Quantification Guidance for the Output-Based Pricing System Regulations (updated February 2024)

Glossary

Act means the Greenhouse Gas Pollution Pricing Act.

additional industrial activity means an industrial activity that is not set out in column 1 of Schedule 1, that is recognized by the Minister, including for the purposes of a facility’s designation as a covered facility under subsection 172(1) of the Act, and that is engaged in in a sector that is recognized by the Minister as being at significant risk of competitiveness impacts resulting from carbon pricing and of carbon leakage resulting from carbon pricing.

biomass means plants or plant materials, animal waste or any product made of either of these, including wood and wood products, bio-charcoal, agricultural residues, biologically derived organic matter in municipal and industrial wastes, landfill gas, bio-alcohols, pulping liquor, sludge digestion gas and fuel from animal or plant origin.

CEMS means a continuous emissions monitoring system.

Coal-fired Electricity Regulations means the Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations.

electricity generation facility means a covered facility that generates electricity as its primary industrial activity, that is used to generate electricity from fossil fuels and that is composed of one unit or a group of units.

gaseous fuel means a fossil fuel that is gaseous at a temperature of 15°C and a pressure of 101.325 kPa.

GHG means greenhouse gas that is set out in column 1 of Schedule 3 to the Act.

2017 GHGRP means the document entitled Canada’s Greenhouse Gas Quantification Requirements: Greenhouse Gas Reporting Program, published by Environment and Climate Change Canada in 2017.

2020 GHGRP means the document entitled Canada’s Greenhouse Gas Quantification Requirements: Greenhouse Gas Reporting Program, the December 2020 version, published by Environment and Climate Change Canada.

Global warming potential or GWP means the global warming potential set out in column 2 of Schedule 3 to the Act for the greenhouse gas set out in column 1 of that Schedule.

HFC means the hydrofluorocarbons set out in items 6 to 24 of Schedule 3 to the Act.

Industrial facility means a covered facility other than an electricity generation facility.

IPCC Guidelines means the guidelines entitled 2006 IPCC Guidelines for National Greenhouse Gas Inventories, published by the Institute for Global Environmental Strategies in 2006.

liquid fuel means a fossil fuel that is liquid at a temperature of 15°C and a pressure of 101.325 kPa.

natural gas means a mixture of hydrocarbons — such as methane, ethane, or propane — that is in a gaseous state at a temperature of 15°C and a pressure of 101.325 kPa and that is composed of at least 70% methane by volume or that has a higher heating value that is not less than 35 MJ/standard m3 and not more than 41 MJ/standard m3. It excludes landfill gas, digester gas, refinery gas, blast furnace gas, coke oven gas or gas derived through industrial processes from petroleum coke or coal, including synthetic gas.

OBS means an output-based standard, which is either numerical and listed in column 3 of Schedule 1 or calculated in accordance with section 37 of the Regulations.

Opt-In Policy means the Policy Regarding Voluntary Participation in the Output-Based Pricing System, published by Environment and Climate Change Canada in 2019.

PFC means the perfluorocarbons set out in items 25 to 33 of Schedule 3 to the Act.

Regulations means the Output-Based Pricing System Regulations.

solid fuel means a fossil fuel that is solid at a temperature of 15°C and a pressure of 101.325 kPa.

specified emission type means an emission type listed in subsection 5(1) of the Regulations.

specified industrial activity means, with respect to a covered facility, an industrial activity specified in subsection 5(2) of the Regulations.

thermal energy means useful thermal energy in the form of steam or hot water that is intended to be used for an industrial purpose.

thermal energy to electricity ratio means, in respect of a unit or equipment that generates electricity, the ratio of the total quantity of thermal energy produced to the total quantity of gross electricity generated by the unit or equipment, not including the quantities from the use of duct burners, in a calendar year and expressed in the same units of measurement.

total capacity means, in respect of a unit or equipment that generates electricity, either

- the maximum continuous rating (the maximum net power that can be continuously sustained by a unit or equipment that generates electricity without the use of duct burners, at a temperature of 15˚C and a pressure of 101.325 kPa), expressed in MW of electricity, as most recently reported to a provincial authority of competent jurisdiction or to the electric system operator in the province where the unit or equipment is located, or

- if no report has been made, the most electricity that was generated by the unit or equipment during two continuous hours in a calendar year, expressed in MW of electricity.

unit means an assembly comprised of a boiler or combustion engine and any other equipment that is physically connected to either, including duct burners and other combustion devices, heat recovery systems, steam turbines, generators, and emission control devices, and that generates electricity and, if applicable, produces thermal energy from the combustion of fossil fuels.

WCI Method means the document entitled Final Essential Requirements of Mandatory Reporting, published on December 17, 2010, by the Western Climate Initiative.

1. Disclaimer

Where there are any inconsistencies between this guidance document, the Greenhouse Gas Pollution Pricing Act (Act) and/or the Output-Based Pricing System Regulations (Regulations) the Act and Regulations prevail.

2. Background

The Regulations, together with the Act, establish the Output-Based Pricing System (OBPS). The objective of the OBPS is to retain a price on carbon pollution that creates an incentive for emissions-intensive and trade-exposed industrial facilities to reduce emissions, while maintaining the competitiveness of Canadian industry relative to their international peers and preventing carbon leakage.

Persons subject to the Act and Regulations are required to provide compensation for the facility’s GHG emissions if they exceed the annual emissions limit applicable to the facility. Tradable surplus credits that can be used for compliance are issued to persons responsible for facilities that emit GHGs in a quantity that is below their limit. This creates an ongoing financial incentive for facilities to reduce their emission intensity to either reduce the amount owed for compensation or to emit below their limit and earn surplus credits.

3. Purpose

This document is intended to provide guidance on the quantification requirements of GHGs and production, including emissions limits and calculated output-based standards (OBS), for covered facilities under theRegulations. All references made in this document are regarding the Regulations unless otherwise specified.

4. Key Definitions of the Regulations

As per section 1, for the purposes of the Act and the Regulations, a facility means:

- (1)(a) all of the following elements that are operated in an integrated way to carry out an industrial activity:

- a site, or multiple sites, at which an industrial activity is carried out and the buildings, equipment, and other structures and stationary items located on those sites, and

- any other sites used in conjunction with the industrial activity, including a quarry, tailings pond, wastewater lagoon or pond and landfill; or

- (b) the portion of a natural gas transmission pipeline system within a province, used to transmit processed natural gas, of which the pipelines and associated installations or equipment — including compressor stations, storage installations and compressors — are operated in an integrated way, but excludes pipelines, installations or equipment that are used in the local distribution of natural gas and that are downstream of a metering station.

-

More than one person responsible — paragraph 1(a)

(2) If more than one person is responsible for the elements referred to in subparagraph (1)(a)(i) or (ii) as an owner or otherwise, including having the charge, management or control of, or as the true decision maker with respect to their operations, those elements are only included in the definition of facility if there is at least one person who is responsible for, owns, has the charge management or control of, or is the true decision maker in common.

-

More than one person responsible — paragraph 1(b)

(3) If more than one person is responsible for the pipelines and associated installations or equipment referred to in paragraph (1)(b) as an owner or otherwise, including having the charge, management or control of, or as the true decision maker with respect to the pipelines and associated installations or equipment, those pipelines and associated installations or equipment are only included in the definition of facility if there is at least one person who is responsible for, owns, has the charge management or control of, or is the true decision maker in common.

-

Single facility

(4) If two or more facilities referred to in paragraph (b) of the definition facility in subsection (1) within the same province have the same person responsible, or, if they have more than one person responsible, they have at least one person responsible in common, and are operated in an integrated way, they are deemed to be a single facility.

-

Interpretation

(5) With respect to a facility

- any part of a public road or of a railway track that is bordered on both sides by the facility and used to carry out the facility’s industrial activities is deemed to be part of the facility;

- for greater certainty, any part of a railway track that is used exclusively to carry out the facility’s industrial activities is part of the facility;

- for greater certainty, buildings that are used for legal, administrative or management purposes and that are not located where an industrial activity is carried out are not included for the purposes of the definition of facility; and

- if two or more facilities referred to in paragraph (b) of the definition facility in subsection (1), within the same province, have the same person responsible or a person responsible in common and are not operated in an integrated way, they each constitute a separate facility.

As per subsection 2(1), an electricity generation facility means a covered facility, other than one whose primary activity is something other than an industrial activity, that generates electricity as its primary industrial activity, used to generate electricity from fossil fuels and composed of one unit or a group of units.

As per subsection 5(1), the specified emission types for which GHGs must be quantified, for a covered facility are:

- Stationary fuel combustion emissions means emissions from stationary devices that combust solid fuels, liquid fuels, gaseous fuels, or tires or asphalt shingles, whether in whole or in part, for the purpose of producing useful heat.

- Industrial process emissions means emissions from an industrial process that involves a chemical or physical reaction other than combustion and the purpose of which is not to produce useful heat.

- Industrial product use emissions means emissions from the use of a product in an industrial process that does not involve a chemical or physical reaction and does not react in the process, including emissions from the use of sulphur hexafluoride (SF6), HFCs and PFCs as cover gases and the use of HFCs and PFCs in a foam-blowing process.

- Venting emissions means controlled emissions that occur due to the design of a facility, to procedures used in the manufacture or processing of a substance or product or to pressure exceeding the capacity of the equipment at the facility.

- Flaring emissions means controlled emissions of gases from industrial activities as a result of the combustion of a gas or liquid stream produced at a facility, the purpose of which is not to produce useful heat. It does not include emissions from the flaring of landfill gas.

- Leakage emissions means uncontrolled emissions. It does not include industrial process emissions and industrial product use emissions.

- On-site transportation emissions means emissions from registered or unregistered vehicles and other machinery that are used at the facility for the transport of substances, materials, equipment or products used in a production process or for the transport of people, and that are fuelled using fuels delivered in a delivery to which an exemption certificate referred to in subparagraph 36(1)(b)(v) of the Act applies.

- Waste emissions means emissions that result from waste disposal at a facility, including the landfilling of solid waste, the biological treatment or incineration of waste and the flaring of landfill gas. Waste emissions do not include emissions from the combustion of tires or asphalt shingles, whether in whole or in part, to produce useful heat or on-site transportation emissions.

- Wastewater emissions means emissions resulting from industrial wastewater and industrial wastewater treatment at a facility.

Subsection 5(2) sets out “specified industrial activities”, which are the industrial activities for which the Regulations establish output-based standards. Specified industrial activities under the OBPS are the industrial activities set out in column 1 of Schedule 1 and “additional industrial activities” engaged in at the covered facility.

For the 2023 compliance period, additional industrial activities are the industrial activities recognized by the Minister for the purpose of the designation of the facility as a covered facility under subsection 172(1) of the Act. Those industrial activities where specified in the notice provided by the Minister that accompanied the covered facility certificate.

For references made in regard to a facility in this document, it is for a covered facility that is covered under the Regulations and the Act.

Please note that all requirements described in this document are the obligations of the person responsible for the covered facility (as described in section 10 of the Regulations).

Refer to Appendix A for frequently asked questions.

5. Quantification of GHGs

The quantity of GHGs that are emitted from a facility must be determined in accordance with section 35. The quantification of those GHGs is set out in sections 16 to 25, which also include special quantification rules set out in subsections 17(5) and 20(6) and sections 22 and 23, and provisions for seeking a permit to use an alternative quantification method set out in sections 26 to 30. This section of the guidance document also provides some calculated examples to clarify certain provisions in the Regulations.

5.1. Quantification of GHGs for Industrial Facilities

A facility’s total quantity of GHGs from all activities, including the generation of electricity, must be quantified for an industrial facility, other than an electricity generation facility. In addition, the sampling, analysis, and measurement requirements needs to be complied with as specified in sections 17 to 19 and 22 to 25. For special rules in regard to quantification set out in subsection 17(5) and sections 22 to 25, refer to section 5.3 of this document.

The total quantity of GHGs is to be calculated as per subsection 17(1), which is the quantity used for the variable A (equation in section 35), to determine the quantity of GHGs emitted. The total quantity of GHGs is to be calculated for each specified emission type (see Key Definitions of the Regulations) and the applicable GHG.

A quantity of a GHG, expressed in tonnes, is converted into carbon dioxide equivalent tonnes (tonnes of CO2e) by multiplying that quantity by the GWP set out for the GHG in column 2 of Schedule 3 to the Act. As of January 1, 2023, the GWP’s in Schedule 3 were updated to reflect the 100-Year Time Horizon established in IPCC’s Fifth Assessment Report (SAR) published in 2014.

The quantity of GHGs from electricity generation for an industrial facility that also generates electricity must be quantified using the methods applicable to the industrial activities engaged in at the facility, as per section 18. For example, if a facility is engaged in the production of lime and also generates electricity, the GHGs from the generation of electricity are calculated in accordance with the methods applicable to the production of lime.

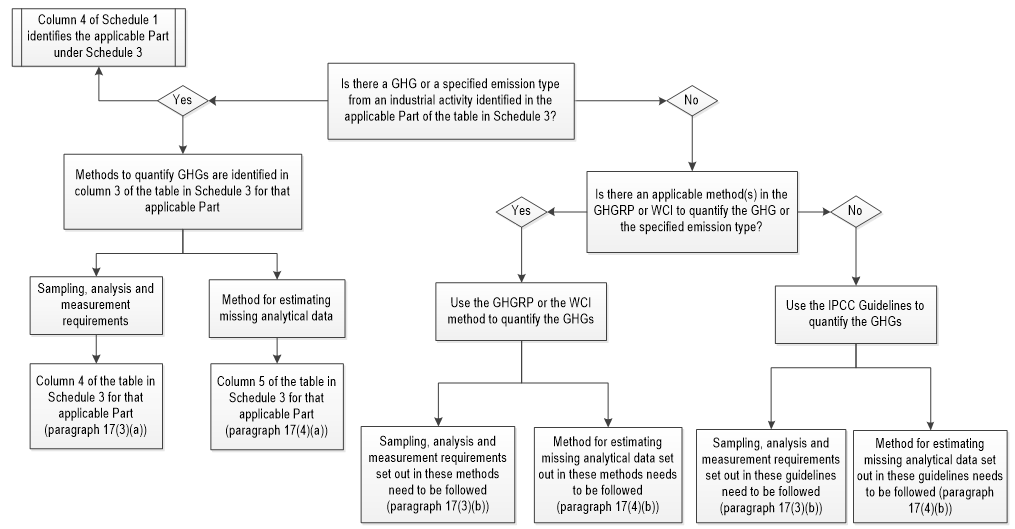

For industrial activities set out in Schedule 1, GHGs from specified emission types listed in subsection 5(1) of the Regulations must be quantified as described below and shown in Figure 1:

Column 4 of Schedule 1 identifies the applicable Part of Schedule 3 that contains the quantification methods applicable to the industrial activity.

- The GHGs set out in Column 2 of Schedule 3 from the specified emission types set out in Column 1 of Schedule 3 must be quantified as follows:

- Quantify the GHGs in accordance with the methods identified in column 3 of the table of the applicable Part in Schedule 3;

- Follow the sampling, analysis and measurement requirements identified in column 4 of the table of the applicable Part in Schedule 3; and

- For circumstances where data is missing, replacement data is to be quantified in accordance with the methods prescribed in column 5 of the table of the applicable Part in Schedule 3.

- If there is no listed quantification method for a GHG or a specified emission type in the applicable Part of Schedule 3, then:

- GHGs must be quantified in accordance with the applicable methods in the 2017 GHGRP or the WCI method. However, if there are no applicable quantification method in the 2017 GHGRP or the WCI method, then the IPCC Guidelines may be used;

- The sampling, analysis and measurement requirements set out in those methods or guidelines must be followed; and

- For circumstances where data is missing, replacement data is to be quantified also in accordance with those methods or guidelines.

Figure 1: Quantification of GHGs for an industrial facility engaged in an industrial activity listed in Schedule 1 (Mandatory and Part 1 of Opt-in Policy facilities).

Long description for figure 1

Figure 1: Quantification of GHGs for an industrial facility engaged in an industrial activity listed in Schedule 1 (Mandatory and Part 1 of Opt-in Policy facilities).

Is there a GHG or a specified emission type from an industrial activity identified in the applicable part of the table in schedule 3?

If yes, Column 4 of schedule 1 identifies the applicable part under schedule 3. Methods to quantify GHGs are identified in column 3 of the table in schedule 3 for that applicable part. For sampling, analysis, and measurement requirements, refer to Column 4 of the table in schedule 3 for that applicable part (paragraph 17(3)(a)). For estimating missing analytical data, refer to column 5 of the table in schedule 3 for that applicable part (paragraph 17(4)(a)).

If no, is there an applicable method(s) in the GHGRP or WCI to qualify the GHG or the specified emission type?

If yes, use the GHGRP or the WCI method to quantify the GHGs. For sampling, analysis, and measurement requirements set out in these methods need to be followed (paragraph 17(3)(b)). For methods for estimating missing analytical data set out in the methods need to be followed (paragraph 17(4)(b)).

If no, use the IPCC guidelines to quantify the GHGs. For sampling, analysis, and measurement requirements set out in these guidelines need to be followed (paragraph 17(3)(b)). For methods for estimating missing analytical data set out in these guidelines need to be followed (paragraph 17(4)(b)).

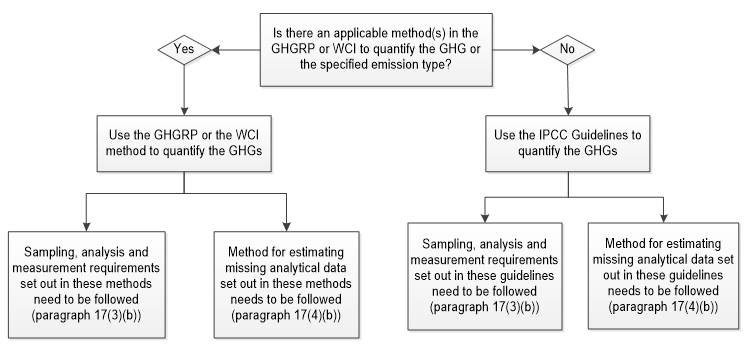

For industrial activities not set out in Schedule 1, GHGs from specified emission types must be quantified as described below (paragraph 17(2)(c)) and shown in Figure 2:

- The 2017 GHGRP or WCI method may be used to quantify GHGs using applicable methods for those industrial activities. However, if there are no applicable quantification method then the IPCC Guidelines may be used,

- The sampling, analysis and measurement requirements set out in those methods or guidelines must be followed, and

- For circumstances where data is missing, replacement data is to be quantified in accordance with those methods or guidelines.

Figure 2: Quantification of GHGs for a facility engaged in an industrial activity not listed in Schedule 1 (Part 2 of the Opt-in Policy facilities).

Long description for figure 2

Figure 2: Quantification of GHGs for a facility engaged in an industrial activity not listed in Schedule 1 (Part 2 of the Opt-in Policy facilities).

Is there an applicable method(s) in the GHGRP or WCI to qualify the GHG or the specified emission type?

If yes, use the GHGRP or the WCI method to quantify the GHGs. Sampling, analysis, and measurement requirements set out in these methods need to be followed (paragraph 17(3)(b)). Method for estimating missing analytical data set out in these methods needs to be followed (paragraph 17(4)(b)).

If no, use the IPCC guidelines to quantify GHGs. Sampling, analysis, and measurement requirements set out in these guidelines need to be followed (paragraph 17(3)(b)). Method for estimating missing analytical data set out in these guidelines needs to be followed (paragraph 17(4)(b)).

Furthermore, an industrial facility’s total quantity of GHGs calculated under subsections 17(1) is not to be rounded to the nearest whole number.

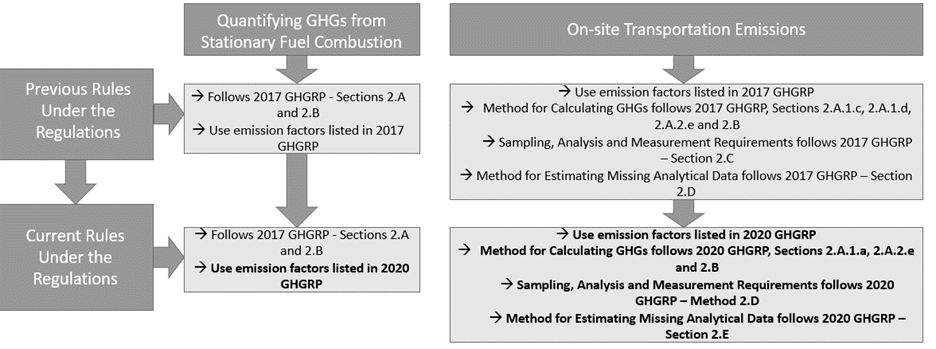

For the purposes of subsection 17(2), if the quantities of GHGs are calculated in accordance with the methods in the 2017 GHGRP 2.A or 2.B, the emission factor tables set out in those methods are replaced by the emission factor tables set out in the 2020 GHGRP as per subsection 17(4.1).

Sampling, analysis, and measurement requirements and methods for estimating missing analytical data for on-site transportation emissions are replaced by those set out in the 2020 GHGRP. These changes are illustrated in Figure 3.

Figure 3: Emission Factors and Quantification Methodologies using the 2020 GHGRP

Long description for figure 3

Figure 3: Emission Factors and Quantification Methodologies using 2020 GHGRP.

For quantifying GHGs from stationary fuel combustion, previous rules under the Regulations prescribed 2017 GHGRP, sections 2.A and 2.B with use of emission factors listed in 2017 GHGRP. The current rules under OBPS regulations prescribe 2017 GHGRP, sections 2.A and 2.B with the use of emission factors listed in 2020 GHGRP.

For on-site transportation emissions, previous rules under the Regulations prescribed:

- For quantifying GHGs, 2017 GHGRP, sections 2.A.1.c, 2.A.1.d, 2.A.2.e and 2.B with the use of emission factors listed in 2017 GHGRP.

- For sampling, analysis and measurement requirements, 2017 GHGRP, section 2.C.

- For the method for estimating missing analytical data, 2017 GHGRP, section 2.D.

The current rules under the Regulations prescribe:

- For quantifying GHGs, 2020 GHGRP, sections 2.A.1.a, 2.A.2.e and 2.B with the use of emission factors listed in 2020 GHGRP.

- For sampling, analysis and measurement requirements, 2020 GHGRP, section 2.D.

- For the method for estimating missing analytical data, 2020 GHGRP, section 2.E.

Other Considerations:

Emissions are not to be included twice when calculating a facility’s GHG emissions. If the quantification methods that apply to an industrial activity or facility result in the calculation of the same emissions under two specified emission types, the emissions must not be included twice. For example, if the quantification methods for a facility with industrial process emissions that are vented result in calculating the emissions twice – once as industrial process emissions and once as vented emissions, the quantity of emissions must only be included once.

On-site transportation emissions are defined in subsection 2(1) of the Regulations. These emissions include those from fuels delivered to which an exemption certificate referred to in subparagraph 36(1)(b)(v) of the Act applies. Fuels for which the fuel charge was paid and used for on-site transportation are not included in the facility’s on-site transportation emissions.

Example 1: An industrial facility engaged in a Schedule 1 activity

A facility is engaged in an industrial activity listed in Schedule 1. The facility modified the process within the industrial activity, which resulted in the installation of a new anaerobic reactor. As a result, there are additional GHGs resulting from wastewater treatment. There is no prescribed method set out in column 3 of the table in the industrial activity’s applicable Part of Schedule 3 for the quantification of GHGs from wastewater emissions.

How should the GHGs from wastewater emissions be quantified?

As per paragraph 17(2)(b), the 2017 GHGRP or the WCI method must be referred to in order to find an applicable method to quantify GHGs from wastewater emissions. In this case, the WCI Method WCI.203(g) has applicable methods to calculate CH4 and N2O from anaerobic wastewater treatment. Therefore, the WCI method is to be used and the sampling, analysis, measurement, and replacement data requirements set out in that method must be complied with.

Example 2: An industrial facility engaged in an industrial activity not listed in Schedule

1

A facility that has been designated as a covered facility under subsection 172(1) of the Act, has specified as its primary activity in its request for designation, an industrial activity not listed in Schedule 1. This activity is specified in the notice that accompanies the covered facility’s certificate for the facility as a specified industrial activity (Part 2 of the Opt-in Policy). This means the facility does not have an applicable Part under Schedule 3 and hence no prescribed quantification methods are available in Schedule 3 for that industrial activity.

The specified emission types occurring at the facility are stationary combustion, on-site transportation, and waste emissions. The waste emissions are due to the combustion of solid and liquid waste in controlled incineration. In addition, the facility purchases electricity from the grid.

How should the facility’s GHGs be quantified?

As per paragraph 17(2)(c), the 2017 GHGRP, the 2020 GHGRP or the WCI method must be referred to in order to find an applicable method for the quantification of stationary combustion, on-site transportation and waste emissions.

- There are applicable methods under the 2017 GHGRP to calculate GHGs from stationary combustion and under the 2020 GHGRP to calculate GHGs from on-site transportation emissions:

- Sections 2.A and 2.B of the 2017 GHGRP are quantification methods to calculate GHGs from stationary combustion and sections 2.A and 2.B of the 2020 GHGRP to calculate GHGs from on-site transportation emissions. The emission factor tables to be used in calculating the GHGs are those set out in the 2020 GHGRP.

- Those applicable 2017 GHGRP or 2020 GHGRP methods must be used and the sampling, analysis, measurement and replacement data requirements set out in those methods must be complied with.

- There are no applicable method in the 2017 GHGRP or the WCI method to calculate GHGs from waste emissions.

- In this case, the IPCC Guidelines must be referred to in order to quantify GHGs from waste emissions.

- The IPCC Guidelines has an applicable method for calculating GHGs from incineration and open burning waste in Chapter 5.

- The sampling, analysis, measurement, and replacement data requirements set out in those guidelines must be complied with.

Should GHGs from purchased electricity be quantified?

No, GHGs from purchased electricity do not need to be quantified. GHGs from electricity are only quantified if the electricity is generated at the facility. As per section 18, those GHGs are to be quantified as per the methods applicable to the industrial activity engaged in at the facility.

5.2. Quantification of GHGs for Electricity Generation Facilities

The total quantity of GHGs from each unit at an electricity generation facility must be quantified and the sampling, analysis, measurement, and replacement data requirements must be complied with, identified in sections 20 to 25.

The total quantity of GHGs is to be calculated as per subsection 20(1), which is the quantity used for the variable A (equation in section 35), to determine the total quantity of GHGs emitted from each unit within a facility. The total quantity of GHGs is to be calculated for each specified emission type (see Key Definitions of the Regulations) and the applicable GHG.

A quantity of a GHG, expressed in tonnes, is converted into carbon dioxide equivalent tonnes (tonnes of CO2e) by multiplying that quantity by the GWP set out for the GHG in column 2 of Schedule 3 of the Act. As of January 1, 2023, the GWP’s in Schedule 3 were updated to reflect the 100-Year Time Horizon established in IPCC’s Fifth Assessment Report (SAR) published in 2014.

The unit’s total quantity of GHGs is the sum of GHGs of stationary fuel combustion emissions (the first sub bullet below) and GHGs from emissions other than stationary fuel combustion emissions (the second sub bullet below) as described below:

- The quantification requirements for stationary fuel combustion emissions for an electricity generation facility depend on the type of fossil fuel used to generate electricity by each unit and whether that unit is registered or not under the Coal-fired Electricity Regulations. There are three cases:

Case 1: The unit is registered under the Coal-fired Electricity Regulations.

Case 2: The unit is not registered under the Coal-fired Electricity Regulations and generates electricity from the combustion of natural gas.

Case 3: Any other unit in which Cases 1 and 2 are not applicable.

For stationary fuel combustion emissions only, the table below illustrates the quantification requirements for each unit as per Division 1 of Part 38 of Schedule 3 to calculate CO2, CH4 and N2O depending on the applicable case.

| GHGs | Case | Method for Calculating GHGs | Sampling,Analysis and Measurement Requirements | Method for Estimating Missing Analytical Data |

|---|---|---|---|---|

| CO2 | Case 1 | Section 20 to 26 of the Coal-fired Electricity Regulations | Section 27 of the Coal-fired Electricity Regulations | Section 28 of the Coal-fired Electricity Regulations |

| Case 2 | Sections 12 to 18 of the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricity | Sections 19 of the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricity | Sections 20 of the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricity | |

| Case 3 | 2017 GHGRP 2.A | 2017 GHGRP 2.C | 2017 GHGRP 2.D | |

| CH4 and N2O | All cases | 2017 GHGRP 2.B | 2017 GHGRP 2.C | 2017 GHGRP 2.D |

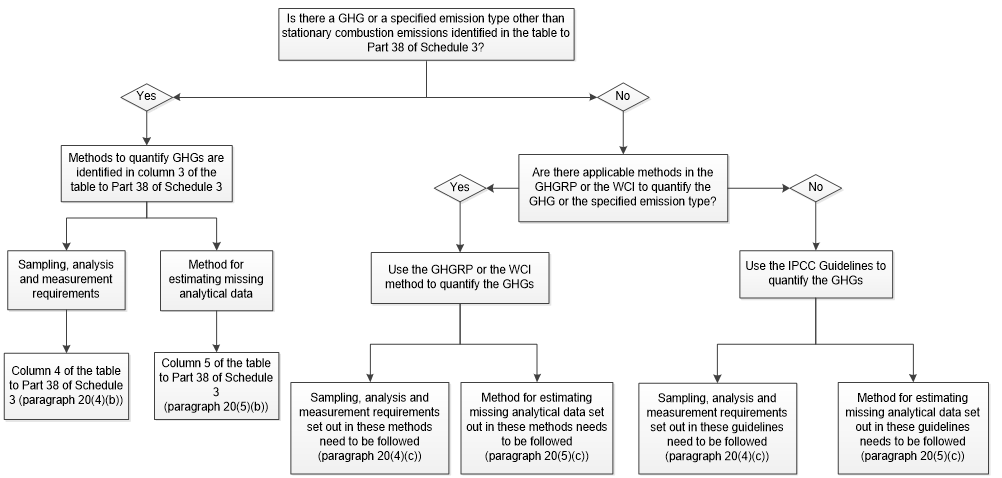

- For specified emission types, other than stationary fuel combustion emissions, GHGs must be quantified as described below and shown in Figure 4:

- The quantification methods are identified in column 3 of the table in Part 38 of Schedule 3.

- The sampling, analysis and measurement requirements are identified in column 4 of the table in Part 38 of Schedule 3.

- For circumstances where data is missing, replacement data is to be calculated in accordance with the methods prescribed in column 5 of the table in Part 38 of Schedule 3.

- If there is no listed method for a GHG from a specified emission type in Part 38 of Schedule 3, the 2017 GHGRP or WCI method may be used. However, if there are no applicable method then the IPCC Guidelines must be used.

- The sampling, analysis and measurement requirements set out in those methods or guidelines need to be followed.

- For circumstances where data is missing, replacement data is to be calculated in accordance with those methods or guidelines.

- The quantification methods are identified in column 3 of the table in Part 38 of Schedule 3.

For special rules in regard to quantification set out in subsection 20(6) and sections 22 to 25, refer to section 5.3 of this document.

Figure 4: Quantification of GHGs from specified emission types, other than stationary fuel combustion emissions, for an electricity generation facility.

Long description for figure 4

Figure 4: Quantification of GHGs from specified emission types, other than stationary fuel combustion emissions, for an electricity generation facility.

Is there a GHG or a specified emission type other than stationary combustion emissions identified in the table to Part 38 of Schedule 3?

If yes, methods to quantify GHGs are identified in column 3 of the table to Part 38 of Schedule 3. For sampling, analysis, and measurement requirements, refer to Column 4 of the table to Part 38 of Schedule 3 (paragraph 20(4)(b)). For estimating missing analytical data, refer to Column 5 of the table to Part 38 of Schedule 3 (paragraph 20(5)(b)).

If no, are there applicable method(s) in the GHGRP or WCI to quantify the GHG or the specified emission type?

If yes, use the GHGRP or the WCI method to quantify the GHGs. For sampling, analysis, and measurement requirements set out in these methods need to be followed (paragraph 20(4)(c)). For methods for estimating missing analytical data set out in the methods need to be followed (paragraph 20(5)(c)).

If no, use the IPCC guidelines to quantify GHGs. For sampling, analysis, and measurement requirements set out in these guidelines need to be followed (paragraph 20(4)(c)). For methods for estimating missing analytical data set out in these guidelines need to be followed (paragraph 20(5)(c)).

Furthermore, an electricity generation facility’s total quantity of GHGs calculated under subsections 20(1) is not to be rounded to the nearest whole number.

5.2.1. Apportioning GHGs

For an electricity generation facility, where GHGs other than GHGs for stationary fuel combustion emissions can only be quantified at a facility level, those GHGs must be apportioned to the facility’s units as per subsection 20(3). Those GHGs must be apportioned based on the ratio of each unit’s total electricity generation relative to the facility’s total electricity generation. Refer to the example below on how to apportion GHGs.

Example 3: Apportioning GHGs

An electricity generation facility with two units emits stationary combustion and on-site transportation emissions. The CO2 from on-site transportation emissions can only be quantified at the facility level and they are 10,000 tonnes of CO2. That quantity of CO2 needs to be apportioned to all the units in the facility as explained in the example below. The same process needs to be followed for quantifying CH4 and N2O emissions.

Electricity generated |

Stationary fuel combustion emissions |

|

|---|---|---|

Unit 1 |

100 GWh |

30,000 tonnes of CO2 |

Unit 2 |

150 GWh |

50,000 tonnes of CO2 |

Facility’s total |

250 GWh |

- |

The following steps show how to calculate the quantity of CO2 for each unit at the facility:

- Calculate the ratio of each unit’s total electricity generation relative to the facility’s total electricity generation.

Ratio for Unit 1 = (100 GWh) / (250 GWh) = 0.4

Ratio for Unit 2 = (150 GWh) / (250 GWh) = 0.6

- Multiply the ratio for Unit 1 with the facility’s CO2 from on-site transportation emissions in order to apportion for each unit.

Unit 1 CO2 from on-site transportation emissions = 0.4 × 10,000 tonnes of CO2 = 4,000 tonnes of CO2

Unit 2 CO2 from on-site transportation emissions = 0.6 × 10,000 tonnes of CO2 = 6,000 tonnes of CO2

- Calculate the quantity of CO2 for each unit.

Quantity of CO2 for Unit 1 = 30,000 tonnes of CO2 + 4,000 tonnes of CO2 = 34,000 tonnes of CO2

Quantity of CO2 for Unit 2 = 50,000 tonnes of CO2 + 6,000 tonnes of CO2 = 56,000 tonnes of CO2

The quantity of CO2 for Unit 1 and 2 is 34,000 and 56,000 tonnes of CO2, respectively.

5.3. Special Rules

Certain provisions in the Regulations do not require the quantification of certain GHGs or for certain GHGs to be included in the facility’s total quantity of GHGs. Those exclusions are listed below. These provisions apply to both industrial and electricity generation facilities:

- As per subsection 22(1), CO2 from biomass is not quantified and is not included in the quantity of CO2 when quantifying the facility’s total quantity of GHGs from the facility as per subsections 17(2) to (4) or subsections 20(2) to (5). However, if a CEMS is used to measure the quantity of CO2 at the facility then CO2 from biomass will have to be quantified and deducted from the quantity of CO2 as measured by the CEMS. The quantity of CO2 from biomass is not to be reported as part of the facility’s annual report.

- As per subsections 17(5) and 20(6), CH4 and N2O generated from stationary devices that combust biomass for the purpose of producing useful heat must be quantified but are not to be included in the quantity of GHGs from stationary fuel combustion emissions calculated in subsections 17(2) to (4) or subsections 20(2) to (5). These quantities of CH4 and N2O are to be reported separately as part of the facility’s annual report (section 4 of Schedule 2).

- As per subsection 22(2), quantification of CH4 from venting or leakage emissions is not required for facilities engaged in:

- The production of bitumen and other crude oil (item 1 of Schedule 1);

- the upgrading of bitumen or heavy oil (item 2 of Schedule 1);

- the processing of natural gas (item 4 of Schedule 1); and

- the transmission of processed natural gas (item 5 of Schedule 1).

CH4 from venting and leakage emissions is not included as part of the quantity of CH4 calculated as per subsections 17(2) to (4). - As per section 23, the “de minimis” provision allows the exclusion of a GHG for any specified emission type if it represents less than or equal to 0.5% of the facility’s total quantity of GHGs, when expressed in tonnes of CO2e. With the specification that the sum of the quantity of GHGs that are to be excluded must not exceed 0.5% of the facility’s total quantity of GHGs. If those parameters are met, then those GHGs can be excluded from the determination made under subsection 17(2) to (4) or 20(2) to (5). Refer to the example below for how to calculate the “de minimis.”

Example 4: De minimis

All GHGs from all specified emission types for a facility are quantified based on the quantification requirements under the Regulations, but minor quantities can be excluded from the total quantity of GHGs. The table below illustrates the facility’s total quantity of GHGs and the percentage of GHGs contributed by both the gas and specified emission type. Some of the GHGs from stationary fuel combustion, leakage and on-site transportation emissions are below 0.5% of the facility’s total quantity of GHGs.

Do these GHGs have to be included in those GHG under subsection 17(1) or 20(1)?

| Specified emission type | CO2 | CH4 | N2O | Total |

|---|---|---|---|---|

| Stationary fuel combustion emissions | 2,940.30 (1.5%) |

2.26 (0.0%) |

13.2 (0.0%) |

2,955.76 (1.5%) |

| Industrial process emissions | 127,431.33 (65.1%) |

2.26 (0.0%) |

62,563.2 (32.0%) |

189,996.79 (97.1%) |

| Leakage emissions | 2.8 (0.0%) |

938.88 (0.5%) |

0.0 (0.0%) |

941.68 (0.5%) |

| On-site transportation emissions | 1,692.13 (0.9%) |

3.25 (0.0%) |

166.14 (0.1%) |

1,861.52 (1.0%) |

| Facility’s total quantity of GHGs | - | - | - | 195,756 |

Based on the table:

- The percentages of CH4 and N2O from stationary fuel combustion emissions are both less than 0.5% of the facility’s total quantity of GHGs.

- The percentage of CH4 from industrial process emissions is less than 0.5% of the facility’s total quantity of GHGs.

- The percentages of CO2 and CH4 from leakage emissions are both equal or less than to 0.5% of the facility’s total quantity of GHGs.

- The percentages of CH4 and N2O from on-site transportation emissions are both less than 0.5% of the facility’s total quantity of GHGs.

As per subsection 23(1), the facility is not required to include the GHGs listed in (a) to (d), however, the sum of those GHGs must not exceed 0.5% of the facility’s total quantity of GHGs as per subsection 23(2).

The following steps are used to determine if the sum of the quantity of GHGs listed in (a) to (d) exceed 0.5% of the facility’s total quantity of GHGs.

The sum of quantity of GHG listed in (a) to (d) = [CH4 + N2O]stationary fuel combustion emissions + [CH4] industrial process emissions + [CO2 + CH4]leakage emissions + [CH4 + N2O]on-site transportation emissions = [2.26 + 13.2] + 2.26 + [2.8 + 938.88] + [3.25 + 166.14] =1,128.79 tonnes of CO2e

The ratio of the quantity of GHG listed in (a) to (d) to the total quantity of GHGs = (1,128.79 tonnes of CO2e) / (195,756 tonnes of CO2e) × 100 = 0.6%

Based on the calculation above, the percentage of those GHGs exceed 0.5% of the facility’s total quantity of GHGs. Therefore, the facility must include some of the GHGs listed in (a) to (d) under subsection 17(2) to (4) or 20(2) to (5). The GHGs not included must not exceed 0.5% of the facility’s total quantity of GHGs.

In this case, for example, it was decided to include the GHGs listed in (d) for on site-transportation emissions, and not to include the GHGs listed in (a) to (c) which have to be summed to check if those GHGs are less than or equal to 0.5% of the facility’s total quantify of GHGs.

The following steps calculate if the sum of the GHGs listed in (a) to (c) do not exceed 0.5% of the facility’s total quantity of GHGs.

The sum of quantity of GHG listed in (a) to (c) = [CH4 + N2O]stationary fuel combustion emissions + [CH4]industrial process emissions + [CO2 + CH4]leakage emissions = [2.26+ 13.2] + 2.26 + [2.8 + 938.88] = 959.40 tonnes of CO2e

The ratio of the quantity of GHG listed in (a) to (c) to the total quantity of GHGs = (959.40 tonnes of CO2e) / (195,756 tonnes of CO2e) × 100 = 0.5%

Therefore, the following GHGs do not need to be included under subsection 17(2) to (4) or 20(2) to (5):

- CH4 and N2O from stationary fuel combustion emissions,

- CH4 from industrial process emissions, and

- CO2 and CH4 from leakage emissions.

5.4. Carbon Capture and Storage

As per subsection 35(1), the quantity of CO2 that is included in the description of A and has been permanently stored in an eligible storage project (variable B) is only deducted from a facility’s total quantity of GHGs that are from the covered facility (variable A). For example, the quantity of CO2 from biomass that is stored is not deducted since CO2 from biomass is not included in the total quantity of GHGs. Eligible storage projects are listed in subsection 35(2). The quantity of CO2 from a covered facility that has been captured but has not been permanently stored in a storage project that meets the requirements of subsection 35(2) is deemed to have been emitted by the covered facility and is included in the quantity of GHGs that are included in the description of A in subsection 35(1). For greater certainty, any quantity of CO2 cannot be deducted if it was not already included in the facility’s total quantity of GHGs as per the description of A in subsection 35(1).

The quantity of CO2 expressed in tonnes of CO2e, that is captured at the facility and subsequently stored must be quantified using section 1 of the 2017 GHGRP.

5.4.1. Continuous Emission Monitoring Systems

As per section 25, any CEMS used by the facility must comply with the Reference Method for Source Testing: Quantification of Carbon Dioxide Releases by Continuous Emission Monitoring Systems from Thermal Power Generation, published by the Minister of the Environment in June 2012. If a CEMS is used to measure CO2 at the facility, then the quantity of CO2 from biomass will have to be quantified and deducted from the total quantity of CO2 as measured by the CEMS.

6. Quantification of Production and Thermal Energy

This section provides guidelines on the quantification of production and thermal energy including a summary flowchart on the quantification of production for both industrial facilities and electricity generation facilities.

6.1. Quantification of Production for Industrial Facilities

As per subsection 31(1), production needs to be quantified for all the specified industrial activities engaged in at the facility, as it is needed to calculate the emissions limit. The following steps help determine the unit of measurement for those activities:

- If the specified industrial activity is listed in Schedule 1:

- the applicable unit of measurement is identified in column 2 of Schedule 1;

- additional quantification requirements may be prescribed in the applicable Part of Schedule 3;

- If the specified industrial activity is an additional industrial activity:

- the unit of measurement is specified by the Minister for that activity. For 2023, the unit of measurement specified by the Minister is the unit of measurement provided in the request to designate the facility under subsection 172(1) of the Act.

Electricity generated at an industrial facility must be quantified in accordance with sections 6 and 7 of Part 38 of Schedule 3. However, production can be:

- Quantified in whole;

- Quantified in part; or

- Not quantified.

As per section 15 of Schedule 2 (annual report), a list of equipment from which electricity was generated but not quantified is required.

Furthermore, the annual production value that is included in the annual report is not to be rounded to three significant figures.

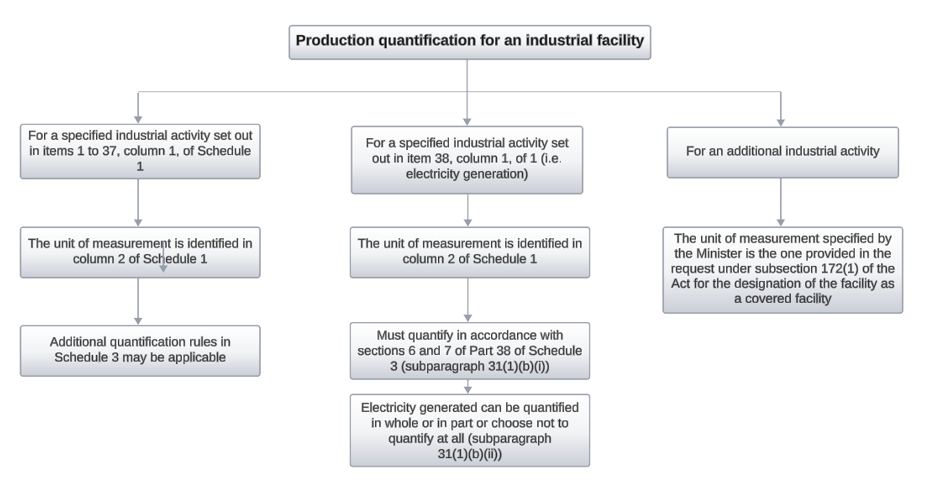

Figure 5: Quantification of production for an industrial facility.

Long description for figure 5

Figure 5: Quantification of production for an industrial facility.

For a specified industrial activity set out in items 1 to 37, column 1 of Schedule 1, the unit of measurement is identified in column 2 of Schedule 1. Additional quantification rules in Schedule 3 may be applicable.

For a specified industrial activity set out in item 38, column 1 of Schedule 1 (i.e. electricity generation), the unit of measurement is identified in column 2 of Schedule 1. Must quantify in accordance with sections 6 and 7 of Part 38 of Schedule 3 (subparagraph 31(1)(b)(i)). Electricity generated can be quantified in whole or in part or choose to not quantify at all (subparagraph 31(1)(b)(ii)).

For an additional specified industrial activity, the unit of measurement specified by the Minister is the one provided in the request under subsection 172(1) of the Act for the designation of the facility as a covered facility.

6.1.1. Measuring Device and Engineering Estimates

Measuring devices used to quantify an industrial facility’s production must comply with the requirements associated with the measuring device. As per subsection 31(2), any measuring device used to measure production must be maintained to be accurate within ± 5% and must also be installed, operated, maintained, and calibrated in accordance with the manufacturer’s specifications or any applicable generally recognized national or international industry standard. Measuring devices used to measure the production of electricity in industrial facilities must also comply with the requirements of subsection 31(2).

Where an industrial facility is unable to directly measure their production using a measuring device, production may be quantified using engineering estimates or mass balance, as per subsection 31(3).

6.2. Quantification of Production for Electricity Generation Facilities

As per subsection 32(1), for an electricity generation facility, gross quantity of electricity produced from each unit within the facility must be quantified based on the type of fossil fuel combusted:

- If the facility uses one fossil fuel (i.e.: natural gas):

- The gross electricity generated is determined in accordance with subsection 4(1) of Part 38 of Schedule 3;

- If the facility has a combustion engine unit and a boiler that share the same steam turbine, then the gross electricity generated for each unit is determined as described in section 5 of Part 38 of Schedule 3.

- If the facility uses a mixture of fossil fuels or a mixture of biomass and fossil fuels:

- The gross electricity generated by each fuel type is determined in accordance with subsections 4(2) and (3) of Part 38 of Schedule 3.

- If the facility has a combustion engine unit and a boiler that share the same steam turbine, then the gross electricity generated for each unit is determined as described in section 5 of Part 38 of Schedule 3.

Note, the responsible person may choose not to quantify part, or all of the quantity of electricity generated from one unit or a group of units, as per subsection 32(2). As per section 15 of Schedule 2 (annual report), a list of unit(s) is required, from which electricity was generated but not quantified.

Furthermore, the annual production value that is included in the annual report is not to be rounded to three significant figures.

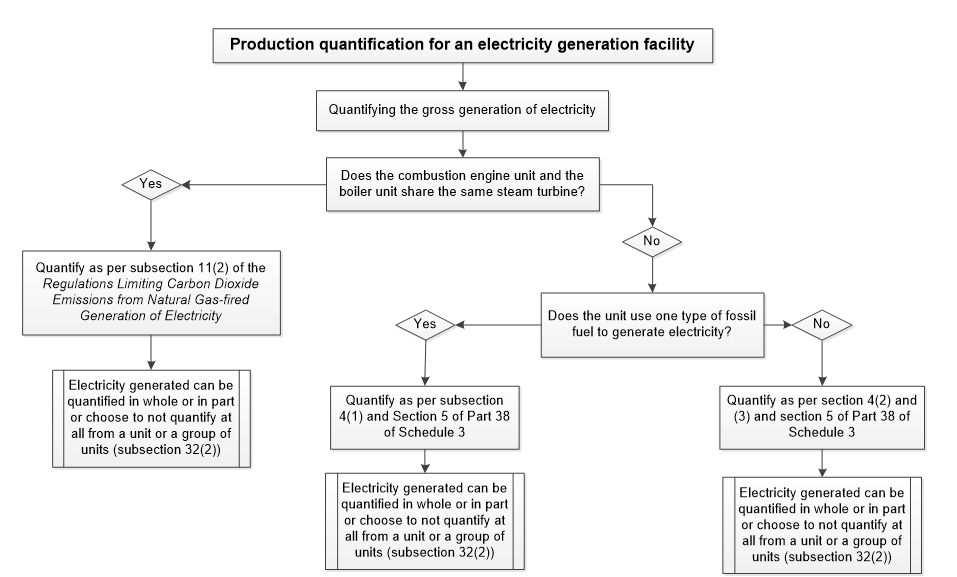

Figure 6: Quantification of production for an electricity generation facility.

Figure 6: Quantification of production for an electricity generation facility.

Production quantification for an electricity generation facility.

Quantifying the gross generation of electricity.

Does the combustion engine unit and the boiler unit share the same steam turbine?

If yes, quantify as per subsection 11(2) of the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricity. Electricity generated can be quantified in whole or in part or choose to not quantify at all from a unit or a group of units (subsection 32(2)).

If no, does the unit use one type of fossil fuel to generate electricity?

If yes, quantify as per subsection 4(1) and Section 5 of Part 38 of Schedule 3. Electricity generated can be quantified in whole or in part or choose to not quantify at all from a unit or a group of units (subsection 32(2)).

If no, quantify as per section 4(2) and (3) and section 5 of Part 38 of Schedule 3. Electricity generated can be quantified in whole or in part or choose to not quantify at all from a unit or a group of units (subsection 32(2)).

Long description for figure 6

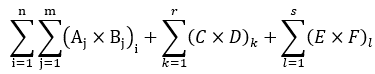

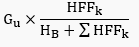

6.3. Quantification of Thermal Energy

Thermal energy transfers between covered facilities must be quantified and reported including the ratio of heat from the combustion of fossil fuels associated with those thermal energy transfers. As set out in subsection 34(1), the ratio of heat from the combustion of fossil fuels during a compliance period is either:

- equal to 1 when the thermal energy is produced from the combustion of only fossil fuels; or

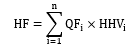

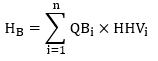

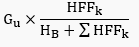

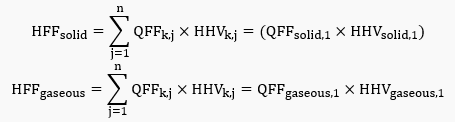

- is determined by the following formula when the thermal energy is produced from the combustion of both fossil fuels and biomass.

- Refer to Example 6 on how to calculate the ratio of heat from the combustion of both fossil fuels and biomass:

HF/(HF+B)

Where

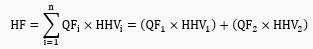

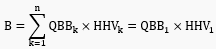

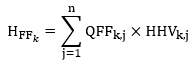

HF is determined by the formula

QFi is the quantity of fossil fuel of type “i” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with subsection 7(2) of Part 38 of Schedule 3 for industrial facilities or subsection 4(3) of Part 38 of Schedule 3 for electricity generation facilities,

HHVi is the higher heating value of the fossil fuel of type “i” combusted in the facility during the compliance period for the generation of thermal energy in accordance with sections 2.C.1 and 2.C.3 of the 2017 GHGRP for industrial facilities or subsection 24(1) of the Coal-fired Electricity Regulations for electricity generation facilities, and

i is the ith fossil fuel type combusted in the facility during the compliance period, where “i” goes from 1 to n and where n is the number of types of fossil fuels combusted, and

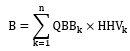

B is determined by the formula

QBBk is the quantity of biomass fuel type “k” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with subsection 7(2) of Part 38 of Schedule 3 and the WCI Method WCI.214 for industrial facilities or subsection 4(3) of Part 38 of Schedule 3 for electricity generation facilities,

HHVk is the higher heating value for biomass fuel type “k” combusted in the facility during the compliance period for the generation of thermal energy in accordance with sections 2.C.1 and 2.C.3 of the 2017 GHGRP and the WCI Method WCI.214 for industrial facilities or subsection 24(1) of the Coal-fired Electricity Regulations for electricity generation facilities, and

k is the kth biomass fuel type combusted in the facility during the compliance period, where “k” goes from 1 to m and where m is the number of types of biomass fuels combusted.

Example 5: Thermal Energy

An industrial facility produces thermal energy from the combustion of diesel, heavy fuel oil and pulping liquor fuels. The facility sells the thermal energy to another covered facility subject to the Regulations. The ratio of heat is then calculated using the formula below.

HF/(HF+B)

- The value of HF corresponds to the quantity of heat from fossil fuels combustion (i.e.: diesel fuel and heavy fuel oil).

- The value of B corresponds to the quantity of heat from biomass combustion (i.e.: pulping liquor fuel).

- The value of HF is calculated using the formula below:

- The value of QF1 corresponds to 2,000 kL, which is the quantity of diesel fuel.

- The value of HHV1 corresponds to 38.3 GJ/kL, which is the higher heating value for diesel fuel which was determined in accordance with sections 2.C.1 and 2.C.3 of the 2017 GHGRP.

- The value of QF2 corresponds to 500,000 kL, which is the quantity of heavy fuel oil.

- The value of HHV2 corresponds to 42.5 GJ/kL, which is the higher heating value for heavy fuel oil which was determined in accordance with sections 2.C.1 and 2.C.3 of the 2017 GHGRP.

HF = (QF1 × HHV1) + (QF2 × HHV2) = (2,000 kL × 38.3 GJ/kL) + (500,000 kL × 42.5 GJ/kL) = 21,326,600 GJ

- The value of B is calculated using the formula below:

- The value of QBB1 corresponds to 700,000 tonnes, which is the quantity of pulping liquor fuel.

- The value of HHV1 corresponds to 14.5 MJ/kg, which is the higher heating value for pulping liquor fuel which was determined in accordance with sections 2.C.1 and 2.C.3 of the 2017 GHGRP and the WCI. Method WCI.214.

B = QBB1 × HHV1 = 700,000 tonnes × 14.5 MJ/kg × (1000 kg / 1 tonne) × (1 GJ / 1000 MJ) = 10,150,000 GJ

- Calculate the ratio of heat based on the values determined in steps 1 and 2:

HF / (HF + B) = (21,326,600 GJ) / (21,326,600 GJ + 10,150,000 GJ) = 0.678

The industrial facility‘s ratio of heat from the combustion of fossil fuels is 0.678.

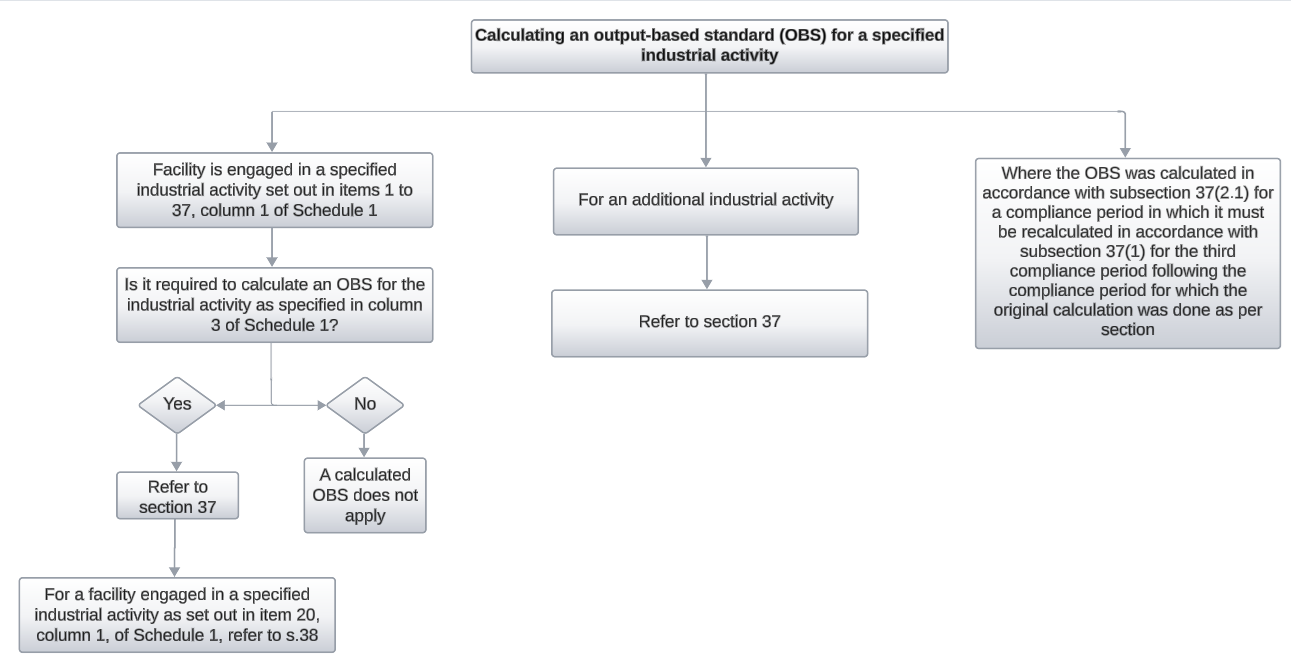

7. Determining the Facility’s Emissions Limit

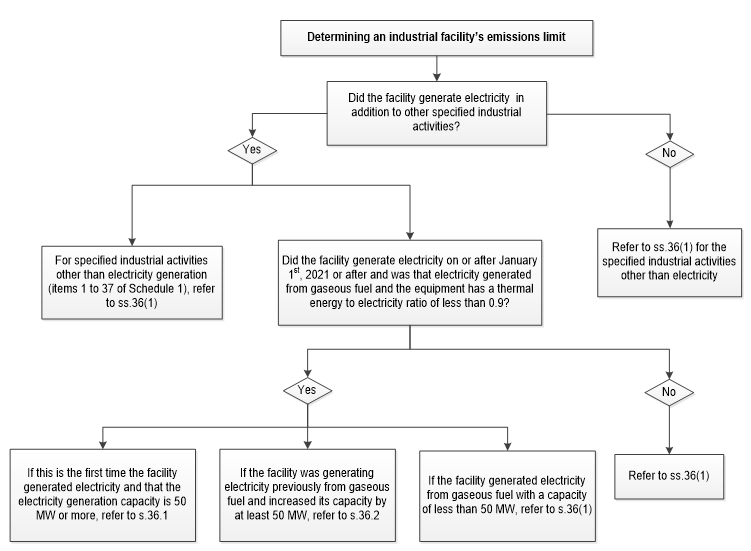

The following sections provide guidance on determining a facility’s emissions limit, including the rules for new electricity production from gaseous fuels and calculated OBS, as well as a summary flowchart on these requirements for both industrial and electricity generation facilities.

7.1. Emissions Limit for Industrial Facilities

7.1.1. General Rule

An industrial facility, other than an electricity generation facility, must determine its emissions limit using the formula set out in section 36. The emissions limit is based on the sum of production from all specified industrial activities, as calculated per section 31, multiplied by the applicable OBS which will decline at the applicable annual tightening rate.The OBSs are listed in column 3 of Schedule 1. Some OBSs are numerical values while others need to be calculated in accordance with section 37. Special rules set out in section 16 and subsections 36(2) to 36(4) may apply for certain specified industrial activities which are identified in the sector specific parts of the document (section 9 of this document).

See below for a breakdown of the emissions limit formula in subsection 36(1).

![The emissions limit is equal to the summation of Ai multiplied by [Bi multiplied by C multiplied by (D minus 2022)]) from i equals 1 to n](/content/dam/eccc/images/climate-change/obps/quantification-guidance-jan-2024/math/5.png)

Where

Ai is the production of each specified industrial activity or sub-activity “i” quantified as per s.31,

Bi is the OBS value:

- Column 3 of Schedule 1

- Calculated as per section 37 as indicated in column 3 of Schedule 1

- Calculated as per section 37 for additional industrial activities.

C is the tightening rate applicable to the industrial activity “i”, as the case may be as follows

- 0% for specified industrial activity in item 38, column 1, Schedule 1

- 1% for specified industrial activities in items 3(c), 7, 8, 17, 19, 20 and 34, column 1, Schedule 1

- 2% for all other specified industrial activities, and

D is the calendar year that corresponds to the compliance period.

7.1.2 New Generation of Electricity

As described in section 36.1, a facility that begins generating electricity from the combustion of gaseous fuel on or after January 1, 2021, and meets the criteria below must apply the decreasing OBS in subsection 36.1(2) in its emissions limit calculation:

- the equipment used to produce the new electricity from gaseous fuels has a capacity equal to or greater than 50 MW; and

- the equipment is designed to operate at a thermal energy to electricity ratio of less than 0.9.

See below for a breakdown of the emissions limit formula in subsection 36(1).

![The emissions limit is equal to the summation of Ai multiplied by [Bi multiplied by C multiplied by (D minus 2022)]) from i equals 1 to n](/content/dam/eccc/images/climate-change/obps/quantification-guidance-jan-2024/math/5.png)

Where

Ai is the production of each specified industrial activity or sub-activity “i” quantified as per s.31,

Bi is the OBS value:

- Column 3 of Schedule 1 except for paragraph 38(c)

- Paragraph 38(c) in column 3 of Schedule 1 is replaced by the value listed in subsection 36.1(2)*

- Calculated as per section 37 as indicated in column 3 of Schedule 1

- Calculated as per section 37 for additional industrial activities,

C is the tightening rate applicable to the industrial activity “i”, as the case may be as follows

- 0% for specified industrial activity in item 38, column 1, Schedule 1

- 1% for specified industrial activities in items 3(c), 7, 8, 17, 19, 20 and 34, column 1, Schedule 1

- 2% for all other specified industrial activities, and

D is the calendar year that corresponds to the compliance period.

*The decreasing OBS is not applicable to a facility engaged in the industrial activity under item 20, column 1, of Schedule 1.

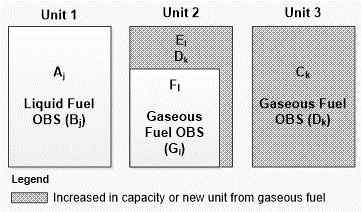

7.1.3. Increased Capacity of Electricity Generation

For a facility that, on or after January 1, 2021, increases its electricity generation capacity from the combustion of gaseous fuel by 50MW or more using equipment that has a thermal energy to electricity ratio of less than 0.9, the formula and the decreasing OBS values in subsections 36.2(2) and 36.1(2) must be used to calculate the emissions limit. Note that for an industrial facility, the increase in capacity applies at the facility level and not at the unit level. Refer to the example below on how to calculate the emissions limit in section 36.2 for industrial facilities.

As specified under subsection 36.2(3), the decreasing OBS only applies to the portion of the electricity generation that is attributed to the total incremental capacity added since December 31, 2020. The portion of electricity generation that is attributed to the existing capacity on December 31, 2020, continues to use the OBS set out in column 3 of paragraph 38(c) of Schedule 1 (i.e., 370 tonnes of CO2e/gigawatt hours). As a result, the production of electricity from equipment that has increased its electricity generation capacity and met the criteria in subsection 36.2(1) must be apportioned using engineering estimates as described in subsection 36.2(3). This is referring to the gross amount of electricity generated by the equipment in the description of E and F in subsection 36.2(2). Note that the generation of electricity is subject to a 0% tightening rate and that other activities will be subject to the relevant tightening rate as outlined in subsection 36.2(2).

As per subsection 36.2(4), any increase in the facility’s electricity generation capacity is cumulative. Therefore, for a facility that increases its capacity over time, the decreasing OBS value applies once the facility has reached an increased capacity of 50MW compared to its capacity on December 31, 2020. Note that the decreasing OBS applies only if the equipment from the increased capacity also has a thermal to electricity ratio of less than 0.9.

Where an industrial facility applies the decreasing OBSs set out in subsection 36.1(2) for a given compliance period, it will continue to apply for all subsequent compliance periods even if:

- the facility is not generating electricity from gaseous fuel or the equipment in question has a thermal energy to electricity ratio that is equal to or greater than 0.9 as per section 36.1; or

- the equipment in question under section 36.2 is not generating electricity from gaseous fuel or has a thermal energy to electricity ratio that is equal to or greater than 0.9.

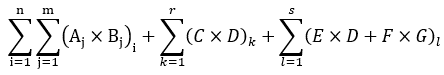

See below for a breakdown of the emissions limit formula in subsection 36.2(2). Variables C and D are the same as in the emissions limit equations above.

![The emissions limit is equal to the summation of Ai multiplied by [Bi multiplied by C multiplied by (D minus 2022)]) from i equals 1 to n plus (E multiplied by F) plus (G multiplied by F plus H multiplied by I)](/content/dam/eccc/images/climate-change/obps/quantification-guidance-jan-2024/math/8.png)

Where

Ai is the production of each specified industrial activity or sub-activity “i”Footnote 1 quantified as per section 31,

Bi is the OBS value:

- Column 3 of Schedule 1

- Calculated as per section 37 as indicated in column 3 of Schedule 1

- Calculated as per section 37 for additional industrial activities,

C is the tightening rate applicable to the industrial activity “i” as follows

- 0% for specified industrial activity in item 38, column 1, Schedule 1

- 1% for specified industrial activities in items 3(c), 7, 8, 13, 17, 19, 20 and 34, column 1, Schedule 1

- 2% for all other specified industrial activities,

D is the calendar year that corresponds to the compliance period,

E is the production electricity from new equipment that meets the criteriaFootnote 2 quantified as per section 31,

F is the decreasing OBS value in subsection 36.1(2),

G is the production of electricity from the equipment with increased capacity and that meets the criteriaFootnote 3 quantified as per section 31 and subsection 36.2(3)Footnote 4 ,

H is the production of electricity from the remaining (original) equipment quantified as per subsections 31 and 36.2(3)Footnote 4 , and

I is the OBS value in paragraph 38(c) column 3 of Schedule 1. Return to footno referrer

Long description for figure 7

Determining an industrial facility’s emissions limit.

Did the facility generate electricity in addition to other specified industrial activities?

If no, refer to ss.36(1) for the specified industrial activities other than electricity.

If yes, for specified industrial activities other than electricity generation (items 1 to 37 of Schedule 1), refer to ss.36(1).

Did the facility generate electricity on or after January 1st, 2021, or after and was that electricity generated from gaseous fuel and the equipment has a thermal energy to electricity ratio of less than 0.9?

If yes, if this is the first time the facility generated electricity and that the electricity generation capacity is 50 MW or more, refer to section 36.1. If the facility was generating electricity previously from gaseous fuel and increased its capacity by at least 50 MW, refer to section 36.2. If the facility generated electricity from gaseous fuel with a capacity of less than 50 MW, refer to section 36(1).

If no, refer to section 36(1).

Example 6: Emissions limit for increased capacity of electricity generation

An industrial facility, other than an electricity generation facility, produces products 1 and 2, in addition to generating electricity from natural gas. On January 1, 2022, the facility installed a natural gas turbine to increase the capacity of its existing electricity generation equipment by an additional 60 MW. That turbine operates at a thermal energy to electricity ratio of 0.75.

The table below provides the facility’s production for all applicable industrial activities and OBSs in order to calculate the facility’s emissions limit.

| Production in 2022 | Applicable OBSs | Applicable Tightening Rate | |

|---|---|---|---|

| Product 1 | 65,000 tonnes | 0.25 tonnes of CO2e/ tonnes of product 1 | 1% |

| Product 2 | 85,000 tonnes | 0.30 tonnes of CO2e/ tonnes of product 2 | 2% |

| Electricity generation | 500 GWh | 288 and 370 tonnes of CO2e/gigawatt hours | 0% |

The facility’s emissions limit for the 2023 compliance period must be calculated using the formula below, as set out in subsection 36.2(2), because the electrical capacity was increased by 50 MW or more and that electrical equipment operates at a thermal energy to electricity ratio of less than 0.9.

![The emissions limit is equal to the summation of Ai multiplied by [Bi multiplied by C multiplied by (D minus 2022)]) from i equals 1 to n plus (E multiplied by F) plus (G multiplied by F plus H multiplied by I)](/content/dam/eccc/images/climate-change/obps/quantification-guidance-jan-2024/math/8.png)

= (A1× (B1 - [B1 × C1 × (D-2022)])) + (A2 × B2 - [B2 × C2 × (D -2022)])) + (E×F) + (G × F + H ×I)

- The values A1 and A2 correspond to production of products 1 and 2.

- The values B1 and B2 correspond to the OBSs for production of products 1 and 2.

- The values of C1 and C2 correspond to the relevant tightening rates for products 1 and 2.

- The value of D corresponds to the year of the compliance period.

- The value of E corresponds to 0 since the facility did not start generating electricity from the combustion of gaseous fuels on or after January 1, 2021, from equipment that was designed to operate at a thermal energy to electricity ratio of less than 0.9.

- The value of F corresponds to 288 tonnes of CO2e/GWh, the decreasing OBS for the 2023 compliance period.

- The value of G corresponds to the quantity of electricity generated by the facility that is apportioned based on the capacity of the new turbine relative to the facility’s total electricity generation capacity.

- The value of H corresponds to the quantity of electricity generated by the facility that is apportioned based on the capacity of the existing equipment relative to the facility’s total electricity generation capacity.

- The value of I corresponds to 370 tonnes of CO2e/GWh, the applicable OBS for existing equipment that generates electricity from gaseous fuel.

The values of G and H are calculated based on the apportioning of the electricity generation from the new and existing equipment relative to the facility’s total electricity generation capacity. The electricity generation capacity from the existing equipment and new turbine are 160 and 60 MW, respectively.

new turbine apportioned = (60 MW) / (160 MW + 60MW) ≈ 0.2727

existing equipment apportioned = 1 - 0.2727 ≈ 0.7273

Electricity from new turbine apportioned (variable E) = 0.2727 × facility's total electricity generation = 0.2727 × 500 GWh = 136.35 GWh

Electricity from existing equipment apportioned (variable F) = 0.7273 × facility's total electricity generation = 0.7273 × 500 GWh = 363.65 GWh

Emissions limit = (A1 × (B1 – [B1 × C × D-2022)])) + (A2 × (B2 – [B2 × C × D - 2022)])) + (E × F) + (G × F + H × I) = (65 000 tonnes of product 1 × (0.25 tonnes of CO2e/tonne of product 1 -[0.25 tonnes of CO2e/tonne of product 1 × 0.01 × (2023-2022)])) + (85 000 tonnes of product 2 × (0.30 tonnes of CO2e/tonne of product 2 - [0.30 tonnes of CO2e / tonne of product 2 × 0.02 × (2023-2022)])) + (0×288 tonnes of CO2e/GWh) + ((136.35 GWh × 288 tonnes of CO2e/GWh + 363.65 GWh × 370 tonnes of CO2e/GWh) = 214 896.8 tonnes of CO2e

The facility’s emissions limit is 214 897 tonnes of CO2e.

7.2. Emissions Limit for Electricity Generation Facility

7.2.1. General Rule

An electricity generation facility emissions limit must be determined using the formula set out in section 41. An electricity generation facility’s emissions limit is based on the sum of the summation, for each unit, of the products of the electricity generated, calculated as per section 32, multiplied by the OBS applicable to the types of fuel used at the unit. Please note that no tightening rate applies to electricity generation facilities. However, as per subsection 41(2), if a unit is registered under the Coal-fired Electricity Regulations and has used solid fuel in 2018, the solid fuel OBS must be used regardless of the actual type of fossil fuel used. This includes modified boiler units that burn two fuels such as coal and natural gas or fully converted boilers that only burn natural gas.

See below for a breakdown of the emissions limit formula in subsection 41(1).

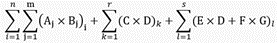

Where Aj is the production of each specified industrial activity or sub-activity “i” quantified as per section 32, and Bj OBS value in paragraphs 38(a) to (c) column 3 of Schedule 1 for that unit “i”.

7.2.2. New Generation of Electricity

The emissions limit must be calculated using the formula set out in subsection 41.1(2) for a new electricity generation facility that starts generating electricity on or after January 1, 2021, and that also meets the other criteria set out in subsection 41.1(1) and also listed below:

- The electricity generation facility has at least one unit that is generating electricity using gaseous fuel; and

- The unit has a capacity greater or equal to 50MW and is designed to operate at a thermal to electricity ratio of less than 0.9.

If the above criteria are met then, then the emissions limit for the facility must be calculated using the formula set out in subsection 41.1(2) and not the one set out in section 41. The OBS (i.e., decreasing OBS) set out in the description of variable D in subsection 41.1(2) applies instead of the OBS set out in paragraph 38(c) of column 1 of Schedule 1 (i.e., 370 tonnes of CO2e/gigawatt hours).

See below for a breakdown of the emissions limit formula in subsection 41.1(2).

Where

Aj is the production of electricity from each unit “i” quantified as per section 32,

Bj is the OBS value in paragraph 38(a) and (b) column 3 of Schedule 1 from that unit “i”,

C is the production of electricity from each unit “k” that meets the criteria Footnote 5 quantified as per section 32,

D is the decreasing OBS value in subsection 41.1(2),

E is the production of electricity from each unit “l” that does not meet the criteria Footnote 5 quantified as per section 32, and

F is the OBS value in paragraph 38(c) column 3 of Schedule 1.

The unit generates electricity from gaseous fuels, has an electricity generation capacity equal to or greater than 50 MW and is designed to operate at a thermal energy to electricity ratio less than 0.9 on or after January 1, 2021

7.2.3. Increased Capacity of Electricity Generation

For an electricity generation facility that on or after January 1, 2021, increased its electricity generation capacity using gaseous fuel by 50MW or more from a unit designed to operate at a thermal to electricity ratio of less than 0.9, the formula in subsection 41.2(2) and the decreasing OBS set out in the description of D in subsection 41.1(2) must be used. Refer to the example below that illustrates how to calculate the emissions limit for an electricity generation facility that has increased its capacity.

As specified under subsection 41.2(3), the decreasing OBS only applies to the portion of the generation from that unit that is attributed to the total incremental capacity added since December 31, 2020. The portion of electricity generation that is attributed to the existing capacity on December 31, 2020, of that unit continues to apply the OBS set out in column 3 of paragraph 38(c) of Schedule 1 (i.e., 370 tonnes of CO2e/gigawatt hours). As a result, the unit that had an increased electricity generation capacity and met the criteria in subsection 41.2(1) must apportion the gross amount of electricity generated by the unit referred to in the description of E and F in subsection 41.2(2) using engineering estimates. As per subsection 41.2(4), any increase in the unit’s electricity generation capacity is cumulative. Therefore, for a unit that increases its capacity over time, the decreasing OBS would apply once the unit has reached an increased capacity of 50MW compared to its capacity on December 31, 2020. Note that the unit in question is designed to operate at a thermal energy to electricity ratio of less than 0.9.

As per section 41.3, where an electricity generation facility generates electricity from gaseous fuel from at least one unit and applies the decreasing OBS set out in subsection 41.1(2) for a previous compliance period, that OBS will continue to apply for all subsequent compliance periods even if:

- the unit or group of units is not producing electricity from gaseous fuel; or

- is designed to operate at a thermal energy to electricity ratio that is equal to or greater than 0.9.

See below for a breakdown of the emissions limit formula in subsection 41.2(2).

Where

Aj is the production of electricity from each unit “i”Footnote 6 quantified as per section 32,

Bj is the OBS value in paragraph 38(a) and (c) column 3 of Schedule 1 from that unit “i”,

C is the production of electricity from each new unit “k” that meets the criteriaFootnote 7 quantified as per section 32,

D is the decreasing OBS value in subsection 41.1(2),

E is the production of electricity from each unit that meets the criteriaFootnote 8 quantified as per section 32 and subsection 41.2(3) Footnote 9 ,

F is the production of electricity from the remaining (original) unit quantified as per section 32, and

G is the OBS value in paragraph 38(c) column 3 of Schedule 1.

Long description for figure 8

Figure 8: Emissions limit for an electricity generation facility.

Determining an electricity generation facility’s emissions limit.

Did the facility generate electricity on or after January 1st, 2021, and was that electricity generated from gaseous fuel and the unit is designed to operate at a thermal energy to electricity ratio of less than 0.9?

If no, refer to section 41.

If yes, if this was the first time the facility generated electricity and has at least one unit with a capacity of 50MW or more, refer to section 41.1. If the facility generated electricity previously from gaseous fuel and increased its capacity by at least 50 MW, refer to section 41.2. If the facility generated electricity from gaseous fuel with a capacity of less than 50 MW, refer to section 41.

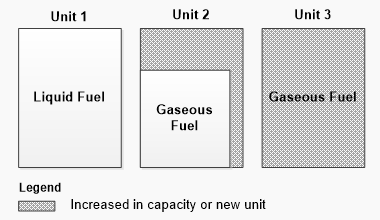

Example 7: Emissions limit for increased capacity of electricity generation

An electricity generation facility has two units to generate electricity from fossil fuels. Unit 1 uses diesel to generate electricity, while Unit 2 uses natural gas.

In January 2022, the facility installed a new turbine to generate electricity from the combustion of natural gas with a capacity of 60 MW and designed to operate at a thermal energy to electricity ratio of 0.75. The new turbine is integrated with Unit 2.

The facility also built a third unit (Unit 3) in January 2022 that is not integrated with Units 1 and 2. Unit 3 generates electricity from the combustion of natural gas, with a capacity of 80 MW and is designed to operate at a thermal energy to electricity ratio of 0.80. The diagram below shows the configuration of each unit within the facility.

The table below provides the facility’s electricity generation from each unit and the applicable OBSs. The facility must calculate the emissions limit for 2022 using the formula below.

| Production in 2022 | Applicable OBSs | |

|---|---|---|

| Unit 1 | 600 GWh | 550 tonnes of CO2e/GWh |

| Unit 2 | 500 GWh | 370 and 329 tonnes of CO2e/GWh |

| Unit 3 | 200 GWh | 329 tonnes of CO2e/GWh |

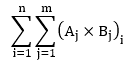

= [(A1 x B1)1] + (C1 x D1) + (E1 x D1 + F1 x G1)

= (A1,1 x B1,1) + (C1 x D1) + (E1 x D1 + F1 x G1)

- The value of A1,1 corresponds to 600 GWh, which is the electricity generated from liquid fuels in Unit 1.

- The value of B1,1 corresponds to 550 tonnes of CO2e/GWh, the applicable OBS for liquid fuels.

- The value of C1 corresponds to 200 GWh, the gross electricity generation from gaseous fuels in Unit 3.

- The value of D1 corresponds to 329 tonnes of CO2e/GWh, the decreasing OBS for the 2022 compliance period.

- The value E1 corresponds to the quantity of electricity generated by the facility that is apportioned based on the capacity of the new turbine relative to the unit’s total electricity generation capacity for Unit 2.