Pacific Economic Development Canada’s Quarterly Financial Report for the quarter ended December 31, 2022

View the print-friendly version: (PDF - 224 KB)

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

Introduction

This quarterly financial report should be read in conjunction with Supplementary Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA) and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subject to an external audit or review.

Authority, Mandate and Program Activities

Pacific Economic Development Canada (PacifiCan) is the regional development agency focused on British Columbia's evolving economy. PacifiCan leads in building a strong, competitive Canadian economy by supporting business, innovation and community economic development unique to British Columbia. PacifiCan operates under the provision of the Western Economic Diversification Act.

PacifiCan is mandated to "support the growth and diversification of British Columbia's economy and advance the interests of the region in national economic policy, programs and projects"

The Departmental Plan and Supplementary Estimates provide further information on PacifiCan's authority, mandate and program activities.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department's spending authorities granted by Parliament and those used by the department, consistent with the Supplementary Estimates for the 2022-2023 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

The Agency uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Financial Structure

PacifiCan manages its expenditures under two votes:

- Vote 1 – Net operating expenditures include salary, and other operating costs (e.g., transportation and communications; professional and special services).

- Vote 5 – Grants and contributions include all transfer payments.

Budgetary statutory authorities represent payments made under legislation approved by Parliament and include items such as the Government of Canada's share of employee benefit plans (EBP).

Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

The following section highlights significant changes to fiscal quarter results as of December 31, 2022. PacifiCan was established on August 6, 2021 as a new federal regional development agency. For comparison purposes, the quarter-ended December 31, 2021 only covered the period from October 1, 2021 to December 31, 2021.

Statement of Authorities: Vote 1 – Net Operating Expenditures

Total authorities available for use for fiscal year 2022-2023 are $27.4 million, a net increase of $3.7 million compared to the $23.7 million for 2021-2022. The net increase is explained by:

- $6.3 million increase in funding for salaries to build agency capacity; and

- $2.6 million decrease in funding for other operating and maintenance costs.

Total authorities used year-to-date has increased to $14.1 million for the quarter ended December 31, 2022 compared to $4.7 million at December 31, 2021. The increase of $9.5 million is mainly due to increased salary expenditures incurred to build the staffing capacity of PacifiCan as a new agency.

Graph 1 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total Available for Use and Used for Vote 1 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2022-23 and compares the authorities used at quarter end.

2022-2023

- $27,387 represents total available for use for the year ending March 31

- $14,116 represents total authorities used for the quarter ending December 31

2021-2022

- $23,686 represents total available for use for the year ending March 31

- $4,654 represents total authorities used for the quarter ending December 31

Statement of Authorities: Vote 5 – Grants and Contributions

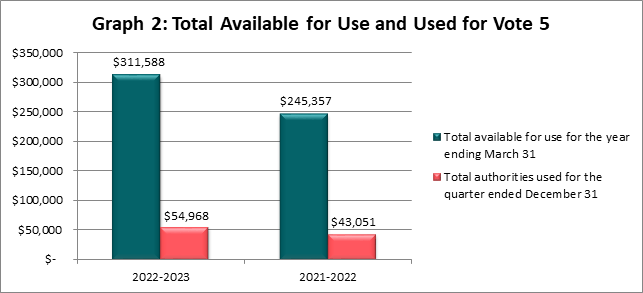

Total authorities available for use for fiscal year 2022-2023 are $311.6 million, a net increase of $66.2 million compared to the $245.4 million for 2021-22. The net increase of $66.2 million is mainly due to:

- $61.6 million increase in the Tourism Relief Fund;

- $52.7 million increase to support jobs and growth;

- $20.7 million increase in the Canada Community Revitalization Fund;

- $12.5 million increase to suppor the Aerospace Regional Recovery Initiative;

- $7.0 million increase to build the Haisla Bridge to support the Liquefied Natural Gas (LNG) project in Kitimat, BC;

- $2.8 million increase to support national quantum strategy;

- $2.0 million increase to support major festivals and events;

- $0.3 million increase to support Black Entrepreneurship Strategy;

- $0.1 million increase to support Women Entrepreneurship Strategy;

- $60.6 million decrease in Regional Relief and Recovery Fund (RRRF);

- $29.3 million decrease from Regional Air Transportation Initiative (RATI);

- $3.0 million decrease from Praxis Spinal Cord project; and

- $0.6 million decrease from Canadian Experience Fund.

Total authorities used year-to-date for the quarter-ended December 31, 2022 increased to $55.0 million, compared to $43.1 million at December 31, 2021. The $11.9 million net increase is mainly explained by:

- $14.3 million increase in payments under the Western Diversification Program (WDP) and other various WDP programs supporting investments in a diverse and growing British Columbia economy;

- $11.1 million increase in payments under the Regional Economic Growth through Innovation (REGI) to support the Innovation and Skills Plan;

- $9.0 million increase in payments made to build the Haisla Bridge supporting the Liquefied Natural Gas (LNG) project in Kitimat, BC;

- $16.4 million decrease in payments under the Regional Recovery and Relief Fund (RRRF) as majority of the projects will be completed in 2022-23;

- $3.5 million decrease in payments under the Regional Air Transportation Initiative to support regional air transportation ecosystems affected by the economic impacts of pandemic; and

- $2.6 million decrease in payments made for the Praxis Spinal Cord project.

Graph 2 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total Available for Use and Used for Vote 5 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2022-23 and compares the authorities used at quarter end.

2022-2023

- $311,588 represents total available for use for the year ending March 31

- $54,968 represents total authorities used for the quarter ending December 31

2021-2022

- $245,357 represents total available for use for the year ending March 31

- $43,051 represents total authorities used for the quarter ending December 31

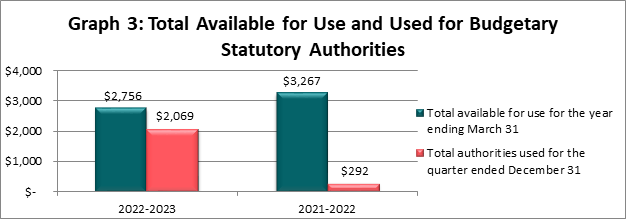

Statement of Authorities: Budgetary Statutory Authorities

Budgetary statutory authorities available for use in fiscal year 2022-2023 are $2.8 million, a decrease of $0.5 million when compared to the $3.3 million in 2021-2022. The decrease of $0.5 million is due to the reduction of the statutory Employee Benefits Payments (EBP) rate by Treasury Board Secretariat from 27% in 2021-22 to 15% in 2022-23.

The total budgetary statutory authorities used for the quarter ended December 31, 2022 increased to $2.1 million, compared to $0.3 million at December 31, 2021. The $1.8 million increase is due to the related salary expenditures and building agency staffing capacity.

Graph 3 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total Available for Use and Used for Budgetary Statutory Authorities (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2022-23 and compares the authorities used at quarter end.

2022-2023

- $2,756 represents total available for use for the year ending March 31

- $2,069 represents total authorities used for the quarter ending December 31

2021-2022

- $3,267 represents total available for use for the year ending March 31

- $292 represents total authorities used for the quarter ending December 31

Statement of the Departmental Budgetary Expenditures by Standard Object

Expenditures by standard object for the quarter ended December 31, 2022 increased to $41.9 million, compared to $36.3 million at December 31, 2021. The $5.6 million increase is mainly explained by:

- $8.2 million increase in payments made under the Western Diversification Program and other programming investing in communities and businesses to continue to diversify, develop and grow the British Columbia economy;

- $6.6 million increase in payments made to REGI;

- $2.0 million increase in payments towards building the Haisla Bridge supporting the Liquefied Natural Gas (LNG) project in Kitimat, BC;

- $2.0 million increase in salary and other personnel expenses to deliver transfer payment programming and to build agency capacity;

- $1.2 million increase in operations and maintenance costs;

- $8.3 million decrease in RRRF transfer payments as majority of the projects will be completed in 2022-23;

- $3.5 million decrease in Regional Air Transportation Initiative; and

- $2.6 million decrease in Praxis Spinal Cord project.

Additional information can be found in the Statement of Authorities, Vote 1 and Vote 5 sections above.

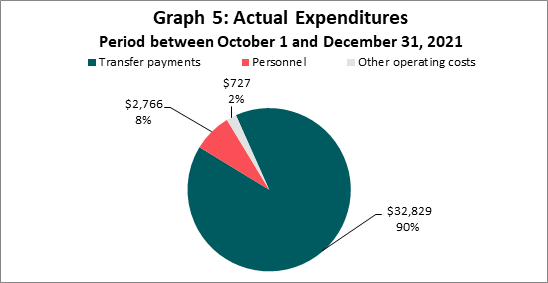

Graph 4 and 5 illustrate the actual expenditures incurred in the third quarter of 2022-2023

(in thousands of dollars)

Text version: Actual Expenditures Period between October 1 and December 31, 2022 (in thousands of dollars)

This pie chart breaks down actual expenditures for the period between October 1 and December 31, 2022.

- $35,259 represents actual spending on Transfer Payments, which accounts for 84% of actual expenditures for the period between October 1 and December 31, 2022

- $4,805 represents actual spending on Personnel, which accounts for 11% of actual expenditures for the period between October 1 and December 31, 2022

- $1,873 represents actual spending on Other operating costs, which accounts for 5% of actual expenditures for the period between October 1 and December 31, 2022

Text version: Actual Expenditures Period between October 1 and December 31, 2021 (in thousands of dollars)

This pie chart breaks down actual expenditures for the period between October 1 and December 31, 2021.

- $32,829 represents actual spending on Transfer Payments, which accounts for 90% of actual expenditures for the period between October 1 and December 31, 2021

- $2,766 represents actual spending on Personnel, which accounts for 8% of actual expenditures for the period between October 1 and December 31, 2021

- $727 represents actual spending on Other operating costs, which accounts for 2% of actual expenditures for the period between October 1 and December 31, 2021

Risks and Uncertainties

The agency is managing the allocation of resources within a well-defined framework of accountabilities, policies and procedures including a system of budgets, reporting and other internal controls to manage within available resources and deemed authorities from Treasury Board.

In response to the COVID-19 pandemic, PacifiCan had identified increased enterprise-wide risks including risks to employee physical and mental health, cyber risk, and risks due to the speed of program delivery to get funding to Canadians economically affected by COVID-19 in a timely manner. PacifiCan continues to deliver programs and maintain physical office spaces by employing risk-based mitigation such as business continuity planning, occupational health and safety planning and people management strategies; a robust system of network systems including encrypted signature, electronic security protocols and mobile equipment to employ remote connectivity; and risk assessments, governance processes, process mapping and segregation of duties.

Significant Changes in Relation to Operations, Personnel and Programs

The Regional Relief and Recovery Fund spending has decreased significantly in fiscal year 2022-2023 mainly due to the conclusion of the Government of Canada COVID-19 Economic Response Plan.

There are no significant changes in relation to operations and personnel for this reporting period.

Approval by Senior Officials

Approved by:

Original signed by:

________________________

Dylan Jones, President

Vancouver, Canada

Date: February 16, 2023

Original signed by:

________________________

Mona Luke, Chief Financial Officer and Senior Executive Director

Statement of Authorities (unaudited)

Fiscal year 2022-2023 (in thousands of dollars)

| Authorities | Total available for use for the year ending March 31, 2023* | Used during the quarter ended December 31, 2022 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $27,387 | $5,988 | $14,116 |

| Vote 5 - Grants and contributions | $311,588 | $35,259 | $54,968 |

Budgetary statutory authorities Employee benefit plans Collection agency fees |

2,756 0 |

689 0 |

2,067 2 |

| Total authorities | $341,731 | $41,936 | $71,153 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.

Fiscal year 2021-2022 (in thousands of dollars)

| Authorities | Total available for use for the year ending March 31, 2022* | Used during the quarter ended December 31, 2021 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $23,686 | $3,311 | $4,654 |

| Vote 5 - Grants and contributions | $245,357 | $32,829 | $43,051 |

Budgetary statutory authorities Employee benefit plans Collection agency fees |

3,267

|

182

|

292

|

| Total authorities | $272,310 | $36,322 | $47,997 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental Budgetary Expenditures by Standard Object (unaudited)

Fiscal Year 2022-2023 (in thousands of dollars)

| Expenditures | Total available for use for the year ending March 31, 2023* | Expended during the quarter ended December 31, 2022 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $21,130 | $4,805 | $12,238 |

| Transportation and communications | 532 | 227 | 549 |

| Information | 504 | 6 | 100 |

| Professional and special services | 5,625 | 1,284 | 2,710 |

| Rentals | 686 | 226 | 312 |

| Repair and maintenance | 492 | 0 | 0 |

| Utilities, materials and supplies | 272 | 8 | 17 |

| Acquisition of machinery and equipment | 902 | 121 | 258 |

| Transfer payments | 331,588 | 35,259 | 54,968 |

| Other subsidies and payments | 0 | 0 | 1 |

| Total net budgetary expenditures | $341,731 | $41,936 | $71,153 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.

Fiscal Year 2021-2022 (in thousands of dollars)

| Expenditures | Total available for use for the year ending March 31, 2022* | Expended during the quarter ended December 31, 2021 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $15,367 | $2,766 | $4,200 |

| Transportation and communications | 125 | 79 | 79 |

| Information | 14 | 2 | 2 |

| Professional and special services | 11,071 | 594 | 606 |

| Rentals | 212 | 39 | 40 |

| Repair and maintenance | 20 | 0 | 0 |

| Utilities, materials and supplies | 31 | 7 | 13 |

| Acquisition of machinery and equipment | 113 | 5 | 5 |

| Transfer payments | 245,357 | 32,829 | 43,051 |

| Other subsidies and payments | 0 | 1 | 1 |

| Total net budgetary expenditures | $272,310 | $36,322 | $47,997 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Page details

- Date modified: