadian businesses weather the current economic downturn, and avoid bankruptcies of otherwise viable firms where possible. LEEFF will not be used to resolve insolvencies or restructure firms, nor will it provide financing to companies that otherwise have the capacity to manage through the crisis. The additional liquidity provided through LEEFF will allow Canada’s largest businesses and their suppliers to remain active during this difficult time and position them for a rapid economic recovery.

- The LEEFF is open to large Canadian employers who:

- have a significant impact on Canada’s economy, as demonstrated by having significant operations in Canada or supporting a significant workforce in Canada;

- can generally demonstrate approximately $300 million or more in annual revenues; and

- require a minimum loan size of about $60 million

- Standard LEEFF loans are funded on an 80% unsecured basis, with the remaining 20% funded on a secured basis on terms identical to those of the borrowers’ existing secured lenders. Fees are charged based on the loan commitment and other loan fees are payable upon repayment. Interest rates escalate through the term of the five-year unsecured loan.

- On June 18, 2020, a funding agreement was entered into between CEEFC and the Minister of Finance. The funding of CEEFC is by way of subscription for Class A Preference Shares of CEEFC on the terms set forth in the funding agreement to provide funding to CEEFC for the administration and implementation of the LEEFF Program. As at March 31, 2021, the aggregate purchase price of the preferred shares was $420M. From a Public Accounts perspective, the Government of Canada's investment in CEEFC is eliminated upon consolidation.

- As at March 31, 2021, CEEFC had issued four loans (amounts exclude accrued interest and transaction fees of $5M):

| Borrower | Agreement Signed | Total Loan Commitment | Amount Funded |

|---|---|---|---|

| Gateway Casino & Entertainment Ltd. | Sept. 2020 | $200M | $100M |

| Conuma Resources Ltd. | Oct. 2020 | $120M | $79M |

| Sunwing Vacations Inc. | Jan. 2021 | $348M | $50M |

| Goodlife Fitness Centres Inc. | Feb. 2021 | $310M | $85.2M |

| Total | $978M | $314.2M |

- On April 12, 2021, CEEFC entered into an agreement with Air Canada whereby CEEFC provided a secured loan facility of $1,500M, three unsecured loan facilities totaling $2,475M and a voucher refund facility of $1,404M. CEEFC also received warrants of Air Canada exercisable until April 2031. Half of the warrants vested on April 12, 2021 and the remaining warrants will vest in proportion to the amounts that Air Canada draws under the unsecured loan facility. CEEFC also purchased Class B Voting Shares of Air Canada for a purchase price of $500M. The accounting for the Air Canada facilities will be part of Public Accounts 2022.

J. Prior year reclassification

Issue / Question:

What were the prior year reclassification to the Public Accounts of Canada related to?

Suggested Response:

- The presentation of the Consolidated Statement of Cash Flow changed to segregate cash from non-cash items related to the provision for doubtful accounts, and net losses on write-offs and write-downs of inventory.

Background:

- The Office of the Auditor General has put a particular emphasis on the classification of items in the Statement of Cash Flow in recent years, resulting in reclassification in the past 3 fiscal years to address the recommendations raised for improving this statement.

K.1-K.3 COVID-19

Impact of COVID-19 on Public Accounts 2021

K.1 Issue / Question:

How are the COVID-19 support measures reflected in the Public Accounts 2021?

Suggested Response:

- The Government of Canada’s COVID-19 Economic Response Plan included a variety of measures to support Canadians and businesses and stabilize the economy.

- COVID-19 support measures appear in the Public Accounts according to the nature of each measure.

- The fiscal impact of the COVID-19 support measures can be found in the Government's consolidated financial statements included in Section 2 of Volume I of the Public Accounts and is further explained in Section 1 in the Financial Statement Discussion and Analysis.

- Comprehensive information on COVID-19 authorities by response measure is available on GC InfoBase.

Background:

- Refer to TAB K.2 for additional information on how the Government is informing Parliamentarians and Canadians about its planned and actual spending, including the extraordinary amounts being spent in response to COVID-19.

- There are several places where the GC reported COVID expenditures, including Estimates, Budget and Economic Updates, the Fiscal Monitor, GC InfoBase, OPQs, and Parliamentary reporting from both Finance and TBS. This is not an exhaustive list and other sources of information may also be available.

Financial Reporting and Transparency / Reporting on COVID-19 Expenditures

Issue / Question:

How is the Government informing Parliamentarians and Canadians about its planned and actual spending, including the extraordinary amounts being spent in response to COVID-19?

Suggested Response:

- Openness, transparency and accountability are guiding principles for the government and its financial reporting.

- The Estimates documents, the Departmental Plans and Departmental Results Reports play an important role by presenting Parliamentarians and Canadians with details on the government’s activities and spending.

- Estimates documents continue to include a reconciliation of the current year’s Estimates to date with the spending outlook announced in the Budget.

- The latest financial information, including planned spending authorities and estimated expenditures, for COVID-19 response measures is publicly available on GC InfoBase and Open Government.

Background:

- The Government provides Parliament with detailed financial information throughout the year.

- Before introducing the first appropriation bill of the fiscal year, the Government tables a Main Estimates, which presents Parliament with information on planned spending. Additional funding requirements during the fiscal year are presented in Supplementary Estimates.

- The Government also tables the Departmental Plans of individual organizations, at the same time as the Main Estimates or soon afterwards, presenting the results expected over the next three years.

- The Estimates documents include information on planned spending, which is approved by Parliament either through an appropriation bill or through separate legislation. They also show how departments will spend their funding on various categories of goods and services (standard objects), and by program or purpose.

- The Government reports actual spending during the fiscal year, through the Fiscal Monitor, a report prepared by Finance Canada that consolidates financial results monthly.

- After the end of the year, financial and program results are published in the Public Accounts and in individual Departmental Results Reports.

- Ministers and departmental officials appear regularly before standing committees, to support parliament’s scrutiny of government spending by answering questions and providing supplemental information.

Key Facts

- By producing a wide range of financial reports, the Government actively supports Parliament’s scrutiny of the use of public funds.

- When Standing Committees study the departments and programs reflected in the Estimates, Ministers and officials are ready to respond to their questions and to provide additional information, analysis and explanation of program design, finances and results.

- As in previous years, the Supplementary Estimates tabled after the federal Budget includes a reconciliation of the current year’s Estimates to date with the spending measures announced in the Budget. In these Supplementary Estimates, we compare planned cash expenditures in the Estimates with the accrual-based forecast set out in Budget 2021.

- Recognizing the extraordinary circumstances and spending levels driven by the pandemic, we have also introduced detailed reporting on activities related to COVID‑19:

- Part I of the Main Estimates, the Government Expenditure Plan, included a listing of relevant legislation.

- Supplementary Estimates (A), 2021–22 provides an update on recently introduced legislation.

- Online annexes to the Estimates documents provide further details on COVID-19 expenditures.

- GC InfoBase includes spending authorities linked to the 2020-21 and 2021-22 Estimates.

- Beginning in March 2021, the Treasury Board Secretariat has reported monthly to the OGGO Committee on the estimated expenditures reported by departments.

COVID-19 Reporting

- Due to the unprecedented levels of spending in response to the pandemic, Parliament has been provided with information beyond what is normally prepared.

- In 2020, the Minister of Finance reported through the spring and summer, on a bi-weekly basis, to the House of Commons Standing Committee on Finance on the use of statutory spending authorities in responding to COVID-19.

- More reporting was also included in Supplementary Estimates (C), 2020–21; Main Estimates, 2021–22; and Supplementary Estimates (A), 2021–22, including:

- A summary of financial authorities under COVID-19 related legislation; and

- A COVID-19 online annex which reconciles the amounts shown in Estimates with the expenditures announced in the COVID-19 Economic Response Plan.

- Information on COVID-19 authorities by response measure is available on GC InfoBase. It will be updated regularly, providing Canadians with an easy-to-use, government-wide view of spending in response to COVID-19.