Briefing binder created for the Deputy Minister of Finance on the occasion of his appearance before the Standing Committee on Finance on March 21, 2024 on Bill C-59, An Act to implement certain provisions of the fall economic statement tabled in Parliament on November 21, 2023 and certain provisions of the budget tabled in Parliament on March 28, 2023, and the Main Estimates 2024-25

On this page:

2024-25 Main Estimates – Explanation of Changes

2023-24 Main Estimates vs. 2024-25 Main Estimates

1. Voted – Budgetary Expenditures – An increase of $16.7 million

| 2023-24 Main Estimates |

2024-25 Main Estimates |

Mains to Mains Difference |

|

|---|---|---|---|

| Program Expenditures | 128,498,703 | 145,198,781 | 16,700,078 |

| Authority for amount by way of direct payments to the International Development Association pursuant to Bretton Woods and Related Agreements Act | 1 | 1 | - |

| Total Voted - Program Expenditures | 128,498,704 | 145,198,782 | 16,700,078 |

The following tables outline the year-over-year changes since the 2023-24 Main Estimates.

Increases in voted items are generally a result of additional funding received for initiatives or programs that were approved via a Treasury Board submission.

| Funding increases ($ millions) | |

|---|---|

| Funding for Indigenous engagement on Trans Mountain | 12.0 |

| Collective bargaining | 10.0 |

| Funding for Financial Sector Legislative Review | 2.8 |

| Funding for Strengthening Canada's Sanctions Capacity and Leadership | 0.9 |

| Funding for membership fees for international anti-money laundering organizations | 0.1 |

| Total Funding Increases | 25.8 |

Decreases in voted items are generally a result of the expiration of time limited funding for specific initiatives or programs.

| Funding decreases ($ millions) | |

|---|---|

| Funding for analytical capacity building (Capacity funding for commercially-oriented assets, including the Trans Mountain Corporation) | (2.5) |

| Refocusing Government Spending | (2.0) |

| Funding for supporting tax policy analysis and development | (1.6) |

| Funding to establish the Sustainable Finance Action Council | (1.2) |

| Enhancing Canada Int'l Contribution to AML and ATF | (1.1) |

| Transfer to the Canadian Security Intelligence Service and the Communications Security Establishment to support mitigation measures under the Retail Payment Activities Act | (0.3) |

| Transfer from ISED: Canadian Innovation and Investment Agency | (0.2) |

| Natural Disaster Protection Gaps | (0.2) |

| Total Funding Decreases | (9.1) |

| Total Funding Change | 16.7 |

2. Total statutory (budgetary) – An increase of $14,096.4 million

| ($ millions) | 2023-24 Main Estimates |

2024-25 Main Estimates |

Variance |

|---|---|---|---|

| Budgetary Statutory | |||

| A - Interest on Unmatured Debt | 32,939.0 | 41,957.0 | 9,018.0 |

| B - Canada Health Transfer | 49,420.6 | 52,080.7 | 2,660.1 |

| C - Fiscal Equalization | 23,963.0 | 25,252.8 | 1,289.8 |

| D - Payments to the Canada Infrastructure Bank | 2,921.3 | 3,454.1 | 532.8 |

| E - Canada Social Transfer | 16,416.3 | 16,908.8 | 492.5 |

| F - Territorial Financing | 4,834.4 | 5,159.0 | 324.5 |

| G - Hibernia Dividend Backed Annuity Agreement | - | 196.9 | 196.9 |

| H - Statutory Subsidies | 42.6 | 44.6 | 2.0 |

| Deputy Prime Minister and Minister of Finance – Salary and motor car allowance | 0.1 | 0.1 | - |

| Payments to International Development Association | 486.9 | 486.9 | - |

| I - Contributions to employee benefit plans | 15.9 | 15.6 | (0.3) |

| J - Debt payments on behalf of poor countries to International Organizations | 51.8 | 51.5 | (0.3) |

| K - Purchase of Domestic Coinage | 84.0 | 81.0 | (3.0) |

| L - Youth Allowances Recovery | (1,302.7) | (1,332.0) | (29.3) |

| M - Alternative Payments for Standing Programs | (5,902.7) | (6,034.0) | (131.3) |

| N - Other Interest Costs | 4,838.0 | 4,582.0 | (256.0) |

| Sub Total Budgetary Statutory | 128,808.5 | 142,905.0 | 14,096.4 |

|

Totals may not add due to rounding |

|||

The increase in budgetary statutory estimates is due to the following factors:

A. Interest on Unmatured Debt – an increase of $9,018.0 million

- Interest on Unmatured Debt are payments that will be made over the course of the year on the Government's market debt (i.e., Government of Canada bonds, Treasury Bills and retail debt). The interest recorded is dependent upon the level and composition of unmatured debt, the effective interest rates applicable and the cost of servicing the debt.

- The $9,018.0 million increase reflects the increased level of debt, as well as higher interest rate expectations on market debt as noted in the 2023 Fall Economic Statement.

B. Canada Health Transfer – an increase of $2,660.1 million

- The Canada Health Transfer is a federal transfer provided to provinces and territories in support of health care and increases year-to-year based on a three-year moving average of nominal gross domestic product growth, with funding guaranteed to increase by at least 3 per cent per year.

- The increase of $2,660.1 million or 5.4 per cent is more than the 5 per cent increase guaranteed by the federal government in the February 2023 10-year health care package.

C. Fiscal Equalization – an increase of $1,289.8 million

- The Fiscal Equalization program ensures that less prosperous provinces have sufficient revenue to provide reasonably comparable levels of public services at comparable levels of taxation, thereby reducing fiscal disparities among provinces. Equalization payments increase from year-to-year based on a three-year moving average of nominal GDP growth.

- The increase of $1,289.8 million is due to the 5.4 per cent gross domestic product-based escalator being applied to the 2023-24 level.

D. Canada Infrastructure Bank – an increase of $532.8 million

- Through the Canada Infrastructure Bank (CIB), the federal government has committed $35 billion to support infrastructure projects across the country. The CIB will focus on priority investment sectors including transit, green infrastructure, clean power, broadband access, and trade and transportation.

- The $532.8 million increase reflects payments to the CIB to carry out approved activities as outlined in their 2022-23 to 2026-27 Corporate Plan.

E. Canada Social Transfer – an increase of $492.5 million

- The Canada Social Transfer is the federal transfer provided to provinces and territories in support of social assistance and social services, post-secondary education, and programs for children.

- The $492.5 million increase is a result of the legislated 3 per cent annual growth rate.

F. Territorial Financing – an increase of $324.5 million

- The Territorial Formula Financing program enables territorial governments to provide their residents with programs and services that are comparable to those provided in the rest of Canada, at comparable levels of taxation, taking into account the higher costs of services and unique circumstances of the North.

- The $324.5 million increase reflects the incorporation of new and updated data for territorial expenditure requirements and revenue capacities into the program's legislated formula.

G. Hibernia Dividend Backed Annuity Agreement – an increase of $196.9 million

- The Hibernia Dividend Backed Annuity Agreement is an agreement between Canada and Newfoundland and Labrador entered into in 2019 that will provide defined, annual payments to the province between 2019 and 2056 totaling $3.3 billion. The payments were based on projected free cash flows of the Canada Hibernia Holding Corporation (CHHC), a Crown corporation that administers Canada's working interest in the Hibernia oil project, over the remaining life of the project. The province will also pay $800 million to Canada between 2045 and 2052, resulting in a net benefit of $2.5 billion to the province.

- The increase of $196.9 million is due to the 2023-24 payment not being included in the 2023-24 Main Estimates. The amount for 2024-25 agrees to the schedule of annuity payments in the Hibernia Dividend Backed Annuity Agreement.

H. Statutory Subsidies – an increase of $2.0 million

- Statutory Subsidies are annual grants paid to the provinces as a result of agreements entered into upon their joining Canada. These amounts are set out in the British North America Acts (BNA Acts) (renamed the Constitution Acts in 1982) and related acts.

- The payment for 2024-25 is an estimate, based on the final computation of 2023‑24, made in December 2023, which incorporated Census 2021 population data.

I. Contribution to Employee Benefit Plans – a decrease of $0.3 million

- The amount for Contribution to Employee Benefit Plans is set by the Treasury Board Secretariat. The 2024-25 percentage is 13.8 per cent of salary funding and represents the government's contribution to various employee benefit plans.

- The decrease of $0.3 million is due to a lower percentage being applied than the prior year offsetting the increases in salary funding included in the 2024-25 Main Estimates.

J. Debt Payments on behalf of poor countries to International Organizations – a decrease of $0.3 million

- At the G8 Summit in Gleneagles in 2005, donors, including Canada, agreed to have international financial institutions cancel 100 per cent of the debts owed to them by eligible poor countries to free up resources to help such countries achieve Millennium Development Goals. To cover its share of the costs, Canada committed a total of $2.5 billion over the 50-year lifespan of this initiative. Canada's first payment for this initiative was made in fiscal year 2005-06. Annual payments will continue until 2054.

- The decrease of $0.3 million is in line with the revised payment schedule agreed to by the Government of Canada and the World Bank.

K. Purchase of Domestic Coinage – a decrease of $3.0 million

- The Department of Finance and the Royal Canadian Mint have a Memorandum of Understanding for the Mint to produce and manage the distribution of domestic coinage on behalf of the Department. The Department of Finance reimburses the Royal Canadian Mint for the cost of coinage production and distribution.

- The decrease of $3.0 million reflects the Mint's revised forecasts for coin demand.

L. Youth Allowances Recovery – an increase in recovery of $29.3 million

- The Youth Allowances Recovery is a recovery from the province of Quebec related to the discontinued Youth Allowances Program.

- Recoveries from the province of Quebec are based on personal income tax data. The $29.3 million increase in the recovery is a result of the forecasted growth of national Basic Federal Tax as calculated in October 2023.

M. Alternative Payments for Standing Programs – an increase in recovery of $131.3 million

- The Alternative Payments for Standing Programs is a recovery from the province of Quebec of an additional tax point transfer (13.5 points) above and beyond the tax point transfer that used to be part of the Canada Health Transfer and the Canada Social Transfer.

- In the 1960s, Quebec chose to use the federal government's contracting-out arrangements for certain federal–provincial programs. Since Quebec, like other provinces, receives its full cash entitlement under the Canada Health Transfer and Canada Social Transfer, the value of these tax points is reimbursed to the Government of Canada each year.

- The increased recovery of $131.3 million is a result of the forecasted growth of national Basic Federal Tax as calculated in October 2023.

N. Other Interest Costs – a decrease of $256.0 million

- Other Interest Costs represent the interest on liabilities for federal public service pension plans, deposit and trust accounts and other specified purpose accounts.

- The interest recorded in this vote is a statutory requirement and is dependent upon the level and composition of pensions and other liabilities, as well as the applicable effective interest rates.

- The decrease of $256.0 million reflects a decrease in the historical average Government of Canada long-term bond rate used to calculate interest on the public service superannuation accounts, which pertain to service pre-April 1, 2000, as well as a decrease in the balance of the superannuation accounts.

Page Proofs

Department of Finance

Raison d'être

The Department of Finance Canada (the Department) is responsible for the overall stewardship of the Canadian economy. This includes preparing the annual federal budget, as well as advising the Government on economic and fiscal matters, tax and tariff policy, social measures, security issues, financial stability and Canada's international commitments.

The Minister of Finance is responsible for this organization.

Additional information can be found in the Organization's Departmental Plan.

Organizational Estimates

| (dollars) | 2022–23 Expenditures | 2023–24 Main Estimates | 2023–24 Estimates To Date | 2024–25 Main Estimates | |

|---|---|---|---|---|---|

| Budgetary | |||||

| Voted | |||||

| 1 | Program expenditures | 329,319,150 | 128,498,703 | 420,988,926 | 145,198,781 |

| 5 | Authority for amount by way of direct payments to the International Development Association under the Bretton Woods and Related Agreements Act | 0 | 1 | 1 | 1 |

| Total Voted | 329,319,150 | 128,498,704 | 420,988,927 | 145,198,782 | |

| Total Statutory | 116,985,671,198 | 128,808,580,978 | 135,607,428,518 | 142,904,970,066 | |

| Total Budgetary | 117,314,990,348 | 128,937,079,682 | 136,028,417,445 | 143,050,168,848 | |

| Non-budgetary | |||||

| Total Statutory | 68,185,295,309 | 0 | 1,390,000,000 | 0 | |

| Total non-budgetary | 68,185,295,309 | 0 | 1,390,000,000 | 0 | |

2024–25 Main Estimates by Purpose

| (dollars) | Operating | Capital | Transfer Payments | Revenues and other reductions | Total |

|---|---|---|---|---|---|

|

Economic and Fiscal Policy |

50,173,222,735 | 0 | 92,827,224,982 | 0 | 143,000,447,717 |

|

Internal Services |

49,871,131 | 0 | 0 | (150,000) | 49,721,131 |

| Total | 50,223,093,866 | 0 | 92,827,224,982 | (150,000) | 143,050,168,848 |

Listing of the 2024–25 Transfer Payments

| (dollars) | 2022–23 Expenditures | 2023–24 Main Estimates | 2024–25 Main Estimates |

|---|---|---|---|

| Contributions | |||

|

Indigenous Participant Funding Program |

50,000 | 0 | 12,000,000 |

| Other Transfer Payments | |||

| Total Statutory | 84,882,219,081 | 88,010,224,717 | 92,815,224,982 |

Listing of Statutory Authorities

| (dollars) | 2022–23 Expenditures | 2023–24 Estimates To Date | 2024–25 Main Estimates |

|---|---|---|---|

|

Canada Health Transfer (Part V.1 – Federal-Provincial Fiscal Arrangements Act) |

45,140,656,521 | 49,420,572,000 | 52,080,686,000 |

|

Interest on Unmatured Debt (Financial Administration Act) |

25,990,399,324 | 36,837,000,000 | 41,957,000,000 |

|

Fiscal Equalization (Part I – Federal-Provincial Fiscal Arrangements Act) |

21,920,222,000 | 23,963,000,000 | 25,252,833,000 |

|

Canada Social Transfer (Part V.1 – Federal-Provincial Fiscal Arrangements Act) |

15,938,157,000 | 16,416,302,000 | 16,908,791,000 |

|

Territorial Financing (Part I.1 – Federal-Provincial Fiscal Arrangements Act) |

4,552,785,221 | 4,834,417,818 | 5,158,964,752 |

|

Other Interest Costs |

5,597,929,854 | 4,875,000,000 | 4,582,000,000 |

|

Payment to the Canada Infrastructure Bank |

384,450,033 | 2,921,312,000 | 3,454,085,000 |

|

Payments to International Development Association (Bretton Woods and Related Agreements Act) |

911,436,000 | 486,916,000 | 486,916,000 |

|

Payment to Newfoundland and Labrador related to the Hibernia Dividend Backed Annuity Agreement (Section 200 - Budget Implementation Act, 2021, No. 1) |

100,733,215 | 156,850,000 | 196,860,000 |

|

Purchase of Domestic Coinage (Royal Canadian Mint Act) |

87,250,876 | 82,000,000 | 81,000,000 |

|

Debt payments on behalf of poor countries to International Organizations pursuant to section 18(1) of the Economic Recovery Act |

56,818,753 | 51,823,068 | 51,535,479 |

|

Statutory Subsidies (Constitution Acts, 1867-1982, and Other Statutory Authorities) |

42,639,341 | 44,585,961 | 44,585,961 |

|

Contributions to employee benefit plans |

14,313,748 | 16,676,310 | 15,561,484 |

|

Deputy Prime Minister and Minister of Finance – Salary and motor car allowance (Salaries Act and Parliament of Canada Act) |

90,400 | 94,700 | 98,600 |

|

Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964) |

(753,319,887) | (1,279,753,650) | (1,331,973,210) |

|

Alternative Payments for Standing Programs (Part VI – Federal-Provincial Fiscal Arrangements Act) |

(6,080,781,000) | (5,795,881,000) | (6,033,974,000) |

2024-25 Estimates - Annex

Items for inclusion in the Proposed Schedules to the Appropriation Bill

Unless specifically identified under the Changes in 2024–25 Main Estimates section, all vote wordings have been provided in earlier appropriation acts.

| Vote No. | Items | Amount ($) |

|---|---|---|

| DEPARTMENT OF FINANCE | ||

| 1 |

|

145,198,781 |

| 5 |

|

1 |

| Total | 145,198,782 | |

2024–25 Budgetary Expenditures by Standard Object

This table shows the forecast of total expenditures by Standard Object, which includes the types of goods or services to be acquired, or the transfer payments to be made and the revenues to be credited to the vote.

Definitions of standard objects available at: http://www.tpsgc-pwgsc.gc.ca/recgen/pceaf-gwcoa/2425/7-eng.html

Interest payments relating to capital leases are included under "Public debt charges". These payments are voted expenditures and are not included under the "Public Debt" heading on the Composition of Estimates and Expenditures table.

| (dollars) | Personnel 1 |

Transportation and communications 2 |

Information 3 |

Professional and special services 4 |

Rentals 5 |

Purchased repair and maintenance 6 |

Utilities, materials and supplies 7 |

Acquisition of land, buildings and works 8 |

Acquisition of machinery and equipment 9 |

Transfer payments 10 |

Public debt charges 11 |

Other subsidies and payments 12 |

Less: Revenues and other reductions | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Department of Finance | 128,424,459 | 1,897,882 | 3,095,895 | 12,126,273 | 1,366,805 | 327,292 | 81,209,961 | 0 | 1,484,136 | 92,827,224,982 | 46,539,000,000 | 3,454,161,163 | 150,000 | 143,050,168,848 |

| Total | 128,424,459 | 1,897,882 | 3,095,895 | 12,126,273 | 1,366,805 | 327,292 | 81,209,961 | 0 | 1,484,136 | 92,827,224,982 | 46,539,000,000 | 3,454,161,163 | 150,000 | 143,050,168,848 |

Statutory Forecasts

| (dollars) | 2022–23 Expenditures | 2023–24 Estimates To Date | 2024–25 Main Estimates |

|---|---|---|---|

| Budgetary | |||

| Department of Finance | |||

| Canada Health Transfer (Part V.1 – Federal-Provincial Fiscal Arrangements Act) | 45,140,656,521 | 49,420,572,000 | 52,080,686,000 |

| Interest on Unmatured Debt (Financial Administration Act) | 25,990,399,324 | 36,837,000,000 | 41,957,000,000 |

| Fiscal Equalization (Part I – Federal-Provincial Fiscal Arrangements Act) | 21,920,222,000 | 23,963,000,000 | 25,252,833,000 |

| Canada Social Transfer (Part V.1 – Federal-Provincial Fiscal Arrangements Act) | 15,938,157,000 | 16,416,302,000 | 16,908,791,000 |

| Territorial Financing (Part I.1 – Federal-Provincial Fiscal Arrangements Act) | 4,552,785,221 | 4,834,417,818 | 5,158,964,752 |

| Other Interest Costs | 5,597,929,854 | 4,875,000,000 | 4,582,000,000 |

| Payment to the Canada Infrastructure Bank | 384,450,033 | 2,921,312,000 | 3,454,085,000 |

| Payments to International Development Association (Bretton Woods and Related Agreements Act) | 911,436,000 | 486,916,000 | 486,916,000 |

| Payment to Newfoundland and Labrador related to the Hibernia Dividend Backed Annuity Agreement (Section 200 - Budget Implementation Act, 2021, No. 1) | 100,733,215 | 156,850,000 | 196,860,000 |

| Purchase of Domestic Coinage (Royal Canadian Mint Act) | 87,250,876 | 82,000,000 | 81,000,000 |

| Debt payments on behalf of poor countries to International Organizations pursuant to section 18(1) of the Economic Recovery Act | 56,818,753 | 51,823,068 | 51,535,479 |

| Statutory Subsidies (Constitution Acts, 1867-1982, and Other Statutory Authorities) | 42,639,341 | 44,585,961 | 44,585,961 |

| Contributions to employee benefit plans | 14,313,748 | 16,676,310 | 15,561,484 |

| Deputy Prime Minister and Minister of Finance – Salary and motor car allowance (Salaries Act and Parliament of Canada Act) | 90,400 | 94,700 | 98,600 |

| Minister of State (Minister of Tourism and Associate Minister of Finance) – Motor car allowance (Parliament of Canada Act) | - | 2,000 | - |

| Minister of State (Minister of Middle Class Prosperity and Associate Minister of Finance) – Motor car allowance | 4,000 | - | - |

| Additional Fiscal Equalization Offset Payment to Nova Scotia (Nova Scotia and Newfoundland and Labrador Additional Fiscal Equalization Offset Payments Act) | 47,772,000 | - | - |

| Fiscal Stabilization (Part II – Federal-Provincial Fiscal Arrangements Act) | - | 576,511,311 | - |

| Payments related to Canada Health Transfer (Section 24.74 - Federal-Provincial Fiscal Arrangements Act) | 2,000,000,000 | 2,000,000,000 | - |

| Payments in relation to transit and housing (Budget Implementation Act, 2022, No. 1) | 750,000,000 | - | - |

| Grant to the IMF's Resilience and Sustainability Trust (Bretton Woods and Related Agreements Act, Section 8.1(2)) | 40,144,062 | - | - |

| Payments to World Bank - Ukraine Multi-Donor Trust Fund | 115,000,000 | - | - |

| Canadian Securities Regulation Regime Transition Office (Canadian Securities Regulation Regime Transition Office Act) | (234,224) | - | - |

| Other Statutory items listed in the Public Accounts of Canada | 29,203,961 | - | - |

| Payments for school ventilation improvement pursuant to the Economic and Fiscal Update Implementation Act, 2021 | 100,000,000 | - | - |

| Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964) | (753,319,887) | (1,279,753,650) | (1,331,973,210) |

| Alternative Payments for Standing Programs (Part VI – Federal-Provincial Fiscal Arrangements Act) | (6,080,781,000) | (5,795,881,000) | (6,033,974,000) |

| Total budgetary | 116,985,671,198 | 135,607,428,518 | 142,904,970,066 |

| Non-budgetary | |||

| Department of Finance | |||

| Other Statutory items listed in the Public Accounts of Canada | 62,948,546,896 | - | - |

| Financial assistance to the International Development Association (Bretton Woods and Related Agreements Act, Section 8) | 386,748,413 | - | - |

| Financial Assistance to Ukraine through IMF Administered Account (Bretton Woods and Related Agreements Act, Section 8.3) | 4,350,000,000 | - | - |

| Bilateral Loan to Ukraine (Bretton Woods and Related Agreements Act, Section 8.3) | 500,000,000 | - | - |

| Payment for the acquisition of shares in the Canada Growth Fund pursuant to the Fall Economic Statement Implementation Act, 2022 | - | 1,390,000,000 | - |

| Total non-budgetary | 68,185,295,309 | 1,390,000,000 | - |

2024-25 Estimates - Expenditures by Purpose

| (dollars) | 2022–23 Expenditures | 2023–24 Main Estimates | 2024–25 Main Estimates Operating | 2024–25 Main Estimates Capital | 2024–25 Main Estimates Transfer Payments | 2024–25 Main Estimates Revenues and other reductions | 2024–25 Main Estimates Total |

|---|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 117,257,491,324 | 128,889,898,527 | 50,173,222,735 | 0 | 92,827,224,982 | 0 | 143,000,447,717 |

| Internal Services | 57,499,024 | 47,181,155 | 49,871,131 | 0 | 0 | (150,000) | 49,721,131 |

| Total | 117,314,990,348 | 128,937,079,682 | 50,223,093,866 | 0 | 92,827,224,982 | (150,000) | 143,050,168,848 |

| (dollars) | 2022–23 Expenditures | 2023–24 Main Estimates | 2024–25 Main Estimates |

|---|---|---|---|

| Department of Finance | |||

| Economic and Fiscal Policy | 68,185,295,309 | 0 | 0 |

| Total | 68,185,295,309 | 0 | 0 |

Interim Supply Requirements

| Vote no. | Vote wording and explanation(s) of Additional Twelfths | Total Main Estimates ($) | Amount Granted ($) |

|---|---|---|---|

| 1 |

An additional one twelfth is required beyond the normal three-twelfths Reason: Reason: |

145,198,781 | 48,399,594 |

| 5 |

No additional twelfths beyond the normal three-twelfths |

1 | 1 |

Reports of Spending Cuts for Indigenous Departments

Issue

Media have published stories comparing 2023-24 and 2024-25 Main Estimates amounts for Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) and Indigenous Services Canada (ISC), portraying them as cuts in government spending, potentially related to the government's savings exercise. The Assembly of Manitoba Chiefs and two NDP MPs have been reported in the media as concerned that such cuts would be misaligned with Indigenous reconciliation.

Key Points

- Comparing Main Estimate totals does not present an accurate picture of spending. The apparent decrease is due to:

- The $23.3 billion exceptional payment for compensation related to First Nations Child and Family Services and Jordan's Principle.

- The sunsetting of other time‑limited funding, most of which is being considered for renewal in Budget.

- Savings exercises largely targeted departmental activities (e.g., travel, consulting); any reductions for Indigenous recipients will be minimal. Planned spending reallocations for CIRNAC and ISC represent a modest share of departmental spending:

| ($ millions) | 2024-25 | 2025-26 | 2026-27 | Total |

|---|---|---|---|---|

| CIRNAC | 15.7 | 23.2 | 33.7 | 72.6 |

| ISC | 64.7 | 108.6 | 170.7 | 344.0 |

Background

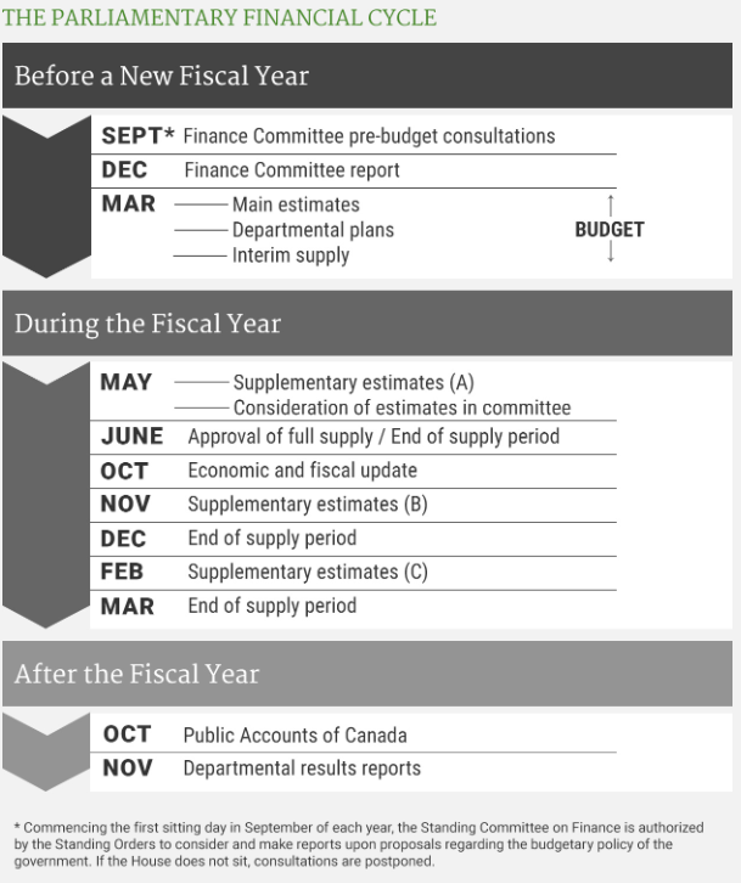

Main Estimates present the government's spending plans for each federal organization and provide items that will be included in an appropriation bill for Parliament's approval. As Main Estimates are prepared in late fall, they do not include spending to be announced in the upcoming Budget.

As Main Estimates do not include the government's complete spending for the year, the government also typically presents Supplementary Estimates to Parliament in May, November and February, which are designated alphabetically as A, B and C. Supplementary Estimates are also referred to committees for review and receive approval through an appropriation bill at the end of the relevant supply period.

The Parliamentary Financial Cycle

Annex 1: Information on ISC's Main Estimates

ISC prepared the information below for internal purposes, but it is not public

Year-Over-Year Major Changes

The net decrease in budgetary spending is $18.6 billion or 46.9% over the 2023-24 Main Estimates. The major changes include:

- a net decrease of $19.9 billion for child and family services which is primarily due to $20.0 billion* for the First Nations child welfare settlement in 2023-24;

- a net decrease of $263.1 million for income assistance which is primarily due to sunset of funding for the Income Assistance – Immediate Supports;

- a net decrease of $167.6 million for public health promotion and diseases prevention which is primarily due to:

- a net decrease in funding for mental wellness, including sunset of funding related to distinctions-based mental wellness and trauma-informed health and cultural supports, mental health and wellness (Budget 2021) and legacy of residential schools (Budget 2022); and

- a net increase in funding for communicable disease control and management.

- a net increase of $248.7 million for health systems support which is mainly due to funding for the First Nations Health Authority;

- a net increase of $675.8 million for community infrastructure which is primarily due to:

- the one-time investment in the Northern Ontario Grid Connection Project; and

- a net decrease in funding related to infrastructure projects in Indigenous communities.

- a net increase of $725.6 million for Jordan's Principle and the Inuit Child First Initiative which is primarily due to a net increase in core funding for the continued implementation of Jordan's Principle; and

- a net increase of $69.2 million for remaining programs with changes in the approved funding levels.

* The variance explanation is based on changes between Main Estimates 2024-25 and 2023-24, therefore it does not include the $3.3 billion obtained via the 2023-24 Supplementary Estimates. In 2023-24, the settlement amount totals $23.3 billion.

Annex 2: Details on Refocusing Government Spending

In Budget 2023, the government committed to reducing spending by $14.1 billion over the next five years, starting in 2023–24, and by $4.1 billion annually after that.

CIRNAC 2024-25 Departmental Plan

CIRNAC is planning the following spending reductions.

- 2024–25: $15,745,357

- 2025–26: $23,230,234

- 2026–27 and after: $33,672,245

CIRNAC will achieve these reductions by doing the following:

- Internal Services and Operational Efficiencies

- Travel Efficiencies aligning with Shared Partner Priorities

- Streamlining Professional Services towards Resolving Claims and Agreements

- Reducing Grants and Contributions following discussions with partners, by targeting areas that will minimize impacts on communities and/or in areas where the funding has not been fully utilized

ISC 2024-25 Departmental Plan

ISC is planning the following spending reductions.

- 2024-25: $64,716,653

- 2025-26: $108,603,653

- 2026-27 and after: $170,702,653

ISC will achieve these reductions by doing the following:

- Internal Services and Operational Efficiencies

- Public Servant Travel Reductions

- Departmental Transformation

- Reducing grants and contributions following discussions with partners, by targeting areas that will minimize impacts on communities and/or in areas where the funding has not been fully utilized.

Page details

- Date modified: