Ministerial Transition Deck 2021

October 22, 2021

Table of contents

Section 1 - Who We Are

ACOA at a glance

Fueling economic growth in Atlantic Canada

- Mission

- Help Atlantic Canada’s economy grow

- Values

- Commitment to the region

- Customer service and creativity

- Urgency

- 1 of 7 regional development agencies

- On-the-ground presence, allowing:

- solid understanding of region’s challenges and opportunities;

- strategic relationships with clients and partners.

- Manages crises at regional level

- COVID-19 pandemic: prime example

- 30 points of service

- 584 full-time equivalents at:

- head office in Moncton, N.B. (with a team in Ottawa);

- regional offices in each provincial capital; and

- satellite locations throughout the region.

Two core functions

Delivering programs and advocating for Atlantic Canada

ACOA’s mandate is twofold:

- Delivering programming principally for small and medium-sized enterprises (SMEs) and community groups

- Advocating for businesses and communities as well as strong economic development policies across the Government of Canada that may impact the region

- Working through effective governance and strong collaboration to ensure Atlantic Canada issues and opportunities are well understood in the federal system (key ministers and officials)

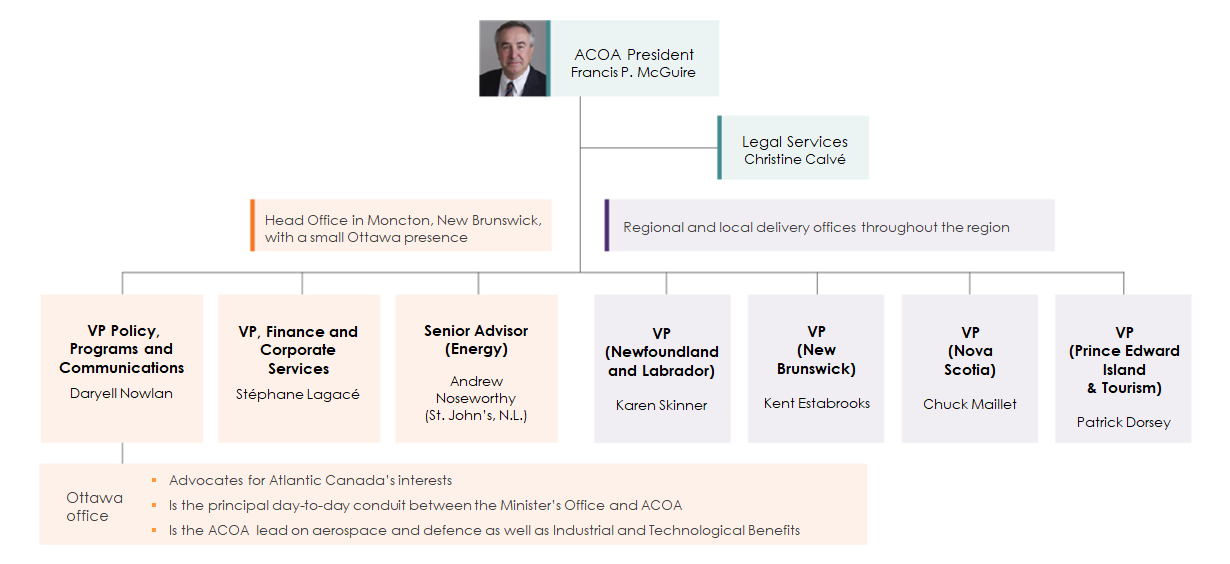

Organizational Structure

Chart Long Description

The image depicts ACOA's organizational structure.

The top box, with a photograph of Francis P. McGuire, includes the text “ACOA President, Francis P. McGuire”. Lines connect the top box with three groups of boxes.

One line points to a single box with the text “Legal Services, Christine Calvé”.

One line points to three boxes with the note “Head Office in Moncton, New Brunswick, with a small Ottawa presence”; the following text appears in each of the three boxes: “VP Policy, Programs and Communications, Daryell Nowlan”; “VP, Finance and Corporate Services, Stéphane Lagacé”; and “Senior Advisor (Energy), Andrew Noseworthy (St. John’s, NL)”. A line from the box “VP Policy, Programs and Communications, Daryell Nowlan” connects to a box with the following note: “Ottawa office: Advocates for Atlantic Canada’s interests; Is the principal day-to-day conduit between the Minister’s Office and ACOA; ACOA lead on aerospace and defence as well as Industrial and Technological Benefits”.

One line points to four boxes with the note “Regional and local delivery offices are throughout the region”; the following text appears in each of the four boxes: “VP Newfoundland and Labrador, Karen Skinner”; “VP New Brunswick, Kent Estabrooks”; “VP Nova Scotia, Chuck Maillet”; .and “VP Prince Edward Island & Tourism, Patrick Dorsey”.

Workforce – Critical for the region

Helping to address labour shortages

Labour shortages is Atlantic Canada’s most pressing challenge, and it is a major issue for skilled and unskilled positions.

- Tools to address issue:

- Automation and digitization, skills development and immigration – top priorities for ACOA.

Areas of focus

Working strategically, guided by focused actions

Key areas of focus include:

- Advanced manufacturing

- Immigration

- Tourism

- Indigenous economic development

- Oceans

- Food

- Clean growth

- Start-up ecosystem

To guide its investments, ACOA applies the following lenses:

- Improving the quality of jobs

- Increasing productivity and digitization for greater competitiveness

- Fostering more diverse workforce participation to address labour shortages

- Leveraging green technologies for economic growth

Partnerships

Bringing together partners to drive economic growth

- ACOA works with federal partners on various key files. For example:

- Other regional development agencies –COVID-19 recovery programs

- Fisheries and Oceans – Blue Economy Strategy

- Innovation, Science and Economic Development & National Defence –Industrial and Technological Benefits / investments in aerospace and defence

- National Research Council –Industrial Research Assistance Program

- ACOA and federal partners work with the provinces on select areas such as:

- International trade

- Tourism development

Economic context

Pre-COVID-19 economic snapshot: strengths and challenges

- Before COVID-19, Atlantic Canada’s economy gained momentum.

- In 2019, Atlantic Canada’s real gross domestic product (GDP) growth surpassed the national average (2.7% for Atlantic Canada vs. 1.9% for Canada).

- The region’s economic growth was driven mainly by increased immigration and automation (Bank of Canada), building on key sectors such as:

- ocean economy

- life sciences

- aerospace and defence

- Yet, structural challenges impacted the region’s growth potential:

- rural population

- aging demographics

- low productivity

- worker shortages

COVID-19 impacts and a two-speed recovery

- Atlantic Canada’s real GDP decreased by 4% in 2020 (Canada: -5.3%), and the region lost 46,500 jobs (a decrease of 4.1% relative to 5.2% for Canada).

- The decline was less pronounced in the Maritimes (-3.4%).

- In Newfoundland and Labrador, the decline was similar to the national average (exacerbated by the oil and gas crisis).

- The region is attracting a lower share of Canada’s immigrants than it was prior to the pandemic(down from 4.8% in the first quarter of 2019 to 3.3% in the first quarter of 2021).

- Some sectors have been able to realign activities to respond to market demand and automate processes.

- Others are expected to take longer to recover. These include:

- oil and gas

- tourism

- culture

- Others are expected to take longer to recover. These include:

Current core programs

Providing strategic, agile support through repayable, provisionally repayable and non-repayable contributions

Atlantic Innovation Fund (AIF)

Business Development Program (BDP)

Regional Economic Growth through Innovation (REGI) (common to all regional development agencies)

- Generally for commercial projects and loans

Innovative Communities Fund (ICF)

- For non-commercial projects and contributions

Community Futures Program (CFP)

- Funds 41 independent Community Business Development Corporations

Current temporary programs

Delivering short-term initiatives

ALL INITIATIVES COMMON TO ALL REGIONAL DEVELOPMENT AGENCIES (except Canada Coal Transition Initiative)

Recent COVID-19 economic recovery funding initiatives

Canada Community Revitalization Fund

- Ending March 31, 2023

Tourism Relief Fund

- Ending March 31, 2023

Aerospace Regional Recovery Initiative

- Ending March 31, 2024

Jobs and Growth Fund

- Ending March 31, 2024

Other funding initiatives

Women Ecosystem Fund

- Ending March 31, 2023

National Ecosystem Fund / Black Entrepreneurship Program

- Ending March 31, 2025

Canada Coal Transition Initiative (common to ACOA and Prairies Economic Development Canada)

- Ending March 31, 2026

Program spending

| Actual Expenditures | Planned Expenditures | |||||

|---|---|---|---|---|---|---|

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 | |

| Operations & Maintenance | $73M | $77M | $79M | $85M | $80M | $77M |

| Grants & Contributions | $276M | $275M | $496M | $377M | $378M | $263M |

| Total | $349M | $352M | $575M | $462M | $458M | $340M |

Over the past decade (2011-2012 to 2020-2021)…

- ACOA approved an annual average of 1,248 projects.

- Average approved contribution: $233,279.

- on average each year, ACOA assisted 973 businesses and invested in 336 communities.

- on average, ACOA’s annual spending was $276M.

In 2021-2022: Out of $462M, $166M are temporary allocations.

- Of the $377M in grants and contributions, $340M were committed as of October 21, 2021.

It is expected that there will be a 47% decrease in grants and contributions spending by 2023-2024, compared to 2020-2021.

Results

Impacting the region’s economy

Sales and labour productivity (2013 to 2018)

- Sales by ACOA-assisted firms grew by an average of 4.4% per year, compared to 1.0% for comparable, unassisted firms.

- Labour productivity by ACOA-assisted firms grew by an average of 2.3% per year, compared to 1.9% for comparable, unassisted firms.

Business exports, growth and R&D (2013 to 2018)

- In 2019, the value of the export of goods from Atlantic Canada was $28.7B, compared to $26.4B in 2018(+8.6%). Due to the pandemic, however, the value of exports dropped to $23.9B in 2020 (-16.6%).

- In 2018, there were 135 ACOA-assisted high-growth firms, up 1.5% compared to 2013.

- ACOA-assisted firms' R&D expenditures as a percentage of revenue averaged 0.6% over the 2013-2018 period, compared to 0.1% for other firms.

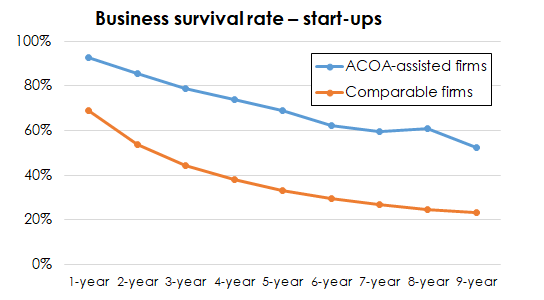

The business survival rate for ACOA-assisted start-ups is 69% vs. 33% for unassisted firms after the crucial fifth year following start-up.

Graph Long Description

The graph shows that the business survival rate for start-up firms that received ACOA assistance was higher than the rate for firms that did not receive ACOA assistance. The blue line (higher), representing ACOA-assisted firms, shows a downward trend over a nine-year period, going from 93% to 52%. The orange line (lower), representing firms that did not receive ACOA assistance, shows a downward trend over a nine-year period, going from 69% to 23%.

Well positioned to deliver

Helping the government deliver on economic development initiatives

ACOA can support the Government of Canada shape policies and programs that can help drive growth in Atlantic Canada.

Rural Economic Development

- Atlantic Canada: most rural population (46% vs. 19% for Canada)

- ACOA highly active in rural initiatives – more than $675.3M expended over the past five years

- Potential for ACOA to focus even more on areas such as:

- increased productivity

- greening

- stronger recovery

Blue Economy

- Atlantic Canada’s ocean sector is forecast to move from $19B in annual activity in 2018 to almost $24B in 2030

- Key priority for ACOA – more than $166.5M expended over past five years

- Potential for ACOA to direct efforts in areas such as:

- ocean-related sustainable economic growth

- conservation initiatives

Automation and Digitization

- Important tools for Atlantic businesses in weathering pandemic

- Key priority for ACOA – more than $322.1M expended over past five years

- Potential for ACOA to engage with partners (e.g. federal organizations) to ensure region’s businesses are positioned to embrace automation and digitalization

Immigration

- Key to getting back to pre-pandemic momentum

- In addition to supporting progress on immigration through convening activities, collaboration with partners, etc., ACOA has provided assistance for attraction and retention projects to the tune of more than $18.6Mexpended over past five years

- Potential for ACOA to help shape initiatives that leverage immigration as a means of addressing skilled labour shortages

Section 2 - Possible early actions and engagement opportunities

Possible early action: Processing project applications

- A number of funding applications have been reviewed and are awaiting ministerial direction.

- Meetings will be organized in the coming weeks to discuss your preferred approach on how to proceed.

Outreach: Engaging with provinces and stakeholders

- Engagement and collaboration opportunities with the Atlantic Provinces could include:

- Discussion with premiers and ministers

- Renewal of Atlantic Trade and Investment Growth Agreement

- Atlantic Growth Strategy

- Meetings could be planned with various stakeholders such as:

- Business leaders, academic institutions, community organizations

Redacted

- redacted

Regional events

- November 4-5, 2021 – Tourism Industry Association of PEI Conference – Charlottetown, P.E.I.

- November 19-21, 2021 – Halifax International Security Forum – H alifax, N.S.

- November 23-25, 2021 – Propelling the Blue Economy – St. John’s, N.L.

- November 24, 2021 – R3 Cleantech – Saint John, N.B.

Page details

- Date modified: