Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2016 and ending March 31, 2017

Chapter II - 2. Employment Insurance regular benefits

From: Employment and Social Development Canada

On this page

- 2. Employment Insurance regular benefits

- 2.1 Employment Insurance regular claims and amount paid

- 2.2 Employment Insurance regular benefits: coverage, eligibility and access

- 2.3 Level of Employment Insurance regular benefits

- 2.4 Extension of Employment Insurance regular benefits for workers in regions affected by the downturn in commodity prices

- 2.5 Employment Insurance regular benefit entitlement

- 2.6 Exhaustion of Employment Insurance regular benefits

- 2.7 Working While on claim provision

- 2.8 Employment Insurance regular benefits and seasonal claimants

2. Employment Insurance regular benefits

Employment Insurance (EI) regular benefits provide temporary income support to partially replace lost employment income for eligible claimants while they look for work or upgrade their skills. To qualify for regular benefits, individuals must have paid EI premiums during their qualifying period (defined as either the 52 weeks prior to the new claim’s establishment or since the establishment of a previous claim, whichever is shorter). They must have been unemployed and without pay for at least seven consecutive days and must have accumulated between 420 and 700 hours of insurable employment over the qualifying period. The number of hours of insurable employment required depends on the unemployment rate of the EI economic region in which they reside at the time of making their claim (known as the Variable Entrance Requirement). Claimants for EI regular benefits must be available for and actively seeking suitable employment during their claim period.

For the purpose of these sections, EI regular claims refer to claims for which at least one dollar of regular benefits was paid.

2.1 Employment Insurance regular claims and amount paid

The number of new EI regular claims decreased by 7.7% to 1.3 million in FY1617, from 1.4 million in the previous year. This decline is attributable in part to the drop in the number of new claims established in Ontario, British Columbia and Quebec due to the upward trend in employment observed in these regions. However, the largest declines in percentage occurred in Newfoundland and Labrador ( 18.1%) and in Alberta (-15.9%). Despite this decline that continued the downward trend in the number of claims established generally observed since FY0910, the number of new claims established in the reporting period (1,321,100) remained 2.1% higher than the number reported in FY0708, prior to the onset of the late-2000s recession (see Chart 5).

Text description of Chart 5

| Regular claims (millions - left scale) | Amount paid ($ billions - right scale) | |

|---|---|---|

| 2007/2008 | 1.3 | $8.4 |

| 2008/2009 | 1.6 | $10.0 |

| 2009/2010 | 1.6 | $14.7 |

| 2010/2011 | 1.4 | $12.8 |

| 2011/2012 | 1.4 | $11.1 |

| 2012/2013 | 1.4 | $10.5 |

| 2013/2014 | 1.3 | $10.4 |

| 2014/2015 | 1.3 | $10.6 |

| 2015/2016 | 1.4 | $12.1 |

| 2016/2017 | 1.3 | $12.7 |

Note: Includes claims for which at least $1 of EI regular benefits was paid.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Unlike the number of new claims, total EI regular benefits paid increased by 4.5% (from $12.1 billion to $12.7 billion), compared with an increase of 14.3% observed in the previous year (see Chart 5). It was the third straight year of increases after a four-year downward trend following a high of $14.7 billion in regular benefits paid in FY0910.

Given that EI regular benefits are meant to provide temporary income support during periods of unemployment for eligible claimants while they search for work, the number of new claims established tends to be sensitive to economic cycles and labour market conditions. In FY1617, as discussed in Chapter 1, the Canadian GDP increased by 1.7% and the labour force by 0.8% (or +156,900) over the previous year. The national unemployment rate slightly decreased from 7.0% in FY1516 to 6.9% in FY1617, leading to a decline in the number of unemployed people (-1.4%) and a drop in the volume of new EI regular claims (-7.7%) (see Chart 6).

Text description of Chart 6

| Regular claims (left scale) | Unemployment rate (right scale) | |

|---|---|---|

| 2012/2013 | -4.6% | 7.2% |

| 2013/2014 | -2.3% | 7.0% |

| 2014/2015 | 1.3% | 6.9% |

| 2015/2016 | 6.6% | 7.0% |

| 2016/2017 | -7.7% | 6.9% |

Note: Includes claims for which at least $1 of EI regular benefits was paid.

Sources: Employment and Social Development Canada, Employment Insurance (EI) administrative data (for data on regular claims); and Statistics Canada, Labour Force Survey, CANSIM table 282-0001 (for data on unemployment rates). ESDC data are based on a 10% sample of EI administrative data.

FY1617, there were, on average, 566,000 beneficiaries receiving EI regular benefits each month, an increase of 3.8% from the average of 545,000 regular beneficiaries in the previous year.Footnote 22 As the number of beneficiaries is based on previously established claims, these two measures tend to move in similar directions, albeit at their own pace. New claim volumes will increase when there is an economic shock and the beneficiary count can remain elevated after the volume of new claims have subsided, as payments continue to be made on previously established claims until benefits are exhausted or the claimants have returned to work—reflecting prevailing economic conditions or, potentially, policies that extend benefit entitlement.

Employment Insurance regular claims and amount paid by province or territory, gender, and age

In FY1617, the number of EI regular claims decreased in every province and territory except Prince Edward Island, Nova Scotia, Northwest Territories and Nunavut. The largest percentage decrease occurred in Newfoundland ( 18.1%), followed by Alberta (-15.9%), and British Columbia (-14.5%)—see Chart 7. Quebec and Ontario, which together accounted for 58.5% of all new regular claims, registered the decreases ( 16,700 and -24,000 respectively), in the number of claims established.

Text description of Chart 7

| % Change claims established | % Change amount paid | |

|---|---|---|

| British Columbia | -14.5% | -0.2% |

| Alberta | -15.9% | 51.7% |

| Saskatchewan | -13.9% | 24.8% |

| Manitoba | -6.0% | 4.1% |

| Ontario | -6.1% | -4.1% |

| Quebec | -4.0% | -7.8% |

| New Brunswick | -2.7% | -1.3% |

| Nova Scotia | 1.0% | -1.2% |

| Prince Edward Island | 0.7% | -0.9% |

| Newfoundland and Labrador | -18.1% | 9.7% |

| Yukon | -4.9% | 0.6% |

| Northwestern Territories | 12.3% | -4.7% |

| Nunavut | 13.2% | 22.3% |

Note: Includes claims for which at least $1 of EI regular benefits was paid.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Like the number of new claims established, the total amount of EI regular benefits paid in the reporting period also fluctuated by province or territory (see Chart 7), with Alberta (+51.7%), Saskatchewan (+24.8%), and Nunavut (+22.3%) reporting the largest increases in percentage over the previous year, while Quebec ( 7.8%) and the Northwest Territories (-4.7%) reported the largest decreases. Furthermore, despite the decrease of their shares of benefit payments, Ontario and Quebec continued to account for the largest share of benefits paid (47.7%).

As for gender, the number of EI regular claims established decreased nationally for both men (-10.0%) and women (-3.7%), to 806,700 and 514,500 respectively (see Table 7). The largest decreases were observed among men and women from Alberta, British Columbia, Ontario, Quebec, and Newfoundland and Labrador. The decline in the number of new EI regular claims was higher for men than women across most provinces and territories, except Yukon (-4.0% for men vs. -6.8% for women). In Nova Scotia, the growth rate was about the same (+1.0% for men vs. +0.9% for women). Compared with the previous year, the share of claims made by men and women remained more or less unchanged at around 61.0% and 39.0%, respectively.

About 68.0% of the total amount paid in EI regular benefits went to men and around 32.0% to women. The amounts paid to men and women increased at about the same pace (+4.3% and +4.9% respectively) —see Table 7. Women either reported higher rates of increase or lower rates of decline in amounts paid in every province and territory with the exception of Newfoundland and Labrador, Ontario and Yukon. At the national level, FY1617 is the first year during the seven past years where men have not reported higher rates of growth than women in claims established as well as in amount paid over the last four years.

As Table 7 shows, there were decreases in the number of claims established by all age groups, with the largest decreases reported by claimants under 25 years old (-9.8%), followed by those 45 years and older ( 9.5%). Claimants between 25 and 44 years old made up the largest share of new claims (44.5%) in the reporting period, followed by those 55 years and older (23.3%). While the order of the shares of new claims established by these different age groups has been relatively stable over the previous year, the share of new claims established by those 55 years and older has increased slowly over time, rising 3.3 percentage points since FY1112.

Unlike for new EI regular claims, all age groups registered increases for EI regular benefits paid. The largest increase was reported by claimants aged 55 years and older (+9.4%). Further, as in the previous year, claimants between 25 and 44 years old accounted for the largest share of amounts paid (43.8%), followed by those aged 55 years and older (24.0%). The share of amount paid by age category has been relatively stable over the last year, with a slight increase in the share of amount paid (+1.1 percentage points – ppts) to those 55 years and older and slight declines in the share of amount paid to youth under 25 years old (-0.4 ppts), claimants between 25 and 44 years old (-0.3 ppts), and those between the ages of 45 and 54 (-0.4 ppts).

| Claims | Amount paid ($ millions) | |||||

|---|---|---|---|---|---|---|

| 2015/2016 | 2016/2017 | Change (%) | 2015/2016 | 2016/2017 | Change (%) | |

| Gender | ||||||

| Men | 896,610 | 806,660 | -10.0% | $8,253.4 | $8,612.3 | +4.3% |

| Women | 534,480 | 514,470 | -3.7% | $3,868.8 | $4,057.8 | +4.9% |

| Age | ||||||

| 24 years old and under | 140,640 | 126,880 | -9.8% | $1,153.7 | $1,158.1 | +0.4% |

| 25 to 44 years old | 639,540 | 588,420 | -8.0% | $5,345.2 | $5,548.9 | +3.8% |

| 45 to 54 years old | 329,800 | 298,500 | -9.5% | $2,844.6 | $2,921.7 | +2.7% |

| 55 years old and over | 321,110 | 307,330 | -4.3% | $2,778.8 | $3,041.3 | +9.4% |

| Canada | 1,431,090 | 1,321,130 | -7.7% | $12,122.2 | $12,670.1 | +4.5% |

Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

These trends are likely attributable in part to Canada’s aging population, as there is a positive correlation between the increase in the number of EI regular claims and amount paid among workers aged 55 years and older and the increase in their share of the Canadian labour force. Older workers accounted for 20.6% of the labour force in FY1617, an increase of 2.9 percentage points from 17.7% in FY1112.Footnote 23

Employment Insurance regular claims and amount paid by industry

The number of new EI regular claims declined in all industries in FY1617 (see Table 8), most notably Mining and oil and gas extraction (-36.1%), Construction (-13.6%), Transportation and warehousing ( 12.5%) and Manufacturing ( 12.3%). The decreases in the number of EI regular claims from claimants from these industries were consistent with the recent downward trend in unemployment in those industries. Furthermore, consistent with the previous year, most of new claims were made by claimants employed, before the establishment of their claim, in Construction (20.7%), Educational services (11.6%), and Manufacturing (9.9%). Combined, these three industries accounted for 42.2% of all EI regular claims, a decrease of 1.3 percentage points compared with the previous year (43.5%).

As for goods-producing industries, the number of new EI regular claims decreased by 14.3% to about 484,700 in the reporting period, a drop driven primarily by the decline in the number of claims established by unemployed claimants from Mining and oil and gas extraction (-36.1%) , Construction (-13.6%), and Manufacturing (-12.3%).

| Number of claims (Percentage share of all claims) |

Amount paid - $ Millions (Percentage share of total amount paid) |

|||||

|---|---|---|---|---|---|---|

| 2015/2016 | 2016/2017 | Change (%) | 2015/2016 | 2016/2017 | Change (%) | |

| Goods-producing Industries | 565,610 (39.5%) | 484,720 (36.7%) |

-14.3% | $5,337.1 (44.0%) | $5,397.7 (42.6%) | +1.1% |

| Agriculture, forestry, fishing and hunting | 57,360 (4.0%) |

51,910 (3.9%) |

-9.5% | $520.4 (4.3%) |

$515.6 (4.1%) |

-0.9% |

| Mining and oil and gas extraction | 38,250 (2.7%) |

24,4330 (1.8%) |

-36.1% | $445.0 (3.7%) |

$448.8 (3.5% |

+0.8% |

| Utilities | 4,230 (0.3%) |

3,980 (0.3%) |

-5.9% | $39.1 (0.3%) |

$42.2 (0.3%) |

+8.1% |

| Construction | 316,290 (22.1%) |

273,380 (20.7%) |

-13.6% | $2,934.7 (24.2%) |

$3,001.5 (23.7%) | +2.3% |

| Manufacturing | 149,480 (10.4%) |

131,020 (9.9%) |

-12.3% | $1,397.9 (11.5%) |

$1,389.6 (11.0%) | -0.6% |

| Services-producing Industries | 821,740 (57.4%) | 762,630 (57.7%) |

-7.2% | $6,487.5 (53.5%) | $6,687.7 (52.8%) | +3.1% |

| Wholesale trade | 48,240 (3.4%) |

43,600 (3.3%) |

-9.6% | $497.1 (4.1%) |

$515.1 (4.1%) |

+3.6% |

| Retail trade | 83,500 (5.8%) |

76,300 (5.8%) |

-8.6% | $685.4 (5.7%) |

$712.3 (5.6%) |

+3.9% |

| Transportation and warehousing | 67,950 (4.7%) |

59,470 (4.5%) |

-12.5% | $520.5 (4.3%) |

$556.8 (4.4%) |

+7.0% |

| Finance and insurance | 15,500 (1.1%) |

14,080 (1.1%) |

-9.2% | $166.5 (1.4%) |

$177.9 (1.4%) |

+6.9% |

| Real estate, rental and leasing | 20,220 (1.4%) |

18,640 (1.4%) |

-7.8% | $191.8 (1.6%) |

$208.1 (1.6%) |

+8.5% |

| Professional, scientific and technical services | 61,630 (4.3%) |

54,190 (4.1%) |

-12.1% | $630.5 (5.2%) |

$666.4 (5.3%) |

+5.7% |

| Business, building and other support services* | 100,250 (7.0%) |

88,740 (6.7%) |

-11.5% | $881.9 (7.3%) |

$876.9 (6.9%) |

-0.6% |

| Educational services | 156,100 (10.9%) |

153,460 (11.6%) |

-1.7% | $711.6 (5.9%) |

$695.1 (5.5%) |

-2.3% |

| Health care and social assistance | 47,610 (3.3%) |

45,740 (3.5%) |

-3.9% | $371.2 (3.1%) |

$389.6 (3.1%) |

+5.0% |

| Information, culture and recreation** | 41,320 (2.9%) |

38,030 (2.9%) |

-8.0% | $336.2 (2.8%) |

$337.1 (2.7%) |

+0.3% |

| Accommodation and food services | 63,840 (4.5%) |

60,630 (4.6%) |

-5.0% | $498.2 (4.1%) |

$496.3 (3.9%) |

-0.4% |

| Other services (excluding Public administration) | 45,900 (3.2%) |

42,020 (3.2%) |

-8.5% | $399.4 (3.3%) |

$424.4 (3.3%) |

+6.3% |

| Public administration | 69,680 (4.9%) |

67,730 (5.1%) |

-2.8% | $597.3 (4.9%) |

$631.5 (5.0%) |

+5.7% |

| Unclassified | 43,740 (3.1%) |

73,780 (5.6%) |

+68.7% | $297.6 (2.5%) |

$584.7 (4.6%) |

+96.5% |

| Canada | 1,431,090 | 1,321,130 | -7.7% | $12,122.2 | $12,670.1 | +4.5% |

Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

* NAICS codes 55 (Management of Companies and Enterprises) and 56 (Administration and Support, Waste Management).

**NAICS codes 51 (Information and Cultural Industries) and 71 (Arts, Entertainment and Recreation).

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Claims from these three industries accounted for 88.5% of all EI regular claims from goods-producing industries in FY1617, a decrease of 0.6 percentage points from the previous year.

The amount of EI regular benefits paid to claimants who worked in goods-producing industries increased by 1.1% to $5.4 billion, much lower than the increase observed in FY1516 (+21.9%). This slower growth was mainly attributable to a decrease in amounts paid to claimants from Manufacturing (-0.6%) and lower increases observed in amounts paid for claims established by claimants who worked in Mining and oil and gas extraction (+0.8%) and Construction (+2.3%) over the previous year. Claimants from these three industries accounted for 89.7% of goods-producing industries’ total amount paid for EI regular benefits.

As for the services-producing industries, the number of EI regular claims established decreased by 7.2% to about 762,600 claims in FY1617, largely due to the number of claims established by claimants from Transportation and warehousing (-12.5%), Professional, scientific and technical services (-12.1%), and Business, building and other support services (-11.5%). In contrast to the number of claims established, the total amount paid to claimants from services-producing industries increased by +3.1% to $6.7 billion, much lower than the increase observed in FY1516 (14.7%). This slower pace of growth is mainly attributable to the lower rate of the growth in amounts paid to claimants from Transportation and warehousing, Professional, scientific and technical services, and Business, building and other support services.

The decreased use of EI regular benefits by both goods- and services-producing industries occurred even as employment trends diverged in the two sectors: goods-producing industries observed an employment loss of 1.2% in FY1617, while the services industry showed employment gains of 1.6% (see Chart 8).

Text description of Chart 8

| Annual Percentage Change | |||

|---|---|---|---|

| Regular Claims | Amount Paid | Employment | |

| Goods-producing industries | -14.3% | 1.1% | -1.2% |

| Services-producing industries | -7.2% | -7.2% | 1.6% |

Note: Includes claims for which at least $1 of EI regular benefits was paid.

Sources:Employment and Social Development Canada (ESDC), Employment Insurance administrative data (for data on regular claims and amount paid) and Statistics Canada, Labour Force Survey, CANSIM table 282-007 (for data on employment). ESDC data are based on 10% sample of EI administrative data.

A recent departmental studyFootnote 24 on re-employment patterns after a layoff, comparing workers based on their EI claim status, examined whether laid-off workers returned to the same industry or transitioned to a new one when re-employed. It also examined the impact of the re-employment on the workers’ wages. The study found that the majority of re-employed laid-off workers found a job in the same industry regardless of whether or not they claimed EI benefits and that the share of laid-off workers that changed industry upon re-employment increased with the duration of the unemployment spell. The study also looked at the impact of returning to or changing industry on laid-off workers' wages by examining those that received a higher, lower or similar wage after re-employment. When returning to the same industry, the majority of re-employed workers maintained a similar or higher wage regardless of their EI claim status.

A key consideration associated with the EI program is that it can increase the quality of the new job found by EI claimant, notably in terms of wages and employment duration, as more time and resources are provided to an individual to search for suitable employment. Some evidence suggests that, in general, unemployment programs have either a very small positive impact or no impact at all on the job quality for re-employed individuals. Some specific sub-programs associated with the EI program may, however, provide more successful outcomes. A recent analysis by Employment and Social Development CanadaFootnote 25 shows that a number of active labour market policies—components of the EI program associated with Employment Benefit and Support Measures, see Chapter III for more information—generally had positive and highly significant impacts on re-employment and employment earnings of individuals.

Impacts of Employment Insurance on labour mobility

The EI program policies permit labour mobility. First, if an individual is receiving EI benefits and decides to move to look for work, they will continue to receive EI benefits with no change to their benefit rate or number of weeks they are entitled to receive during the benefit period, as EI benefits are based on where the individual resides when the claim is established. Second, if an individual voluntarily leaves their job in order to relocate to follow a spouse, common-law partner or dependent child (for access to medical treatment centres or other care needs), it is considered a valid reason for separation and they remain eligible to receive EI benefits.

A number of studies have focused on the determinants of labour mobility within Canada and how EI may affect a worker’s decision to migrate for employment. The available evidence suggests that EI is generally not a barrier to labour mobility. Studies suggest that the EI program does not significantly affect migration decisions,* while factors such as demographics and regional labour market characteristics (such as age, gender, employment rates, population size, etc.) as well as moving costs, play key roles in these decisions.** Among EI regular claimants, those in regions with a high unemployment rate (12.1% or higher) were more likely to commute to work from one EI economic region to another, but less likely to permanently move to another EI economic region; however, the overall effect of EI benefits on geographical attachment was very minimal.***

* Source: HRSDC, Commuting and Mobility Patterns of Employment Insurance (EI) Recipients and Non-Recipients. (Ottawa: HRSDC, Evaluation Directorate, 2011).

** Source: André Bernard, Ross Finnie and Benoît St-Jean, (Interprovincial Mobility and Earnings. (Ottawa: Statistics Canada, 2008).

*** Source: HRSDC, Regional Out-Migration and Commuting Patterns of Employment Insurance (EI) Claimants. (Ottawa: HRSDC, Evaluation Directorate, 2012).

Employment Insurance regular benefits and firms

According to 2015 tax dataFootnote 26 there were 1.2 million firmsFootnote 27 operating in Canada, an increase of 1.3% compared to 2014. There were about 303,800 firms associated with the establishment of an EI regular benefit claim as a claimant’s former employer in 2015 (or 25.4% of all firms).

The proportion of firms with at least one employee receiving EI regular benefits varied widely according to firm size, with smaller firms being less likely to be the last employer of a claimant.Footnote 28 In 2015, 20.0% of small-sized firms (1 to 19 employees) had at least one former employee who received EI regular benefits. In comparison, 74.8% of small-to-medium (20 to 99 employees) firms, 95.0% of medium-to-large (100 to 499 employees) and 99.6% of large-sized (500 employees or more) firms had a former employee who received EI regular benefits.

| Number of firms | Employment distribution** (% share) | EI claimant distribution*** (% share) | ||

|---|---|---|---|---|

| All firms | Firms with a least one employee receiving EI regular benefits | |||

| Small | 1,083,684 | 216,409 | 21.6% | 26.1% |

| Small-medium | 92,694 | 69,363 | 19.5% | 24.1% |

| Medium-large | 15,646 | 14,860 | 15.8% | 17.8% |

| Large | 3,215 | 3,201 | 43.1% | 32.0% |

| Canada | 1,195,239 | 303,833 | 100.0% | 100.0% |

* The categories of firm size reflect those found in Business Dynamics in Canada, a Statistics Canada publication. Small-sized firms are defined as those that employ 1 to 19 employees. Small-to-medium sized firms employ 20 to 99 employees. Medium-to-large sized firms employ 100 to 499 employees. Large-sized firms employ 500 employees or more.

** The number of workers in a firm is the number of individuals with employment income in that firm, as indicated on a T4 form. The number of workers is adjusted so that each individual in the labour force is only counted once and individuals who work for more than one firm are taken into account. For example, if an employee earned $25,000 in firm 1 and $25,000 in firm 2, then he or she was recorded as 0.5 employees at the first firm and 0.5 employees at the second firm.

*** These are based on the number of people receiving EI regular benefits in 2015.

Sources: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 100% sample of EI administrative data; CRA administrative data. CRA data are based on a 100% sample.

However, compared to the distribution of the workforce, employees from smaller firms tended to be over-represented among EI regular claimants (see Table 9). Workers in large-sized firms were underrepresented among EI regular claimants, accounting for 43.1% of workers and only 32.0% of EI regular claimants. All other categories of firms were over-represented among EI regular claimants—small firms, for example, represented 21.6% of workers and 26.1% of EI regular claimants. This higher use of EI regular benefits could suggest that, in difficult business or economic conditions, smaller firms may need to make broader adjustments to their workforces, resulting in a larger share of their employees claiming EI regular benefits as a result of layoffs. Moreover, this trend can also be influenced by industry-related characteristics such as the greater prevalence of seasonal jobs, generally more likely to rely on EI, in small firms relative to the national average in some industries.Footnote 29

Employment Insurance (EI) regular claims and amount paid by EI claimant category

As shown in Table 10, the number of claims established declined in all claimant categories in FY1617. Long-tenured workers reported the largest decrease, down 13.4% over the previous year, followed by frequent (-7.2%) and occasional claimants (-4.9%). Occasional workers continued to account for the largest share (53.5%) of all new EI regular claims established, an increase of 1.6 percentage points compared to the previous year (51.9%). In contrast, the share of long-tenured workers declined moderately by 1.7 percentage points to 24.9%, while that of frequent claimants was barely changed at 21.6%.

The decrease in claims established by long-tenured workers in FY1617 continues the downward trend observed since the recession in FY0910. The number of EI regular claims established by long-tenured workers in FY1617 (approximately 329,300) remained below the peak reported in FY0809 (519,800) (see Chart 9).

As in the previous year, occasional claimants accounted for the largest share of total benefit payments (49.1%) in FY1617, a decrease of 1.4 percentage points over the previous year. They were followed by long-tenured workers and frequent workers who accounted for 29.1% and 21.9%, respectively, of total benefit payments. Long-tenured workers (+17.2%) and occasional workers (+1.7%) witnessed increases in their EI regular benefit payments, while frequent claimants witnessed a decrease (-3.3%) (see Table 10 and Chart 10).

| Number of claims (Percentage share of all claims) |

Amount paid - $ Millions (Percentage share of total amount paid) |

|||||

|---|---|---|---|---|---|---|

| 2015/2016 | 2016/2017 | Change (%) | 2015/2016 | 2016/2017 | Change (%) | |

| Long-tenured workers | 380,460 (26.6%) |

329,290 (24.9%) |

-13.4% | $3,141.1 (25.9%) |

$3,681.5 (29.1%) |

+17.2% |

| Occasional claimants | 742,840 (51.9%) |

706,150 (53.5%) |

-4.9% | $6,118.7 (50.5%) |

$6,220.2 (49.1%) |

+1.7% |

| Frequent claimants | 307,790 (21.5%) |

285,690 (21.6%) |

-7.2% | $2,862.3 (23.6%) |

$2,768.4 (21.9%) |

-3.3% |

| Canada | 1,431,090 (100.0%) |

1,321,130 (100.0%) |

-7.7% | $12,122.2 (100.0%) | $12,670.1 (100.0%) |

+4.5% |

Note: Totals may not add up due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

*See Annex 2.1 for definitions of claimant categories referenced in this table.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are, based on a 10% sample of EI administrative data.

Furthermore, as Table 10 illustrates, the distribution of the total amount paid to these different claimant categories was not in alignment with the distribution of claims they established. In fact, long-tenured workers received a larger share of the total amount paid (29.1%) relative to their share of claims (24.9%) in FY1617. Occasional claimants, who made up 53.5% of total claims, accounted for 49.1% of the total amount paid.

Text description of Chart 9

| 2008/2009 | 2009/2010 | 2010/2011 | 2011/2012 | 2012/2013 | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | |

|---|---|---|---|---|---|---|---|---|---|

| Long-tenured workers | 31.6% | 30.0% | 24.0% | 25.6% | 23.3% | 21.5% | 19.5% | 26.6% | 24.9% |

| Occasional claimants | 50.6% | 51.4% | 53.9% | 51.8% | 53.1% | 55.1% | 57.8% | 51.9% | 53.5% |

| Frequent claimants | 17.8% | 18.6% | 22.1% | 22.6% | 23.6% | 23.4% | 22.7% | 21.5% | 21.6% |

Note: Includes claims for which at least $1 of regular benefits was paid.

* See Annex 2.1 for definitions of claimant categories referenced in this chart.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Text description of Chart 10

| Amount paid ($ billions) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2008/2009 | 2009/2010 | 2010/2011 | 2011/2012 | 2012/2013 | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | |

| Long-tenured workers | $3.0 | $5.1 | $4.4 | $3.2 | $2.7 | $2.4 | $2.1 | $3.1 | $3.7 |

| Occasional claimants | $4.8 | $6.9 | $5.7 | $5.2 | $5.0 | $5.3 | $5.7 | $6.1 | $6.2 |

| Frequent claimants | $2.2 | $2.7 | $2.7 | $2.8 | $2.8 | $2.7 | $2.7 | $2.9 | $2.8 |

Note: Includes claims for which at least $1 of EI regular benefits was paid.

* See Annex 2.1 for definitions of claimant categories referenced in this chart.

Source: Employment and Social Developement Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Employment Insurance regular claims by hours of insurable employment and by unemployment rate in the Employment Insurance economic region of establishment

The unemployment rate in an EI economic region determines the number of hours of insurable employment needed to qualify for EI, known as the Variable Entrance Requirement (VER). The higher the unemployment rate in a given region, the lower the number of hours needed to qualify for EI regular benefits (see Annex 2.2). More information on eligibility and access to EI regular benefits is available in Section 2.2 (Employment Insurance regular benefits: coverage, eligibility and access).

Variable entrance requirement

In order to establish a benefit period a worker must accumulate between 420 and 700 hours of insurable employment in the qualifying period depending on the applicable regional rate of unemployment. The higher the regional rate of unemployment, the lower the number of hours of insurable employment required.

| Unemployment rate | Entrance requirement |

|---|---|

| 6.0% and under | 700 hours |

| 6.1% to 7.0% | 665 hours |

| 7.1% to 8.0% | 630 hours |

| 8.1% to 9.0% | 595 hours |

| 9.1% to 10.0% | 560 hours |

| 10.1% to 11.0% | 525 hours |

| 11.1% to 12.0% | 490 hours |

| 12.1% to 13.0% | 455 hours |

| More than 13.0% | 420 hours |

Consistent with previous years, claimants who accumulated more than 1,820 insurable hours accounted for the highest share of new EI regular claims (25.7%), a decrease of 2.0 percentage points from the previous year. This is the first decline in the share of claimants in this category after five years of consecutive increases. Despite this decline, the shares of EI regular claims based on the number of insurable hours accumulated by claimants was relatively stable across categories. Claims with fewer than 700 insurable hours registered the largest increase (+13.7%), while those with 1,820 hours or more witnessed the greatest decrease (-14.3%) (see Table 11).

| 2012/2013 | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | |

|---|---|---|---|---|---|

| Less than 700 hours | 74,780 (5.5%) |

68,880 (5.2%) |

64,390 (4.8%) |

67,170 (4.7%) |

76,340 (5.8%) |

| 700 to 979 hours | 210,690 (15.5%) |

201,280 (15.2%) |

203,690 (15.2%) |

207,610 (14.5%) |

216,650 (16.4%) |

| 980 to 1,259 hours | 261,440 (19.3%) |

252,600 (19.1%) |

256,210 (19.1%) |

264,500 (18.5%) |

242,610 (18.4%) |

| 1,260 to 1,539 hours | 249,250 (18.4%) |

244,230 (18.4%) |

245,530 (18.3%) |

260,870 (18.2%) |

239,030 (18.1%) |

| 1,540 to 1,819 hours | 223,640 (16.5%) |

219,660 (16.6%) |

218,840 (16.3%) |

235,120 (16.4%) |

207,440 (15.7%) |

| 1,820 hours and more | 337,010 (24.8%) |

339,150 (25.6%) |

353,950 (26.4%) |

395,820 (27.7%) |

339,060 (25.7%) |

| Canada | 1,356,810 | 1,325,810 | 1,342,610 | 1,431,090 | 1,321,130 |

Note: Data may not add up to the total due to rounding. Includes claims for which at least $1 of EI regular benefits was paid.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Chart 11 depicts the average number of hours of insurable employment per claim receiving EI regular benefits. In FY1617, on average, claimants who qualified for EI regular benefits accumulated 1,363 hours of insurable employment during their qualifying period, a decrease of 2.2% over the previous year. It was the first decrease after five years of consecutive increases since FY1011.

Text description of Chart 11

| 2008/2009 | 2009/2010 | 2010/2011 | 2011/2012 | 2012/2013 | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | |

|---|---|---|---|---|---|---|---|---|---|

| Men | 1,446 | 1,385 | 1,358 | 1,377 | 1,393 | 1,400 | 1,406 | 1,418 | 1,385 |

| Women | 1,357 | 1,325 | 1,309 | 1,315 | 1,328 | 1,338 | 1,342 | 1,353 | 1,328 |

| Canada | 1,413 | 1,362 | 1,338 | 1,352 | 1,367 | 1,376 | 1,381 | 1,393 | 1,363 |

Furthermore, the average number of hours of insurable employment per claim that qualified for EI regular benefits varied by province and territory, gender and age. Indeed, the number of hours per claim in the Atlantic provinces and the Territories tends to be lower than in other jurisdictions. For instance, claims from Newfoundland and Labrador showed the lowest average number of hours of insurable employment per claim (1,135 hours), followed by Nunavut (1,186 hours). Claims established in Alberta had the highest average number of hours with 1,501.

By gender, results showed that claims made by men (1,385 hours) had, on average, 57 more hours of insurable employment than claims made up by women (1,328 hours) compared to 62 hours in the previous year, a decrease of 8.1%. This decrease in FY1617 marks the first decline in gender gap for the last five years (see Chart 11). Further, results by age show that claimants aged 55 years and over accumulated the lowest number of hours of insurable employment on average in FY1617 (1,298 hours), while those between 25 and 44 years of age had the highest average (1,398).

Table 12 shows that there were decreases in the number of new claims by regional unemployment rates, except claims established in EI economic regions with unemployment rates between 7.1% to 8.0%, 11.1% to 12.0%, and 14.1% to 15.0%. The largest decrease (-32.9%) occurred in EI economic regions with unemployment rates of 13.1% to 14.0%, while those with unemployment rates of 14.1% to 15.0% reported the greatest increase (+61.2%). In addition, claimants from EI regions with an unemployment rate between 6.1% and 7.0% accounted for the largest share of EI new claims with 27.5%, an increase of 2.1 percentage points over the previous year. As a point of reference, the table also presents the labour force by regional unemployment rate for FY1617.

| Unemployment rate | Employment Insurance regular claims (share of claims in %) |

Labour force (share of labour force in %) | ||||

|---|---|---|---|---|---|---|

| 2012/2013 | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | 2016/2017 | |

| 0.1% to 6.0% | 199,610 (14.7%) |

187,910 (14.2) |

273,380 (20.4%) |

218,020 (15.2%) |

171,350 (13.0%) |

4,117,840 (20.9%) |

| 6.1% to 7.0% | 159,140 (11.7%) |

196,410 (14.8%) |

158,060 (11.8%) |

363,660 (25.4%) |

363,170 (27.5%) |

6,516,870 (33.1%) |

| 7.1% to 8.0% | 177,020 (13.1%) |

259,710 (19.6%) |

329,870 (24.6%) |

279,030 (19.5%) |

299,000 (22.6%) |

4,482,230 (22.7%) |

| 8.1% to 9.0% | 441,350 (32.5%) |

327,910 (24.7%) |

236,460 (17.6%) |

216,290 (15.1%) |

169,290 (12.8%) |

2,161,060 (11.0%) |

| 9.1% to 10.0% | 100,260 (7.4%) |

45,870 (3.5%) |

78,450 (5.8%) |

75,660 (5.3%) |

65,480 (5.0%) |

812,730 (4.1%) |

| 10.1% to 11.0% | 49,340 (3.6%) |

84,810 (6.4%) |

55,950 (4.2%) |

50,430 (3.5%) |

35,420 (2.7%) |

400,410 (2.0%) |

| 11.1% to 12.0% | 43,320 (3.2%) |

52,390 (4.0%) |

44,380 (3.3%) |

16,740 (1.2%) |

21,420 (1.6%) |

194,540 (1.0%) |

| 12.1% to 13.0% | 19,890 (1.5%) |

10,030 (0.8%) |

7,660 (0.6%) |

43,880 (3.1%) |

35,300 (2.7%) |

388,650 (2.0%) |

| 13.1% to 14.0% | 27,860 (2.1%) |

6,620 (0.5%) |

470 (0.0%) |

16,910 (1.2%) |

11,350 (0.9%) |

54,670 (0.3%) |

| 14.1% to 15.0% | 17,740 (1.3%) |

20,030 (1.5%) |

25,870 (1.9%) |

23,650 (1.7%) |

38,190 (2.9%) |

124,750 (0.6%) |

| 15.1% to 16.0% | 21,730 (1.6%) |

57,470 (4.3%) |

25,100 (1.9%) |

31,980 (2.2%) |

25,370 (1.9%) |

60,450 (0.3%) |

| 16.1% or higher | 99,550 (7.3%) |

76,650 (5.8%) |

106,960 (8.0%) |

94,840 (6.6%) |

85,790 (6.5%) |

391,720 (2.0%) |

| Canada | 1,356,810 | 1,325,810 | 1,342,610 | 1,431,090 | 1,321,130 | 19,705,900 |

Note: Data may not add up to the total due to rounding. Includes claims for which at least $1 of EI regular benefits was paid.

*Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

Sources: Employment and Social Development Canada, Employment Insurance (EI) administrative data and Statistics Canada, special tabulations from the Labour Force Survey. EI data are based on a 10% sample of EI administrative data.

2.2 Employment Insurance regular benefits: coverage, eligibility and access

In order to qualify for EI regular benefits, applicants have to meet three core eligibility requirements: the claimant must have had insurable employment and paid EI premiums within the previous 52 weeks; the reason for job separation must be valid according to the Employment Insurance Act, such as a layoff or quit for just cause; and the claimant must have worked a minimum number of insurable hours – based on either the regional unemployment rate (varying from 420 to 700 hours) or the claimant’s status as a new entrant or re-entrant (910 hours)Footnote 30 – within their qualifying period (defined as either the previous 52 weeks or since the establishment of their last claim, whichever is shorter).

Elimination of the New Entrant and Re-Entrants (NEREs) requirement

Michael lives in Victoria, British Columbia and has been working part-time at an accounting firm for the past six months since graduating from college, for a total of 760 hours. He was recently laid off.

Under the previous EI eligibility rules, Michael would have been considered as a new entrant to the labour market, and would have required 910 hours of insurable employment over the past 52 weeks to qualify for EI benefits. Since Michael only worked for 760 hours during this period, he would not have qualified for EI benefits.

Under the new rules, Michael now has the same eligibility requirements as other EI claimants residing in his region. In July 2016, the threshold for applicants living in Victoria was 665 hours. Because of the elimination of the NERE provision, Michael now meets the eligibility requirement for EI benefits and will receive up to 16 weeks EI benefits while he looks for new work.

Statistics Canada publishes Employment Insurance Coverage Survey (EICS) statistics on an annual basis to provide insight on the coverage of the EI program. It provides statistics about eligible recipients as well as those who did not qualify for the EI regular benefits, and maternity and parental benefits. This section provides a review of the results from the EICS to assess eligibility and access for EI regular benefits in 2016.Footnote 31

Chart 12 illustrates the characteristics of the unemployed population in Canada for 2016 with respect to their eligibility criteria for EI regular benefits. According to the EICS, there was an average of 1,302,000 unemployed individuals per month in Canada in 2016. Among these unemployed, 850,300 had paid EI premiums in the 12 months prior to becoming unemployed. These workers represent 65.3% of all unemployed people, a rate that has remained unchanged from the previous year. A total of 155,500 individuals (11.9% of total unemployed) paid EI premiums in 2016 but could not collect EI benefits because of invalid job separation (that is they quit without a justifiable cause, or quit to go to school). The number of workers who did not have sufficient insurable hours but met other eligibility requirements was 101,400, representing 7.8% of the unemployed—down 1.3 percentage points from 2015 (9.1%). The number of unemployed who were eligible to receive EI benefits increased from 569,400 in 2015 (43.8% of total unemployed) to 593,500 in 2016 (45.6% of total unemployed).

Text description of Chart 12

| (U) Total Unemployed: 1,302,000 (100%) | |

|---|---|

| (A) Unemployed without hours of insurable employment: 451,700 (34.7%) | A1—Did not work in the previous 12 months or never worked: 399,800 (30.7%) |

| A2—Self-employed and unpaid family workers: 51,900 (4.0%) | |

| (B) EI Premium-paying unemployed workers with invalid reasons for job separation: 155,500 (11.9%) | B1—Quit without a just cause - other reasons: 101,300 (7.8%) |

| B2—Quit to go to school: 54,200 (4.2%) | |

| (C) Potentially eligible unemployed workers: 101,400 (7.8%) | C1—Did not have sufficient insurable hours: 101,400 (7.8%) |

| (D) Eligible Unemployed: 593,500 (45.6%) | D1—Receiving EI regular benefits: 398,100 (30.6%) |

| D2—Benefits temporarily interrupted or waiting to receive benefits: 102,800 (7.9%) | |

| D3—Did not claim or receive benefits for unknown reasons: 42,600 (3.3%) | |

| D4—Exhausted EI benefits in the past 12 months: 41,600 (3.2%) | |

| D5—Receiving non-regular EI benefits: 8,400 (0.6%) |

Note: totals may not add up to rounding.

Source: Statistics Canada, Employment Insurance Coverage Survey, 2016.

Table 13 outlines the distribution of the unemployed population by EI eligibility characteristics from 2012 to 2016. The number of unemployed with valid job separations increased for the second consecutive year in 2016 compared to 2015 (+7,100), while the number of unemployed with invalid job separations decreased for the third consecutive year in 2016 compared to the previous year (-5,100). The share of unemployed individuals who had sufficient hours to qualify for EI increased by 1.8 percentage points from the previous year to reach 45.6% – the highest share since 2009. The number of unemployed persons with insufficient hours to qualify for EI benefits but who met other eligibility requirements decreased by 16,900 from 2015 to reach 101,400 in 2016, representing 7.8% of the total unemployed. Lastly, the share of EI recipients increased by 1.5 percentage points in 2016 to reach 31.2% of the total unemployed population, compared to 29.7% in 2015. This rate was the highest since 2010. Consequently, the share of EI non-recipients decreased from 70.3% in 2015 to 68.8% in 2016—the lowest within the last five years.

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

| Non-contributors | 501,400 (38.3%) |

492,600 (37.5%) |

491,500 (39.0%) |

450,900 (34.7%) |

451,700 (34.7%) |

| EI contributors | 808,400 (61.7%) |

819,700 (62.5%) |

768,000) (61.0%) |

848,300 (65.3%) |

850,300 (65.3%) |

| Invalid job separations | 179,500 (13.7%) |

195,600 (14.9%) |

187,400 (14.9%) |

160,600 (12.4%) |

155,500 (11.9%) |

| Valid job separations | 628,800 (48.0%) |

624,100 (47.6%) |

580,500 (46.1%) |

687,700 (52.9%) |

694,800 (53.4%) |

| Insufficient hours for EI | 113,700 (8.7%) |

88,500 (6.7%) |

97,900 (7.8%) |

118,300 (9.1%) |

101,400 (7.8%) |

| Sufficient hours for EI | 515,100 (39.3%) |

535,600 (40.8%) |

482,600 (38.3%) |

569,400 (43.8%) |

593,500 (45.6%) |

| EI benefit recipients | |||||

| EI recipients | 357,800 (27.3%) |

369,000 (28.1%) |

341,500 (27.1%) |

385,900 (29.7%) |

406,500 (31.2%) |

| EI non-recipients* | 951,900 (72.7%) |

943,400 (71.9%) |

918,000 (72.9%) |

913,200 (70.3%) |

895,600 (68.8%) |

| Total unemployed (Canada) | 1,309,700 (100.0%) |

1,312,400 (100.0%) |

1,259,500 (100.0%) |

1,299,100 (100.0%) |

1,302,000 (100.0%) |

Note: Totals may not add up due to rounding.

*Defined as the total share of unemployed persons, regardless of eligibility, who did not receive EI benefits (including both regular and special benefits) in the year reviewed.

Source: Statistics Canada, Employment Insurance Coverage Survey, 2012 to 2016.

Coverage of Employment Insurance regular benefits

As mentioned previously, recipients of EI regular benefits have to make EI premium contributions in the 52 weeks prior to submitting a claim. While the actual receipt of EI benefits is subject to further eligibility requirements, the number of unemployed persons who contributed to the EI program by paying premiums in the previous 52 weeks is an important factor in determining the program’s overall coverage of the unemployed population.

Chart 13 illustrates the share of EI contributors of the total unemployed in Canada from 2008 to 2016. The share of unemployed contributors remained the same in 2016 (65.3%) as the previous year, reversing the downward trend that has been observed since 2009. Higher EI coverage rates of the unemployed tend to occur during economic downturns, as slowing economic activity leads to layoffs that increase the share of unemployed contributors among all unemployed. For example, at the beginning of the recession, in FY0809, the share of unemployed contributors reached a peak (70.1% in 2008 and 70.3% in 2009). Likewise, the downturn in commodity prices slowed down economic growth in 2015 and in 2016, which explains the higher share of unemployed contributors in those years.

Text description of Chart 13

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|

| Employment Insurance contributors (% share) | 70.1% | 70.3% | 64.7% | 64.5% | 61.7% | 62.5% | 61.0% | 65.3% | 65.3% |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2008 to 2016.

Chart 14 provides an illustration of the trend in the share of EI non-contributors in Canada from 2008 to 2016. It is noticeable that the share of total non-contributors to the EI program and those who have no recent insurable employment remained unchanged in 2016 from the previous year. The share of unemployed who had been without work in the past 12 months increased from 21.4% in 2015 to 22.5% in 2016 (+1.1 percentage points). Persons who stated that they had never worked declined for the second consecutive year to represent 8.2% of the total unemployed population. As shown in Chart 14, those who had not worked in the previous 12 months and those who had never worked account for a greater share of the total unemployed over the years.

Text description of Chart 14

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|

| Total EI non-contributors | 29.9% | 29.7% | 35.3% | 35.5% | 38.3% | 37.5% | 39.0% | 34.7% | 34.7% |

| Have no recent insurable employment (e.g. self-employed and unpaid family workers) | 4.4% | 4.9% | 3.0% | 3.4% | 4.4% | 4.5% | 4.4% | 4.0% | 4.0% |

| Have not worked in the previous 12 months (excluding those who have never worked) | 18.3% | 18.3% | 24.1% | 25.0% | 24.6% | 24.3% | 23.3% | 21.4% | 22.5% |

| Have never worked | 7.2% | 6.5% | 8.3% | 7.1% | 9.3% | 8.8% | 11.4% | 9.3% | 8.2% |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2008 to 2016.

Table 14 shows the EI coverage rates by region, gender, age, and work pattern. In 2016, Ontario reported the lowest share of unemployed persons who paid EI contributions (57.7%), while the Atlantic provinces reported the highest (80.7%). On the basis of gender, a larger share of unemployed men (70.9%) contributed EI premiums than unemployed women (56.8%). By age categories, older unemployed workers aged 45 years and over had the highest share of EI contributors (71.2%), compared to younger workers 24 years of age and under (56.3%) and those who were aged between 25 to 44 years (65.5%). The EI coverage rate among unemployed non-permanent workers (78.8%) was higher than that among the permanent workers (72.0%).

| Unemployed contributors as a share of total unemployed (UC/U) | |

|---|---|

| Region | |

| Atlantic* | 80.7% |

| Quebec | 65.6% |

| Ontario | 57.7% |

| Prairies** | 68.7% |

| British Columbia | 69.9% |

| Gender | |

| Men | 70.9% |

| Women | 56.8% |

| Age category | |

| 24 years old and under | 56.3% |

| 25 to 44 years old | 65.5% |

| 45 years old and over | 71.2% |

| Work pattern | |

| Permanent | 72.0% |

| Full-time | 74.5% |

| Part-time | 59.6% |

| Non-permanent | 78.8% |

| Seasonal | 85.5% |

| Other non-standard*** | 74.5% |

| Canada | 65.3% |

* The Atlantic region includes the provinces of Newfoundland and Labrador (82.9%), Prince Edward Island (90.5%), Nova Scotia (76.2%) and New Brunswick (80.9%).

** The Prairie region includes the provinces of Manitoba (59.0%), Saskatchewan (71.3%) and Alberta (70.0%).

*** Other non-standard refers to non-permanent paid jobs that were either temporary, term, contractual, casual or other non-permanent (but not seasonal). These unemployed were not self-employed.

Source: Statistics Canada, Employment Insurance Coverage Survey, 2016.

Eligibility for Employment Insurance regular benefits

As noted above, in order to be eligible to receive EI regular benefits, Canada’s unemployed have to meet three core eligibility requirements (that is, paid EI premiums within the previous 52 weeks, a valid job separation, and worked a minimum number of insurable hours within their qualifying period---defined as either the previous 52 weeks or since establishing their last claim, whichever is shorter—based on the regional unemployment rate).

The 2016 EICS estimates that the number of unemployed persons potentially eligible to receive EI benefits (that is, who had paid EI premiums within the preceding 12 months and had a valid job separation) reached 694,800 (53.4% of total unemployed) in 2016, compared to 687,700 persons (52.9% of total unemployed) in 2015. This represents the majority of the EI contributor population and excludes those with reasons for job separations that did not meet the EI program’s eligibility criteria. The share of unemployed individuals who were potentially eligible for EI benefits continued to rise for the second consecutive year in 2016 due to the continued increase (+7,100) in the number of unemployed who reported having worked in insurable employment and had a valid job separation and relatively smaller increase (+2,900) in total unemployed population.

Chart 15 illustrates the EI eligibility rate—the share of potentially eligible unemployed population with enough insurable hours to qualify for EI benefits--over the last decade. After falling for two previous consecutive years, the EI eligibility rate increased from 82.8% in 2015 to 85.4% in 2016 (+2.6 percentage points). This increase could be partly attributable to the elimination of the NERE requirement that came into effect on July 3, 2016. A total of 593,500 individuals were considered eligible (that is, had enough insurable hours of employment) out of 694,800 EI contributors with a valid job separation. The EI eligibility rate tends to fluctuate modestly with changes in the labour market responding to wider business cycle fluctuations.

Text description of Chart 15

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Canada | 82.3% | 82.1% | 86.2% | 83.9% | 78.4% | 81.9% | 85.8% | 83.1% | 82.8% | 85.4% |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2007 to 2016.

One important consideration regarding the eligibility for EI regular benefits is that claimants accumulate varying hours of insurable employment. As indicated by EI administrative data, the eligible claimants who successfully establish a claim generally accumulate hours of insurable employment well beyond the minimum requirement under the Variable Entrance Requirement (VER) provision. In FY1617, the share of regular claimants who had qualified with insurable hours near the minimum entrance requirement, defined as being within 70 hours of the VER, increased to 4.0% from 3.1% in the previous fiscal year (see Chart 16).

Text description of Chart 16

| 2012/2013 | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | |

|---|---|---|---|---|---|

| Level of EI regular claims (left scale) | 42,440 | 40,200 | 40,820 | 44,270 | 52,840 |

| Claims as a share of all EI regular claims (right scale) | 3.1% | 3.0% | 3.0% | 3.1% | 4.0% |

Note: Includes claims for which at least $1 of regular benefits was paid.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

The number of eligible regular claimants who qualify near the minimum entrance requirement ranged from a low of 40,200 claimants in FY1314 to a high of 52,800 in the reporting fiscal year. In general, claimants qualifying within 70 hours of their VER are disproportionately found in EI economic regions with higher unemployment rates (12.1% or greater), which could be partly attributable to the importance of seasonal employment in those EI economic regions and the discrete period available to accumulate sufficient insurable hours for workers in those industries.

A recent departmental study—based on Record of Employment (ROE)Footnote 32 data--looked into the share of laid-off unemployed persons with enough insurable hours to meet the VER from 2001 to 2016.Footnote 33 The study found that those who reported recent laid-off job separations (the reason for separation was shortage of work) with enough combined hours to meet the VER in their 52-week qualification period declined over time, from 75.4% in 2001 to 70.1% in 2016. This may not fully reflect potential eligibility where previous employment did not result in a ROE being generated. Another departmental study examining the extent to which employers issue a ROE when there is an interruption of earnings found that 30.2% of earnings interruptions in 2014 were not associated with a ROE.Footnote 34

Eligibility for Employment Insurance regular benefits by province

Because the eligibility rates are sensitive to economic conditions and the prevalence of specific employment patterns during the qualifying period (such as, the incidence of full-time versus part-time hours, permanent versus temporary employment etc.), demographic and regional labour force characteristics show significant variation in eligibility outcomes. Table 15 outlines the EI eligibility rates by province over the last five years. In 2016, the lowest eligibility rate was observed in Manitoba (75.3%) and the highest was in Prince Edward Island (98.5%). Compared to the 2015 EICS statistics, the EI eligibility increased in six out of ten provinces while decreased in the rest. The largest increases were observed in British Columbia (+12.1 percentage points) and Nova Scotia (+11.1 percentage points), while the largest decrease was observed in Saskatchewan (-11.0 percentage points) followed by Manitoba (-7.6 percentage points).

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

| Newfoundland and Labrador | 93.5% | 93.9% | 94.1% | 93.7% | 95.9% |

| Prince Edward Island | 92.8% | 94.4% | 93.4% | 92.7% | 98.5% |

| Nova Scotia | 88.5% | 94.8% | 81.2% | 82.3% | 93.3% |

| New Brunswick | 92.4% | 96.4% | 90.5% | 96.2% | 94.6% |

| Quebec | 81.2% | 86.1% | 84.3% | 81.5% | 86.7% |

| Ontario | 79.7% | 83.1% | 81.0% | 84.8% | 81.3% |

| Manitoba | 82.0% | 85.6% | 91.4% | 82.9% | 75.3% |

| Saskatchewan | 81.2% | 82.3% | 85.4% | 89.9% | 78.9% |

| Alberta | 69.4% | 87.9% | 80.4% | 78.6% | 84.9% |

| British Columbia | 86.4% | 81.5% | 77.3% | 75.2% | 87.3% |

| Canada | 81.9% | 85.8% | 83.1% | 82.8% | 85.4% |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2012 to 2016.

Over time, it can be seen that the Atlantic provinces have the highest EI eligibility rates, while Ontario and the Western provinces have comparatively lower eligibility rates. Between 2012 and 2016, the greatest variability in eligibility rates is found in Alberta (18.5 percentage points) and Manitoba (16.1 percentage points) and the least variability is found in Newfoundland (2.3 percentage points).

Eligibility for Employment Insurance regular benefits by gender and age

Table 16 outlines the EI eligibility rates by gender and age in 2015 and 2016. Historically, a higher proportion of men hold full-time and/or permanent jobs in Canada and a higher proportion of women work in part-time and/or temporary jobs. This difference in employment characteristics among men and women is reflected in the eligibility rates for the two genders. In 2016, the EI eligibility rate of men increased by 5.2 percentage points from the previous year to 87.2%, whereas the eligibility rate of women decreased by 2.7 percentage points from the previous year to 81.6%.

| Eligibility rate in 2015 | Eligibility rate in 2016 | Change (in percentage points) | |

|---|---|---|---|

| Gender | |||

| Men | 82.0% | 87.2% | +5.2 |

| Women | 84.3% | 81.6% | -2.7 |

| Age category | |||

| 24 years old and under | 54.0% | 50.8% | -3.2 |

| 25 to 44 years old | 82.1% | 88.4% | +6.3 |

| 45 years old and over | 90.7% | 94.0% | +3.4 |

| Canada | 82.8% | 85.4% | +2.6 |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2015 and 2016

By age groups, unemployed workers aged 45 and older had the highest eligibility rate at 94.0% in 2016, increasing 3.4 percentage points from the previous year (90.7%). However, the largest increase in eligibility was among those who were 25 to 44 years old—the eligibility rate for them increased by 6.3 percentage points, from 82.1% in 2015 to 88.4% in 2016. Younger workers who are aged between 15 and 24 tend to have lower labour force attachment, and are more likely to quit their jobs to go back to school. This is reflected in their lower eligibility rate; in 2016, the youth eligibility rate declined by 3.2 percentage points to reach 50.8% from the previous year (54.0%).

Eligibility for Employment Insurance regular benefits by type of employment

Under the EI program’s eligibility requirements, previous employment characteristics significantly influence the EI eligibility rate (that is, having worked for a minimum number of insurable hours in the previous 52 weeks or since the start of last claim, whichever is shorter). Intuitively, unemployed workers who previously held full-time positions have a higher eligibility rate because they are more likely to have worked enough hours of insurable employment to qualify for EI regular benefits than part-time workers. Similarly, those who had permanent jobs are also more likely to report a higher eligibility rate than those who were classified as having temporary employment.

Chart 17 illustrates the EI eligibility rates by previous employment characteristics from 2009 to 2016. It can be seen that the eligibility rate for both permanent and temporary workers increased in 2016 from the previous year. In 2016, the eligibility rate for permanent workers was 92.8%, compared to 75.7% for temporary workers and 85.4% for all workers. The gap in eligibility rates between permanent workers and temporary workers decreased to 17.1 percentage points in 2016, down from 17.9 percentage points in the previous year. In the previous seven years, this gap was the lowest in 2014 (9.9 percentage points) and the highest in 2010 (20.0 percentage points).

Text description of Chart 17

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|

| All Workers | 86.2% | 83.9% | 78.4% | 81.9% | 85.8% | 83.1% | 82.8% | 85.4% |

| Permanent workers | 92.2% | 92.4% | 87.2% | 89.9% | 91.4% | 87.7% | 90.0% | 92.8% |

| Temporary workers | 75.3% | 72.3% | 68.3% | 72.2% | 79.0% | 77.7% | 72.2% | 75.7% |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2009 to 2016.

As shown in Chart 18, the eligibility rate of permanent full-time workers was 95.3% in 2016—the highest observed in the last ten years. The eligibility rate for temporary seasonal workers is not far below than that of full-time permanent employees, and the gap between the eligibility rates of these two groups reduced in 2016 compared to the previous year. Temporary seasonal workers have an eligibility rate consistently above part-time permanent employees and temporary non-seasonal workers. The eligibility rates of temporary non-seasonal workers (66.4% in 2016) and permanent part-time workers (62.4% in 2016) have relatively the same trend and experienced fluctuations over the past seven years.

Text description of Chart 18

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|

| Permanent full-time workers | 94.3% | 94.5% | 91.2% | 94.6% | 95.0% | 90.1% | 93.3% | 95.3% |

| Permanent part-time workers | 68.8% | 74.4% | 54.9% | 65.2% | 71.4% | 66.2% | 65.8% | 62.4% |

| Temporary seasonal workers | 81.4% | 83.6% | 81.2% | 75.6% | 85.1% | 84.6% | 82.6% | 87.5% |

| Temporary non-seasonal workers | 70.5% | 64.7% | 60.0% | 69.8% | 74.5% | 73.0% | 64.0% | 66.4% |

Source: Statistics Canada, Employment Insurance Coverage Survey, 2009 to 2016

Access to Employment Insurance regular benefits

Access to EI regular benefits is another way to consider of how well the EI program is working to meet the needs of the labour market in providing EI regular benefits to help the unemployed transition to new employment.Footnote 35 For the purpose of the EI Monitoring and Assessment Report, access to EI regular benefits is measured as the share of unemployed population receiving EI regular benefits. The two main ratios used to measure accessibility are the Beneficiary-to-Unemployed (B/U) ratio and the Beneficiary-to-Unemployed Contributor (B/UC) ratio. Chart 19 shows the comparison of these two ratios for 2015 and 2016.

Both the B/U ratio and the B/UC ratio increased in 2016 compared to 2015. This is because the increase in the number of beneficiaries (+27,300) from 2015 to 2016 was much higher than the increase in the number of unemployed (+2,900) and the number of unemployed contributors (+2,000) during the same time period.

Text description of Chart 19

| 2015 | 2016 | |

|---|---|---|

| Beneficiary-to-Unemployed (B/U) Ratio | 39.8% | 41.8% |

| Beneficiary-to-Unemployed Contributor (B/UC) Ratio | 61.0% | 64.0% |

Sources: Statistics Canada, Employment Insurance Coverage Survey (for data on unemployed (U), and unemployed contributors (UC)); and Statistics Canada, monthly Employment Insurance statistics release, CANSIM table 276-0020 (for data on regular beneficiaries (B)).

The Beneficiary-to-Unemployed (B/U) ratio

The access measure with the broadest population base is the Beneficiary-to-Unemployed (B/U) ratio where the average number of individuals who received EI regular benefits in the reference week of the EICS is expressed as a share of the corresponding unemployed population.Footnote 36 As such, it includes a significant segment of the population who are considered ineligible for EI regular benefits (such as the number of unemployed who have not worked in the previous year or never worked, who did not have a valid job separation, or who were self-employed) and is sensitive to changes in the composition of the unemployed population and the proportion of the unemployed people outside the scope of the EI program coverage.

Chart 20 illustrates the B/U ratio for Canada from 2012 to 2016. Because the total unemployed population is considered within the B/U ratio, its movement is more likely to reflect labour market conditions and EI eligibility fluctuations that are not necessarily associated with EI policies. This makes this ratio less suited to measuring access to EI regular benefits.

Text description of Chart 20

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

| Beneficiary-to-Unemployed (B/U) ratio (%) | 40.6% | 38.4% | 38.6% | 39.8% | 41.8% |

Note: The B/U Ratio is calculated as follows: (number of EI regular beneficiaries ÷ number of unemployed).

Source: Statistics Canada, Employment Insurance Coverage Survey (for data on the unemployed (U)); and Statistics Canada, monthly Employment Insurance statistics release, CANSIM table 276-0020 (for data on regular beneficiaries (B)).

The Beneficiary-to-Unemployed Contributor (B/UC) ratio

Another access measure, known as the Beneficiary-to-Unemployed Contributor (B/UC) ratio, is the number of EI regular beneficiaries as a share of the unemployed who contributed EI premiums in the previous 12 months. This ratio considers a narrower target population than the B/U ratio. Because the B/UC ratio measures accessibility among unemployed workers for whom the EI regular benefits are designed to provide coverage, and excludes those unemployed who did not contribute EI premiums during their last employment period, this ratio may provide a better assessment of accessibility to EI regular benefits of the EI program.

Chart 21 illustrates the B/UC ratios for Canada from 2012 to 2016. The B/UC ratio increased from 61.0% in 2015 to 64.0% in 2016 (+3.0 percentage points). This increase is attributable to the growth in the number of beneficiaries of EI regular benefits (+5.3%) outpacing the growth in the number of unemployed contributors (+0.2%).

Text description of Chart 21

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

| Beneficiary-to-Unemployed Contributor (B/UC) ratio (%) | 65.8% | 61.5% | 63.4% | 61.0% | 64.0% |

Note: The B/UC ratio is calculated as follows: (number of EI regular beneficiaries ÷ number of unemployed who contributed to the EI program).

Source: Statistics Canada, Employment Insurance Coverage Survey (for data on the unemployed contributors (UC)); and Statistics Canada, monthly Employment Isurance statistics release, CANSIM table 276-0020 (for data on regular beneficiaries (B)).

Access and eligibility to Employment Insurance regular benefits among the youth

A recent study by ESDC* looked at the EI eligibility characteristics and access to EI benefits among Canada’s youth (those who are aged between 15-24 years). In 2015, a significant proportion (45.6%) of the unemployed young workers consisted of EI non-contributors, due to the rise in young individuals who have never worked, as well as the rise in the number of self-employed and unpaid family workers—a trend that has been observed since the 2008 recession. Among the unemployed young workers who contributed to the EI program, more than half (52.9%) of them had an invalid job separation. This may be attributable to the employment characteristics of the younger workers (they are more likely to quit jobs to go back to school, which is counted as an invalid job separation by the EI program) compared to workers in other age groups.

The EI eligibility rate among the youth was 54.0% in 2015, compared to 82.1% among those who were 25 to 44 years of age, and 90.7% among those who were aged 45 years and over. Over the years, young females were found to have lower EI eligibility rates than young males, except in 2001 and 2015. Between 2000 and 2015, the average EI eligibility rate for young males was 54.7%, compared to 45% for young females.

In terms of access to EI regular benefits, in 2015 the B/U ratio for young unemployed workers was 16.8%, compared to 46.2% for those aged 25-54 years, and 50.5% for older workers aged 55 and over. The B/UC ratio for the youth was 31% in 2015, compared to 67.3% among unemployed workers in the older age groups. Both of these ratios were found to be lower among young females than males.

*ESDC. Access and Eligibility to EI Regular Benefits among Young People in Canada’s Labour Market. (Ottawa: ESDC, Employment Insurance Policy Directorate, 2018).

2.3 Level of Employment Insurance regular benefits

The level of EI regular benefits (that is the weekly regular benefit rate) that an EI claimant is entitled to receive is calculated as 55% of their highest (best) weeks of insurable earnings over the qualifying period, up to the maximum weekly benefit rate. The number of weeks used to determine this level varies from 14 to 22 weeks depending on the unemployment rate of the claimant’s EI economic region. Furthermore, low-income family claimants may be eligible for the Family Supplement Provision which can increase their level of benefits up to 80% of their weekly insurable earnings (see subsection 2.1.1).

During the reporting period, EI regular claimants received on average $449 in weekly regular benefits, a 0.7% increase from $446 in the previous year. This slight increase marks the first time since FY1213 that growth in the average weekly regular benefits was below 1.0%. Year-over-year, only Territories, New Brunswick, Quebec, Ontario, Manitoba and British Columbia reported increases in their level of weekly regular benefits, while other jurisdictions witnessed decreases , except for Prince Edward Island where the average weekly regular benefit remained unchanged. The average level of EI weekly regular benefits at the provincial and territorial level varied from a high of $511 in the Northwest Territories to a low of $419 in Prince Edward Island during the reporting period (see Annex 2.5). Claimants from Atlantic provinces, Quebec and Manitoba had average weekly regular benefit rates that were under the national average.

Text description of Chart 22

| Insurable hours worked | Men's average weekly benefit rate | Women's average weekly benefit rate |

|---|---|---|

| 420 to 559 | $375 | $273 |

| 560 to 699 | $401 | $312 |

| 700 to 839 | $416 | $328 |

| 840 to 979 | $434 | $355 |

| 980 to 1119 | $450 | $371 |

| 1120 to 1259 | $464 | $399 |

| 1260 to 1399 | $475 | $419 |

| 1400 to 1539 | $486 | $457 |

| 1540 to 1679 | $490 | $446 |

| 1680 to 1819 | $495 | $450 |

| 1820 or more | $511 | $472 |

Note:Includes all claims for which at least $1 of EI regular benefits was paid.

Source: Employment and Social Development Canada, Employment insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Consistent with the past several years, men had a higher average weekly regular benefit rate ($474) than women ($412) in FY1617. The gap in the average weekly benefit rate between men and women is observable for all hours of insurable employment worked during the qualifying period and is more apparent at lower levels of labour market attachment (see Chart 22). This gap between the average weekly benefit rates of men and women is gradually closing. Indeed, in FY0910 women’s average weekly benefit rate was 84.6% of men’s, while in FY1617 it reached 86.9%. Among men, those 45 years to 54 years old had the highest average weekly regular benefit rate ($488), while it was those between 25 and 44 years old ($427) among women.

As shown in Table 17, EI regular claims established by claimants between 25 and 44 years old had the highest average weekly EI regular benefit rate in FY1617 ($462), while those established by claimants younger than 25 years old had the lowest ($412). Among all age categories, claimants who were between 45 and 54 years old experienced the highest increase in their weekly benefit rate (+1.3% or +$6), while those under 25 years old were the only ones who reported a decrease (-1.7% or -$7).

| Men | Women | Total | ||||

|---|---|---|---|---|---|---|

| 2015/2016 | 2016/2017 | 2015/2016 | 2016/2017 | 2015/2016 | 2016/2017 | |

| 24 years old and under | $437 | $429 | $363 | $364 | $419 | $412 |

| 25 to 44 years old | $479 | $484 | $421 | $427 | $458 | $462 |

| 45 to 54 years old | $482 | $488 | $408 | $414 | $449 | $455 |

| 55 years old and over | $459 | $463 | $385 | $392 | $431 | $435 |

| Canada | $470 | $474 | $406 | $412 | $446 | $449 |

Note: Includes all claims for which at least $1 in EI regular benefits was paid.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Table 18 shows that during the reporting period, all claimant categories experienced an increase in their average weekly benefit rate, with the largest increase observed for frequent claimants and long-tenured workers. Long-tenured workers were entitled to the highest average weekly regular benefit rate with $489, which compares to $453 for frequent claimants and $429 for occasional claimants.

| Average weekly benefit rate ($) | EI claimants who were entitled to the maximum weekly benefit rate in 2016/2017 (%) | |||

|---|---|---|---|---|

| 2015/2016 | 2016/2017 | Change (%) | ||

| Long-tenured workers | $482 | $489 | +1.6% | 63.7% |

| Occasional claimants | $428 | $429 | +0.3% | 38.1% |

| Frequent claimants | $446 | $453 | +1.6% | 45.7% |

| Canada | $446 | $449 | +0.7% | 46.1% |

Note: Includes all claims for which at least $1 in EI regular benefits was paid.

*See Annex 2.1 for definitions of claimant categories referenced in this table.

Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

The proportion of claims that were paid at the maximum benefit rate (based on the MIE) fell by 2.9 percentage points to 46.1% in FY1617 over the previous year. By gender, 56.9% of men who established a regular claim during the reporting period were entitled to the maximum weekly benefit rate compared to only 29.2% of women. This proportion varied from 30.4% for regular claimants younger than 25 years old to 50.7% for those aged between 25 and 44 years old. As for claimant categories, a sizeable majority (63.7%) of long-tenured workers who had an EI claim established were entitled to the maximum weekly benefit rate compared to only 45.7% of frequent claimants and 38.1% of occasional claimants.

Claimant obligations to search for and accept suitable employment

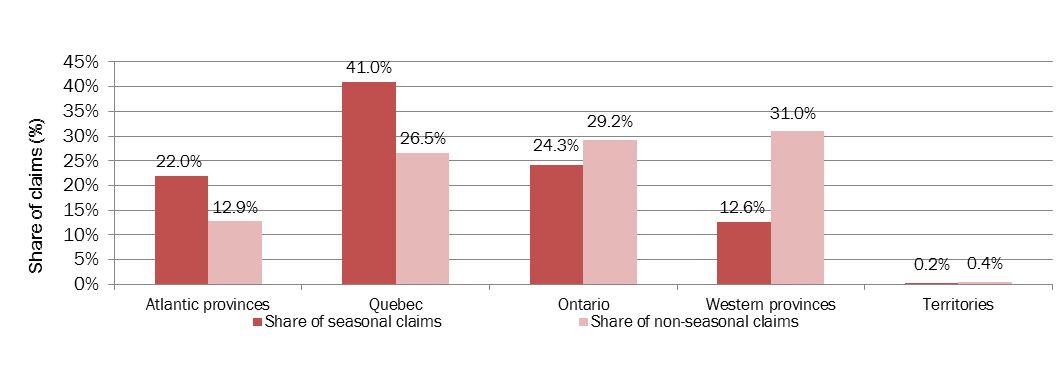

In order to receive EI benefits under the Employment Insurance Act, an EI regular benefit claimant—with certain exceptions—must be capable of and available for, but unable to obtain, suitable employment and must demonstrate this by searching for and taking advantage of an opportunity for suitable employment. During the reporting period, the criteria for determining what constitutes suitable employment were the following: